TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Lemonade Making A Comeback!

Revolutionizing

The Insurance Industry!

And, “Weekly Options Members” Make 115% Potential

Profit In Less Than 1 Hour!

Maybe There Is More to Come?

April 23, 2021

Lemonade Inc, one of the highest-momentum stocks heading into 2021, is looking at revolutionizing the insurance industry. The stock price has moved higher the past two days which has supported this weekly options trade.

And, “Weekly Options Members” are now up potential profits of 115%, in less than one hour.

Another trade was executed later in the day as more upwards movement is expected.

Lemonade Inc (NYSE: LMND)

Prelude…..

Lemonade shares increased to $93.74, up 1.74%, by midday on Thursday. As at close of trading, Lemonade's stock was trading at a volume of 2,257,597. The market value of their outstanding shares is at $5.5 billion.

In the next earnings report analysts’ Consensus Estimates are calling for earnings of -$3.20 per share and revenue of $115 million. These totals would mark changes of +11.85% and +21.82%, respectively, from last year.

The Actual Recommended Trade…..

** OPTION TRADE: Buy LMND APR 30 2021 90.000 CALLS at approximately $3.85.

(actually bought for $2.65)

The Days Trading Explained…..

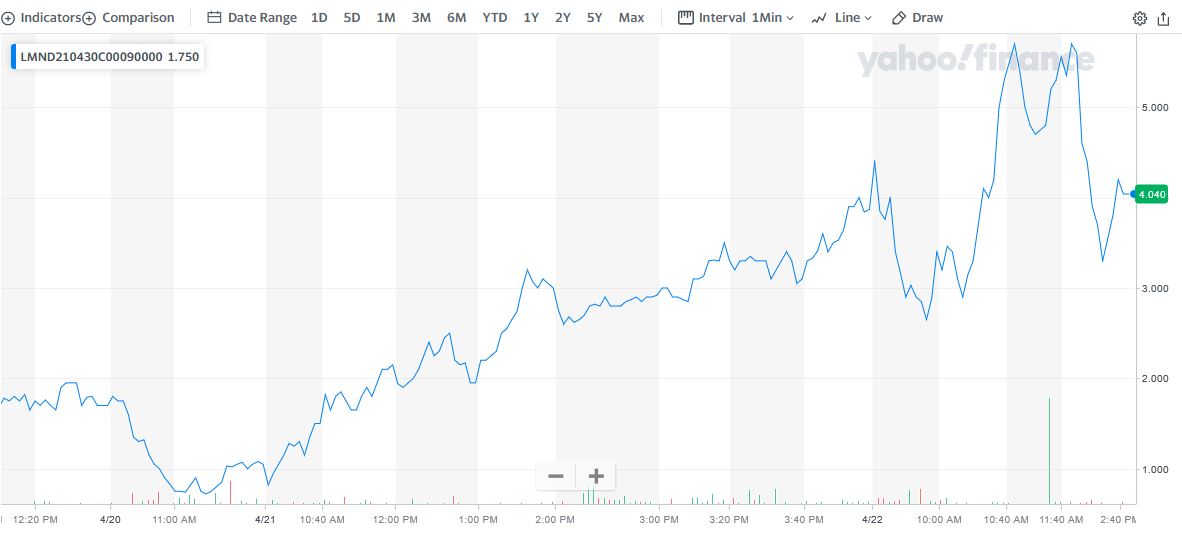

Weekly Options Members” entered a Lemonade weekly options trade on Thursday, April 22, 2021 at 9:51am for $2.65.

By 10:49am (58 minutes later) the price of the option was up to $5.70 – a nice profit of 115%.

The stock price of Lemonade receded from this point providing another opportunity to enter the trade after taking a good profit. This entry took place at 1:53pm for a cost of $3.30.

As at close on the trading day, the option price had already increased to $4.04; further potential profit of 22%.

Therefore, if the market rallies Friday further profit can be expected.

Why The Trade Recommendation On Lemonade?

After losing steam recently many of the so-called "reopening stocks" and SPACs are starting to rally, particularly Lemonade Inc (NYSE: LMND).

The stock market was having a generally strong day on Wednesday, with all three major averages in positive territory., and Lemonade is now coming back to life.

Lemonade was one of the highest-momentum stocks heading into 2021 and has lost about half of its value since its January peak, and was down by about 20% over the past month alone prior to today's move.

Lemonade wants to revolutionize the insurance industry, which it sees as ripe for disruption. It works with artificial intelligence (AI) and data mining to provide a faster and simpler user experience for a target market that's used to online shopping and video communications.

When Lemonade went public last July, it only sold homeowners and renters insurance. At the beginning of the third quarter, it launched pet insurance, and at the beginning of the fourth quarter, it introduced term life insurance. Both of these ventures work within the same AI-driven model and digitally powered system as the homeowners and renters products, with fast approval sans human interaction.

The Major Catalysts for This Trade.....

1. Expanding into Auto Insurance.....

On Tuesday Lemonade announced a major expansion of its business today. The company, which primarily sells renters, homeowners, and pet insurance, added term life insurance earlier this year. Now, Lemonade is expanding into auto insurance, which could be a huge growth driver over the next few years.

Lemonade announced that it plans to launch its Lemonade Car auto insurance platform by the end of the year, and early registration for interested customers is now live on the company's website.

Why auto insurance?

- Auto insurance is a massive addressable market. In the United States alone, it is estimated to be a $300 billion industry, roughly 70 times the size of Lemonade's core renters and pet insurance markets.

- Lemonade's customers want to buy their auto insurance through the company. The easy process of buying renters, homeowner, or pet insurance, as well as the company's quick claims process, have been a massive hit. Lemonade reached the 1 million customer milestone in a fraction of the time of most of its larger peers.

As chief operating officer Shai Wininger said, "We're seeing an overwhelming demand for a Lemonade car insurance product from our customers." The company estimates that its existing customer base spends about $1 billion on car insurance each year, so this product has the potential to have an immediate and game-changing impact on the company's revenue.

Lemonade's auto insurance product

will use the company's proprietary artificial intelligence to handle

emergencies and process claims. It also says that the product will be

"especially attractive" to drivers of electric vehicles and other

environmentally friendly cars.

2. Launched Life Insurance.....

Lemonade rolled out its life insurance product in the first quarter, so we haven't seen any results yet. Life insurance is by far the largest insurance market Lemonade has entered so far (approximately $800 billion globally), but it's also an industry that is ripe for innovation.

3. Product Offerings.....

The company is building up its product offerings fast, which will please a lot of current and potential customers.

Lemonade now offers homeowners, renters, pet, and life insurance, and most recently announced that it is going into the car insurance business. Customers can bundle their insurance products with Lemonade , meaning one-stop shopping.

4. Worldwide Presence.....

Lemonade, unlike other insurance companies, does not plan on offering its services in the U.S. alone. Lemonade is now also available in the Netherlands, Germany, and most recently France. Nothing is stopping Lemonade from offering its services to other countries in Europe and around the world.

5. Value for Customers.....

Lemonade's system may be similar, but it's also faster -- approving claims in as little as one second -- and often cheaper. It appeals to a young clientele, who are settling down with a first home and often purchasing insurance policies for the first time. Lemonade is targeting this group, with an average age in their early thirties, and hoping to create lifetime value with an assortment of insurance products.

Besides opening up the company to new markets, these products are meant to unlock greater value from each customer as they sign on for more products, with higher premium per customer, lowered customer acquisition costs, and long-term retention. As of the fourth quarter, half of pet and life policy purchases were from existing customers.

Lemonade is launching new products at a rapid rate, and it's far from finished. In fact, its biggest project seems to be right around the corner.

6. Lemonade Is Growing Fast.....

Lemonade's revenue has soared since the platform's initial launch in 2016, but its bottom line remains deep in the red.

|

Fiscal Year |

2017 |

2018 |

2019 |

2020 |

|---|---|---|---|---|

|

Revenue |

$2 million |

$23 million |

$67 million |

$94 million |

|

Net Income (Loss) |

($28 million) |

($53 million) |

($109 million) |

($122 million) |

Data source: Lemonade.

On the bright side, three of its core growth metrics -- its gross written premium (GWP), its net losses per dollar of GWP, and its gross loss ratio -- are all headed in the right directions.

|

Fiscal Year |

2017 |

2018 |

2019 |

2020 |

|---|---|---|---|---|

|

GWP |

$9 million |

$47 million |

$116 million |

$214 million |

|

Net Loss per Dollar of GWP |

($3.12) |

($1.13) |

($0.94) |

($0.57) |

|

Gross Loss Ratio |

161% |

113% |

79% |

71% |

Data source: Lemonade.

Lemonade is attracting more users, selling more insurance plans, and taking smaller losses on each plan. As a result, its gross and adjusted EBITDA margins are gradually improving, thanks in part to its use of AI and chatbots instead of human customer service representatives.

Lemonade's total number of customers grew from just 308,835 at the end of 2018 to just over a million at the end of 2020. Its average premium per customer rose from $145 to $213 during the same period.

Approximately 70% of Lemonade's customers are under the age of 35, and roughly 90% of its customers had no plans to switch to other carriers. That stickiness makes it a great play on the millennial market, and its average premiums could continue climbing as its aging customers purchase more expensive plans or Lemonade rolls out additional insurance services.

7. Future Outlook......

Lemonade expects its revenue to rise 21%-24% in fiscal 2021, but that growth rate isn't entirely comparable to the prior year due to a change in its reinsurance structure in the second half of 2020.

Instead, Lemonade says its gross earned premium, or the earned portion of its GWP, is a clearer indicator of its growth. It expects its gross earned premium to increase by 70%-73% for the full year.

8. Analysts Positivity.....

Analysts expect strong revenue growth for the next three to five years.

- Piper Sandler decreased their price objective on Lemonade from $159.00 to $134.00 and set an “overweight” rating for the company in a report on Tuesday, March 30th.

- JMP Securities lifted their price target on shares of Lemonade from $105.00 to $130.00 and gave the company an “outperform” rating in a research report on Tuesday, March 9th.

- Bank of America began coverage on shares of Lemonade in a research note on Monday, March 15th. They set an “underperform” rating and a $29.00 price objective for the company.

- Finally, Oppenheimer upgraded shares of Lemonade from a “market perform” rating to an “outperform” rating and set a $110.00 price objective on the stock in a report on Monday, March 15th.

Summary.....

As Lemonade goes through the ups and downs of its first year as a publicly traded company, it certainly isn't sitting still.

The insurance technology company was one of the hottest IPOs of 2020, opening at roughly $50 in its market debut that July and hitting a high of $183 this January. But it's lost more than half its value since that time, mostly after a disappointing fourth-quarter earnings report.

Lemonade is

still fairly new and very much in growth mode, and in the past year it has

added pet and life insurance. To hear management tell it, the best may be yet

to come. On the fourth-quarter conference call, COO Shai Wininger said the

company is working on a new product that "may well be the most significant

launch we've ever done."

Therefore…..

Will Lemonade Stock Price Continue To Climb?

Will Our Latest Trade On Lemonade Stock Come To Fruition?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Weekly Options USA, and get the full details on the next trade.

Join us today and find out!

While there are many more areas that can help to explain option trading, this is a basic overview of what stock options are, and where and how they started.

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.

Back to Weekly Options USA Home Page from Lemonade Making A Comeback!