TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

211%

Profit As CHEWY Stock Surges!

is more PROFIT EXPECTED!

Join Us and Get the Trades!

Chewy is still far and away the market leader in pet online retail, having successfully taken the niche from Amazon. Chewy is a must-have partner for any pet product seller.

The company has become profitable in recent years, thanks to these loyal fans that keep coming back and spending more.

Chewy has seen its share price rise by 15% in the past week, and is up nearly 60% in the past three months.

Chewy has reported six consecutive quarters of profitability topped by a tripling of its earnings per share in its latest quarter.

This set the scene for Weekly Options USA Members to profit by 211% using a CHWY Weekly Options trade!

Join Us And Get The Trades – become a member today!

Sunday, June 23, 2024

by Ian Harvey

UPDATE

Chewy Inc (NYSE: CHWY) is a favorite e-commerce destination of pet parents because they can find just about anything they need for their pets here, from food and toys to health insurance and prescription medication. The company has become profitable in recent years, thanks to these loyal fans that keep coming back and spending more.

Chewy has seen its share price rise by 15% in the past week, and is up nearly 60% in the past three months.

Chewy has reported six consecutive quarters of profitability topped by a tripling of its earnings per share in its latest quarter.

Autoship makes up more than 77% of Chewy's net sales, showing that these regular orders -- rather than random, one-time ones -- drive the company's growth.

The company has extended its e-commerce platform into Canada. This was done without great expense due to the company's existing infrastructure and software stack. And it opened its first in-person veterinary clinics, a move that will diversify the revenue base and offer the e-commerce shop more exposure.

The company has received 10 buy-now reiterations from analysts since its last earnings report, showing that overall sentiment toward the stock is changing as its profitability blossoms.

Despite its rapid recent ascension, Chewy's share price should have plenty of room to continue running as it improves its newfound profitability.

Currently, Chewy is expanding into higher-margin verticals ranging from pet healthcare, pet insurance, and wholly owned veterinary clinics to private-label products, ads on its platform, and a new paid membership program.

The CHWY Weekly Options Potential Profit Explained.....

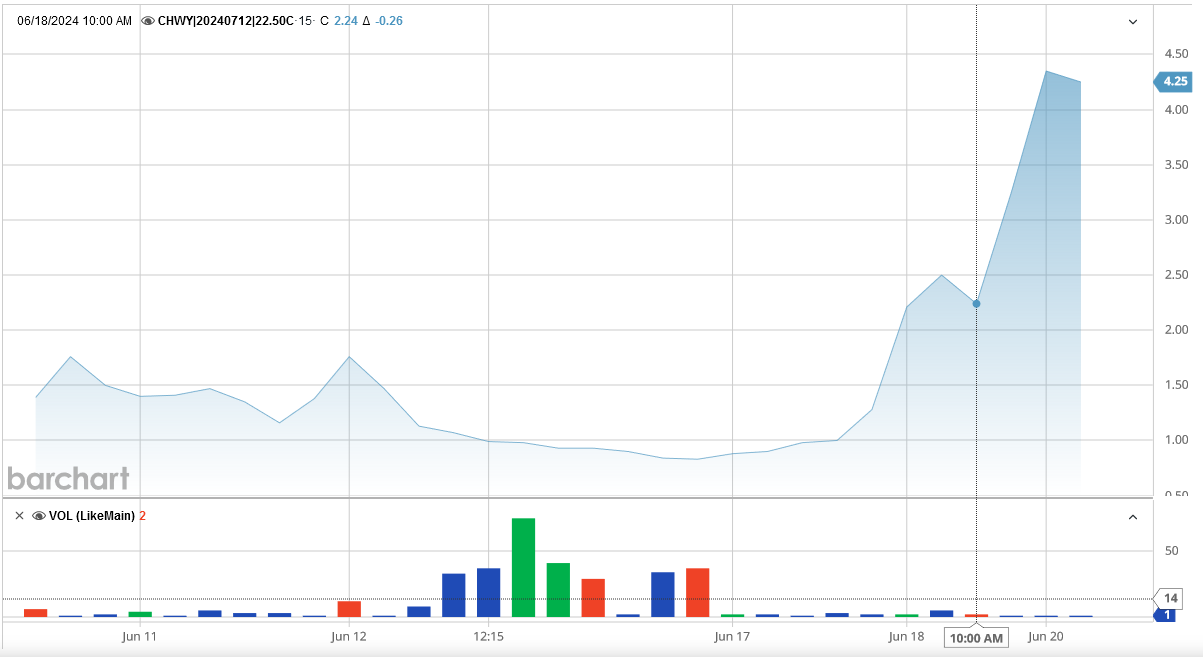

** OPTION TRADE: Buy CHWY JUL 12 2024 22.500 CALLS - price at last close was $2.01 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the CHWY Weekly Options (CALL) Trade on Monday, June 10, 2024 for $1.40.

Sold the CHWY Weekly options contracts on Thursday, June 20, 2024 for $4.35; a potential profit of211%.

(This result will vary for members depending on their entry and exit strategies).

Holding the remaining PLTR Weekly options contracts for further profit!

Don’t miss out on further trades – become a member today!

Why the CHEWY Weekly Options Trade was Originally Executed!

Trade Analysis

Chewy Inc (NYSE: CHWY) continues to dominate the online pet retail sector, with a robust growth trajectory despite recent market valuation adjustments. As a leader in this niche, Chewy has effectively edged out major competitors like Amazon and remains a crucial partner for pet product vendors.

Current Situation

Chewy is actively expanding its market share from traditional retail channels, enhancing its product range and exploring new market segments such as pet healthcare and insurance. The company's revenue is nearing a $12 billion annual rate, with significant improvements in profit margins.

Key Insights from Earnings Call

Chewy's first-quarter earnings demonstrated substantial growth, with GAAP net income tripling to $66.9 million. This performance underscores the company's strong market position and operational efficiency.

Catalysts for the Trade

Chewy's recent fiscal results showed a 30% increase following their first-quarter report. The company's strategic expansion into healthcare and insurance, alongside potential advertising revenue streams, presents significant growth opportunities.

Further Catalysts for the Trade

Revenue Growth and Customer Engagement

Despite a slowdown in customer growth, Chewy's revenue per customer has seen a notable increase, indicating effective customer monetization strategies. The introduction of Chewy-branded veterinary clinics and a $500 million stock buyback plan further bolster its market position.

Analyst Reactions

Analysts have responded positively to Chewy's strategic initiatives, with upgrades and increased price targets reflecting confidence in the company's growth trajectory.

Company Overview

Founded in 2011 as "Mr. Chewy," Chewy has revolutionized the pet retail industry through its exclusive online presence and customer-centric approach. Acquired by PetSmart in 2017 for $3.35 billion, it continues to operate independently, focusing on delivering high-quality pet products and exceptional service.

Technical Analysis

- Market capitalization: $9.89 billion.

- PE ratio: 126.39.

- Beta: 1.00.

- 52-week low: $14.69.

- 52-week high: $40.78.

- Fifty-day simple moving average: $17.22.

- Two-hundred-day simple moving average: $18.32.

Summary

Chewy's strategic diversification and robust financial performance position it well for future growth. The company's focus on expanding its service offerings and enhancing customer value propositions makes it a compelling option for this week's trade.