TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

“Weekly Options

TradeS” Recommendations

Week Beginning Monday, JANUARY 11, 2021

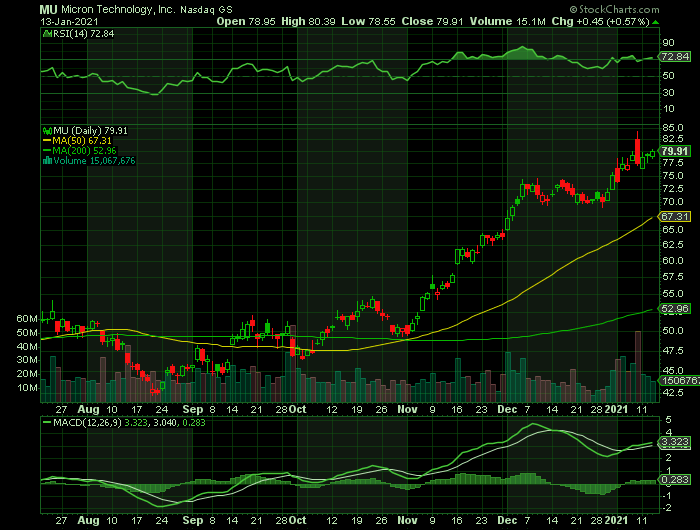

Weekly Options Trade – Micron Technology, Inc. (NASDAQ: MU) Calls

Thursday, January 14, 2021

** OPTION TRADE: Buy MU JAN 22 2021 80.000 CALLS at approximately $1.45.

(Some members have asked for the following.....

Place a pre-determined sell at $2.90.

Include a protective stop loss of $0.60.)

Prelude.....

The global semiconductor industry will return to growth this year despite disruptions from the Covid-19 pandemic, a new forecast shows. Memory-chip companies are on pace to post the biggest gains in 2020.

And, Micron Technology, Inc. (NASDAQ: MU) will certainly be at the forefront of this situation.

We previously executed a trade on MU back in December, and within 4 hours had made potential profits of 113%.

The Major CatalystS for This Trade.....

1. Optimistic Outlook.....

For Micron, the end of 2020 was marked by a shift from a company struggling under difficult macro conditions and the semiconductor industry’s cyclical nature to one offering a more optimistic outlook. The transition got full confirmation last Thursday when the memory giant beat the estimates in its latest quarterly results.

In F1Q21, Micron delivered revenue of $5.77 billion, a 12.3% uptick over the same period last year, while beating Street’s forecast by $110 million. FQ1 Non-GAAP EPS of $0.78 came in $0.09 above consensus.

The company’s guidance for the next quarter was also a display of strength, with revenue anticipated to come in between $5.6 billion to $6 billion, above the $5.52 billion of revenue Street analysts were calling for.

2. Demand For Micron’s Memory Products Is On The Rise.....

The trends are in Micron’s favor, too. 5G smartphones require more DRAM memory and the company is well positioned to benefit as 5G use becomes more prevalent in the years ahead.

3. Analysts Positivity.....

Susquehanna analyst Mehdi Hosseini says that despite the bullish sentiment, Micron’s tone on the earnings call was one of caution, which reminds him of the noises made in the previous earnings call. Yet, he sees this vigilant position as a positive.

“We actually favor conservatism especially in the current environment where customers are unwilling to commit to more than a few months of shipment contracts,” Hosseini said.

“We argue MU remains on pace to exit 2021 with well over $2 of quarterly earnings,” the analyst opined. “In fact, after two years of recession in earnings (FY/CY 19-20), compares are favorable, pricing dynamics changing to favor suppliers, and there are increased prospects of quarterly operating margin doubling over the next year."

As a result, Hosseini reiterated a Positive (i.e. Buy) rating on MU, while increasing his price target from $90 to $100. The new figure implies a 26% upside potential from current levels.

Further Catalysts.....

Micron historically focused on providing DRAM for PCs and servers. The firm then expanded into the NAND flash memory market. The company increased its DRAM scale with the purchase of Elpida (completed in mid-2013) and Inotera (completed in December 2016).

The stock will increase over the next year given the increased demand for and sales of the company’s memory product solutions for the cloud server, enterprise, client, graphics and networking markets.

Micron’s ultra-bandwidth solutions, which are known to deliver maximum bandwidth to feed client’s data-hungry workloads like high-performance computing, artificial intelligence systems and professional visualization workstations, will continue to spike in demand amid a transition to long-term remote working conditions.

For the current quarter, the company is expected to earn $0.62 per share, which is a change of +37.78% from the year-ago reported number.

Over the last 30 days, the Consensus Estimate for Micron has increased 20.67% because three estimates have moved higher compared to no negative revisions.

For the full year, the company is expected to earn $3.80 per share, representing a year-over-year change of +34.28%.

There has been an encouraging trend in estimate revisions for the current year as well. Over the past month, five estimates have moved up for Micron versus one negative revision. This has pushed the consensus estimate 5.86% higher.

Summary.....

Earnings estimates for this company have been showing solid improvement lately. The stock has already gained solid short-term price momentum, and this trend might continue with its still improving earnings outlook.

Analysts' growing optimism on the earnings prospects of this chipmaker is driving estimates higher, which should get reflected in its stock price.

For Micron, strong agreement among the covering analysts in revising earnings estimates upward has resulted in meaningful improvement in consensus estimates for the next quarter and full year.

Micron shares have added 10% over the past four weeks, suggesting that investors are betting on its impressive estimate revisions.

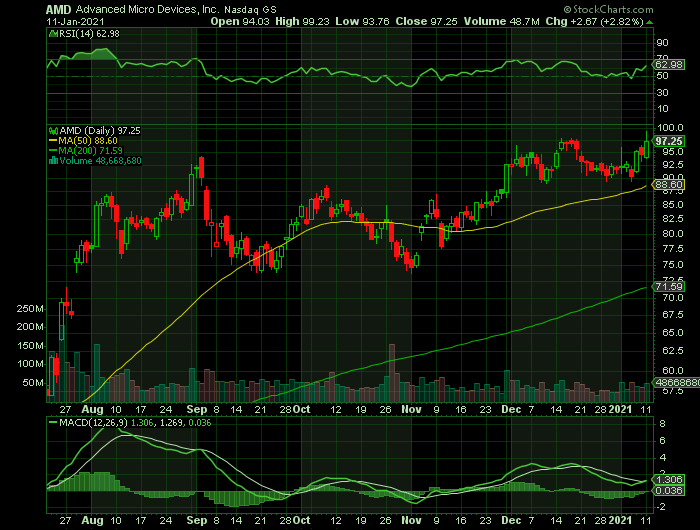

Weekly Options Trade – Advanced Micro Devices, Inc. (NASDAQ:AMD) Calls

Tuesday, January 12, 2021

** OPTION TRADE: Buy AMDJAN 29 2021 100.000 CALLS at approximately $4.50.

(Some members have asked for the following.....

Place a pre-determined sell at $9.00.

Include a protective stop loss of $1.80.)

Prelude.....

The Santa Clara, Calif.-based company Advanced Micro Devices, Inc. (NASDAQ:AMD), a global semiconductor company, saw its stock almost doubled in 2020. Market share gains against Intel in the CPU (central processing unit) space and strong sales of gaming hardware in the wake of the novel coronavirus pandemic helped the chipmaker record impressive top- and bottom-line growth throughout the year, and investors laughed all the way to the bank as a result.

But don't be surprised to see AMD replicate its performance in 2021, as the catalysts that drove its growth in 2020 are here to stay.

The Major CatalystS for This Trade.....

1. Earnings Report.....

AMD is scheduled to release its earnings on January 26, 2020. Based on 10 analysts' forecasts, the consensus EPS forecast for the quarter is $0.41. The reported EPS for the same quarter last year was $0.27.

AMD's revenue from the semi-custom business more than doubled in the third quarter of 2020, rising 116% year over year to $1.13 billion. The chipmaker credits this terrific growth to two factors: higher sales of semi-custom chips, and a jump in server processor sales. The good news for AMD is that these two verticals are expected to sustain their terrific momentum in 2021, thanks to two major catalysts.

2. A More Dominant CPU Player…..

AMD has made massive strides in the CPU market against Intel in the past year. AMD reportedly held 22.4% of the x86 CPU market at the end of the third quarter of 2020, according to Mercury Research, its highest share in 13 years.

AMD has managed to chip away at Intel's CPU dominance thanks to its superior product line, which is based on a smaller manufacturing node, allowing it to deliver better computing performance and reduce power consumption. For example, AMD's recently released Ryzen 5000 series desktop processors can outperform their Intel counterparts according to independent benchmarks.

Not surprisingly, AMD is expected to increase its x86 CPU market share significantly this year. Rosenblatt Securities analyst Hans Mosesmann predicts that AMD could boost its share to as much as 50% this year, which would be more than double where it stood at the end of the third quarter of 2020. So AMD's computing and graphics segment, which has delivered 47% revenue growth in the first three quarters of 2020, seems to have enough ammunition to sustain its hot run in the New Year.

3. Cyberpunk 2077 Is Driving An Upgrade Cycle.....

This game is very demanding and thus it is driving consumers to upgrade GPUs in droves.

4. Crypto Mining Is Driving Sales.....

Further Catalysts.....

AMD could widen its advantage in 2021, as it is expected to refine its existing Zen 3 architecture. Supply chain gossip indicates that AMD could enhance its 7-nanometer (nm) manufacturing process to update the Ryzen 5000 series CPUs in the second half of the year. The gains are expected to be incremental compared to the current-generation CPUs also based on a 7nm node -- but Intel's troubles are likely to help AMD maintain its technological advantage.

The launch of Intel's 10nm desktop chips (which are expected to compete with AMD's 7nm chips) has been substantially delayed. Chipzilla is offering 10nm Tiger Lake chips only on laptops, giving AMD a free run in the desktop space, where the former is currently selling 14nm chips. What's more, Intel is expected to remain stuck on a 14nm manufacturing node for the better part of the year, as its 10nm desktop parts are expected only in the second half of the year.

AMD should have refined its 7nm process further by then, and getting ready to make the jump to the Zen 4 architecture (based on a 5nm node) in 2022. Meanwhile, Intel is expected to continue playing catch up: Its competing 7nm CPUs aren't expected to arrive until 2023, as the chip giant is a year behind schedule on the development of this platform.

AMD's semi-custom business could be on a roll this year is because of gaming consoles. The chipmaker is powering Sony's PlayStation 5 and Microsoft's Xbox Series X consoles, and these devices seem to be setting the sales chart on fire. Sony has reportedly sold 3.4 million PS5 units in just four weeks and is facing supply shortages because of huge demand.

The launch of the new-generation gaming consoles is expected to drive a big upgrade cycle, with one analyst estimating that the PS5 could hit over 200 million in sales. That would be almost twice the sales of the previous-generation PS4 console. And as the PS5 and the Xbox Series X have been launched only recently, they are likely to see strong demand over the coming months and help AMD boost sales.

AMD's market share gains in the server market space will be another growth driver for the EESC (Enterprise, Embedded and Semi-Custom) business. According to IDC, the revenue of servers running AMD processors shot up 112.4% year over year in the third quarter of 2020, outpacing the broader market's revenue growth of just 2.2%.

This is a clear indication that AMD is rapidly gaining market share against Intel, currently the dominant player in the server processor market with a market share of 93.4%, according to Mercury Research. But AMD has eaten quickly into Intel's dominance and has an opportunity to give its top line a big boost by capturing more market share.

Analysts Thoughts.....

“We think 2021 is setting up to be a banner growth year for semiconductors as 1) the macro-economy recovers, 2) distribution channels refill, and 3) markets see increased semi content,” says Piper Sandler semiconductor analyst Harsh Kumar.

Added Kumar, “First, we feel the global re-opening and recovery will benefit semiconductors, as enterprises and consumers enter the new normal. Second, distribution channels are at or near all-time lows, and the refilling of the channel should add another leg of growth on top end demand. Finally, markets like automotive, industrial, mobile, and several others are benefitting from increasing semiconductor content. Overall, we see 2021 being a strong year for semis, particularly after a weak 2019 (trade war) and 2020 (pandemic).”

Summary.....

Analyst estimates compiled by Yahoo! Finance point toward nearly 27% growth in AMD's revenue in fiscal 2021, along with a 48% jump in earnings per share. AMD looks capable of delivering that kind of growth given the various catalysts it is sitting on, so it could remain a top growth stock -- and recreate its 2020 performance in the new year.

Back to Weekly Options USA Home Page