TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

A Nvidia Weekly Put Option Pays Off

As Shares Hurt By Regulations!

Weekly Options Members

Are Up 71% Potential Profit Using A Weekly PUT Option!

At a briefing late Monday, the U.S. Department of Commerce imposed significantly expanded restrictions on the types of advanced semiconductors and chip-making equipment that could be exported to China, Iran, and Russia.

The new rules will require NVIDIA Corporation (NASDAQ:NVDA) and other companies to obtain licenses from the U.S. government before selling the most advanced processors to customers in China, as well as 40 other countries that are under U.S. arms embargoes.

This set the scene for Weekly Options USA Members to profit by 71%, using a NVDA Options trade!

Join Us And Get The Trades – become a member today!

Friday, October 20, 2023

by Ian Harvey

Why the NVDA Weekly Options Trade was Originally Executed!

Regulators announced a limit that could hurt AI chip sales.

At a briefing late Monday, the U.S. Department of Commerce imposed significantly expanded restrictions on the types of advanced semiconductors and chip-making equipment that could be exported to China, Iran, and Russia. The new rules were designed to curb the ability of these countries to use AI for military applications.

The new rules will require NVIDIA Corporation (NASDAQ:NVDA) and other companies to obtain licenses from the U.S. government before selling the most advanced processors to customers in China, as well as 40 other countries that are under U.S. arms embargoes. The restrictions also apply to equipment used in the manufacture of high-end AI chips.

Commerce Secretary Gina Raimondo addressed the additional measures. While she acknowledged the possible benefits of AI, she was also wary of the potential for the technology to be misused:

“Artificial Intelligence is probably the most obvious example of the kind of transformational technology that we have to assess and control. It's true that AI has the potential for huge societal benefit. But it also can do tremendous and profound harm if it's in the wrong hands and in the wrong militaries.”

The NVDA Weekly Options Trade Explained.....

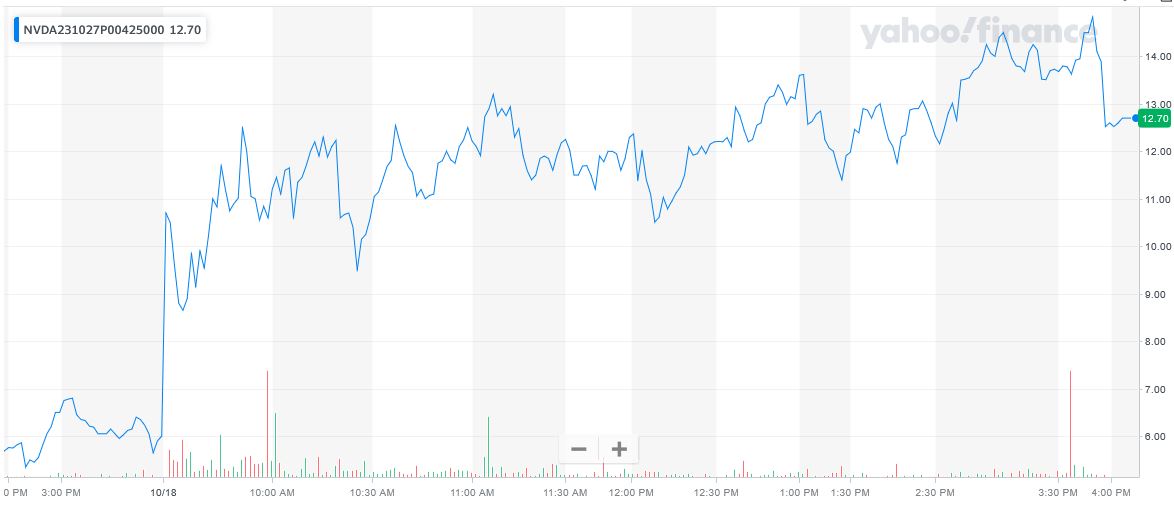

** OPTION TRADE: Buy NVDA OCT 27 2023 425.000 PUTS - price at last close was $6.00 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the NVDA Weekly Options (PUT) Trade on Wednesday, October 18, 2023, at 9:35, for $8.65.

Sold the NVDA weekly options contracts on Wednesday, October 18, 2023, at 3:48, for $14.83; a potential profit of71%.

Don’t miss out on further trades – become a member today!

Further Catalysts for the NVDA Weekly Options Trade…..

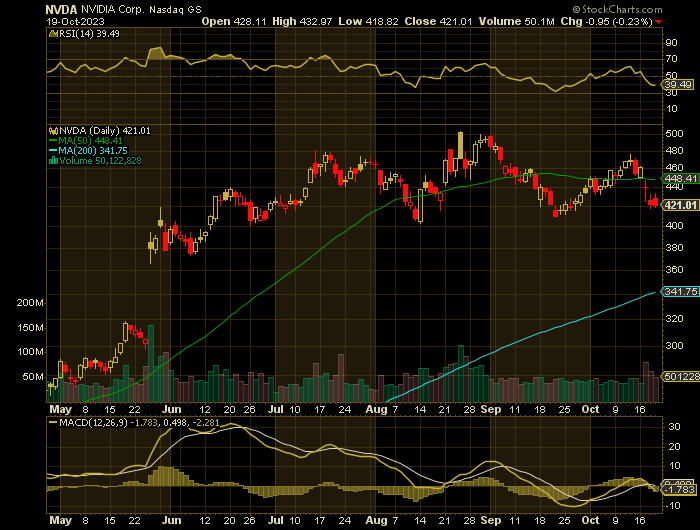

These latest rules reinforce and expand the restrictions implemented last year, which limited the sale of the most advanced processors. Nvidia and Intel both responded to the export controls by developing redesigned chips that fell within the limits of the restrictions.

Nvidia reduced the speed of its flagship processor, releasing the A800 and H800 chips for customers in China.

Unlike the previous restrictions, the new rules focus less on processor speed and more on computing performance. This would also effectively ban the sale of the redesigned processors to China.

In a statement released early on Tuesday, Nvidia sought to downplay the effect of these additional restrictions on its results:

“We comply with all applicable regulations while working to provide products that support thousands of applications across many different industries. Given the demand worldwide for our products, we don't expect a near-term meaningful impact on our financial results.”

Other Catalysts.....

Nvidia said it may be forced to move some business operations out of countries that are in the purview of U.S. export curbs after the Biden administration on Tuesday expanded its restrictions on export of certain high-end technology.

The chipmaker also said the new rules may impact its ability to complete the development of certain products in a timely manner, support existing customers of those products, or supply customers of those products outside the affected regions.

Under the expanded curbs, which go into effect in 30 days, the U.S. has now restricted a broader swathe of advanced chips and chipmaking tools to a greater number of countries including Iran and Russia, and blacklisted Chinese chip designers Moore Threads and Biren.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from NVIDIA

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.