TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

972% Profit: How a Super Micro Computer Options

Trade

Turned $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trade, which delivered an astonishing 972% return in just a short period.

The Setup

Super Micro Computer (NASDAQ: SMCI) has been a high-growth stock, fueled by the surging demand for AI and high-performance computing solutions. With bullish momentum building, an options trade was strategically placed to capitalize on an explosive move.

The Trade

An options contract was purchased for just $285 with the expectation that SMCI’s stock price would rally. Thanks to a strong earnings report and increasing institutional interest, the stock surged, causing the value of the options contract to skyrocket.

The Result

As SMCI’s share price climbed rapidly, the option’s value soared, reaching $3,054—a massive 972% gain!

Lessons from This Trade

- Spot Strong Trends Early – Recognizing SMCI’s momentum within the AI sector was key to identifying this opportunity.

- Leverage Options for Higher Returns – Options allow traders to control more shares with less capital, amplifying gains.

- Have a Profit-Taking Plan – Knowing when to lock in profits is crucial, as options can be volatile.

This trade proves that with the right strategy, even a small investment can turn into a significant windfall.

Join Us and Get Future Trades!

Wednesday, February 19, 2025

by Ian Harvey

UPDATE

Super Micro Computer (NASDAQ: SMCI) has been on an absolute tear recently, making it one of the most exciting stocks in the market. For traders who spotted the opportunity early, the gains have been nothing short of spectacular. One such trade turned a modest $285 into $3,054, yielding a 972% return in a short period!

Why Did SMCI Stock Skyrocket?

SMCI has

been surging due to a combination of factors:

✅ Strong AI & Data Center Demand – The company’s advanced server

solutions are critical to powering artificial intelligence (AI) and data

centers.

✅ Bullish Guidance – Supermicro’s CEO, Charles Liang, recently announced

a bold target of $40 billion in revenue by 2026, significantly higher

than previous forecasts.

✅ Regaining Investor Confidence – After facing accounting concerns and a

potential delisting threat from Nasdaq, the company reassured investors that it

would meet the February 25 deadline to submit its delayed SEC filings.

✅ Massive Stock Rebound – Despite falling 70% in late 2024, SMCI

has been on a five-day winning streak, nearly doubling its stock price in

2025 and making it the top-performing stock in the S&P 500 this

year.

The Trade: Spotting the Opportunity

A well-timed call option was placed on SMCI, anticipating a significant rally. As momentum built and the stock price soared, the option’s value exploded by 972%, turning a small investment of $285 into $3,054!

Lessons from This High-Gain Trade

🔹 Identify

Stocks with Momentum – SMCI’s surge was fueled by renewed investor

confidence and bullish revenue projections.

🔹 Leverage Options for Maximum Gains – Options allow traders to

control more shares with a fraction of the capital, leading to amplified

profits.

🔹 Follow Institutional Interest & Market Trends – As major

players piled into SMCI, it became clear that smart money was backing the

rally.

🔹 Have an Exit Strategy – The stock’s volatility means locking

in profits at the right time is key.

What’s Next for SMCI?

With continued AI-driven growth and a recovering reputation, SMCI remains a stock to watch. While risks still exist, such as Nasdaq compliance deadlines and past accounting concerns, its AI-fueled future could keep the rally going.

For traders and investors alike, SMCI’s wild ride proves that strategic positioning in the right stock at the right time can deliver life-changing returns.

The SMCI Weekly Options Potential Profit Explained.....

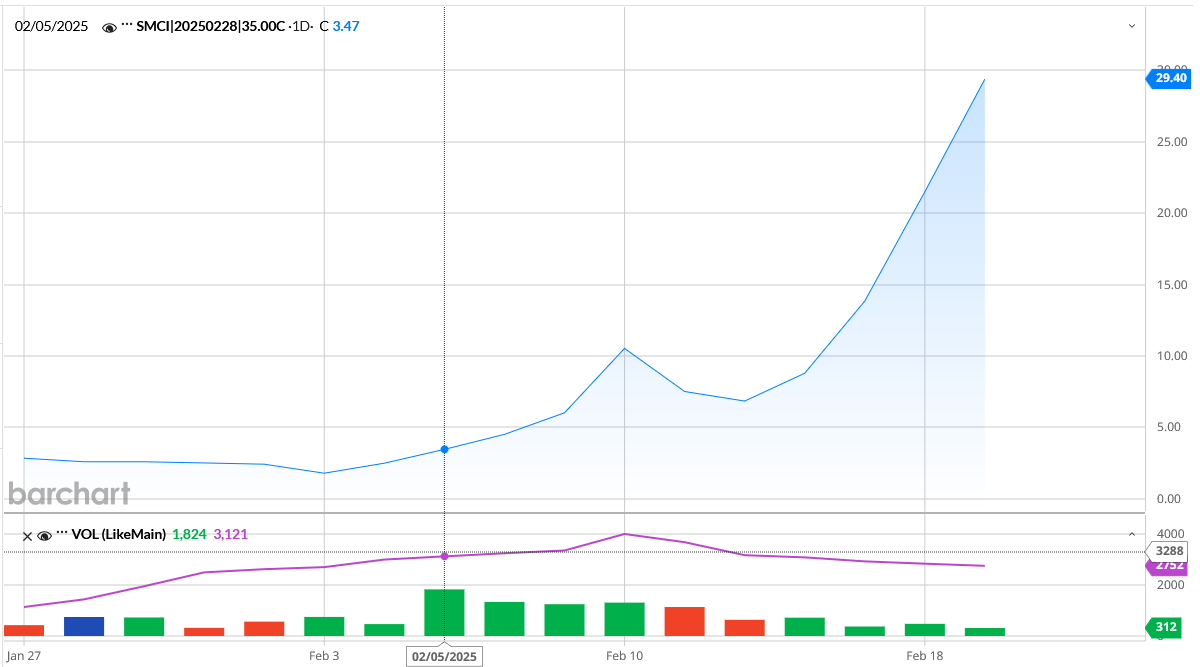

** OPTION TRADE: Buy SMCI FEB 28 2025 35.000 CALLS - price at last close was $4.60 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the SMCI Weekly Options (CALL) Trade on Monday, January 27, 2025 for $2.85.

Sold the SMCI Weekly Options contracts on Wednesday, February, 2025, for $30.54; a potential profit of 972%.

Don’t miss out on further trades – become a member today!

Why the SMCI Weekly Options Trade was Originally Executed!

Trade Analysis

Current Situation

Super Micro Computer (NASDAQ: SMCI) is a prominent player in the high-performance, high-efficiency server technology sector. Founded in 1993 and based in San Jose, California, Super Micro Computer has established itself as a reliable partner in the technology industry, delivering advanced computing solutions to a diverse clientele including data centers, cloud computing providers, and enterprises. The company's product offerings encompass server systems, storage solutions, networking devices, and software.

Super Micro Computer's CEO, Charles Liang, who has over three decades of experience in the technology sector, has steered the company towards consistent revenue growth. The company's financial health is robust, with a profit margin exceeding 10% in recent years, and its debt levels have remained stable. Super Micro's stock has seen significant price fluctuations, particularly influenced by the COVID-19 pandemic's impact on the technology sector. However, the stock has recovered impressively, indicating strong market confidence in its financial health and growth prospects.

Key Insights from Earnings Call

During the most recent earnings call, Super Micro Computer's management emphasized the company's ongoing commitment to innovation and market expansion. The company has been actively exploring new markets, particularly the rapidly growing cloud computing space, and has made strategic acquisitions to enhance its product portfolio. The focus on energy efficiency and sustainability aligns with the increasing demand for environmentally-friendly technology solutions, further positioning Super Micro as a leader in the industry.

Catalysts for the Trade

- Technological Advancements: Super Micro's continuous innovation in server and storage solutions, particularly for AI and cloud applications, positions it well for future growth.

- Market Expansion: The company's strategic moves into new markets and its focus on sustainability are likely to attract new customers and retain existing ones.

- Financial Stability: Super Micro's consistent financial performance and strong market position provide a solid foundation for its stock's potential appreciation.

Further Catalysts

Super Micro's recent initiatives in expanding its product line and entering new markets are expected to drive further growth. The company's emphasis on innovative and energy-efficient solutions is likely to resonate well with the evolving demands of the technology sector.

Analysts project Super Micro to continue its trajectory of revenue growth, with potential to expand its market share further, especially as it capitalizes on the opportunities presented by cloud computing and AI technologies.

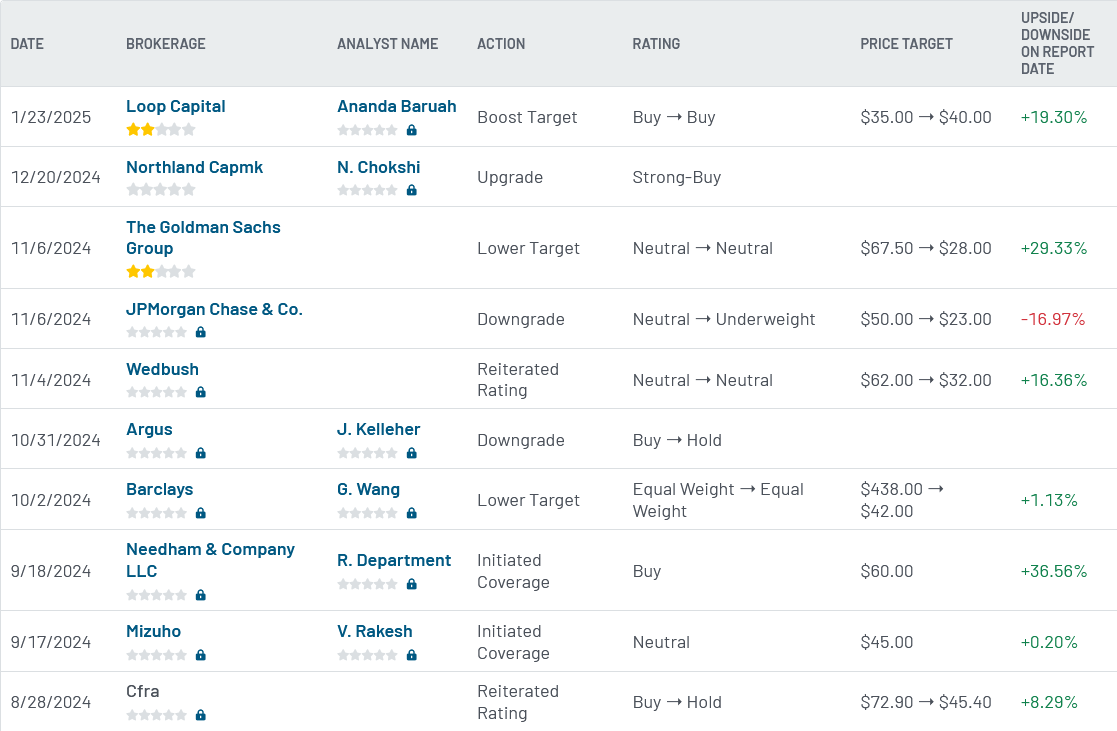

Analyst Reactions

Recent analyses by Wall Street experts suggest a positive outlook for Super Micro Computer's stock, with several maintaining a 'Buy' rating. The consensus among analysts is that Super Micro's innovative approach and strategic market expansions will continue to drive its stock's performance in the upcoming periods.

Company Overview

Super Micro Computer, Inc., known for its high-performance server technology, continues to lead innovations in the tech industry. With a global presence and a reputation for reliability, Super Micro offers a comprehensive range of products that cater to a variety of tech needs.

The company's commitment to sustainability and efficiency is evident in its product designs, making it a preferred choice for eco-conscious enterprises.

Technical Analysis

- Market Capitalization: $24.57 billion

- PE Ratio: 22.05

- Beta: 1.31

- 52-Week Low: $17.25

- 52-Week High: $122.90

- Fifty-Day SMA: $33.83

- Two-Hundred-Day SMA: $45.41

Summary

Super Micro Computer presents a compelling investment opportunity in the high-performance server and storage market. The company's robust financial health, innovative product offerings, and strategic market expansions create a favorable environment for stock appreciation. The current market dynamics and the company's focus on sustainability further enhance its appeal to investors.

Trade Execution

Consider placing a buy order for SMCI FEB 28 2025 35.000 CALLS, with a premium of $4.60. Adjust your sell point and stop loss according to your risk tolerance.

Disclaimer

This trade suggestion is based on the current market analysis and is not a guaranteed success. Always consider your risk tolerance and consult with a financial advisor if necessary.