TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

218% Profit As Meta Platforms Continues To Grow!

Meta Platforms Inc (NASDAQ: META) and Ray-Ban maker EssilorLuxottica announced Tuesday that they've extended their partnership with plans to "collaborate into the next decade to develop multi-generational smart eyewear products."

Meta Platforms’ shares are benefiting from steady user growth across all regions, particularly Asia Pacific. Increased engagement for its offerings like Instagram, WhatsApp, Messenger and Facebook has been a major growth driver.

AI monetization by Meta Platforms has been appreciated by analysts on Wall Street.

This set the scene for Weekly Options USA Members to profit by 218% using a META Weekly Options trade!

Join Us And Get The Trades – become a member today!

Tuesday, September 17, 2024

by Ian Harvey

UPDATE

Meta Platforms Inc (NASDAQ: META) and Ray-Ban maker EssilorLuxottica announced Tuesday that they've extended their partnership with plans to "collaborate into the next decade to develop multi-generational smart eyewear products."

The Facebook parent company has been working with the Paris-based EssilorLuxottica since 2019. The latest version of Meta's Ray-Ban-branded smart glasses offer an HD camera, calling capabilities and some voice-enabled AI assistant features. The product has gotten largely positive reviews and stands out as a hit within Meta's broader metaverse business.

Meta Platforms’ shares are benefiting from steady user growth across all regions,

particularly Asia Pacific. Increased engagement for its offerings like

Instagram, WhatsApp, Messenger and Facebook has been a major growth driver.

META has been leveraging AI to improve the potency of its platform offerings.

These services currently reach more than 3.2 billion people daily. User growth

remained solid in the United States, with WhatsApp reaching more than 100

million monthly users and Thread approaching the 200 million milestone.

It witnessed good year-over-year growth across Facebook, Instagram and Threads.

Meta now expects to invest significantly more over the next few years in

developing more advanced models and the largest AI services in the world.

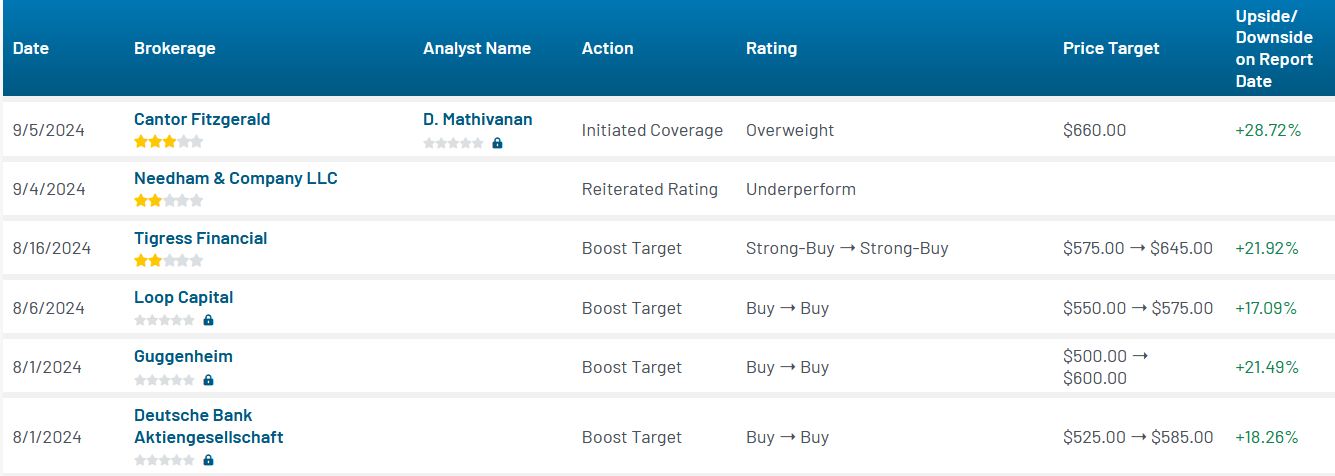

AI monetization by Meta Platforms has been appreciated by analysts on Wall Street. Tigress Financial recently raised the price target on the stock to $645 from $575 and kept a Strong Buy rating, noting that the increasing cash flow of the firm was enabling ongoing investments in artificial intelligence initiatives that drive increasing user engagement, better content, and a more effective advertising experience.

The META PLATFORMS Weekly Options Potential Profit Explained.....

** OPTION TRADE: Buy META OCT 04 2024 530.000 CALLS - price at last close was $7.47 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the META Weekly Options (CALL) Trade on Monday, September 09, 2024 for $7.00.

Sold the META Weekly options contracts on Tuesday, September 17, 2024 for $22.27; a potential profit of218%.

(This will vary for members depending on their entry and exit strategies).

Don’t miss out on further trades – become a member today!

Why the META PLATFORMS Weekly Options Trade was Originally Executed!

Trade Analysis

Current Situation

Meta Platforms Inc. (NASDAQ: META) is a prominent technology conglomerate known for its extensive social media and online services. The company's platforms, including Facebook, Instagram, WhatsApp, and Messenger, collectively boast over 3.2 billion users as of March. Meta's revenue model is heavily reliant on advertising, which has seen significant growth due to AI-driven enhancements and an increase in ad prices.

In the second quarter of 2024, Meta reported a 7% increase in daily active users and a substantial 73% rise in earnings per share, with revenue climbing 22.10% year-over-year to $39.07 billion. This growth was fueled by a 10% increase in both the number of ads served and the cost per ad. The company's strategic acquisitions and innovations in AI technology, such as the development of its own AI models like Llama, have positioned it strongly for continued growth and expansion into new markets such as the metaverse.

Key Insights from Earnings Call

During the recent earnings call, Meta's management highlighted the significant role of AI in driving ad revenue growth. The introduction of AI models has not only improved ad targeting but also enhanced user engagement, which in turn has attracted more advertisers to its platforms. The company's forward-looking statements suggest a strong focus on leveraging AI to further enhance its advertising capabilities and expand its user base.

Catalysts for the Trade

- Robust User Growth: Meta's platforms continue to attract new users globally, which directly contributes to its advertising revenue.

- AI Innovations: Ongoing advancements in AI technology are expected to drive further efficiencies in ad delivery and effectiveness.

- Expansion into New Markets: Meta's foray into the metaverse and other new technologies presents additional growth opportunities.

Further Catalysts

Meta's recent acquisition of Nvidia's H100 GPUs and the development of its custom chip are set to enhance its computing power, which is crucial for the development of advanced AI applications. This strategic move is likely to bolster its capabilities in AI and machine learning, providing a competitive edge in the tech industry.

Analysts are optimistic about Meta's growth trajectory, with several raising their price targets following the company's impressive quarterly performance. The consensus among analysts is that Meta's stock is poised for substantial growth, driven by its strong fundamentals and strategic initiatives.

Analyst Reactions

According to recent research from 27 Wall Street analysts, Meta Platforms Inc's stock has an average twelve-month price target of $576.66, with a high estimate of $660.00 and a low of $360.00. Analysts have highlighted Meta's robust technology stack and its potential to capitalize on the increasing demand for advanced digital advertising solutions.

The technology sector has recently experienced volatility, partly influenced by geopolitical tensions and comments from former President Donald Trump regarding Taiwan and trade policies. Despite these fluctuations, experts like Dan Ives from Wedbush view the current tech sell-off as a buying opportunity, particularly for stocks with strong fundamentals like Meta Platforms Inc.

Company Overview

Meta Platforms, Inc., originally known as Facebook, was founded in 2004 and is headquartered in Menlo Park, California. The company provides a range of social media and online services, enabling people to connect, share, discover, and engage with content. Meta's platforms include Facebook, Instagram, WhatsApp, and Messenger, each serving as a powerful tool for personal and professional communication, as well as digital marketing.

The company's recent rebranding to Meta Platforms reflects its strategic shift towards building the metaverse, a virtual space for users to interact more immersively using VR and AR technologies. This move is part of Meta's broader ambition to lead the next generation of digital experiences, leveraging its massive user base and cutting-edge technology.

Technical Analysis

- Market Capitalization: $1.27 trillion

- PE Ratio: 28.73 (reflecting its growth potential despite high valuation)

- Beta: 1.21 (indicating moderate volatility relative to the market)

- 52-Week Low: $279.40

- 52-Week High: $544.23

- Fifty-Day SMA: $505.18

- Two-Hundred-Day SMA: $494.12

Summary

Meta Platforms presents a compelling investment opportunity in the rapidly evolving tech sector. The company's innovative AI-driven solutions, robust user growth, and strategic expansion into new markets create a favorable environment for stock appreciation. The current PE ratio, while on the higher side, reflects the market's confidence in its future growth potential.

Trade Execution

Consider placing a buy order for META OCT 04 2024 530.000 CALLS, with a premium of $7.47. Adjust your sell point and stop loss according to your risk tolerance.

Disclaimer

This trade suggestion is based on the current market analysis and is not a guaranteed success. Always consider your risk tolerance and consult with a financial advisor if necessary.