TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Broadcom: A

Rising Star in the AI-Driven Tech Revolution!

Weekly

Options Members Profit Up 1,125%!

Broadcom achieved significant milestones in 2024, driven by a 220% surge in AI-related revenues and strong diversification across its semiconductor and software segments.

With its market cap surpassing $1 trillion, strategic partnerships with tech giants, and continued innovation in AI infrastructure, Broadcom is positioned for sustained growth and industry leadership.

This set the scene for Weekly Options USA Members to profit by 1,125% using an AVGO Weekly Options trade!

Join Us And Get The Trades – become a member today!

Monday, December 16, 2024

by Ian Harvey

UPDATE

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom (NASDAQ: AVGO) has cemented its place as a leading innovator in the technology landscape, achieving remarkable milestones in 2024. The company's focus on artificial intelligence (AI) and strategic diversification have propelled its market capitalization beyond $1 trillion, solidifying its position as one of the top-performing companies globally.

Pioneering AI Innovation

Broadcom's success in 2024 has been significantly driven by its AI initiatives. The company reported a staggering 220% increase in AI-related revenues, which now account for $12.8 billion of its total sales. These AI-driven achievements underscore Broadcom's pivotal role in the global AI ecosystem, with its cutting-edge networking chips and custom AI accelerators at the forefront of data center technology. By ensuring seamless data movement and optimized processing efficiency, Broadcom’s products are indispensable in maximizing the performance of AI infrastructure.

Strategic Partnerships and Market Expansion

Broadcom’s collaboration with tech giants such as Alphabet, Meta, and ByteDance highlights its dominance in the AI chip market, projected to grow between $60 billion and $90 billion by 2027. Additionally, its recent ventures with Apple and OpenAI promise to unlock further growth opportunities, reflecting the company’s ability to adapt and innovate in an ever-evolving industry.

Diversification and Long-Term Growth

While AI has been a key driver, Broadcom's diversified business model strengthens its market resilience. Its semiconductor and enterprise software segments, including the transformative VMware acquisition, have seen robust growth. In fiscal 2024, Broadcom's total revenue soared by 44% to $51.5 billion, with software revenues skyrocketing by 181%. This balanced revenue stream ensures stability while offering exciting growth prospects.

Positioned for Continued Success

Broadcom’s strong financial performance, combined with its forward-looking investments in AI and strategic acquisitions, positions it for sustained success. Analysts predict a compound annual growth rate of over 60% in its AI segment, with broader revenue and earnings growth expected to continue through 2025 and beyond. With a competitive valuation and unparalleled technological advancements, Broadcom remains an attractive choice for investors seeking exposure to AI-driven growth.

Conclusion

As a trailblazer in AI and a diversified tech powerhouse, Broadcom exemplifies the potential of innovation and strategic execution. Its achievements in 2024 set the stage for even greater success, ensuring that the company remains a key player in shaping the future of technology.

The AVGO Weekly Options Potential Profit Explained.....

** PROPOSED OPTION TRADE: Buy AVGO JAN 03 2025 180.000 CALLS - price at last close was $3.80 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the AVGO Weekly Options (CALL) Trade on Tuesday, December 03, 2024 for $4.00.

Sold the AVGO Weekly Options contracts on Friday, December 13, 2024, for $49.00; a potential profit of1,125%.

Don't miss out on further trades – become a member today!

Why the AVGO Weekly Options Trade was Originally Executed!

Trade Analysis

Current Situation

Broadcom Ltd (NASDAQ: AVGO) is a prominent technology firm known for its semiconductor and infrastructure software solutions. Founded in 1961, Broadcom has evolved into a key player in the tech industry, renowned for its innovation and customer-centric approach.

Broadcom's diverse product portfolio includes semiconductor solutions for a variety of applications, such as wired and wireless communications, enterprise storage, and industrial markets. Additionally, the company provides infrastructure software solutions, including network switches, network processors, and storage controllers, making it a comprehensive provider for technology needs.

The company's commitment to research and development has positioned it at the forefront of technological advancements, particularly in sectors like healthcare, automotive, and telecommunications. Broadcom's ability to innovate continuously has been a significant factor in its ability to expand its customer base, which includes industry giants like Apple, Cisco, and Samsung.

Despite challenges such as the US-China trade tensions affecting tariffs on some of Broadcom's products, the company has maintained strong financial performance, with significant revenue and earnings growth driven by its broad product offerings and innovative solutions.

Key Insights from Earnings Call

During the most recent earnings call, Broadcom's management emphasized the sustained demand for its semiconductor and software solutions. The company's strategic focus on AI technology and the expansion of its infrastructure software offerings have been well-received in the market, further solidifying its competitive position.

Additionally, Broadcom's acquisition strategy, although viewed critically by some, has been defended by the company as essential for maintaining competitiveness in the rapidly evolving tech landscape. The company continues to invest heavily in research and development, ensuring its long-term growth and innovation.

Catalysts for the Trade

- Technological Advancements: Broadcom's continuous innovation in semiconductor and software solutions positions it well to capitalize on the growing tech market demands.

- Strategic Acquisitions: Despite some controversy, Broadcom's acquisitions have strengthened its market position and broadened its product portfolio, offering more comprehensive solutions to its customers.

- Robust Financial Performance: The company's strong financial health, evidenced by consistent revenue growth and profitability, makes it an attractive option for investors.

Further Catalysts

Looking ahead, Broadcom's focus on integrating AI technologies and expanding its software solutions are expected to drive further growth. The company's ability to adapt to market demands and its strategic investments in technology development are likely to continue attracting interest from large-scale customers and partners.

Analyst Reactions

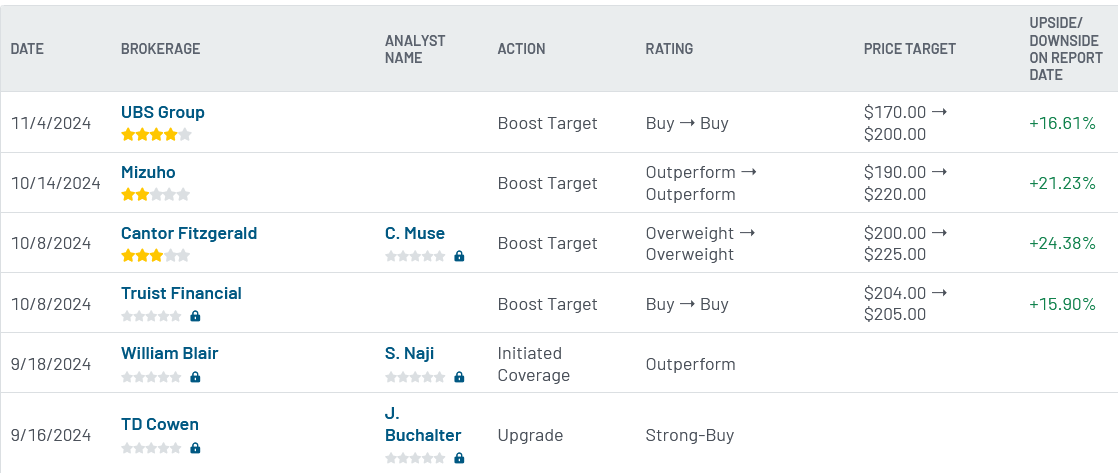

Recent analyses by financial experts highlight Broadcom's robust market position and its potential for continued growth. Analysts have pointed to the company's innovative product lines and strategic market maneuvers as key factors in its sustained success.

Furthermore, the tech sector's volatility, influenced by factors like geopolitical tensions, has led analysts to recommend Broadcom as a potentially stable investment, given its strong fundamentals and strategic market positioning.

Company Overview

Broadcom Inc., initially founded as a semiconductor company, has grown significantly over the decades to become a leader in the technology sector. The company's rebranding and expansion into infrastructure software solutions have broadened its impact and market reach, making it a pivotal player in the global tech landscape.

The company's ability to integrate innovative technologies into its offerings, such as AI and machine learning, has allowed it to maintain a competitive edge and adapt to changing market conditions effectively.

Technical Analysis

- Market Capitalization: $777.70 billion

- PE Ratio: 144.79 (indicative of high growth potential)

- Beta: 1.17 (reflecting moderate volatility relative to the market)

- 52-Week Low: $90.31

- 52-Week High: $186.42

- Fifty-Day SMA: $173.39

- Two-Hundred-Day SMA: $161.69

Summary

Broadcom presents a compelling investment opportunity in the rapidly evolving tech sector. The company's innovative approach to semiconductor and software solutions, combined with its strategic market positioning and robust financial performance, create a favorable environment for potential stock appreciation. The current market dynamics, particularly the tech sector's resilience amid volatility, further enhance Broadcom's appeal to investors.

Trade Execution

Consider placing a buy order for AVGO JAN 03 2025 180.000 CALLS, with a premium of $3.80. Adjust your sell point and stop loss according to your risk tolerance.

Disclaimer

This trade suggestion is based on the current market analysis and is not a guaranteed success. Always consider your risk tolerance and consult with a financial advisor if necessary.