TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

WHAT ARE WEEKLY OPTIONS? WATCH THE VIDEO

by Amanda Harvey

What are weekly options? In order to explain what weekly options are, let’s go right back to the beginning of this equation, and look at where they start from. Options in general are what’s known as a derivative, which means that they are a financial instrument that are based on stocks or shares of companies which are listed on the stock market. Owning a stock or a share is essentially like owning a tiny piece of a company, which means that if the company makes money, then your shares increase in value. Likewise, if the company isn’t doing well, then your shares become less valuable.

Options were introduced as a way of being able to control a certain amount of shares on the stock market without actually buying them outright.

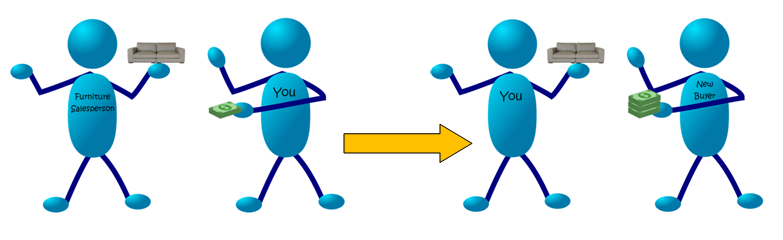

A good way to look at options is that basically, buying what’s called an options contract is like being able to pay money to put a reserved sticker on a piece of furniture, that keeps it for you at a certain price.

When you buy an options contract, you are buying the right to purchase the shares that the options are based on at a set price which is known as the strike price at the end of a certain period of time, which is called the expiration of the contract.

So for example, let’s take the analogy of buying a piece of furniture. You go into a furniture store and you see a really beautiful sofa that is currently priced at $2000. Now you think it’s very likely that this price is going to increase, because this sofa is very popular. You’re not sure if you want to buy the sofa, but you would like the possibility of doing so, and what you want to do is to reserve that, by buying the options contract “reserved sticker” and putting it on the sofa, saying that you can buy that sofa on a date, one month later, at the price of $2100.

Then you go away, and you wait to see what happens, and to decide whether you actually do want to buy the sofa. You then find out a week later, through an advertisement you get in the mail, that the sofa is being sold now for $2800. At this stage you have a couple of choices if you would like to take advantage of having paid the cost of a premium, which is what you pay to buy an options contract, in order to reserve that sofa at that price.

WHAT ARE WEEKLY OPTIONS PROFIT OPPORTUNITIES?

You can decide that you

want to wait until the expiration date of your contract, and then buy the sofa

at the price of $2100. At that time, assuming that the market price is still

$2800 or more you could immediately sell the sofa at a profit that might be

$700 or higher, minus the cost of the premium you paid. Alternatively you might

want to keep the sofa as an investment piece, believing that it will become a

collectors’ item, and therefore increase further in value.

Another possibility is that you don’t actually want to buy the sofa, but you can see that this options contract, or reserved sticker, has increased in value. Let’s say just for the sake of this example that you paid 10% of the cost of the sofa to buy that options contract, so you paid $210, and now because the sofa has increased in value, you can actually get a higher price for passing that reserved sticker onto somebody else. That person thinks the price is still going to go up, and so they think being able to have that sofa reserved for them to buy at a cost of $2100 is really worthwhile, even though they might need to pay you a premium of $280 for your reserved sticker. This means that your options contract has increased in its own intrinsic value by $70.

You might also believe that the sofa is going to continue to increase in value, so you might decide to hold onto your contract until closer to the expiration date in order to sell the contract at an even greater profit if that further increase does happen. This is one time where judgment and research are important. You need to decide whether to take the proverbial bird in the hand, and sell at a profit while you know that you can, or wait in the expectation of being able to catch the two birds you believe will appear in the bush.

When your options contract is about to expire, it is very important to know how the strike price compares to the current market price.

Going back to our previous analogy of the sofa, if the price stays higher than the strike price of $2100, then the contract is described as being “in-the-money.” In this scenario, unless you want to buy the sofa at expiration of your contract, you need to take action before the expiration date. If you don’t sell your contract prior to expiration, you will have to buy the sofa at $2100.

If the expiration date comes, and things have not gone according to your expectations, so the value of that sofa has not increased, and in fact now the store and other stores are selling the sofa for $1000, because the wood was found to have been sourced unethically, then your options contract expires “out-of-the-money,” which means that it’s worthless, and you have lost the cost of your premium.

What are weekly options differences to standard options?

This gives a general explanation of how options work, so let’s move onto the specific points of weekly options, and how they differ from other options contracts.

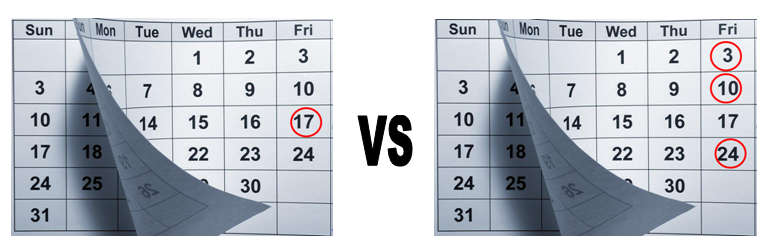

The main difference between standard options and weekly options is the length of time between when they are issued and when they expire.

Standard options contracts expire monthly, on the third Friday of each month. It is possible to buy contracts of standard options many months in advance of their expiration date, or to take a contract with an expiration date that is only days away.

Weekly options typically have expiration dates on three or four Fridays of each month. There are no weekly options expiring on the third Friday of the month, as that is the expiration date for monthly options. Weekly options can usually be bought for up to 6 weeks in advance of expiration.

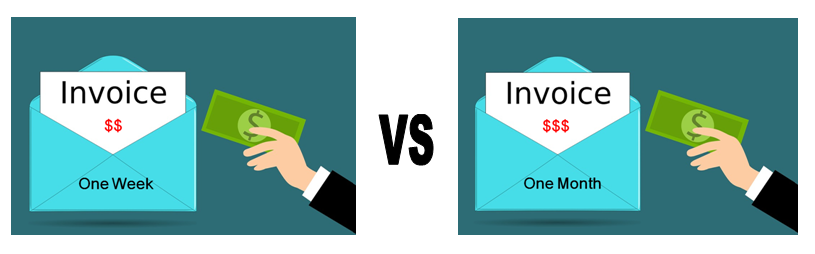

Because weekly options are designed for a short period of time, they are generally used when traders expect the price of a stock to move very quickly. In this case, they don’t need a contract that gives them a long amount of time. They plan to go into the contract and get out of the contract again very quickly. One of the advantages of using weekly options, as opposed to monthly options is that the cost you pay for the premium is usually lower than the premium of the corresponding monthly option. The price of the premium is based on a number of factors, and one of these factors is time value. All premiums on options tend to become cheaper as the contract nears its expiration date, and the time value becomes lower.

Back to the illustration of the sofa, you might have seen on an entertainment blog that a certain celebrity is going to buy the same sofa tomorrow. You know that this will probably cause the sofa to jump hugely in price, which is a great opportunity for getting in on this predicted price movement with an options contract. You don’t need a contract with a long duration, as you plan to buy and sell your contract within a couple of days. A weekly option is great in this case, as you are not paying extra money for time value that you don’t need. It’s also great if you want to actually buy the sofa a few days later on expiration date, and sell it to someone who is willing to pay above market price, now that the sofa is hard to find.

Recent Articles

-

191% Weekly Option Win on Super Micro Computer Amid Market Mayhem

191% Weekly Option Win on Super Micro Computer Amid Market Mayhem – What’s Next? -

Tariffs and the Stock Market: Positive and Negative Impacts in 2025

Tariffs and the Stock Market: Positive and Negative Impacts in 2025. This article explores both the positive and negative effects of tariffs on the stock market based on recent data, forecasts, and ma… -

SMCI’s Wild Ride: Options Traders Are Profiting From the Ups and Downs

SMCI’s Wild Ride: How Options Traders Are Profiting From the Ups and Downs

Back to Weekly Options USA Home Page from What Are Weekly Options? Watch the Video