TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

41% Profit Using An Advanced Micro Devices Weekly Option!

More Profit To Come!

Advanced Micro Devices, Inc. (NASDAQ AMD) has a dominant market share of 90% in the emerging AI-enabled personal computing industry.

"Rising tide could create profitable niche for next tier of vendors," Bank of America's Vivek Arya said in a note on Sunday.

Advanced Micro Devices stock has increased by 75% in the past six months.

This set the scene for Weekly Options USA Members to profit by 41% using an AMD Options Trade!

Join Us And Get The Trades – become a member today!

Wednesday, April 03, 2024

by Ian Harvey

Why the Advanced Micro Devices Weekly Options Trade was Originally Executed!

While Advanced Micro Devices, Inc. (NASDAQ AMD) is chasing Nvidia in the data center, the company has a dominant market share of 90% in the emerging AI-enabled personal computing industry. Millions of computers from manufacturers like Dell and HP have already shipped with AMD's Ryzen AI chips, which allow users to process AI on-device. That leads to a faster, more responsive experience, because AI workloads don't have to travel to and from the data center.

"Rising tide could create profitable niche for next tier of vendors," Bank of America's Vivek Arya said in a note on Sunday.

Arya observed that the accelerator market, which enables the complex inner workings of generative AI chatbots, should double over the next three years to about $200 billion.

In the recent fourth quarter of 2023, the Ryzen AI series sent the company's Client segment revenue up 62% year over year. Combined with the growing shipments of the MI300 chips -- which could generate $3.5 billion in sales in 2024 -- this could be AMD's biggest year.

The rapid growth in that market "could create volatile but fruitful opportunities among the #2 vendors," Arya said.

"Each 'junior samurAI' trades interestingly at a valuation premium to its respective leader, so greater stock volatility is to be expected. However, as the leader expands the market TAM, the junior can likely continue to carve a profitable niche," Arya said.

Advanced Micro Devices stock has increased by 75% in the past six months.

Generative AI won’t just happen on servers; it will also take place on clients. PCs and phones will need small, but powerful central processing units, as well as graphics processing units, to handle the load.

Samsung has already seen the future, and linked with AMD’s GPU design for its next-generation Exynos chip.

The value of a chip is in its software, far more than in the fabrication. That’s why AMD went “fab-less” before Su became CEO.

Software can be licensed. It can be integrated into a competitor’s hardware. It’s part of the “coopitition,” cooperation built within competition, that has been part of technology for decades.

The Advanced Micro Devices Weekly Options Potential Profit Explained.....

** OPTION TRADE: Buy AMD APR 26 2024 190.000 CALLS - price at last close was $6.45 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the AMD Weekly Options (CALL) Trade on Tuesday, April 02, 2024 for $3.80.

Sold HALF the AMD weekly options contracts on Wednesday, April 03, 2024 for $5.35; a potential profit of 41%.

(This result will vary for members depending on their entry and exit strategies).

Holding the remaining contracts for further profit!

Don’t miss out on further trades – become a member today!

About Advanced Micro Devices .....

Advanced Micro Devices, Inc., also known as AMD, is a semiconductor company operating in the global market. The company was incorporated in 1969 and is one of the oldest semiconductor manufacturers on the market today. Headquartered in Santa Clara, California, Advanced Micro Devices is fundamental to most verticals within the global economy.

Advanced Micro Devices operates in two segments; Computing And Graphics and Enterprise, Embedded, and Semi-Custom. Advanced Micro Devices products span a range of semiconductor applications including microprocessors, chipsets, GPUs, data centers, system-on-a-chip, development services, and technology for gaming consoles which gives it some of the broadest exposure of any semiconductor company today.

Advanced Micro Devices markets its high-performance products under a host of brands that include AMD Ryzen, AMD Ryzen PRO, Ryzen Threadripper, Ryzen Threadripper PRO, AMD Athlon, AMD Athlon PRO, AMD FX, AMD A-Series, AMD PRO A-Series, AMD Radeon graphics, and AMD Embedded Radeon graphics brands and there are pro-models available in all categories.

The company serves OEMs across all verticals, cloud service providers, independent distributors, online retailers, and add-in-board manufacturers through a network of direct sales, independent distributors, and sales representatives that have offices in all major markets.

Advanced Micro Devices is run by a team of industry-leading innovators who believe in the concepts of high-performance and adaptive computing. Adaptive Computing is a technology that can learn and alter its functioning and adapt to meet the needs of its users. The push toward adaptive computing is being led by Dr. Lisa Su who joined the team in 2012 as a Senior Vice President and is now Chairman of the Board and CEO. Before joining Advance Micro Devices Dr. Su spent 18 years working in various positions at two other very high-profile semiconductor companies that are still in operation today.

The factor that makes AMD stand out from the crowd is its twin focus on high-performance computing and high-performance graphics. This focus gives AMD an edge over the competition because it is the best at combining the two aspects into custom solutions that are driving innovations and advancements in other industries and fields of research. The latest innovation, and one hailed as the biggest advance in CPU cache technology in over a decade, is the creation of the AMD EPYC processors which include AMDs 3-D V-Cache technology. The V-Cache technology alters the way data is stored in the cache and is resulting in up to 66% improvement in performance.

If quality, performance, leadership, and innovation aren’t enough to sway an investor Advanced Micro Devices is also a leader in the push toward sustainable and green operations. The company is on track to meet the four pillars of its plan which are 1) a 50% reduction in greenhouse gas emissions by 2030 2) reach a 30X increase in efficiency for many of its processors 3) 100% of suppliers must have public GHG goals and 4) 80% of suppliers sourcing renewable energy by 2025.

Further Catalysts for the AMD Weekly Options Trade…..

AMD's consistency in execution gives Arya confidence that it can maintain a 5% to 10% share in the AI accelerator market that Nvidia dominates.

"This is lower than the 20% share opportunity some bulls would argue for, but we argue AMD is being flanked on 3 sides - from leader NVDA with its incumbency/scale and well-priced Blackwell products, from custom chips with their lower-price/higher optimization, and from multiple start-ups going after market niches," Arya said.

Still, while AMD is playing catch up in the AI market, "we expect it to leverage its chiplet architecture to move faster to the 3nm node for CY26 AI products," Arya said.

Bank of America reiterated its $195 price target, representing potential upside of 7%.

Other Catalysts.....

AMD makes some of the world's most popular chips for consumer electronics. They can be found in the Microsoft Xbox Series X and the Sony PlayStation 5, not to mention a long list of personal computers. But AMD recently launched its MI300 series of data center chips in a quest to chase down Nvidia.

The MI300 is available as a standard GPU called the MI300X, but it's also available in a combined GPU and CPU configuration called the MI300A. AMD is already shipping the MI300A to the Lawrence Livermore National Laboratory for its El Capitan supercomputer, which will be one of the most powerful in the world when it comes online this year. But a number of leading data center operators, including Microsoft, Oracle, and Meta Platforms, are also lining up to buy the MI300 series.

AMD can thus combine the capabilities of its Radeon GPUs with those of its Ryzen CPUs. It can integrate these capabilities quickly, with the chips of competitors. They can be produced on the same silicon, speeding them to market.

AMD already has nearly one-third of the PC market, and it’s not losing that share with the latest Zen5 Ryzen chip. As negotiations over chips for tomorrow’s AI PCs begin, Su is in a very strong position.

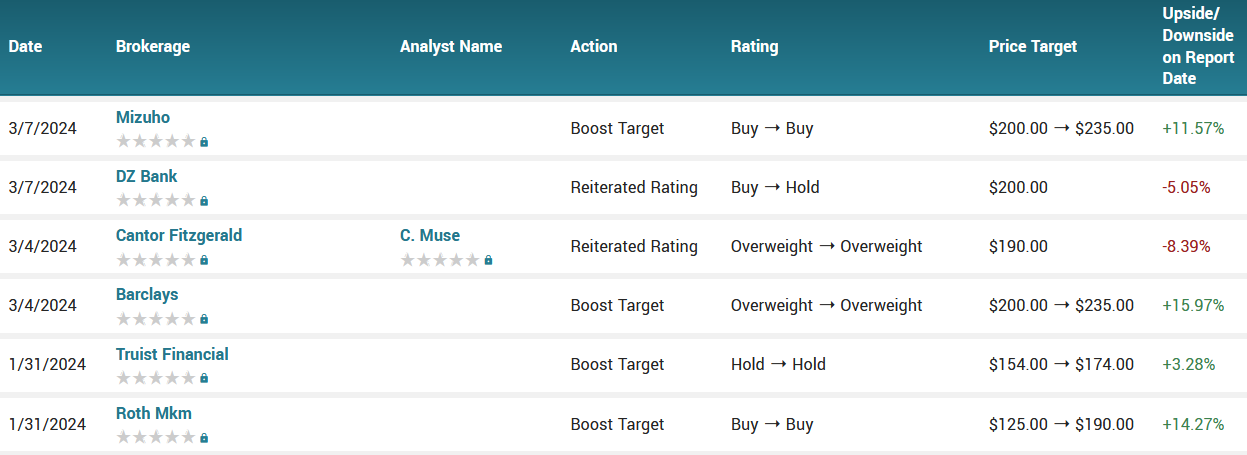

Analysts.....

According to the issued ratings of 28 analysts in the last year, the consensus rating for Advanced Micro Devices stock is Moderate Buy based on the current 3 hold ratings and 25 buy ratings for AMD. The average twelve-month price prediction for Advanced Micro Devices is $181.82 with a high price target of $270.00 and a low price target of $110.00.

Summary.....

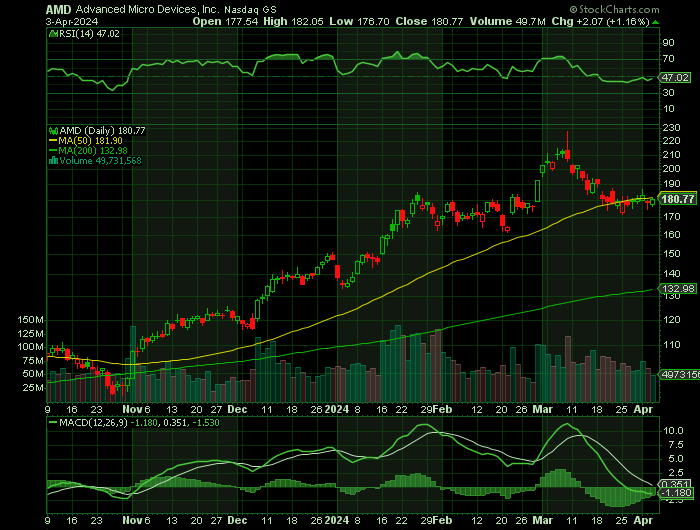

Shares of Advanced Micro Devices stock traded up $2.85 during mid-day trading on Monday, hitting $183.34. 74,250,312 shares of the stock were exchanged, compared to its average volume of 77,914,352. The company has a 50-day simple moving average of $181.50 and a 200 day simple moving average of $142.26. The company has a debt-to-equity ratio of 0.03, a quick ratio of 1.86 and a current ratio of 2.51. Advanced Micro Devices, Inc. has a 12 month low of $81.02 and a 12 month high of $227.30. The company has a market capitalization of $296.30 billion, a P/E ratio of 352.58, and a P/E/G ratio of 2.71 and a beta of 1.64.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from

Advanced Micro Devices

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!