TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Two-Step Profit Strategy on Boeing:

192% Gain on Puts,

Now Flipping Bullish with Calls!

Tuesday, March 25, 2025

by Ian Harvey

"Soaring Gains: 192% Profit on Boeing Put – Now Flipping to a Call as Recovery Takes Flight!"

Join Us and Get the Trades!

Step 1: Capitalizing on Boeing’s Struggles – The 192% PUT Win

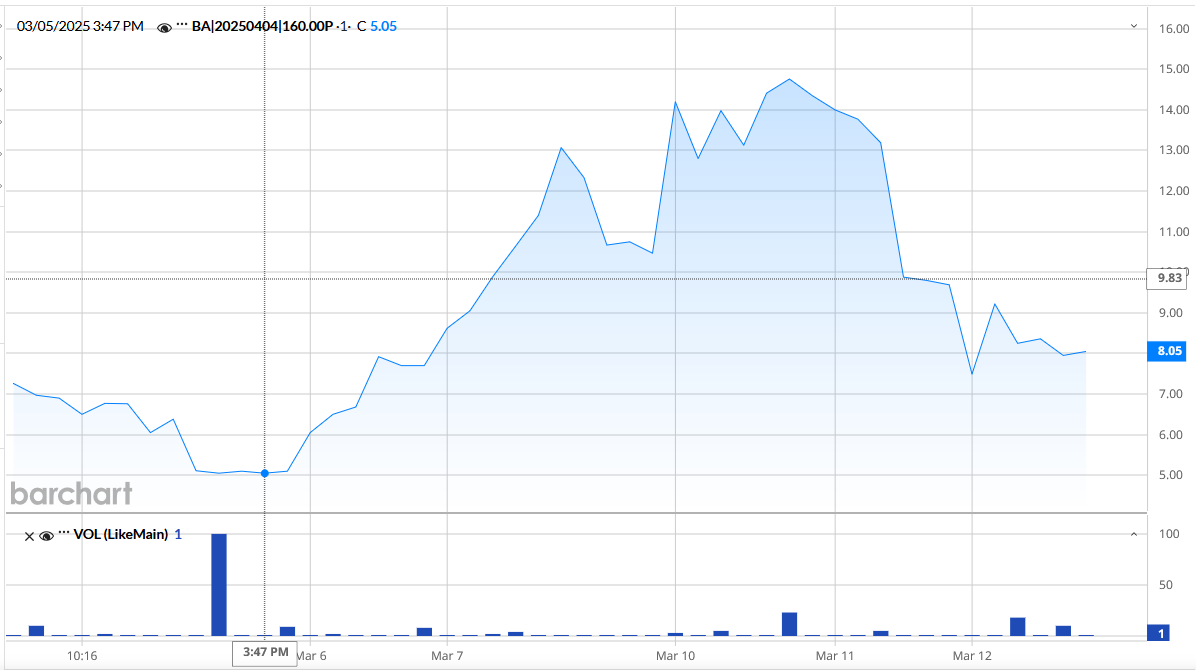

Back on March 5, 2025, a strategic PUT trade on Boeing (NYSE: BA) was initiated, targeting short-term downside as the aerospace giant faced turbulent market conditions.

Trade Details:

- Option Type: PUT

- Strike Price: $160

- Expiration: April 4, 2025

- Entry Premium: $5.05

This bearish position was driven by a combination of macroeconomic volatility, Boeing's disappointing earnings report, and regulatory and operational headwinds. The company was under intense scrutiny due to manufacturing and certification delays across its aerospace divisions, particularly surrounding the Vulcan Centaur rocket via the United Launch Alliance (ULA) joint venture with Lockheed Martin.

By March 10, the trade yielded a 192% profit, as Boeing's stock slid amid news that ULA would cut its 2025 launch targets by 40%, slashing revenue projections by hundreds of millions.

This was a textbook example of trading the news and aligning with technical weakness. However, the market narrative began to shift…

Step 2: Boeing Rebounds – Time for a Bullish Call Trade

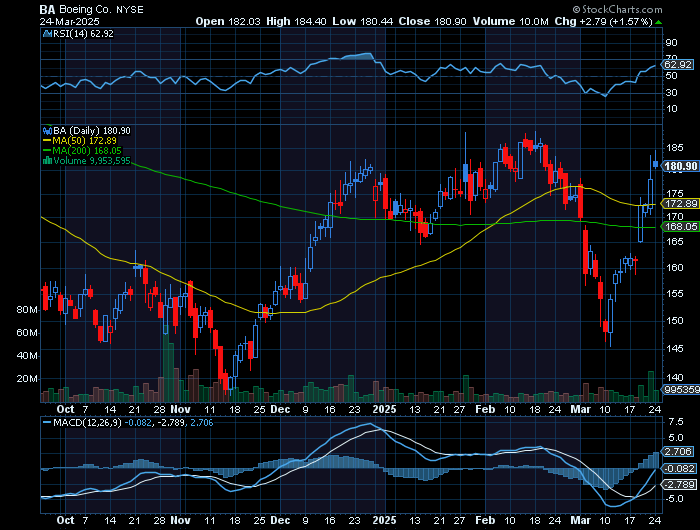

As of March 25, 2025, the outlook for Boeing has changed dramatically, providing an ideal setup for a CALL trade as positive catalysts emerge. Here’s what’s fueling the turnaround:

Key Bullish Catalysts:

- Massive Defense Contract Win

Boeing clinched a $20 billion contract to develop the Next Generation Air Dominance (NGAD) fighter jet, replacing Lockheed’s F-22. Long-term, this could generate over $250 billion in revenue across decades, solidifying Boeing’s defense dominance. - Leadership and Operational

Restructuring

Under new CEO Kelly Ortberg, Boeing has refocused on core efficiency. Production of the 737 MAX and Dreamliner has picked up, with 25 MAX deliveries in February—a clear sign of operational recovery. - Valuation and Sentiment Rebound

Boeing stock has rallied +10.05% in the past week, reflecting renewed investor optimism. With the stock trading at a forward P/E of just 36.9 and still 40% below all-time highs, the valuation looks attractive, especially given the company’s $435 billion backlog. - Positive Analyst Momentum

Major institutions have raised their targets:

- Barclays: $210

- Citi Research: $210

- RBC Capital: $200

- J.P. Morgan: $190

Current price: ~$178

Recommended CALL Trade Setup:

Option Type: CALL

Suggested Strike: $185

Expiration: APR 25, 2025 (to allow time for bullish momentum to play

out)

Entry Price Target: $5–$7 depending on market conditions

Risk Management Tips:

- Take partial profits at +50% and trail the rest.

- Consider stop-loss around -40% if market conditions reverse.

Conclusion: Turning the Page

After a strategic win with the PUT trade and nearly tripling gains, Boeing now sets the stage for a rebound fueled by defense contracts, production recovery, and improving sentiment.

The stock may not be free of risk, but this two-step strategy shows how you can profit in both directions when you follow the catalysts. For active traders, this is a prime example of adapting with the narrative and capitalizing on volatility.

From turbulence to takeoff — Boeing might just be ready to fly again.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

Back to Weekly Options USA Home Page from

Two-Step Profit Strategy on Boeing!

Recent Articles

-

191% Weekly Option Win on Super Micro Computer Amid Market Mayhem

191% Weekly Option Win on Super Micro Computer Amid Market Mayhem – What’s Next? -

Tariffs and the Stock Market: Positive and Negative Impacts in 2025

Tariffs and the Stock Market: Positive and Negative Impacts in 2025. This article explores both the positive and negative effects of tariffs on the stock market based on recent data, forecasts, and ma… -

SMCI’s Wild Ride: Options Traders Are Profiting From the Ups and Downs

SMCI’s Wild Ride: How Options Traders Are Profiting From the Ups and Downs