TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

1300% Profit From META Weekly Options Trade!

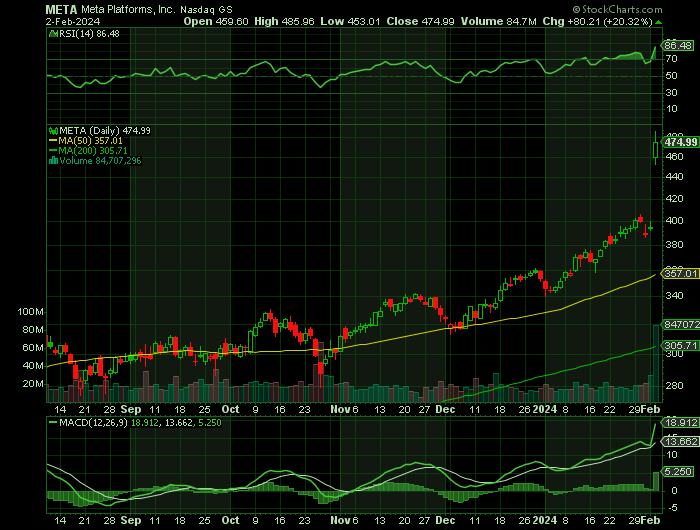

Meta Platforms (NASDAQ: META), the Facebook parent, delivered a smashing fourth-quarter earnings report on Thursday, announcing a massive share buyback, and declaring a dividend for the first time, as well as focusing on cutting back costs and shoring up billions in profits.

The stock rose 20% Friday to close at an all-time high of $474.99 per share. The gain added $197 billion to its market capitalization, the biggest single-session market value addition.

Meta has some clear advantages in its AI efforts. The social media giant's business model has always involved gathering and monetizing huge amounts of data.

This set the scene for Weekly Options USA Members to profit by 1,301% using a META Options trade!

Join Us And Get The Trades – become a member today!

Saturday, February 03, 2024

by Ian Harvey

Meta Platforms (NASDAQ: META), the Facebook parent, delivered a smashing fourth-quarter earnings report on Thursday, announcing a massive share buyback, and declaring a dividend for the first time, as well as focusing on cutting back costs and shoring up billions in profits.

The stock rose 20% Friday to close at an all-time high of $474.99 per share. The gain added $197 billion to its market capitalization, the biggest single-session market value addition.

“Solid execution, faster growth, and increased capital structure efficiency improve the outlook from here,” Brian Nowak, an analyst at Morgan Stanley, wrote in a note Friday.

“Meta’s AI pipeline for both users and advertisers is robust, with more tools set to launch and scale throughout ‘24,” he added.

Meta, which reduced headcount by 22% in 2023, unveiled plans for a $50 billion stock buyback, and announced its first quarterly dividend on Thursday, a sign to investors that it has money to spare and a reason for them to stick around.

While the company is making big cost cuts, it continues to spend aggressively on artificial intelligence advancements, namely in generative AI but also on the background technologies to help feed its social media products and power its ad targeting.

Why the META Weekly Options Trade was Originally Executed!

Since the Nasdaq Composite began trading in 1972, in every year following a market recovery, the tech-heavy index rose again -- and those second-year gains averaged 19%. The economy is the wildcard here, though, and it could yet stumble in 2024. But historical patterns suggest that this could be a good year for investors.

Recent developments in the field of artificial intelligence (AI) helped fuel the market's rise last year and will likely drive further gains in 2024. While estimates vary wildly, generative AI is expected to add between $2.6 trillion and $4.4 trillion to the global economy annually over the next few years, according to a study by McKinsey Global Institute. This will result in windfalls for many companies in the field.

One such company is Meta Platforms Inc (NASDAQ: META).

Meta has a long and distinguished history of using AI to its advantage. From identifying and tagging people in photos to surfacing relevant content on its social media platforms, Meta has never been shy about deploying AI systems.

Following the release of ChatGPT in late 2022, Meta's share price has been on a tear, jumping a substantial 174% in the last 12 months alone. Investors are optimistic about the company's decision to pivot away from metaverse development to focus more on generative AI, which could optimize its advertising and improve its consumer-facing platforms.

At first glance, Meta has some clear advantages in its AI efforts. The social media giant's business model has always involved gathering and monetizing huge amounts of data. And generative AI opens another avenue for this strategy through large language models (LLMs), which are algorithms designed to create content out of trained datasets.

The META Weekly Options Potential Profit Explained.....

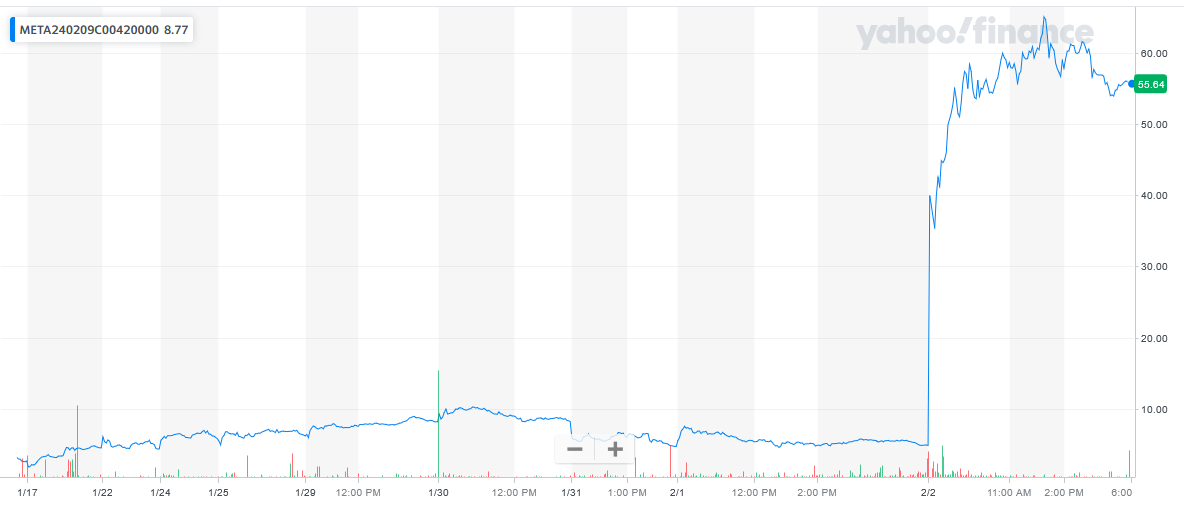

** OPTION TRADE: Buy META FEB 09 2024 420.000 CALLS - price at last close was $4.55 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the META Weekly Options (CALL) Trade on Monday, January 22, 2024 for $4.64.

Sold the META weekly options contracts on Friday, February 02, 2024 for $65.00; a potential profit of 1,301%.

Don’t miss out on further trades – become a member today!

About Meta Platforms.....

Meta Platforms, Inc. is a US-based multinational technology company and 1 of the Big 5 US tech companies. It is a member of the FAANG group holding the first position with its original name, Facebook.

Meta Platforms, Inc life began in 2004 as a digital “face book” for Harvard students. The company was founded by Mark Zuckerburg and a group of friends but now only Zuckerburg remains. The company quickly grew and expanded into other universities and then opened itself to the public in 2006. As of 2006, anyone over the age of 13 can be a Facebook user which is the company’s primary source of income. As of 2022, the company claimed more than 2.9 billion monthly active Facebook users.

Facebook, Inc filed for its IPO on January 1st 2012. The prospectus stated the company was seeking to raise $5 billion but it got so much more. The day before the IPO execs announced it would sell 25% more stock than it had previously stated because of the high demand. The company wound up raising more than $16 billion making it the 3rd largest IPO in history at the time.

The massive IPO valuation earned Facebook a spot in the S&P 500 in the first year of its public life. Although its valuation has deteriorated in the wake of scandal and consumer trends within social media, early investors were treated to gains in excess of 1000% at the peak of the stock run. Mark Zuckerburg retained 22% ownership in the company following the IPO, and 57% of the voting rights. As of 2022, those holdings were down to about 14% of the company and 54% of the voting rights.

Over the years, Facebook acquired a large number of apps and other businesses that include but are not limited to Instagram and WhatsApp. The company changed its name to Meta Platforms DBA Meta in 2021 to reflect its business and mission better. The new name describes the metaverse and refers to the seamless social interaction provided by Meta’s social media application universe.

Today, Meta develops digital applications that allow people to connect with family, friends, businesses, and merchants through Internet connections. Applications are available for mobile, PC, VR, and smart homes.

The company’s primary operating segment is the Family of Apps. The family of Apps includes Facebook and all the other digital applications. This segment produces virtually all of the revenue which is in turn 97% advertising oriented. The other operating segment is Reality Labs. Reality Labs develops and markets a line of virtual and augmented-reality products.

Further Catalysts for the META Weekly Options Trade…..

Meta is adding conversational AI experiences across its popular apps, introducing features ranging from more responsive image editing on Instagram to conversational chatbots with distinct personalities on WhatsApp. These efforts probably won't immediately impact Meta's operational performance, but they could help maintain its platforms' user engagement and generate valuable customer data.

On the operational side, Meta is bouncing back from the challenges it faced in 2022. Third-quarter (2023) revenue jumped by 23% year over year to $34.15 billion, while net income jumped 164% to $11.58 billion, helped by aggressive cost cutting and layoffs. And with a forward P/E of just 22, it isn't too late for investors to bet on the company's long-term potential.

Other Catalysts.....

Meta doesn't have a cloud infrastructure service to peddle its AI wares, but it quickly developed a workaround. After developing its open-source Llama AI model, Meta made it available on all the major cloud services -- for a price. Furthermore, Meta offers a suite of free AI-powered tools to help advertisers succeed.

Improving economic conditions will no doubt boost its digital advertising business. And with the stock trading at just 22 times forward earnings, Meta is inexpensive relative to its opportunity.

Analysts.....

Meta Platforms had its target price increased by JMP Securities from $380.00 to $410.00 in a report published on Friday. JMP Securities currently has a market outperform rating on the social networking company’s stock.

According to the issued ratings of 49 analysts in the last year, the consensus rating for Meta Platforms stock is Moderate Buy based on the current 2 sell ratings, 4 hold ratings, 41 buy ratings and 2 strong buy ratings for META. The average twelve-month price prediction for Meta Platforms is $366.23 with a high price target of $470.00 and a low price target of $175.00.

Summary.....

Meta Platforms stock traded up $7.32 during trading on Friday, reaching $383.45. 21,670,806 shares of the company were exchanged, compared to its average volume of 12,618,938. The company has a market cap of $985.41 billion, a P/E ratio of 33.84, a PEG ratio of 1.03 and a beta of 1.22. Meta Platforms, Inc. has a 52-week low of $134.61 and a 52-week high of $384.36. The stock's 50 day moving average price is $345.51 and its 200 day moving average price is $319.22. The company has a debt-to-equity ratio of 0.13, a quick ratio of 2.57 and a current ratio of 2.57.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from META

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!