TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Taiwan Semiconductor Defies Stock

Market Pullback!

“Weekly Options” Members

Profit Up 177%

In 3 Days!

More Growth Expected?!

Wednesday, December 01, 2021

by Ian HarveyTaiwan Semiconductor shares moved higher on Wednesday along with the stock market in Taiwan as investors ignored heavy losses in the U.S. markets overnight after comments by the U.S. Federal Reserve chair on downsizing asset purchases.

And “Weekly Options” Members Profit Up 177% In 3 Days!

More to come?

Taiwan Semiconductor Mfg. Co. Ltd. (ADR)(NYSE: TSM)

On Monday, November 29, 2021, a Taiwan Semiconductor Weekly Options trade was recommended to our members based on several catalysts.

READ Details of the Original Taiwan Semiconductor Weekly Options Recommendation Further Below.....

Shares in Taiwan moved higher on Wednesday as investors ignored heavy losses in the U.S. markets overnight after comments by the U.S. Federal Reserve chair on downsizing asset purchases, dealers said.

The bellwether electronics sector again served as the main driver of the gains on the broader market as investors rushed to pick up large-cap semiconductor stocks to push the market up by more than 150 points by the end of the session

The Taiex soon regained its footing as buying occurred with semiconductor stocks, in particular the two major pure wafer foundry operators Taiwan Semiconductor Manufacturing Co. and United Microelectronics Corp. (UMC).

"While Powell talked about a possible move to speed up the pace to downsize the Fed's asset purchases, his comments did not involve any quicker rate hike cycle," Mega International Investment Services Corp. analyst Alex Huang said.

"Many investors here remain calm and still anticipate that the Fed will raise its key interest rates twice next year, unchanged from the previous expectations," Huang said.

Meanwhile, in the U.S. major corporate leaders warned lawmakers that time is running out for them help spur the return of critically important semiconductor manufacturing to the U.S.

Executives from more than 50 U.S. companies in a Wednesday letter called on congressional leaders to pass legislation that provides $52 billion in grants and incentives for domestic chip production, as well as a separate bill to encourage semiconductor design and manufacturing.

“We call on Congress to take prompt action to fund the ‘Creating Helpful Incentives for the Production of Semiconductors’ (CHIPS) for America Act and enact a strengthened version of the ‘Facilitating American-Built Semiconductors’ (FABS) Act to include an investment tax credit for both design and manufacturing,” the executives wrote in the letter, organized by the Semiconductor Industry Association.

Signatories to the letter included executives of prominent overseas companies with operations in the U.S., such as leading chipmaker Taiwan Semiconductor Manufacturing Co. and Toyota Motor Corp.

The Actual Recommended Taiwan Semiconductor Weekly Options Trade.....

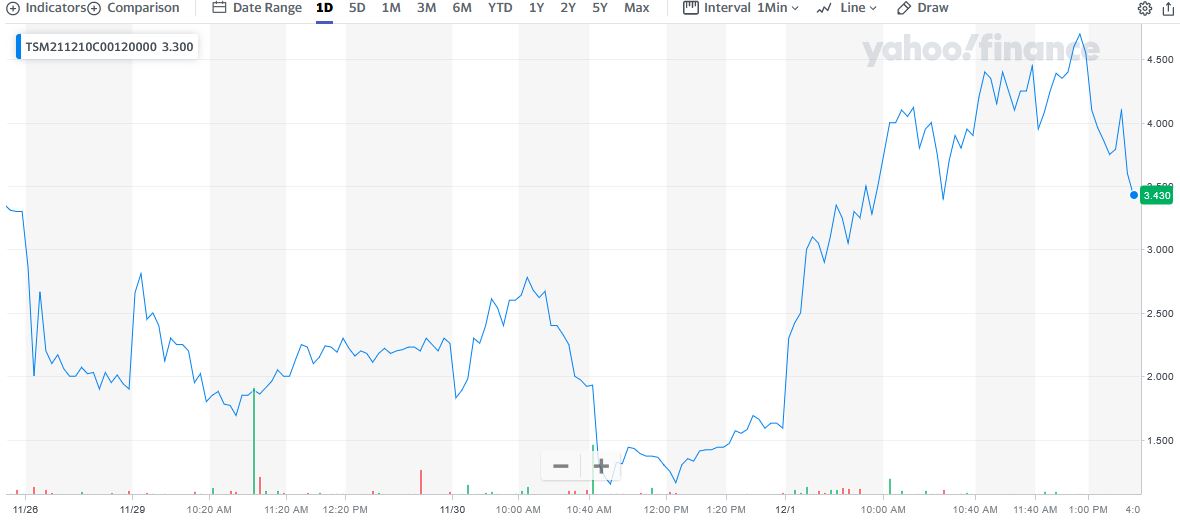

** OPTION TRADE: Buy TSM DEC 10 2021 120.000 CALLS at approximately $1.90.

(Actually bought for $1.69)

Taiwan Semiconductor Weekly Options Trade Call Success Explained.....

Monday, November 29, 2021

- Bought at 10:31 for $1.69

Wednesday, December 01, 2021

- Sold at 12:47 for $4.70

Total Potential Profit is 177%

It is very likely that a new Taiwan Semiconductor Weekly Options trade, if recommended, will be also successful.

Join us and see what we are proposing!

The Original Major Catalysts for the Taiwan Semiconductor Weekly Options Trade…..

Prelude.....

A global shortage in semiconductor chips has been wreaking havoc on the tech sector, automotive industry, consumer electronics industry, and everything in between thanks to massive supply chain snarl ups. The global Covid-induced supply crunch for chips has badly hurt production across a number of industries, ranging from cars to consumer appliances, smartphones and personal computers.

The trade war between the United States and China has only served to make a bad situation worse.

But whereas the global chip shortage has been a nightmare for businesses that make cars and home appliances as well as people who buy them, semiconductor stock investors are hardly complaining as they continue to see outsized gains on their investments.

Taiwan Semiconductor Mfg. Co. Ltd. (ADR)(NYSE: TSM), the world's largest 3rd party chip manufacturer, counts tech heavyweights such as Apple Inc. (NASDAQ:AAPL), Nvidia and Qualcomm as its clients. In fact, TSMC is so dominant that it accounted for 54% of total foundry revenue globally last year as per TrendForce data.

About TSM…..

Taiwan Semiconductor Manufacturing's has obtained lead in advanced semiconductor manufacturing over the past few years, and that lead only seems to be getting bigger. Last month, rival Intel, one of the last chipmakers that manufactures its own chips, admitted that it had run into a design flaw for its 7 nm manufacturing process, and would be falling some 12 months behind schedule. Intel had already ceded the leading-edge node lead to TSM in 2018, and that lead only seems to be getting bigger.

Advanced chip manufacturing is hard, but TSM's years of experience making a wide variety of semiconductors has given it a knowledge and process lead that other manufacturers are struggling to match. In fact, rival GlobalFoundries threw in the towel on competing with Taiwan Semi on the leading edge back in 2018. Intel itself even hinted that it may outsource some manufacturing going forward, likely to TSM. The U.S. government also recently subsidized TSM to build a new fabrication plant in Arizona on national security grounds.

It seems TSM has built itself a formidable moat in chip manufacturing.

The Major Catalysts for the Taiwan Semiconductor Weekly Options Trade…..

1. Japanese Approved Funding.....

The Japanese government approved 774 billion yen ($6.8 billion) in funding for domestic semiconductor investment, backing up Prime Minister Fumio Kishida’s commitment to make the nation a major global provider of essential computer chips.

Tokyo will spend part of the 617 billion yen package on a planned semiconductor plant by Taiwan Semiconductor Manufacturing Co. and Sony Group Corp. in Kumamoto prefecture. While the Ministry of Economy, Trade and Industry haven’t elaborated on the exact amount that will be used for the project, it has said it would pay “up to half” of the total investment needed for a project in this category. For legacy chip production, aid for up to one-third of the total capital expenditure will be provided, the ministry said.

2. Co-operation With Eastern European Nations.....

Taiwan is looking at cooperating with three Eastern European countries on semiconductors, a minister said on Thursday, a move likely to find favour in Brussels which has been courting Taiwanese semiconductor firms to manufacture in the bloc.

Kung Ming-hsin, who heads Taiwan's National Development Council, told reporters following his visit to Slovakia, the Czech Republic and Lithuania last month that all three countries had mentioned they wanted to work on chips with the island.

3. Wedgewood Partners Comments…..

TSMC manufactures some of the most advanced chips for fabless tech companies that do not own their own foundries. Last month, Wedgewood Partners, an investment management firm, had this to say about TSMC:

"Taiwan Semiconductor Manufacturing detracted from performance as the market attempted to price in a downturn in the semiconductor cycle. Although there are some signs that memory markets might be somewhat oversupplied, we have yet to see any tangible signs that logic semiconductors – particularly at the leading-nodes where the Company dominates – are in anything but short supply. In addition, and as a result of this strong demand, the Company should be able to pass through price increases to help fund very attractive returns on the rare leading-edge capacity that serves this demand."

4. Price Increases…..

TSMC is reportedly raising prices by 10% for advanced chips, while less advanced chips–used commonly by automakers--would cost 20% more.

5. Analysts Thoughts.....

Investment

bank JPMorgan is recommending that investors pursue trends in the semiconductor

space that are more structural than cyclical. Structural trends tend to be

longer-term, permanent changes in an industry whereas cyclical trends are influenced

by the business cycle and tend to be short-lived.

JPM

recommends investing in very high-end computing segments, noting there’s

ongoing disruption in high-end computing globally, which used to be very

monolithic but is now being fragmented as more companies enter the space.

JPMorgan

also recommends investing in semiconductor companies that focus on legacy,

long-tail technologies, such as TSM. This company manufactures a variety of

less advanced chips in areas like power management, microcontrollers, sensors

and other consumer-related segments.

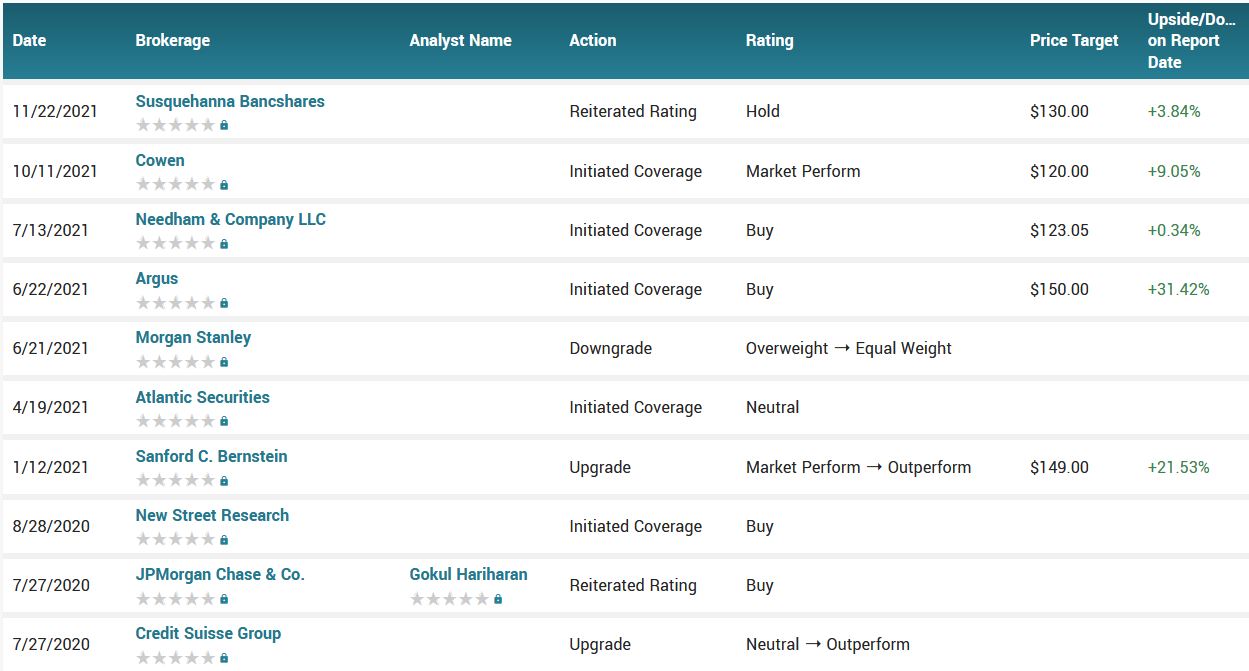

According to the issued ratings of 8 analysts in the last year, the consensus rating for Taiwan Semiconductor Manufacturing stock is Hold based on the current 5 hold ratings and 3 buy ratings for TSM. The average twelve-month price target for Taiwan Semiconductor Manufacturing is $133.15 with a high price target of $150.00 and a low price target of $120.00.

Conclusion.....

Shares of Taiwan Semiconductor traded up $5.68 during trading on Wednesday, reaching $122.83. The stock had a trading volume of 255,678 shares, compared to its average volume of 9,772,632.

Taiwan Semiconductor Manufacturing Company Limited has a 52 week low of $96.20 and a 52 week high of $142.20. The business’s 50-day moving average price is $115.70 and its 200 day moving average price is $116.82. The company has a debt-to-equity ratio of 0.22, a current ratio of 1.92 and a quick ratio of 1.65. The stock has a market capitalization of $637.01 billion, a PE ratio of 29.73, and a P/E/G ratio of 1.77 and a beta of 0.89.

Therefore…..

The Taiwan Semiconductor Weekly Options Trade Has Been A Big Winner!

What Further Taiwan Semiconductor Weekly Trades Will We Recommend?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Weekly Options USA, and get the full details on the next trade.

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.

Back to Weekly Options USA Home Page from Taiwan Semiconductor