TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

546% Profit Using An Advanced Micro Devices Weekly Option!

Artificial intelligence would not be possible if not for the high-performance semiconductors that power the cutting-edge technology. Advanced Micro Devices, Inc. (NASDAQ AMD) is gearing up to be the next major supplier of power AI tools, besides Nvidia-- and its profit opportunity is enormous.

AMD's stock has climbed 111% year to date alongside its growing prospects in AI. The tech company is gearing up to challenge AI's leading chip supplier Nvidia with a new line of graphics processing units (GPUs) -- the hardware necessary for training AI models.

AMD recently began selling a line of accelerators called the MI300. It expects to get revenue of $3.5 billion from that product this year, up from an earlier projection of $2 billion.

This set the scene for Weekly Options USA Members to profit by 546% using an AMD Weekly Options trade!

Join Us And Get The Trades – become a member today!

Sunday, March 17, 2024

by Ian Harvey

UPDATE

Artificial intelligence would not be possible if not for the high-performance semiconductors that power the cutting-edge technology. Advanced Micro Devices, Inc. (NASDAQ AMD) is gearing up to be the next major supplier of power AI tools, besides Nvidia-- and its profit opportunity is enormous.

CEO Lisa Su expects sales of AI accelerators -- specialized computing hardware that speeds up machine learning workloads -- to surge to a staggering $400 billion by 2027. AMD has a solid plan to win market share.

AMD's new MI300 accelerators are designed to power AI applications in data centers. They integrate central processing units (CPUs), graphics processing units (GPUs), and ultra-fast memory to boost performance and energy efficiency while running AI workloads.

Microsoft and Meta Platforms are already lining up to deploy to AMD's AI offerings in their cloud data centers.

Additionally, AMD intends to lead the shift to AI-powered personal computers (PCs). Its new Ryzen 8040 Series processors make it easier and faster to run AI models on laptops. Leading PC makers like Dell and HP are planning to feature AMD's chips in their new AI PCs in early 2024.

Why the Advanced Micro Devices Weekly Options Trade was Originally Executed!

Nvidia Corp. has surged in early trading after delivering another eye-popping sales forecast, adding fresh momentum to a stock rally that already made it the world’s most valuable chipmaker.

The shares jumped about 13% in premarket trading on Thursday following the announcement. They earlier closed at $674.72 in New York, leaving them up 36% for the year.

That turned Wednesday’s report into a highly anticipated event for both Wall Street and the tech world. And the numbers — along with the upbeat tone from Huang — renewed confidence that spending will stay strong.

Shares of Advanced Micro Devices, Inc. (NASDAQ AMD), another chipmaker expected to benefit from AI growth — also gained in late trading.

“The entire market is watching this report and expectations have been elevated,” Wolfe Research analyst Chris Caso said in a note. Guidance was strong enough to “demonstrate continued momentum, while also leaving room for continued upside through the second half.”

Revenue in the current period will be about $24 billion, the company said in a statement Wednesday. Analysts had predicted $21.9 billion on average. Results in the fourth quarter also sailed past Wall Street estimates.

The outlook extends a streak of Nvidia shattering expectations, thanks to insatiable demand for its artificial intelligence accelerators — highly prized chips that crunch data for AI models. The technology has helped power a proliferation of chatbots and other generative AI services, which can create text and graphics based on simple prompts.

“Accelerated computing and generative AI have hit the tipping point,” Chief Executive Officer Jensen Huang said in the statement. “Demand is surging worldwide across companies, industries and nations.”

Nvidia’s market capitalization increased by more than $400 billion this year — bringing its valuation to $1.7 trillion — as investors bet that the company will remain the prime beneficiary of an AI computing boom.

However, Nvidia faces risks, including mounting competition and a push by some customers to develop their own AI chips.

AMD's stock has climbed 111% year to date alongside its growing prospects in AI. The tech company is gearing up to challenge AI's leading chip supplier Nvidia with a new line of graphics processing units (GPUs) -- the hardware necessary for training AI models.

AMD recently began selling a line of accelerators called the MI300. It expects to get revenue of $3.5 billion from that product this year, up from an earlier projection of $2 billion.

The Advanced Micro Devices Weekly Options Potential Profit Explained.....

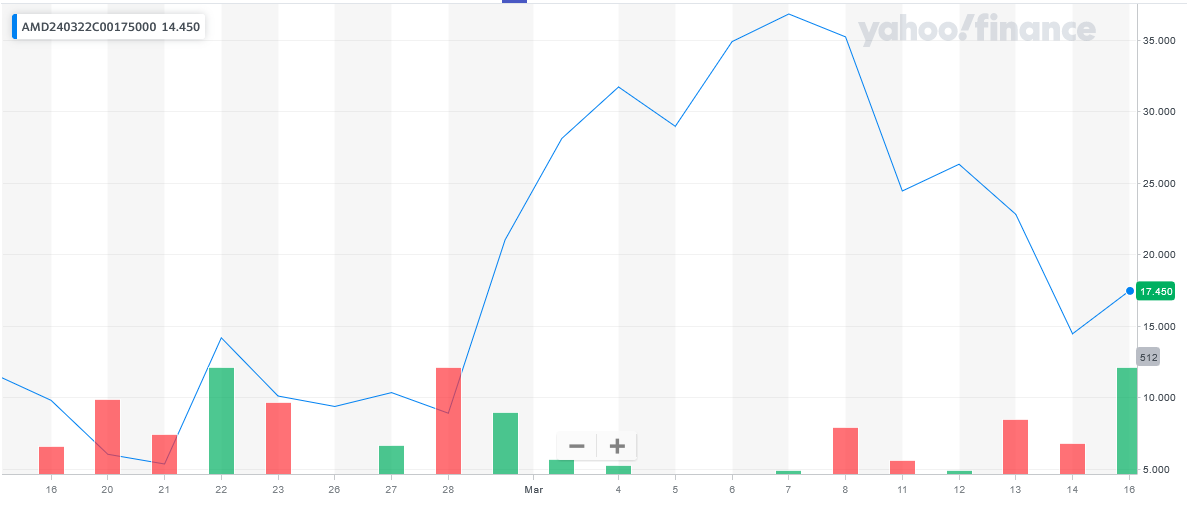

** OPTION TRADE: Buy AMD MAR 22 2024 175.000 CALLS - price at last close was $5.35 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the AMD Weekly Options (CALL) Trade on Thursday, February 22, 2024 for $8.00.

Sold the AMD weekly options contracts on Friday, March 08, 2024 for $51.70; a potential profit of546%.

(This result will vary for members depending on their entry and exit strategies).

Don’t miss out on further trades – become a member today!

About Advanced Micro Devices .....

Advanced Micro Devices, Inc., also known as AMD, is a semiconductor company operating in the global market. The company was incorporated in 1969 and is one of the oldest semiconductor manufacturers on the market today. Headquartered in Santa Clara, California, Advanced Micro Devices is fundamental to most verticals within the global economy.

Advanced Micro Devices operates in two segments; Computing And Graphics and Enterprise, Embedded, and Semi-Custom. Advanced Micro Devices products span a range of semiconductor applications including microprocessors, chipsets, GPUs, data centers, system-on-a-chip, development services, and technology for gaming consoles which gives it some of the broadest exposure of any semiconductor company today.

Advanced Micro Devices markets its high-performance products under a host of brands that include AMD Ryzen, AMD Ryzen PRO, Ryzen Threadripper, Ryzen Threadripper PRO, AMD Athlon, AMD Athlon PRO, AMD FX, AMD A-Series, AMD PRO A-Series, AMD Radeon graphics, and AMD Embedded Radeon graphics brands and there are pro-models available in all categories.

The company serves OEMs across all verticals, cloud service providers, independent distributors, online retailers, and add-in-board manufacturers through a network of direct sales, independent distributors, and sales representatives that have offices in all major markets.

Advanced Micro Devices is run by a team of industry-leading innovators who believe in the concepts of high-performance and adaptive computing. Adaptive Computing is a technology that can learn and alter its functioning and adapt to meet the needs of its users. The push toward adaptive computing is being led by Dr. Lisa Su who joined the team in 2012 as a Senior Vice President and is now Chairman of the Board and CEO. Before joining Advance Micro Devices Dr. Su spent 18 years working in various positions at two other very high-profile semiconductor companies that are still in operation today.

The factor that makes AMD stand out from the crowd is its twin focus on high-performance computing and high-performance graphics. This focus gives AMD an edge over the competition because it is the best at combining the two aspects into custom solutions that are driving innovations and advancements in other industries and fields of research. The latest innovation, and one hailed as the biggest advance in CPU cache technology in over a decade, is the creation of the AMD EPYC processors which include AMDs 3-D V-Cache technology. The V-Cache technology alters the way data is stored in the cache and is resulting in up to 66% improvement in performance.

If quality, performance, leadership, and innovation aren’t enough to sway an investor Advanced Micro Devices is also a leader in the push toward sustainable and green operations. The company is on track to meet the four pillars of its plan which are 1) a 50% reduction in greenhouse gas emissions by 2030 2) reach a 30X increase in efficiency for many of its processors 3) 100% of suppliers must have public GHG goals and 4) 80% of suppliers sourcing renewable energy by 2025.

Further Catalysts for the AMD Weekly Options Trade…..

Huang and Altman are not the only semiconductor executives who have commented on artificial intelligence. In fact, since it's now become a major global phenomenon, managements of other semiconductor stocks, such as Advanced Micro Devices, have weighed in.

AMD's Su, whose firm is the only direct competitor to NVIDIA's products in non-Arm based GPU designs, believes that the artificial intelligence data center computing products market was worth $45 billion in 2023. Her remarks, made in December also shared the Santa Clara, California based chip designer's estimates that by 2027 end, this market will have grown to $400 billion.

Other Catalysts.....

Advanced Micro Devices is an unavoidable artificial intelligence stock since it is capable of designing AI processors, accelerators, and GPUs. This was also clear during its CEO’s AI talk in December 2023, where Dr. Su outlined a multi-billion dollar market for her firm’s products.

As of December 2023 end, 120 out of 933 hedge funds had invested in the firm. Advanced Micro Devices’s largest investor among these is Ken Fisher’s Fisher Asset Management due to its $4.1 billion stake.

Growth.....

Shares of AMD have outperformed over the past six months. The company is benefiting from portfolio strength and an expanding partner base. Strong demand for EPYC processors has been a growth driver.

The launch

of the Ryzen 8040 series processor with Ryzen AI and Instinct MI300 Series data

center AI accelerators bodes well for top-line growth. AMD continues to benefit

from acquisitions, including Xilinx and Pensando, which has diversified its

business. For fourth-quarter 2023, AMD expects to witness year-over-year growth

in the Data Center and Client segments by double-digit percentage.

Sequentially, the Data Center segment’s revenues are expected to grow on a

double-digit percentage, while Client is expected to increase. However,

weakness in the Gaming and Embedded segment revenues are expected to hurt

top-line growth.

AI…..

AMD isn't banking solely on stealing market share from Nvidia in GPUs. AMD is seeking to lead its own space within AI by doubling down on AI-powered PCs. According to research firm IDC, PC shipments are projected to see a major boost this year, with AI integration serving as a key catalyst. And a Canalys report predicts that 60% of all PCs shipped in 2027 will be AI-enabled.

AMD supplies chips to PC and notebook manufacturers across tech, with a 23% market share in laptop central processing units (CPUs). Consequently, AMD could significantly profit from increased demand for AI-equipped PCs, carving out its own niche in the burgeoning AI market.

Moving Forward.....

AMD wasn't as well equipped as Nvidia in 2023 to immediately begin supplying its chips to the swarm of AI developers requiring high computing power. However, the chip designer unveiled a new AI GPU last December that could see it attain a lucrative role in the industry.

The company's MI300X AI GPU is expected to be highly competitive with similar offerings from Nvidia and has already caught the attention of some of AI's biggest players. In November 2023, Microsoft announced Azure would become the first cloud platform to implement AMD's new GPU to optimize its AI capabilities. Microsoft has a close partnership with ChatGPT developer OpenAI, making the company a powerful ally for AMD.

AMD released its fourth-quarter 2023 earnings on Jan. 30. The company's revenue rose 10% year over year to $6 billion in the quarter, beating analysts' forecasts by $60 million. Solid growth came from its AI-focused data center segment, which posted revenue growth of 38%.

AMD could be on the brink of a stellar growth year as it begins shipping the MI300X and sees returns on its considerable investment in AI.

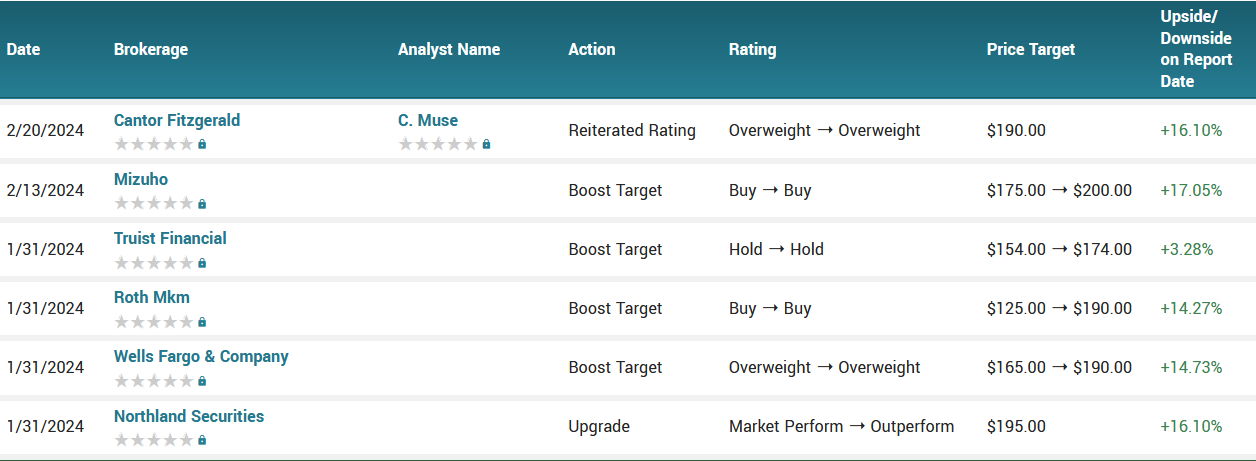

Analysts.....

Wall Street analysts are now becoming increasingly optimistic on AMD shares.

The investment bank Jefferies raised their target price for AMD to $200/share from $130/share. JPMorgan, Goldman Sachs, Baird, and a host of other investment banks also made significant increases to their target prices in late January 2024. Overall, Wall Street is rating AMD’s shares as a “Strong Buy,” and the average 12-month target price of $191/share implies a 10% potential return at the chipmaker’s current price.

Of course, AMD is likely to trade beyond its average price target, especially as the company benefits both from the end of the chip slump and entrance into the novel AI chip market.

According to the issued ratings of 27 analysts in the last year, the consensus rating for Advanced Micro Devices stock is Moderate Buy based on the current 2 hold ratings and 25 buy ratings for AMD. The average twelve-month price prediction for Advanced Micro Devices is $179.06 with a high price target of $270.00 and a low price target of $110.00.

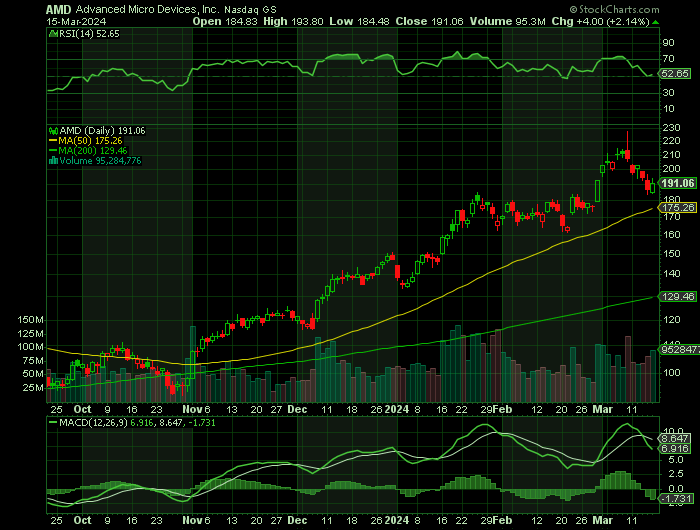

Summary.....

Advanced Micro Devices traded down $1.40 during trading hours on Wednesday, reaching $164.29. 48,396,446 shares of the company were exchanged, compared to its average volume of 80,770,492. The company has a current ratio of 2.51, a quick ratio of 1.86 and a debt-to-equity ratio of 0.03. The stock’s 50-day moving average is $158.06 and its 200-day moving average is $126.66. The firm has a market cap of $262.86 billion, a PE ratio of 315.95, a price-to-earnings-growth ratio of 2.61 and a beta of 1.63. Advanced Micro Devices has a twelve month low of $75.92 and a twelve month high of $184.92.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from

Advanced Micro Devices

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!