TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Tariffs and the Stock Market:

Positive and Negative Impacts in 2025

Monday, March 31, 2025

by Ian Harvey

Introduction

As the U.S. economy navigates through President Trump's second term, tariffs have once again taken center stage, influencing both corporate strategies and investor sentiment. The implementation of reciprocal tariffs, most notably labeled as "Liberation Day" tariffs on April 2, has generated significant volatility in financial markets. The implications of these tariffs are far-reaching, affecting corporate earnings, inflation, economic growth, and, ultimately, the stock market.

This article explores both the positive and negative effects of tariffs on the stock market based on recent data, forecasts, and market reactions.

Join Us and Get the Trades - More

setups coming... Stay tuned!

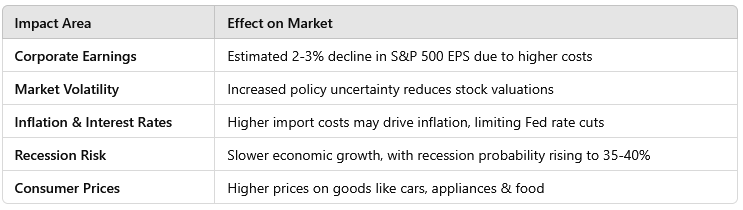

Negative Effects of Tariffs on the Stock Market

1. Earnings Pressure on S&P 500 Companies

Tariffs directly reduce corporate profits by increasing the cost of imported goods and production inputs. Goldman Sachs Research estimates that every 5-percentage-point increase in the U.S. tariff rate reduces S&P 500 earnings per share (EPS) by approximately 1-2%. If the proposed tariffs on imports from Mexico, Canada, China, and potentially the European Union are fully implemented, the cumulative impact could lower S&P 500 EPS by 2-3%.

The pressure arises in two ways:

- Profit Margin Squeeze: If companies absorb the higher costs to remain competitive, their profit margins will shrink.

- Reduced Sales: If companies pass costs onto consumers, sales volumes may decline as higher prices dampen demand.

Additionally, a stronger U.S. dollar—which often follows tariff policies—would reduce foreign revenue for multinational companies, further weighing on profits.

2. Market Volatility and Uncertainty Premium

The uncertainty surrounding tariff implementation has fueled stock market volatility. The U.S. Economic Policy Uncertainty Index surged to historically high levels amid trade negotiation talks. This uncertainty forces investors to demand higher risk premiums, lowering stock valuations. Goldman Sachs suggests the increased uncertainty may reduce the S&P 500's price-to-earnings multiple by 3%.

Additionally, historical data shows that the S&P 500 declined:

- 5% cumulatively on days when U.S. tariffs were announced (2018-2019)

- 7% on days when other countries retaliated

Recent weeks have seen a similar pattern, with U.S. indices falling:

- S&P 500 down 1.5%

- Nasdaq Composite down 2.5%

- Dow Jones Industrial Average down 1%

3. Inflationary Pressure and Interest Rate Risk

Tariffs increase the price of imported goods, adding to inflationary pressures. If inflation rises, it limits the Federal Reserve’s flexibility to cut interest rates, a key factor supporting stock prices. Analysts fear that aggressive tariff policies could push core inflation above 4%, compelling the Fed to maintain higher rates longer, which would weigh heavily on growth stocks.

4. Recession Risk

As tariffs increase production costs, reduce corporate earnings, and suppress consumer demand, they increase the risk of an economic slowdown. JPMorgan has raised the probability of a U.S. recession to 40%, while Goldman Sachs increased its recession forecast to 35%, citing tariff-induced drag on business sentiment and spending.

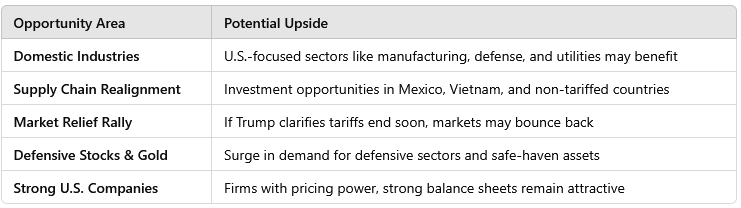

Positive Effects and Market Opportunities

1. Support for Domestic Industries

One of the stated aims of the tariff policy is to revive U.S. manufacturing and reduce trade deficits. Sectors that cater to domestic markets and rely less on foreign supply chains—such as utilities, healthcare services, defense, and regional banks—are likely to benefit from reduced foreign competition.

Additionally, U.S.-focused manufacturers may see improved market share as tariffs make imported goods less competitive.

2. Long-term Supply Chain Realignment

While disruptive in the short term, tariffs have forced corporations to diversify supply chains away from heavily tariffed countries. Countries like Mexico, Vietnam, and Thailand have already benefited from redirected investments. For global investors, this opens up new market opportunities beyond U.S. equities.

3. Potential for a Relief Rally

If President Trump clarifies that the April 2 "Liberation Day" tariffs are the final round, investor sentiment could improve. Market analysts suggest that removing uncertainty may trigger a short-term relief rally, particularly in oversold sectors like technology and consumer discretionary stocks.

4. Flight to Safe Assets and Sector Rotation

The tariff-induced volatility has shifted investor preference toward:

- Large-cap U.S. stocks with strong balance sheets

- Defensive sectors (utilities, healthcare, consumer staples)

- Gold and bonds (Gold recently hit an all-time high above $3,100 per ounce)

Investors have also rotated into low-volatility ETFs and funds with exposure to high-quality companies capable of weathering economic downturns.

The Broader Picture: Opportunity Amid Uncertainty

While tariffs introduce significant downside risks, they also create pockets of opportunity for agile and diversified investors. Historical analysis shows that once policy uncertainty peaks, stock market returns improve markedly in the following year. Furthermore, long-term fundamentals like solid corporate earnings, AI-driven innovation, and domestic consumption may support equity markets once the dust settles.

Conclusion

The imposition of tariffs in 2025 is a double-edged sword for the U.S. stock market. On one hand, tariffs elevate costs, squeeze profits, increase uncertainty, and raise recession risks. On the other hand, they offer potential benefits for domestic industries, open new global market opportunities, and may strengthen long-term U.S. trade leverage.

Investors should expect heightened volatility in the short term but can strategically position themselves by:

- Diversifying portfolios

- Prioritizing domestic-focused and defensive sectors

- Keeping an eye on policy developments

- Maintaining a long-term perspective

As Warren Buffett and Benjamin Graham wisely taught, successful investors can use periods of uncertainty to buy quality businesses at discounted prices.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

Back to Weekly Options USA Home Page from

Tariffs and the Stock Market!

Recent Articles

-

191% Weekly Option Win on Super Micro Computer Amid Market Mayhem

191% Weekly Option Win on Super Micro Computer Amid Market Mayhem – What’s Next? -

Tariffs and the Stock Market: Positive and Negative Impacts in 2025

Tariffs and the Stock Market: Positive and Negative Impacts in 2025. This article explores both the positive and negative effects of tariffs on the stock market based on recent data, forecasts, and ma… -

SMCI’s Wild Ride: Options Traders Are Profiting From the Ups and Downs

SMCI’s Wild Ride: How Options Traders Are Profiting From the Ups and Downs