TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

PROFITING FROM WEEKLY OPTIONS

by Amanda Harvey

Profiting from weekly options requires understanding how to trade weekly options effectively, planning your trading strategy, and most of all timing the market.

FINDING THE RIGHT STOCKS

The very first step towards profiting from your trading is to find the best stocks on which to trade weekly options. There are a number of factors involved in choosing stocks that provide the best trading opportunities.

Price movement is obviously extremely important when it comes to profiting from weekly options. If a price does not move significantly in the direction of the trade – upwards for a call option, or downwards for a put option – there will not be any opportunity for realizing a worthwhile profit.

FACTORS TO CONSIDER FOR PROFITING FROM WEEKLY OPTIONS

One of the key factors that make a weekly option a viable choice for a profitable trade is that there is an imminent catalyst which is expected to cause a substantial change in the price. These catalysts include company news such as sales or earnings reports, events in the sector, and general economic news.

It is also vital to consider other factors when selecting which weekly options to trade. Implied volatility, which is the anticipated amount of fluctuation in price movement, is one main consideration. If a stock is unlikely to experience considerable price movement, it is not likely to provide the desired profit from an options trade.

the importance of volume

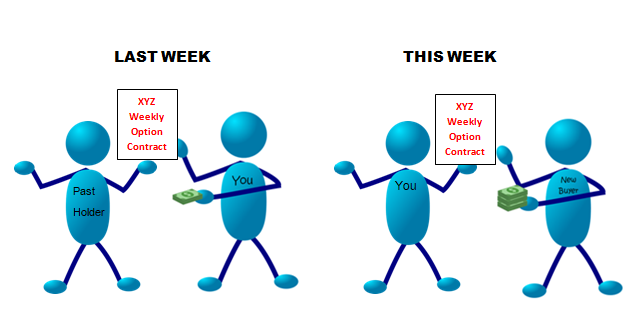

Volume is also a main point to consider when trading weekly options for profit. An option that shows high volume indicates that a large number of contracts are being bought and sold. This means that when the desired profit has been attained, there will very likely be buyers ready to purchase your contract at your required price. If a stock and its corresponding options tend to experience low volume, this may result in being unable to sell your contract, even if the market price has reached your goal.

USING ENTRY STRATEGY

Another vital aspect to profiting from weekly options is to have a solid approach to your entry and exit strategy. Buying into an options contract at the best possible time, and the right price sets the stage for a profitable trade. With our trading alert service, there is a buy-in price given with each trade, but our members need to use their judgment in different scenarios.

The price at which you wish to buy into an option may not always be possible at the moment you want to enter the trade. In this situation, you need to gauge whether it is likely to keep climbing, in which case, entering at a slightly higher price would still be worthwhile.

EXITING THE TRADE AT THE BEST POSSIBLE TIME

Deciding when to exit the trade can very well determine whether or not you achieve a profit at all, and also the size of that profit. There are many different approaches that you can take in regard to your exit strategy, and it depends largely on your risk tolerance as well as your ability to monitor your trades.

We remind our members and readers often that taking moderate and consistent profits leads to a pleasing overall result. Two pitfalls to avoid are either putting too much capital into any one trade, or letting emotions run away with you when you get out of trades too soon out of fear, or hold them too long out of greed.

WINNING WITH WEEKLYs

When trading weekly options, you need up-to-the-minute knowledge of the events affecting the market, as well as an understanding of which weekly options to trade, how much to pay for these trades, what strategies to use, and when to enter and exit each trade.

If this sounds like a lot of work to you, don’t worry! Our membership service does all of this for you, so join us today, and start winning with weeklys.

Recent Articles

-

191% Weekly Option Win on Super Micro Computer Amid Market Mayhem

191% Weekly Option Win on Super Micro Computer Amid Market Mayhem – What’s Next? -

Tariffs and the Stock Market: Positive and Negative Impacts in 2025

Tariffs and the Stock Market: Positive and Negative Impacts in 2025. This article explores both the positive and negative effects of tariffs on the stock market based on recent data, forecasts, and ma… -

SMCI’s Wild Ride: Options Traders Are Profiting From the Ups and Downs

SMCI’s Wild Ride: How Options Traders Are Profiting From the Ups and Downs

Back to Weekly Options USA Home Page from Profiting from Weekly Options