TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

71% Profit In Less Than 2 Hours,

Using A Microsoft Weekly Option!

Shares of Microsoft Corporation (NASDAQ:MSFT) rallied Thursday morning, climbing as much as 3.1%, despite a downturn in the broader market. As of 1:59 p.m. ET, the stock was still up 2.4%.

Microsoft Corporation (NASDAQ:MSFT) continues to innovate, taking another step in its race to add generative AI capabilities to its array of enterprise products on Wednesday, announcing the availability of its Microsoft Copilot for Security platform.

This set the scene for Weekly Options USA Members to profit by 71% using a MSFT Options trade!

Join Us And Get The Trades – become a member today!

Thursday, March 14, 2024

by Ian Harvey

UPDATE

Shares of Microsoft rallied Thursday morning, climbing as much as 3.1%, despite a downturn in the broader market. As of 1:59 p.m. ET, the stock was still up 2.4%.

The catalyst that sent the tech giant higher was commentary issued by a Wall Street analyst suggesting the latest version of Copilot will boost Microsoft's cloud growth.

Microsoft just announced that its Copilot for Security will be generally available beginning April 1. This latest addition to the company's lineup of generative AI assistants "will help security and IT professionals catch what others miss, move faster, and strengthen team expertise." The system has been trained on threat intelligence to help guard against unauthorized intrusions.

Analysts at Wells Fargo believe this latest offering will result in incremental growth for Azure, Microsoft's cloud infrastructure service, during its fiscal fourth quarter (which ends Jun. 30) and into fiscal 2025. The analysts cite the service's consumption-based pricing, which they believe will drive greater adoption. The analysts maintained their overweight (buy) rating and price target of $460, which represents roughly 11% upside potential compared to Wednesday's closing price.

Why the Microsoft Weekly Options Trade was Originally Executed!

Microsoft Corporation (NASDAQ:MSFT) continues to innovate, taking another step in its race to add generative AI capabilities to its array of enterprise products on Wednesday, announcing the availability of its Microsoft Copilot for Security platform.

The service, which hits the market April 1, is meant to help cybersecurity professionals better understand security threats and cut down on the time it takes to discover security issues. The platform has been in public preview since November 2023.

“Copilot is informed by large-scale data and threat intelligence, including more than 78 trillion security signals processed by Microsoft each day, and coupled with large language models to deliver tailored insights and guide next steps,” Vasu Jakkal, Microsoft corporate vice president of security, said in a statement.

Copilot for Security is powered by OpenAI’s GPT-4, as well as Microsoft’s own AI models, and integrates into Microsoft Sentinel and Microsoft Defender XDR.

Microsoft’s Sentinel is a platform that allows cybersecurity professionals to detect and hunt for threats, while Microsoft Defender helps them protect against, and address, attacks. Microsoft Security Copilot provides a means for cybersecurity workers to ask questions about threats and attacks and get responses based on whether and where potential attacks can or have hit an enterprise’s systems.

Both Wedbush and Barclays currently have an Outperform rating on MSFT with a price target of $475, indicating a potential upside of nearly 15%. Truist Securities also has an Outperform rating on the Magnificent Seven stock with a price target of $600, reflecting a potential upside of nearly 50%.

The Microsoft Weekly Options Potential Profit Explained.....

** OPTION TRADE: Buy MSFT APR 05 2024 420.000 CALLS - price at last close was $6.96 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the MSFT Weekly Options (CALL) Trade on Thursday, March 14, 2024, at 9:33, for $8.35.

Sold half the MSFT weekly options contracts on Thursday, March 14, 2024, at 11:19, for $14.25; a potential profit of71%.

(This result will vary for members depending on their entry and exit strategies).

Holding the remaining contracts for further profit!

Don’t miss out on further trades – become a member today!

About Microsoft.....

Microsoft Corporation was founded in 1975 in Albuquerque, New Mexico by Bill Gates and Paul Allen. The two quit their respective Harvard schooling and programming jobs to start a software company focused on the then-popular Altair 8800. Originally named Micro-Soft, Microsoft is a portmanteau of the words microprocessor and software. The company quickly took off and was relocated to Washington State where it is headquartered today.

Microsoft launched a game called Flight Simulator in 1982 that has since become the longest-running video game franchise. The company’s first major breakthrough came in the early 80s when it licensed MS-DOS to IBM for their personal computer and then another came in 1985 the company altered the way computers were used when it launched Windows. Windows used a graphical interface to display information that included drop-down menus, scroll bars, and other features commonly found in operating systems today.

Microsoft went public in 1986 making founder Bill Gates the world’s youngest billionaire. Other innovations that helped make the company’s name include Windows 95 which included many upgrades to the original and, when the Internet took off, Internet Explorer. Bill Gates gave up his role as CEO in 2000 and the company is now run by Satya Nadella. Mr. Nadella took over the role of CEO in 2014 and then the role of chairman in 2021.

Today the company develops, licenses, and supports software, services, devices, and solutions worldwide. The company operates in three segments that include Productivity and Business Processes, Intelligent Cloud, and More Personal Computing. As of 2022, Microsoft’s Azure powered more than 20% of the Cloud putting it in second place globally.

The Productivity and Business Processes segment offers several software solutions including Office, Exchange, SharePoint, Microsoft Teams, Office 365 Security and Compliance, Microsoft Viva, and Skype for Business. Microsoft also operates Skype, Outlook.com, OneDrive, and LinkedIn for business professionals as well as Dynamics 365. Dynamics 365 is a set of cloud-based and on-premises business solutions for organizations and enterprises of all sizes.

Further Catalysts for the MSFT Weekly Options Trade…..

Microsoft is one of the most promising tech giants, as the company's strategic investments in the field of generative artificial intelligence (AI) and gaming are paying off. The company has a sizable stake in the viral generative AI platform ChatGPT creator OpenAI, which generated $1.6 billion in annual revenues in 2023, less than a year since its launch. OpenAI is poised to generate $2 billion in annualized revenues.

Shares of MSFT have surged by over 10% so far this year, outperforming the tech-focused Nasdaq Composite Index's 7.9% gains over this period. Stanley Druckenmiller is one of the most successful investors of all time, with a net worth of nearly $6.2 billion. And, Druckenmiller holds approximately 1.1 million of MSFT stock (as of December 31), accounting for roughly 13.1% of his total portfolio.

The company also invested 15 million euros in French startup Mistral AI, which is widely regarded as a major competitor to OpenAI. While the investment is currently under scrutiny from the European Union because of potential antitrust practices, the stake in Mistral AI could pivot Microsoft to become the biggest player in the generative AI space.

Other Catalysts.....

Microsoft has two major growth engines in enterprise software and cloud computing, and the company controls a large chunk of both markets. Specifically, Microsoft accounts for about 16% of software-as-a-service (SaaS) revenue, twice as much as its closest competitor, due to strength in office productivity (Microsoft 365) and enterprise resource planning (Dynamics 365) software.

Additionally, Microsoft Azure accounts for roughly 24% of cloud infrastructure and platform services revenue, which puts it seven points behind market leader Amazon Web Services, but 13 points ahead of Alphabet's Google Cloud. That success is a product of expertise in hybrid computing solutions, developer capabilities, and artificial intelligence (AI) services.

Microsoft reported better-than-expected financial results in the second quarter of fiscal 2024 (ended Dec. 31). Revenue increased 18% year over year to $62 billion on strong momentum in cloud computing and modest growth in enterprise software. Meanwhile, non-GAAP (generally accepted accounting principles) net income soared 26% year over year to $2.93 per diluted share due to disciplined expense management.

Microsoft is leaning into generative AI across its software and cloud businesses. The company launched a natural language assistant for Microsoft 365 that can draft text in Word and create content in PowerPoint. It also launched a generative AI assistant for Dynamics 365 that can automate sales, customer service, and finance workflows.

Similarly, Microsoft has formed an exclusive partnership with OpenAI. Per that agreement, Azure is the exclusive cloud provider to OpenAI, meaning its infrastructure powers applications like ChatGPT. Additionally, Azure customers can integrate their own data into large language models like GPT-4 to build custom generative AI applications. JPMorgan analysts have said, "Microsoft's investment into OpenAI, which started years ago, could potentially prove to be some of the best money ever spent."

Analysts.....

Microsoft last month started price hikes for its cloud and on-premise products in global markets, with a couple more in the months ahead, which could lead to incremental revenue gains for the software giant, Wells Fargo said.

"We see a modest 1 to 2 percentage point tailwind to as-reported Microsoft Cloud revenue growth in FY25/FY26 (assuming these regions make up 10-15% of revenue), particularly given outsized impact to Japan, MSFT's third-largest geo," said Wells Fargo equity analyst Michael Turrin in a note.

The costs of Microsoft Cloud services increased by 6% to 12% in India, Korea, Norway, Sweden and Taiwan on Feb. 1. On April 1, Japan will see an increase of 20% on both cloud and on-premise products, while Chinese customers will experience a 7% jump on cloud starting May 1.

"This ensures that customers across different geographies and currencies will encounter consistent pricing, reflecting the exchange rate of the local currency to the U.S. dollar," Microsoft said in a December statement.

Also, Microsoft's Azure continues to gain market share. It grew the fastest among hyperscalers to 34% of market share during its fiscal second-quarter, compared to 30% three years prior.

"Though not updating its Azure outlook for 4Q, we expect 4Q results remain stable or accelerate from 3Q levels, given greater-than-expected AI contributions and easing compares heading into FQ4," Turrin added.

Wells Fargo maintains its Overweight rating and a $460 price target on Microsoft.

According to the issued ratings of 39 analysts in the last year, the consensus rating for Microsoft stock is Moderate Buy based on the current 3 hold ratings and 36 buy ratings for MSFT. The average twelve-month price prediction for Microsoft is $415.00 with a high price target of $500.00 and a low price target of $232.00.

Summary.....

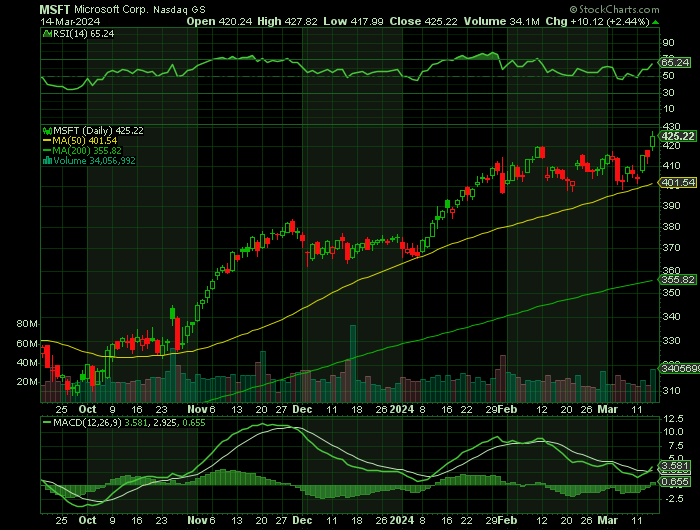

Microsoft shares opened at $415.10 on Thursday. Microsoft Co. has a 12 month low of $255.86 and a 12 month high of $420.82. The company has a market cap of $3.08 trillion, a price-to-earnings ratio of 37.53, and a P/E/G ratio of 2.15 and a beta of 0.89. The company has a quick ratio of 1.20, a current ratio of 1.22 and a debt-to-equity ratio of 0.19. The business has a fifty day simple moving average of $401.90 and a 200-day simple moving average of $367.46.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from MICROSOFT

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!