TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

“Weekly Options

TradeS” Recommendations

Week Beginning Monday, mAY 09, 2022

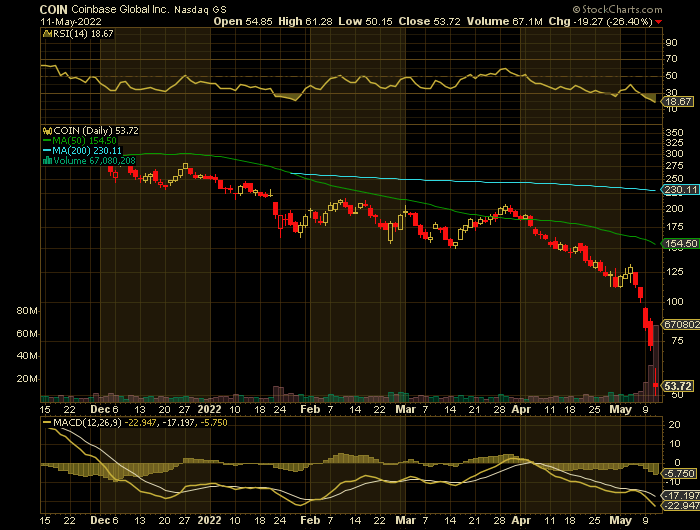

Weekly Options Trade – Coinbase Global Inc (NASDAQ: COIN) Puts

Thursday, May 12, 2022

** OPTION TRADE: Buy COIN MAY 27 2022 50.000 PUTS at best price.

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at Approx. 100% of BUY price.

Include a protective stop loss of -60% of price entered.

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point – I am not pushing for 100% unless I feel that it has the legs to accomplish this!)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

Prelude.....

Shares of Coinbase Global Inc (NASDAQ: COIN) gapped down before the market opened on Wednesday after the company announced weaker than expected quarterly earnings. The stock had previously closed at $72.99, but opened at $63.00. Coinbase Global shares last traded at $59.70, with a volume of 545,229 shares.

It’s been death by a thousand cuts for shareholders of crypto exchange Coinbase , whose shares went public just over a year ago and have only traded lower since. It was a sign of things to come, and an indicator that the party was over for high-flying tech companies.

Coinbase is dependent on the liquidity of the crypto market, and if traders see gains, then the company gets a slice when they withdraw funds. Unfortunately, the market has been in turmoil in the last year and investors are pulling away.

Their shares are down a full 83% from the high they hit on the opening day of trading, and have been hitting new lows for several weeks now.

About Coinbase Global.....

Coinbase Global, Inc. provides financial infrastructure and technology for the cryptoeconomy in the United States and internationally.

The company offers the primary financial account in the cryptoeconomy for retailers; a marketplace with a pool of liquidity for transacting in crypto assets for institutions; and technology and services that enable ecosystem partners to build crypto-based applications and securely accept crypto assets as payment.

Coinbase Global, Inc. was founded in

2012 and is based in Wilmington, Delaware.

The Other Major Catalysts for the NFLX Weekly Options Trade…..

Earnings.....

The San Francisco headquartered company released its Q1 earnings yesterday which, to put it kindly, weren’t great. As we’ll see, the numbers are likely going to inspire a fresh round of selling.

The cryptocurrency exchange reported ($1.98) earnings per share for the quarter, missing analysts’ consensus estimates of $0.74 by ($2.72). The business had revenue of $1.17 billion for the quarter, compared to the consensus estimate of $1.48 billion. Coinbase Global had a net margin of 46.23% and a return on equity of 77.65%. The business’s quarterly revenue was down 35.2% on a year-over-year basis. During the same period last year, the firm posted $3.05 EPS.

Poor Numbers.....

The company’s most recent earnings report which was released after the bell rang to end Tuesday’s session, was devastating. Both revenue and EPS missed analyst expectations, with the former showing year-on-year contraction of 35%, while the latter was much deeper in the red than previously forecasted. To make matters worse, management went out of their way to warn of slowing growth in their forward-looking guidance.

They told investors they expect both the number of monthly transacting users and total trading volume to decline in Q2 from Q1 levels, largely driven by the slump in crypto prices seen in recent weeks. "In April, we saw continued declines in both crypto asset volatility and crypto prices, which we believe are associated with weakness in financial markets," the company said in its Q1 shareholders letter. "We continue to expect that during a prolonged and stressful scenario for our business, we will aim to manage our 2022 potential adjusted EBITDA losses to approximately $500M on a full-year basis," it added.

Crpyto Influence......

Note thatwhere crypto goes, so too goes Coinbase. The main reason for this is that crypto is still considered a risky asset, and so will overperform when there’s a risk-on sentiment, and underperform when there’s a risk-off sentiment. There has been a risk-off market for almost all of 2022. In addition, when crypto is trading down, and it tends to do so quite aggressively, the prospects for its world wide application are dimmed. As a result of that, related products and services like crypto exchanges such as Coinbase, become less attractive. It also doesn’t help that Coinbase has struggled to turn a consistent profit, and now with interest rates starting to be raised in the face of soaring inflation, its costs are only going to increase.

Regulation Expected.....

Government officials have made it clear that regulation is coming. Treasury Secretary Janet Yellen said in April that more government oversight is needed in the fledgling industry and that over the next six months, Treasury would work with the White House and other agencies to develop reports and recommendations on digital currencies.

“Our regulatory frameworks should be designed to support responsible innovation while managing risks – especially those that could disrupt the financial system and economy,” Yellen said.

Short Interest.....

COIN saw a significant growth in short interest in the month of April. As of April 15th, there was short interest totalling 7,280,000 shares, a growth of 18.4% from the March 31st total of 6,150,000 shares. Currently, 5.0% of the company’s shares are short sold. Based on an average daily trading volume, of 4,830,000 shares, the days-to-cover ratio is currently 1.5 days.

Bankruptcy Rumors.....

CEO Brian Armstrong may have compounded the market’s consternation by tweeting about a required filing that Coinbase made that disclosed how the crypto exchange protects assets it acts as custodian for in the event of a bankruptcy.

"There is some noise about a disclosure we made in our 10Q today about how we hold crypto assets," Armstrong tweeted. "Your funds are safe at Coinbase, just as they’ve always been. We have no risk of bankruptcy; however, we included a new risk factor based on an SEC requirement called SAB 121, which is a newly required disclosure for public companies that hold crypto assets for third parties."

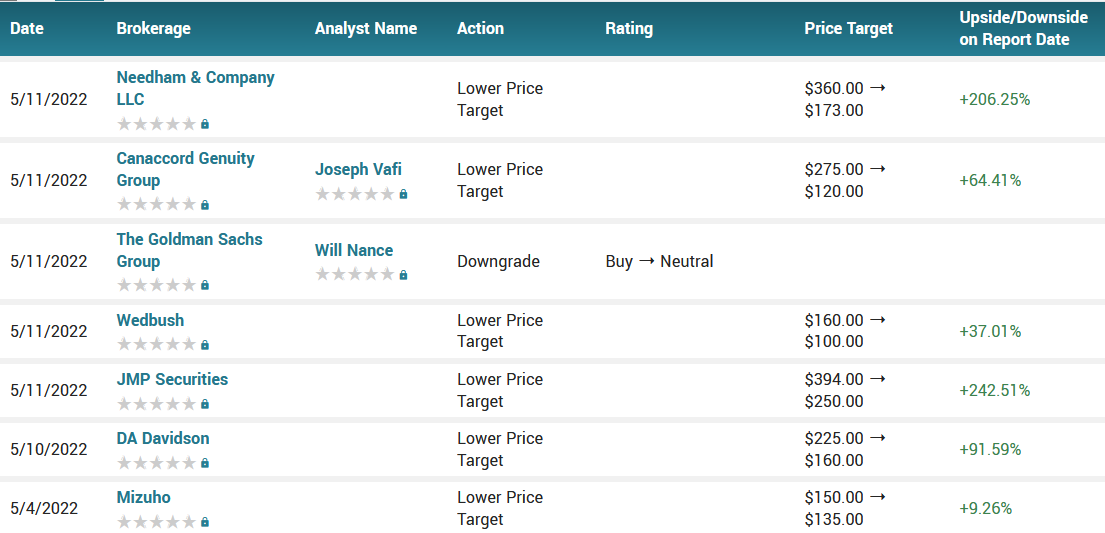

Analyst Thoughts.....

Mizuho

believes that among the biggest downside risks is that a crypto-winter has

started, which will see the crypto market cap shrink, leading to further

pricing compression.

“I’ve never been more bearish on Coinbase

than we are today,” Dan Dolev, senior analyst of fintech equity research at

Mizuho said. “There are two scenarios

here: a mild [crypto] winter — which I would put the probability on that at

less than 50% — and some sort of crypto ice age. I think if we get to a crypto

ice age, the survivability is much more questionable.”

Patrick O’Shaughnessy, an analyst who covers Coinbase for Raymond James, acknowledged in a note to clients that there was an ongoing debate over whether the crypto market was in one of its typical funks or if this was the post-pandemic bubble deflating.

“While management strongly believes the former will prove to be true, we suspect there is more than a bit of truth to the latter, particularly with crypto failing to serve as an inflation hedge thus far in 2022,” O’Shaughnessy wrote.

Like much of Wall Street, O’Shaughnessy said his firm expects Coinbase to continue to lose money in the coming quarters, and that the “cons of increased crypto regulation down the road will decidedly outweigh the pros.”

According to the issued ratings of 19 analysts in the last year, the consensus rating for Coinbase Global stock is Buy based on the current 1 sell rating, 4 hold ratings and 14 buy ratings for COIN. The average twelve-month price target for Coinbase Global is $248.00 with a high price target of $455.00 and a low price target of $100.00.

Summary.....

Coinbase Global shareholders are down dramatically for the year, even worse than the market loss of 9.8%. The latest earnings suggest more downside, and institutions have continued to make the first moves pre-market open.

Coinbase's fifty day moving average price is $153.72 and its 200 day moving average price is $219.37. The company has a current ratio of 1.61, a quick ratio of 1.61 and a debt-to-equity ratio of 0.53. The firm has a market capitalization of $11.79 billion and a PE ratio of 3.73.

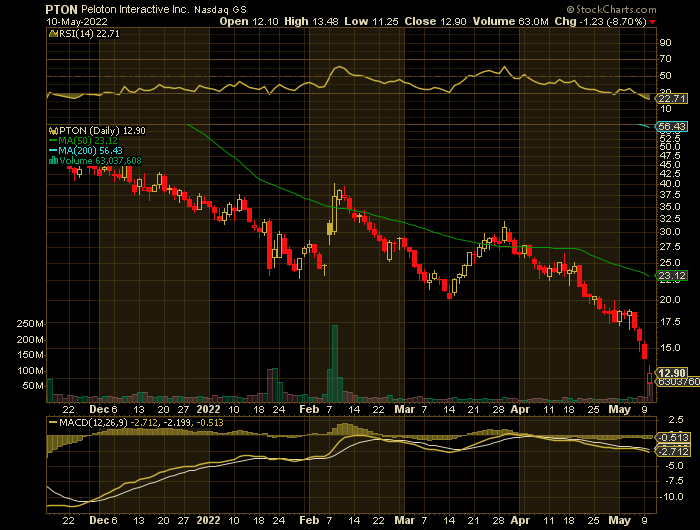

Weekly Options Trade –Peloton Interactive Inc (NASDAQ: PTON) Puts

Wednesday, May 11, 2022

** OPTION TRADE: Buy PTON MAY 27 2022 13.000 PUTS - price at last close was $1.63 - adjust accordingly.

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at Approx. $3.25

Include a protective stop loss of -60% of price entered. (Approx. $0.65)

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point – I am not pushing for 100% unless I feel that it has the legs to accomplish this!)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

Prelude.....

The market is punishing stocks that come through with "beat and raise" results this earnings season. So you can probably imagine how a textbook "miss and lower" quarterly report will go over. Shares of Peloton Interactive Inc (NASDAQ: PTON) plummeted on Tuesday morning after posting a rough financial update.

Shares, which have already fallen more than 60% this year, fell $1.57 to $12.56. At their peak, shares of Peloton cost as much as $171.

Peloton's uphill ride to get more sales is getting rougher as more people return to gyms and other pre-pandemic exercise routines and embrace cheaper options.

The maker of high-end exercise bikes and treadmills, once highflying in the early days of the pandemic, on Tuesday reported mounting losses and slowing sale. It also offered a bleak sales outlook for the current quarter and said it had signed a commitment to borrow hundreds of millions of dollars, raising questions for some investors about the chances of a turnaround.

“Peloton has a lot of work to do to convince investors that the business model still works," said Neil Saunders, managing director of GlobalData Retail. ”It's coming off a high. People were at home and wanted to stay fit. But now people are starting to go back to the gyms. They want the social aspect."

About Peloton Interactive.....

Peloton Interactive, Inc. provides interactive fitness products in North America and internationally. It offers connected fitness products with touchscreen that streams live and on-demand classes under the Peloton Bike, Peloton Bike+, Peloton Tread, and Peloton Tread+ names.

The company also provides connected fitness subscriptions for various household users, and access to various live and on-demand classes, as well as Peloton Digital app for connected fitness subscribers to provide access to its classes.

As of June 30, 2021, it had approximately 5.9 million members. The company markets and sells its interactive fitness products directly through its retail showrooms and at onepeloton.com.

Peloton Interactive, Inc. was founded in 2012 and is headquartered in New York, New York.

The Other Major Catalysts for the PTON Weekly Options Trade…..

Earnings.....

Revenue tumbled 27% to hit $964.3 million for Peloton's fiscal third quarter, ending in March, as a 55% year-over-year increase in subscription revenue was no match for a 42% plunge in the larger hardware category.

Operating expenses have more than doubled over the past year, and even though one-time restructuring and goodwill impairment charges account for the lion's share of that increase, it's still not an encouraging sight when the top line is going the other way. Peloton's net loss ballooned to $757.1 million, or $2.27 a share. Analysts were holding out for a deficit of just $0.83 a share on $973 million in revenue.

Poor Outlook.....

As bad as the fiscal third quarter was, the company's outlook for the current three-month period is worse. Peloton expects to generate $675 million to $700 million in revenue in the fiscal fourth quarter, which ends next month. We're talking about a 27% year-over-year decline and a 29% sequential decline. Analysts were bracing for a seasonal sequential dip in revenue, but Peloton will land well below the $821.7 million that Wall Street pros were targeting.

Downward Spiral......

Peloton aged about a decade last year. It had a rough 2021 that started with a treadmill recall and growing concerns about how the company would fare as the rollout of viable COVID-19 vaccines would send workout seekers back to fitness centers, gyms, and spinning classes. A character on a popular TV show would be killed off following a Peloton session. Sales growth would decelerate sharply as 2021 played out, and the same head-turning market darling of a growth stock that saw its stock soar fivefold in 2020 would go on to give back nearly all of those gains by the end of last year.

Peloton stock has gone on to shed more than two-thirds of its value in 2022. The departure in February of co-founder and CEO John Foley initially triggered buyout speculation, but sometimes art imitates strife -- folks are buying Peloton gear, while folks aren't buying Peloton itself.

Thinly Capitalized......

The new CEO Barry McCarthy concedes that the company is "thinly capitalized" at this point. With interest rates rising and its share price plummeting, any kind of capital raise to lengthen its lifeline will be painful. You can credit Peloton for trying, but eventually all credit needs to be paid.

The company signed binding commitment letter with JP Morgan and Goldman Sachs to borrow $750 million. Barry McCarthy said in a letter to shareholders that Peloton ended the quarter with $879 million in cash, “which leaves us thinly capitalized for a business of our scale.”

That, according to UBS analyst Arpiné Kocharyan, would mean paying more to land customers compared with focusing on selling stationary bikes. After a cash flow burn of $747 million in the most recent quarter, Kocharyan believes that will lead to heightened concern about the cash Peloton has to work with.

Saunders said that Peloton faces a tough battle in reworking its business, especially in the app area. He pointed to companies like Apple, which is investing extensively in its own fitness solutions. And he also said big brands like Lululemon are pivoting more toward classes and services.

Analyst

Thoughts.....

According to the issued ratings of 31 analysts in the last year, the consensus rating for Peloton Interactive stock is Hold based on the current 1 sell rating, 14 hold ratings and 16 buy ratings for PTON. The average twelve-month price target for Peloton Interactive is $55.28 with a high price target of $120.00 and a low price target of $28.00.

Summary.....

With its equipment sales softening, Peloton expects its subscriber growth to decelerate markedly. Management projects that its connected fitness subscriptions will inch up to 2.98 million by the end of the fourth quarter, which would represent sequential growth of less than 1%. The company also warned that its total revenue will decline by roughly 27% compared to the fourth quarter of fiscal 2021.

Last week, Bloomberg reported that Peloton is seeking to sell as much as 20% of the company to an outside investor in a move to shore up cash and further its turnaround.

Peloton's 50-day simple moving average is $24.88 and its 200-day simple moving average is $39.73. Peloton Interactive, Inc. has a 52-week low of $17.38 and a 52-week high of $129.70. The firm has a market cap of $6.12 billion, a price-to-earnings ratio of -4.97 and a beta of 0.97. The company has a quick ratio of 1.29, a current ratio of 2.33 and a debt-to-equity ratio of 0.36.

Weekly Options Trade –Netflix Inc (NASDAQ: NFLX) Puts

Tuesday, May 10,

2022

** OPTION TRADE: Buy NFLX MAY 13 2022 172.500 PUTS - price at last close was $5.90 - adjust accordingly.

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at Approx. $8.50

Include a protective stop loss of -60% of price entered. (Approx. $2.40)

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point – I am not pushing for 100% unless I feel that it has the legs to accomplish this!)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

Prelude.....

The brutal rout in tech stocks this year is shaking analysts’ confidence in once high-flying megcaps.

Brokerage firms expect shares of the so-called FAANG companies in aggregate to trade for less in the next 12 months than they had projected at the start of the year. The share-price targets for Facebook owner Meta Platforms Inc., Apple Inc., Amazon.com Inc., Netflix Inc. and Google parent Alphabet Inc. have fallen by more than 17% on average in 2022, putting that measure on track to decline over the year for the first time on record.

The turnabout in sentiment reflects the bear market that has hit the Nasdaq 100 Index this year, triggered by Federal Reserve interest rate increases, the impact of surging inflation on consumer demand, and supply-chain snags, all of which have fueled fears of an economic slowdown.

“It’s analysts catching up to reality, and this is a massive change on how companies are being valued,” said Greg Taylor, chief investment officer at Purpose Investments. “We’re now going to get the reality that with interest rates at these levels and inflation at these levels, these high-growth companies are not going to be valued the way they were.”

The headwinds also have shown up in weaker-than-expected quarterly results.

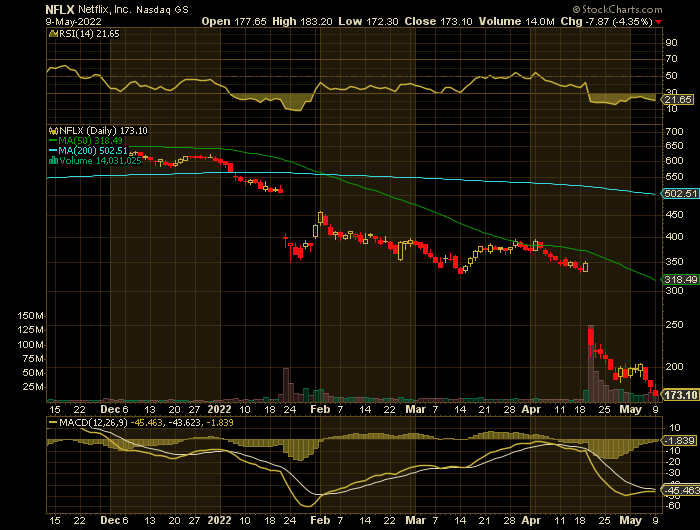

Shares of Netflix Inc (NASDAQ: NFLX) fell 49.2% in April 2022. The stock is now down 72% in 6 months, brutally punished by the market's hasty retreat from growth stocks and other risky investments. Even the growth investors who might normally pick up Netflix shares on the cheap under these circumstances have stayed away, because the video-streaming veteran is losing customers for the first time in a decade.

About Netflix.....

Netflix, Inc. provides entertainment services. It offers TV series, documentaries, feature films, and mobile games across various genres and languages.

The company provides members the ability to receive streaming content through a host of internet-connected devices, including TVs, digital video players, television set-top boxes, and mobile devices. It also provides DVDs-by-mail membership services in the United States. The company has approximately 222 million paid members in 190 countries.

Netflix, Inc. was incorporated in 1997 and is headquartered in Los Gatos, California.

Other Major Catalysts for the NFLX Weekly Options Trade…..

Earnings.....

Netflix was on the outs long before April rolled in. The stock took a massive haircut in January after its subscriber growth guidance for the first quarter came in below Wall Street's expectations.

The first-quarter report hit the news wires on April 19, and it wasn't pretty. The soft prediction for subscriber additions turned into a negative number for the first time since the Qwikster era in 2011. Even worse, management sees the negative trends continuing in the second quarter, so the next quarter's subscriber drop looks even larger.

It didn't matter that Netflix also reported revenue right in line with analyst projections while crushing analysts' bottom-line targets. Earnings of $3.53 per share left the Street consensus far behind at $2.90 per share.

The company is raising subscription prices and tweaking its business operations to cut costs and boost profits. But investors are ignoring all of that to focus on those all-important subscriber figures. Netfix shares fell more than 37% the next day alone.

Subscriber Downfall.....

Multiple factors contributed to the subscriber shortfall. Inflation is driving consumers to cut back on expenses. According to the company, password sharing is allowing more than 100 million households to use the service without paying for subscriptions of their own. The company's decision to shut down its service in Russia after that country invaded Ukraine meant losing 700,000 accounts in Q1 -- notably more than its net subscriber loss for the period. And price increases enacted by streaming service providers to cover their soaring content budgets are leading customers to question the value of their subscriptions.

Competition......

Perhaps the biggest issue for Netflix is intensifying competition. Formidable rivals such as Disney, Amazon, Apple, Warner Bros Discovery, and Paramount Global are bolstering their content libraries and battling fiercely for market share. This streaming arms race is leading analysts to question whether Netflix can continue to spend its way to dominance -- or if it's at risk of being surpassed by some of its deep-pocketed competitors.

In a more bullish market environment, investors might have been more sanguine about Netflix's prospects. But inflation fears and the prospect of rapidly rising interest rates are driving many people to take a more pessimistic view of even the best growth stocks. And that's no doubt contributing to Netflix's recent swoon.

"Too Woke".....

Promptly putting salt in that very fresh wound after the last earnings report was none other than Tesla CEO Elon Musk, who took to his favourite medium to declare that the cause of the streaming company’s woes could be charted back to their own content, which he described as being virulently too “woke”.

“The woke mind virus is making Netflix unwatchable,” the richest man in the world tweeted on his personal account in response to a report that detailed how the company had lost 200,000 subscribers in the first quarter of business in 2022.

Recession Anxiety.....

Recession anxiety appears to be spreading through the stock market, overshadowing a respectable corporate earnings report season.

"Investor concerns about Fed tightening, surging interest rates, and the risk of recession have outweighed the surprising strength of 1Q earnings reports," Goldman Sachs strategist David Kostin wrote in a note last Monday. "Results have exceeded expectations and prompted modest upward revisions to estimates for the remainder of 2022 and for 2023, driven largely by the energy sector. However, the boost to analyst estimates has not been enough to offset portfolio manager fears about the downside risk to EPS if the economy falls into recession and the downside risk to valuations as the Fed tightens policy."

Future Outlook.....

Netflix now spends $17 billion per year on content and projects a loss of 2 million subscribers in the current quarter. It's back to the drawing board for shell shocked Netflix investors who are also grappling with tech stocks that collectively lost $1.8 trillion in April. Not only is Netflix a victim of the latest tech sector plunge, but it's also facing more competition now than it ever has in its 23-year history. The streaming competition now includes Hulu, YouTube, Disney+, Apple TV, HBO Max, Peacock, and Paramount, to name a few.

Meanwhile, networks like NBC and CBS have been pulling back their own content to bring eyeballs to their streaming platforms. Shows like "The Office" and "Friends" departed Netflix to return to NBC's Peacock. Meanwhile, Marvel parent company Disney reclaimed popular Marvel Netflix originals like "Daredevil" and "Jessica Jones."

Amid such headwinds, Piper Sandler downgraded Netflix to "neutral" last month and lowered its price target to $293 from $562, contending it's unlikely the company will return to its prior subscriber growth. Weighing in on Netflix's options, Piper Sandler analysts noted, "Password sharing and ad-supported tiers look promising, but implementation is more than two years away."

Wells Fargo isn't finding any clarity in the results either. “Negative [subscription] growth and investments to reaccelerate revenues are the nail in the NFLX narrative coffin,” the firm wrote. The bank's analysts added that Netflix's outlook is now “clear as mud.”

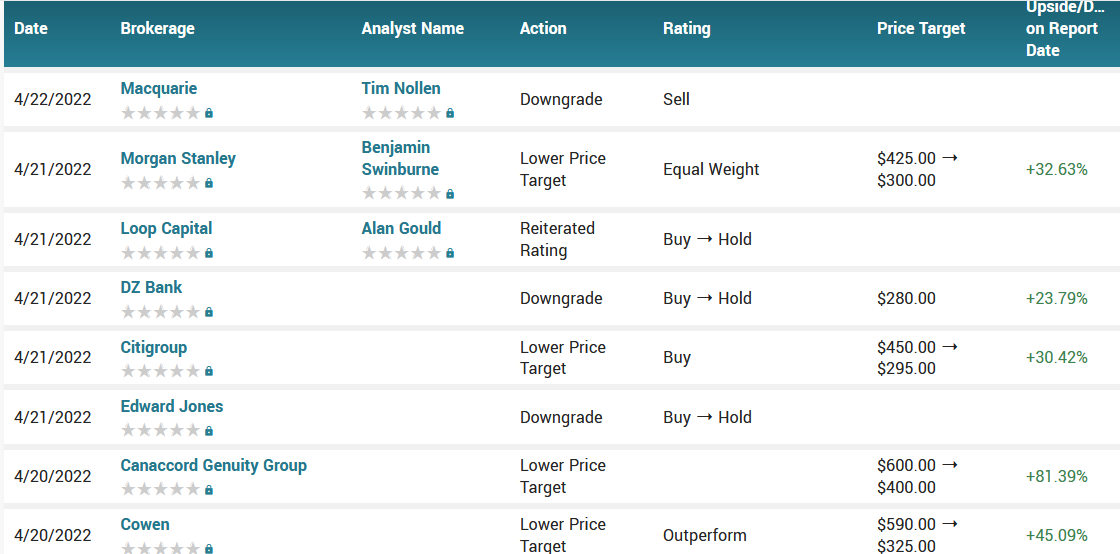

Analyst Thoughts.....

According to the issued ratings of 38 analysts in the last year, the consensus rating for Netflix stock is Hold based on the current 3 sell ratings, 26 hold ratings and 9 buy ratings for NFLX. The average twelve-month price target for Netflix is $376.05 with a high price target of $730.00 and a low price target of $235.00.

Summary.....

Netflix shocked investors a few weeks ago when it disclosed that its total subscriber number fell by 200,000 in the first quarter. It was the first time the streaming titan had a net loss of subscribers in more than a decade. Worse still, Netflix said it expects to lose another net 2 million subscribers in the second quarter.

Netflix has shed nearly half its value since then. The decline is even more shocking when viewed relative to the stock's peak above $700 per share in November. It is now down a staggering 74% from that lofty level.

Netfixhas a market cap of $80.40 billion, a P/E ratio of 16.42, a P/E/G ratio of 0.98 and a beta of 1.28. The company has a quick ratio of 1.05, a current ratio of 1.05 and a debt-to-equity ratio of 0.83. The firm’s 50-day simple moving average is $321.58 and its two-hundred day simple moving average is $472.40. Netflix, Inc. has a 1-year low of $175.81 and a 1-year high of $700.99.

Weekly Options Trade –Teladoc Health Inc (NYSE: TDOC) Puts

Monday, May 09,

2022

** OPTION TRADE: Buy TDOC MAY 13 2022 33.000 PUTS - price at last close was $1.43- adjust accordingly.

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at Approx. $2.30

Include a protective stop loss of -60% of price entered. (Approx. $0.60)

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point – I am not pushing for 100% unless I feel that it has the legs to accomplish this!)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

Prelude.....

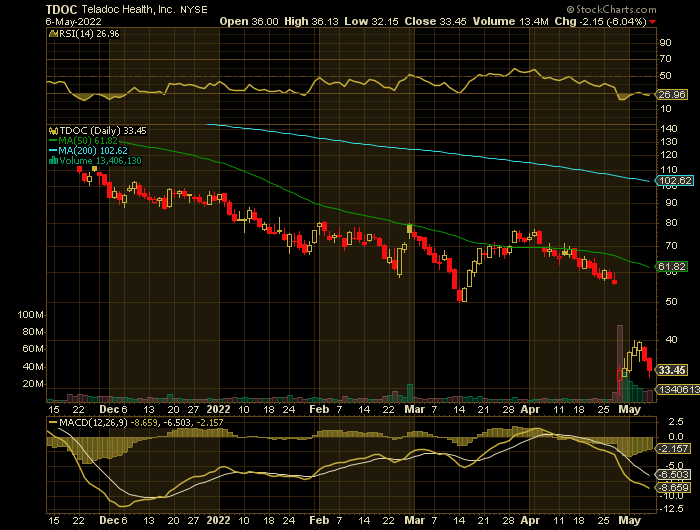

Medical health services company Teladoc Health Inc (NYSE: TDOC) has seen its prognosis go from bad to worse over the past month. TDOC stock had already plunged as part of the broader selloff in speculative technology companies. However, that selloff accelerated dramatically following Teladoc’s latest earnings report, which was a disappointment on almost all fronts.

Teladoc hasn't been profitable. But it has steadily grown both revenue and numbers of medical visits by percentages in the double or triple digits since the start of the pandemic. And annual revenue already was on the rise well before the pandemic.

However, the company lost more than $40 per share last quarter, or more than the stock is currently trading for entirely.

Teladoc recorded a noncash goodwill impairment charge of $6.6 billion in the quarter. Goodwill is the amount a company pays for an asset beyond the actual value of that asset. The recent impairment charge suggests that Teladoc paid too much for Livongo.

Teladoc's woes also involve the performance of

its BetterHelp mental health business and its chronic-care business. In

BetterHelp, yield on marketing spend has been disappointing in recent weeks, as

smaller rivals have bid high to win online advertising opportunities. In

chronic care, the time line to signing on clients has lengthened; that's as

employers focus on the coronavirus and on getting employees back to offices

instead of deciding on telehealth contracts.

About Teladoc Health.....

Teladoc Health, Inc. provides virtual healthcare services in the United States and internationally. The company offers a portfolio of services and solutions covering non-urgent, episodic, chronic, and complicated medical conditions, including diabetes, hypertension, chronic kidney disease, cancer, congestive heart failure, and mental health conditions.

It offers a range of programs and services, including primary and specialty care telehealth solutions, chronic condition management, expert medical services, mental health solutions, and platform and program services.

The company serves employers, health plans, hospitals and health systems, and insurance and financial services companies, as well as individual members. It offers its products and services under the Teladoc, Livongo, and BetterHelp brands.

The company

was formerly known as Teladoc, Inc. and changed its name to Teladoc Health,

Inc. in August 2018. The company was incorporated in 2002 and is headquartered

in Purchase, New York.

Other Major Catalysts for the TDOC Weekly Options Trade…..

Earnings.....

Teladoc Health last issued its earnings results on Wednesday, April 27th.

The health services provider reported ($41.58) earnings per share for the quarter, missing analysts’ consensus estimates of ($0.58) by ($41.00). Teladoc Health had a negative return on equity of 2.12% and a negative net margin of 321.94%.

During the same quarter in the prior year, the firm earned $0.13 EPS.

As a group, analysts predict that Teladoc Health will post -2 EPS for the current fiscal year.

Forecast.....

Teladoc has cut its full-year forecast. It decreased revenue guidance to a range of between $2.4 billion and $2.5 billion. That's compared to earlier guidance in the range of $2.5 billion to $2.6 billion.

In large part, this lowered guidance is based on the troubles with BetterHelp and chronic care.

Competition......

Teladoc Health is the largest independent telehealth business in America, but it's competing with some deep-pocketed giants of the healthcare-benefits management industry that want their members to see the physicians they employ.

Teladoc Health's chronic-care numbers have been disappointing for over a year. But BetterHelp, its mental health segment, was until recently making big gains. Unfortunately, the company is losing ground to well-funded competitors that keep entering the market.

When reporting first-quarter results, Teladoc Health walked back the forward-looking guidance it provided three months earlier. Instead of revenue rising to a range between $2.55 billion and $2.65 billion, the company told investors to expect between $2.4 billion and $2.5 billion in top-line sales. According to management, investing in heavy advertising for BetterHelp has been delivering lower returns than it used to. Specifically, the company complained about increasing competition for keywords associated with online therapy.

Insider Trading.....

Adam C. Vandervoort sold 3,513 shares of the firm’s stock in a transaction on Thursday, March 3rd. The shares were sold at an average price of $70.24, for a total value of $246,753.12.

Also, SVP Andrew Turitz sold 1,754 shares of the firm’s stock in a transaction on Thursday, March 3rd. The shares were sold at an average price of $70.24, for a total transaction of $123,200.96.

In the last ninety days, insiders sold 14,842 shares of company stock valued at $1,042,502. 1.55% of the stock is owned by insiders.

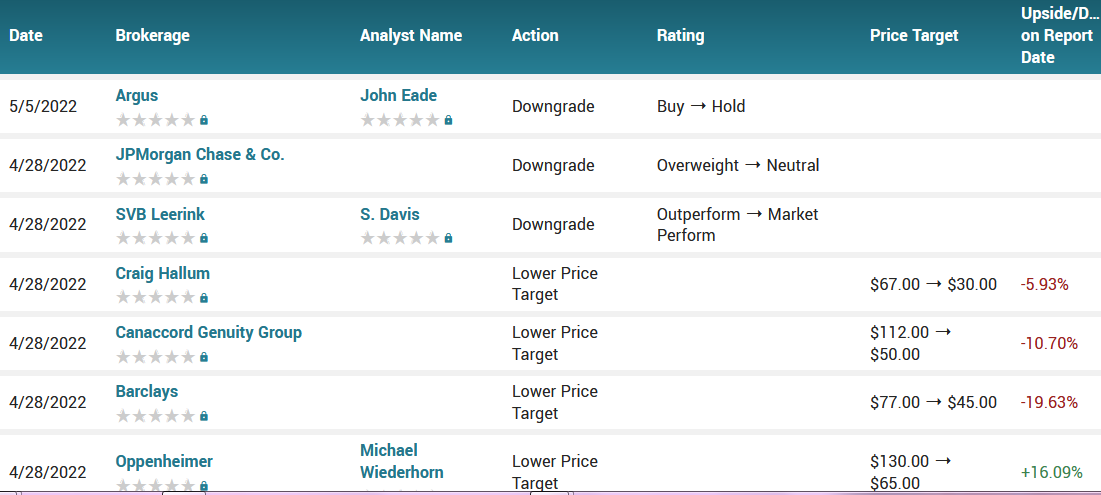

Analyst Thoughts.....

According to the issued ratings of 27 analysts in

the last year, the consensus rating for Teladoc Health stock is Hold based on

the current 19 hold ratings and 8 buy ratings for TDOC. The average

twelve-month price target for Teladoc Health is $94.54 with a high price target

of $210.00 and a low price target of $30.00.

Summary.....

It’s rough enough for speculative technology companies right now. The sector is out of favor and quarterly results are up against impossibly strong comparisons from early 2021 during the height of the stay-at-home era. Teladoc would be having trouble regardless. But throw in a sharp miss against guidance, falling profit margins, and that massive Livongo write-off and it’s understandable why traders are rushing to sell TDOC stock even after its massive crash.

Teladoc Health has a fifty-two week low of $28.75 and a fifty-two week high of $174.32. The company has a debt-to-equity ratio of 0.17, a current ratio of 3.94 and a quick ratio of 3.48. The firm has a market cap of $5.39 billion, a PE ratio of -0.78 and a beta of 0.82. The stock has a fifty day simple moving average of $61.57 and a 200-day simple moving average of $85.10.

Back to Weekly Options USA Home Page