TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

SMCI’s Wild Ride:

How Options

Traders Are Profiting From the Ups and Downs

What now?

Friday, March 28, 2025

by Ian Harvey

Super Micro Computer Inc. (NASDAQ: SMCI) has been one of the most volatile and talked-about stocks in the market—delivering huge opportunities for options traders who know how to capitalize on both the surges and the pullbacks. Let’s take a look at three real-world examples of how traders have played SMCI’s rollercoaster price action using call and put options.

Join Us and Get the Trades - More

setups coming... Stay tuned!

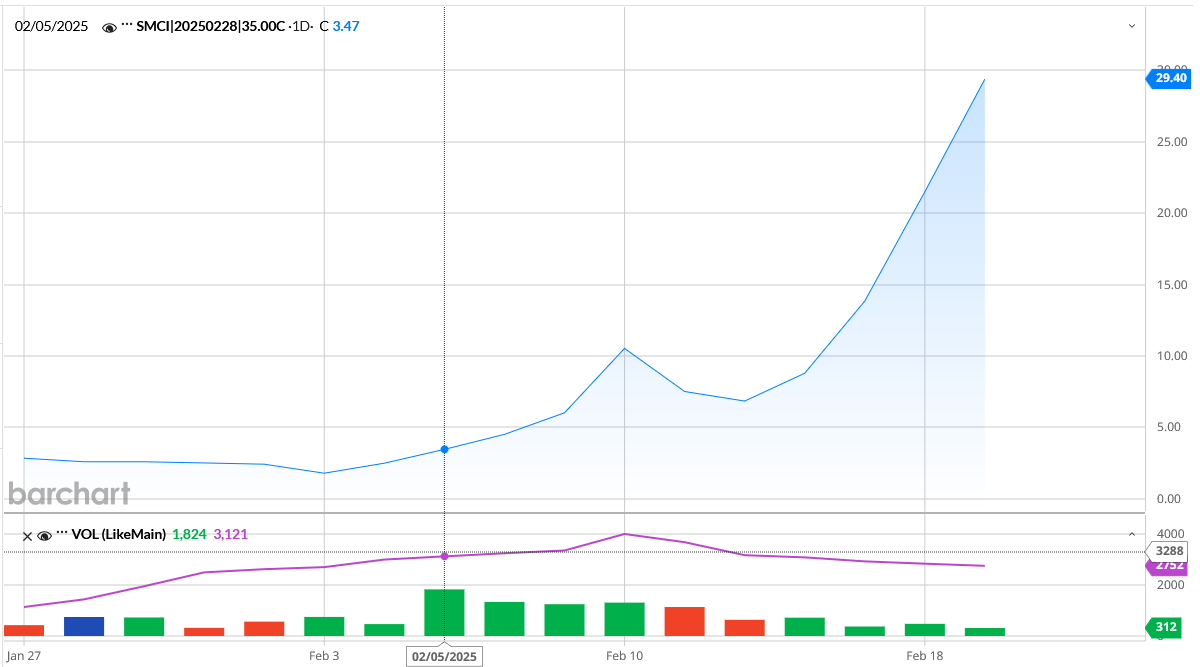

Part 1: Turning $285 Into $3,054 — The Power of a Well-Timed Call Option

In early 2025, SMCI was riding a wave of bullish momentum. Investor sentiment was strong, fueled by increasing demand for AI servers, renewed confidence following accounting concerns, and bold revenue guidance from the company’s CEO, Charles Liang. This presented a prime opportunity for an aggressive call option trade.

The Trade:

An options trader purchased a single call option contract on SMCI for $285,

betting on a sharp upward move.

The Outcome:

Thanks to SMCI’s strong earnings, rapid institutional buying, and favorable

market conditions, the stock price surged—skyrocketing the value of the call

option to $3,054 in a short time. That’s a massive 972% profit on a

single trade.

Key Takeaways:

- Identify trends early: The AI-driven rally was clear, and SMCI was perfectly positioned.

- Use options to amplify profits: Options provide leveraged exposure without tying up large amounts of capital.

- Have an exit plan: Knowing when to take profits is critical in volatile markets.

Part 2: Capturing Quick Profits with a Put Option During SMCI’s Pullback

Not long after the rally, SMCI stock began to show cracks. Declining profit margins, increased legal risks, and growing competition from Dell and HPE weighed on the stock. Sensing the shift in sentiment, options traders flipped the script.

The Trade:

On March 6, 2025, a trader bought weekly put options on SMCI with a $35

strike price and an expiration date of April 11, 2025. The entry price was

$3.15 per contract.

The Result:

In just one trading day, the puts delivered a 45% profit as

SMCI’s stock declined sharply amid margin concerns and intensified competition.

Catalysts:

- Falling gross and net profit margins

- Increased capital requirements and a $1.75B capital raise

- Legal risks from DOJ investigations and shareholder lawsuits

- A growing belief that SMCI’s valuation was too aggressive

This quick-win strategy showed how nimble traders can profit even when sentiment flips negative.

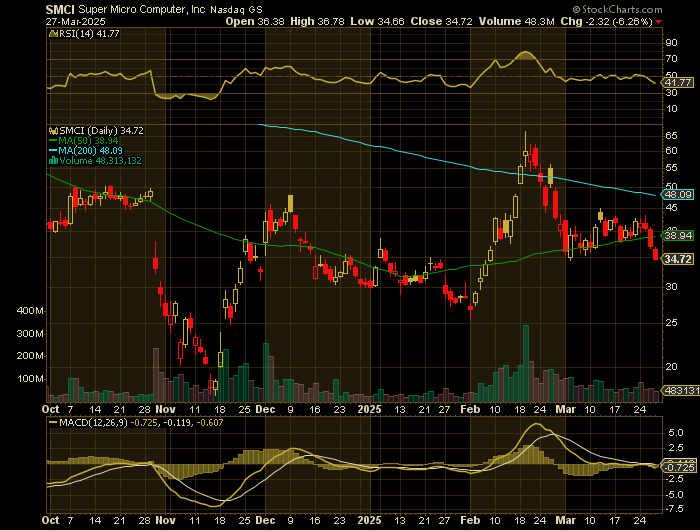

Part 3: SMCI Under Pressure — Another Opportunity for Short-Term Weekly Puts?

Fast forward to late March 2025, and SMCI’s troubles have deepened. The stock declined over 16% in a single week, dragged down by:

- A Sell Rating from Goldman Sachs, which cited unfavorable risk/reward and intense competition

- Comments from Alibaba’s Chairman warning of an AI bubble

- A broader market pullback due to fresh trade war tariffs and global economic concerns

SMCI’s stock fell to $37.04, a sharp drop from its recent highs. But the bearish case doesn’t stop there. Margin pressures remain, revenue growth is slowing, and competitive threats are rising.

For short-term traders, this opens up another clear setup:

🔻 A short-term weekly put option strategy—positioned to capture continued downside if SMCI fails to hold support levels.

Why Consider Another Put?

- Technical weakness: SMCI has broken key moving averages.

- Market headwinds: Trade tensions and a general risk-off environment.

- Structural concerns: Narrowing margins, slowing growth, and increased capital needs.

Risk

Management Reminder:

As with all options trades, especially in volatile stocks like SMCI, define

your risk, use position sizing, and have clear profit and loss targets.

Final Thoughts

Super Micro Computer’s wild price swings have provided textbook examples of how skilled options traders can profit from both bullish rallies and bearish pullbacks. Whether you’re riding a breakout with a call option or hedging against a downturn with puts, SMCI’s story highlights the power of options when combined with smart market analysis and disciplined risk management.

The opportunity is always in the movement—are you ready to take advantage of the next one?

Disclosure: Always manage options risk with protective stops and defined exit plans. As with any trade, past performance is not indicative of future results.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

Back to Weekly Options USA Home Page from

SMCI’s Wild Ride!

Recent Articles

-

191% Weekly Option Win on Super Micro Computer Amid Market Mayhem

191% Weekly Option Win on Super Micro Computer Amid Market Mayhem – What’s Next? -

Tariffs and the Stock Market: Positive and Negative Impacts in 2025

Tariffs and the Stock Market: Positive and Negative Impacts in 2025. This article explores both the positive and negative effects of tariffs on the stock market based on recent data, forecasts, and ma… -

SMCI’s Wild Ride: Options Traders Are Profiting From the Ups and Downs

SMCI’s Wild Ride: How Options Traders Are Profiting From the Ups and Downs