TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Up 126% Profit In

2 Days With An Intel Weekly Option!

Intel Corporation (NASDAQ: INTC) is a premier global technology leader that specializes in the creation of microprocessors and integrated digital technology platforms.

Several events have occurred in the last week which has helped the Intel stock to rebound, with the company’s shares soaring more than 11%, its best weekly performance since November.

Qualcomm has approached Intel for a probable takeover, which should bode well for both companies.

As well, Intel has declared a new partnership with Amazon, where Amazon Web Service (AWS) will use Intel’s custom chip designs.

This set the scene for Weekly Options USA Members to profit by 126% using an INTC Weekly Options trade!

Join Us And Get The Trades – become a member today!

Monday, September 23, 2024

by Ian Harvey

UPDATE

Intel Corporation (NASDAQ:INTC) has struggled to make a breakthrough in its stumbling foundry business, with its shares down 57%. Intel has been dealing with costly technological advancements that have led to various cash concerns and compelled the company to suspend dividend payments and cut jobs. Intel’s failure to take advantage of the booming artificial intelligence (AI) revolution has also taken a toll on the stock.

However, several events have occurred in the last week which has helped the Intel stock to rebound, with the company’s shares soaring more than 11%, its best weekly performance since November. Let’s look at these catalysts.....

- As per a Wall Street Journal report, Qualcomm has approached Intel for a probable takeover, which should bode well for both companies. Intel manufactures personal computers (PC) and server chips, whereas Qualcomm makes mobile products. So, a deal should help both companies to make the most of the other’s strengths and improve market share.

- As well, Intel has declared a new partnership with Amazon, where Amazon Web Service (AWS) will use Intel’s custom chip designs. Amazon is partnering with Intel for chip design since NVIDIA Corporation NVDA has increased its pricing for the e-commerce giant.

- Also, Intel declared it would convert its foundry business into a subsidiary. This is positive news for Intel investors since they were concerned about the company handing over chip designs to industry rivals.

- And the latest good news for investors, according to a report in Bloomberg, Apollo Global Management, one of the world's biggest private equity firms, has offered to take a multibillion-dollar stake in Intel.

The INTEL Weekly Options Potential Profit Explained.....

** OPTION TRADE: Buy INTC OCT 25 2024 22.000 CALLS - price at last close was $1.40 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the INTC Weekly Options (CALL) Trade on Wednesday, September 18, 2024 for $1.03.

Sold the INTC Weekly options contracts on Monday, September 20, 2024 for $2.33; a potential profit of126%.

(This will vary for members depending on their entry and exit strategies).

Don’t miss out on further trades – become a member today!

Why the INTEL Weekly Options Trade was Originally Executed!

Trade Analysis

Current Situation

Intel Corporation (NASDAQ: INTC) is a premier global technology leader that specializes in the creation of microprocessors and integrated digital technology platforms. The company, founded in 1968 and headquartered in Santa Clara, California, has been instrumental in shaping the digital age. Intel's transition from a PC-centric entity to a data-centric enterprise has broadened its market scope, encompassing AI, 5G, and IoT among other innovations.

Intel operates through several segments including Client Computing Group (CCG), Data Center Group (DCG), Internet of Things Group (IOTG), and more, reflecting its diversified business model. The company's strategic partnerships, such as with MILA for AI drug discovery, underscore its commitment to innovation and growth in high-potential areas.

Intel's recent announcement to spin off its foundry business highlights its strategic focus on optimizing its core operations and enhancing shareholder value. This move is expected to provide the necessary agility and focus required for Intel to compete more effectively in the global semiconductor market.

Key Insights from Earnings Call

During the latest earnings call, Intel's management discussed several key strategies aimed at revitalizing its core semiconductor business. The company's focus on cost management and operational efficiency was evident, as it aims to navigate the current challenges in the global supply chain and competitive landscape.

The spin-off of the foundry business is seen as a strategic step to streamline operations and focus on high-growth areas such as AI and autonomous driving technologies. This restructuring is expected to make Intel more competitive against rivals and better positioned to capitalize on market opportunities.

Catalysts for the Trade

- Strategic Restructuring: Intel's decision to spin off its foundry business could lead to more focused growth in its core areas and potential market share gains.

- Technological Advancements: Intel's continuous innovation in AI and IoT positions it well to benefit from the expansion in these sectors.

- Partnerships: Strategic alliances, such as with Amazon for AI chip development, are likely to drive both technological advancement and revenue growth.

Further Catalysts

Intel's recent partnerships and restructuring efforts provide a solid foundation for its future growth. The company's focus on AI and cloud computing, in collaboration with major industry players like Amazon, sets the stage for significant advancements and market share expansion.

Analysts are cautiously optimistic about Intel's strategic directions, acknowledging the potential for recovery and growth despite the competitive pressures.

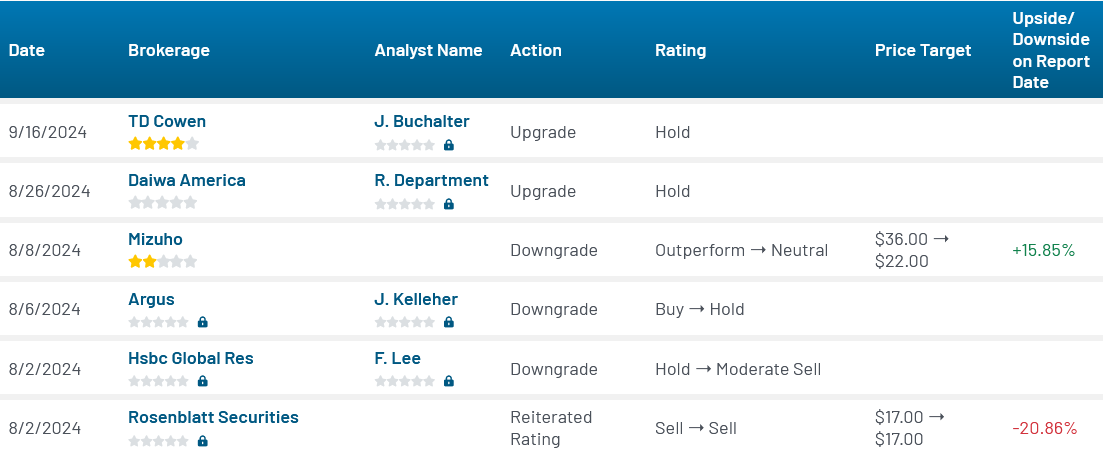

Analyst Reactions

Recent analyses by market experts reflect a mixed outlook for Intel, with several noting the challenges it faces in a highly competitive market. However, the strategic moves to streamline operations and invest in growth areas like AI and autonomous driving are seen as positive steps.

While some analysts remain skeptical about the immediate impact of these strategies, the long-term outlook for Intel is favorable, with potential for market share gains and stronger financial performance.

Company Overview

Intel Corporation has been a pivotal player in the tech industry, driving innovations that have powered the digital revolution. From powering the first silicon chips in Silicon Valley to leading today's AI and IoT advancements, Intel's journey is marked by continuous transformation and strategic adaptability.

The company's broad portfolio of products and services, from microprocessors to system-on-chip solutions, positions it uniquely in the market. Intel's commitment to innovation is evident in its R&D initiatives and its strategic partnerships, which aim to bring next-generation technologies to market.

Technical Analysis

- Market Capitalization: $89.41 billion

- PE Ratio: 21.78 (reflecting its current earnings)

- Beta: 1.03 (indicating volatility slightly above the market average)

- 52-Week Low: $18.51

- 52-Week High: $51.28

- Fifty-Day SMA: $24.45

- Two-Hundred-Day SMA: $31.29

Summary

Intel presents a nuanced investment opportunity, with its strategic restructuring and focus on high-growth areas like AI and IoT poised to drive future growth. While current challenges persist, the company's proactive strategies and robust technological foundation provide a solid basis for potential market share gains and improved financial performance.

Trade Execution

Consider placing a buy order for INTC OCT 25 2024 22.000 CALLS, with a premium of $1.40. Adjust your sell point and stop loss according to your risk tolerance.

Disclaimer

This trade suggestion is based on the current market analysis and is not a guaranteed success. Always consider your risk tolerance and consult with a financial advisor if necessary.