TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

606% Profit Using A SoundHound AI Weekly Option!

Shares of SoundHound charged sharply higher this week, soaring as much as 74.9%, according to data supplied by S&P Global Market Intelligence. As of 1:02 p.m. ET on Thursday, the stock was still up 34%.

SoundHound AI Inc (NASDAQ: SOUN) stock may have underperformed the broader market over the past year, but it has simply taken off after chip giant Nvidia revealed in a 13F filing that it has invested $3.7 million in the company.

This set the scene for Weekly Options USA Members to profit by 606% using a SOUN Options trade!

Join Us And Get The Trades – become a member today!

Friday, March 15, 2024

by Ian Harvey

UPDATE

Shares of SoundHound AI (NASDAQ: SOUN) charged sharply higher this week, soaring as much as 74.9%, according to data supplied by S&P Global Market Intelligence. As of 1:02 p.m. ET on Thursday, the stock was still up 34%.

The catalyst sending the artificial intelligence (AI) specialist soaring was robust results from another company in the AI space, Oracle (NYSE: ORCL).

There has been a great deal of insight into the broader adoption of AI. Some market commentators have wondered if the ongoing demand for AI would continue. This seems to answer that question with a resounding yes.

Since last month, when it came to light that Nvidia owned a stake in SoundHound AI, the stock has more than doubled. It now trades for 24 times forward sales, despite a lack of profits.

Why the SoundHound AI Weekly Options Trade was Originally Executed!

SoundHound AI Inc (NASDAQ: SOUN) stock may have underperformed the broader market over the past year, but it has simply taken off after chip giant Nvidia revealed in a 13F filing that it has invested $3.7 million in the company. As a result, share prices of SoundHound AI -- which provides an AI-enabled voice platform to customers and helps them build and deploy conversational voice assistants -- surged a whopping 66% in a single day.

“While a relatively minor investment, given roughly 246.9M SOUN shares outstanding, we believe the investment validates much of the work accomplished by SoundHound to-date and provides added credibility to the company’s growth strategy by a leader in the AI space,” H.C.Wainwright analyst Scott Buck opined. “As seen in Thursday trading, we expect NVIDIA’s involvement in SOUN shares to drive new investor interest in the company and potentially re-rate valuation levels.”

This eye-popping surge brought SoundHound's year-to-date gains to 80%. As a result, the stock now trades at 21 times sales. The good part is that SoundHound could justify its expensive valuation thanks to its robust growth. SoundHound hasn't released its full-year 2023 results yet.

However, its fourth-quarter revenue guidance of $16 million to $20 million indicates that it would have ended the year with revenue of almost $47 million at the midpoint (based on its revenue of $28.7 million for the first nine months of the year). That would be a 51% jump from its 2022 revenue of $31 million when the company's top line increased 47%.

Even better, analysts expect SoundHound to maintain a 40%-plus revenue growth rate in 2024 and 2025 as well.

The SoundHound AI Weekly Options Potential Profit Explained.....

** OPTION TRADE: Buy SOUN MAR 28 2024 4.000 CALLS - price at last close was $0.70 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the SOUN Weekly Options (CALL) Trade on February 22, 2024 for $0.85.

Sold half the SOUN weekly options contracts on Wednesday, February 28, 2024 for $4.10; a potential profit of 383%.

Sold the remaining SOUN weekly options contracts on Thursday, March 14, 2024 for $6.00; a potential profit of 606%.

(This result will vary for members depending on their entry and exit strategies).

Holding the remaining contracts for further profit!

Don’t miss out on further trades – become a member today!

About SoundHound AI.....

SoundHound AI Inc. is a cutting-edge technology company developing artificial intelligence (AI) solutions for voice-enabled devices and mobile applications. The company is headquartered in Santa Clara, California, with additional San Francisco and Tokyo offices. Founded in 2005 SoundHound AI has been at the forefront of voice recognition technology, with its flagship product being the SoundHound music and voice recognition app. The app has over 315 million downloads worldwide, and the company has also partnered with several prominent automobile manufacturers to integrate its technology into cars.

The leadership team at SoundHound AI comprises experienced executives with technology and business backgrounds. The CEO and co-founder, Keyvan Mohajer, has over 25 years of experience in technology and has led the company since its inception. In 2022, the company announced the appointment of a new Chief Financial Officer, Nitesh Sharan, who has 20+ years of experience in finance. Before joining SoundHound AI, he was the CFO at Nike and also served as the assistant treasurer at Hewlett Packard.

SoundHound AI has been experiencing revenue growth over the past few years while maintaining a healthy profit margin. The company has also held a healthy profit margin of around 10%. However, the company has struggled with debt in the past and in Q3 of 2022, the company made changes to bring that debt under control by slashing 10% of its workers. In 2021, the company raised $100 million in a funding round led by Tencent Holdings. In Q1 of 2023, the company issued new Series A Preferred Stock and Class A common stock to the shareholders' disappointment. Over the past year, SoundHound AI's stock price has been volatile, with several significant price movements. Trading volume has been relatively stable over the past year, with an average daily volume of around 1.5 million shares. SoundHound AI's valuation metrics are favorable when compared to industry peers.

SoundHound AI operates in the highly competitive AI technology industry, which is expected to grow rapidly over the next decade. The company faces competition from established players such as Google, Microsoft and Amazon and emerging startups. The industry is also subject to significant regulatory and political pressures as governments worldwide seek to regulate the use of AI technology.

SoundHound AI has several growth opportunities, including expanding its technology into new markets and developing new products. The company has already made inroads into the automobile industry, integrating its technology into several prominent car brands. In addition, the company has recently launched a new product, Houndify, which is a platform that allows developers to integrate voice recognition technology into their applications.

One of the primary risks facing SoundHound AI is the intense competition in the AI technology industry. The company must continue to innovate and differentiate itself from its competitors to remain successful. In addition, the industry is subject to significant regulatory and political pressures, which could impact the company's growth prospects. Finally, the company's success depends on adopting voice recognition technology, which could be affected by changes in consumer preferences or advances in alternative technologies.

Another challenge facing SoundHound AI is the potential for intellectual property disputes. The company's technology relies heavily on proprietary algorithms and software, which could be subject to infringement claims by competitors. The company may also face challenges in protecting its intellectual property rights in countries where intellectual property laws need to be stronger or better enforced.

Finally, SoundHound AI's growth is dependent on the ability to attract and retain talented employees. The company operates in a highly competitive industry and faces stiff competition for top talent from other technology companies. In addition, the company must compete with other startups for access to funding, which could impact its ability to invest in research and development and other growth initiatives.

Further Catalysts for the SOUN Weekly Options Trade…..

Consensus analyst estimates have significantly increased revenue growth expectations for SoundHound. That's not surprising, as the company's cumulative bookings backlog stood at $341.7 million at the end of the third quarter of 2023. SoundHound points out that "bookings are derived from committed customer contracts and reflect revenue expected to be realized over the life of such contracts."

So, the company has a solid revenue pipeline that should allow it to maintain healthy growth rates not only in 2024 and 2025, but also over the long run. What's more, SoundHound management points out that it sees a huge total addressable market (TAM) worth $160 billion in 2026, driven by the growing demand for AI-powered voice platforms across multiple markets such as automotive, restaurants, retail, healthcare, and entertainment, among others.

Not surprisingly, SoundHound AI's forward sales multiples are substantially lower than its trailing price-to-sales ratio.

Other Catalysts.....

The company is due to report Q4 earnings on February 29, and that could offer another catalyst. Additional proof that the company is progressing towards reaching breakeven levels, along with an update on the recently finalized acquisition of SYNQ3 Restaurant Solutions, and the potential of a revenue guide for 2024, could further boost investor confidence and support the recent gains.

Considering the “meaningful growth opportunity” and anticipating an improving margin profile over time, H.C.Wainwright analyst Scott Buck thinks that even after the big gains, the shares’ valuation “remains attractive.”

“We recommend investors accumulate a position in SOUN shares ahead of more positive operating results and favorable news flow driven by secular growth within the AI sector,” the analyst further said.

All in all, Buck maintained a Buy rating on the shares, backed by a $5 price target, implying the shares will post further growth of 25% in the year ahead. (To watch Buck’s track record, click here)

Only 2 other analysts have recently chimed in with SOUN reviews, but like Buck, they are also positive, making the consensus view here a Strong Buy. Going by the $4.67 average price target, a year from now, the shares will be changing hands for a 17% premium.

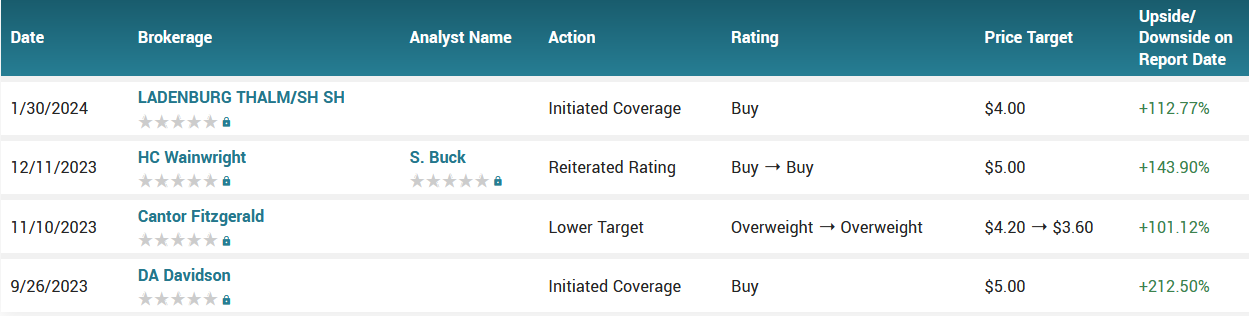

Analysts.....

According to the issued ratings of 4 analysts in the last year, the consensus rating for SoundHound AI stock is Buy based on the current 4 buy ratings for SOUN. The average twelve-month price prediction for SoundHound AI is $4.40 with a high price target of $5.00 and a low price target of $3.60.

Summary.....

SoundHound AI stock opened at $3.77 on Thursday. The company has a current ratio of 5.11, a quick ratio of 5.11 and a debt-to-equity ratio of 7.22. SoundHound AI has a 12-month low of $1.49 and a 12-month high of $5.11. The stock has a market cap of $930.89 million, a price-to-earnings ratio of -8.02 and a beta of 1.09. The business’s 50-day moving average is $2.16 and its 200 day moving average is $2.09.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from SOUNDHOUND

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!