TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

77% Profit Using An intel corporation Weekly Option!

The Wall Street Journal reported last Wednesday that the U.S. Commerce Department awarded Intel Corporation (NASDAQ:INTC) $8.5 billion in subsidies to help defray the cost of expanding semiconductor production in Arizona, New Mexico, Ohio, and Oregon.

Before the market opened yesterday, UBS' Timothy Arcuri helped stoke AMD’s stock price. He added $4 per share to his Intel price target for a new level of $50.

This set the scene for Weekly Options USA Members to profit by 77% using a INTC Options trade!

Join Us And Get The Trades – become a member today!

Tuesday, April 02, 2024

by Ian Harvey

UPDATE

Many tech stocks sank in the light gloom that was the equity market on Monday. One exception was that chipmaking mainstay, Intel Corporation (NASDAQ:INTC).

Before the market opened yesterday, UBS' Timothy Arcuri made the change. He added $4 per share to his Intel price target for a new level of $50.

Arcuri's adjustment is due to a change in financial reporting Intel recently announced that affects its Intel Foundry manufacturing business. This will better reflect what the company believes is the "foundry-like relationship" between the unit and Intel Products -- the goods it sells.

The analyst wrote that by running the numbers according to this new regime, "we are taking a slightly more positive view of Intel Foundry's revenue and margin potential."

Also, other analysts are expecting decent growth in the near future. On average they are anticipating a 14% annual rise in revenue this year, accompanied by a sturdy 28% increase in per-share net income. Those figures should land at 12% and a meaty 67% in 2025.

As well, Intel has secured an impressive $20 billion in financial backing from Washington. This includes $8.50 billion worth of direct funding from the U.S. Department of Commerce and the eligibility for federal loans up to $11 billion. These funds will fuel the company's pioneering IDM 2.0 project by enabling it to construct and expand chip manufacturing facilities in the U.S., develop next-generation manufacturing processes and create tens of thousands of direct jobs with the addition of an even greater number of indirect jobs.

Why the Intel Corporation Weekly Options Trade was Originally Executed!

The Wall Street Journal reported Wednesday that the U.S. Commerce Department awarded Intel Corporation (NASDAQ:INTC) $8.5 billion in subsidies to help defray the cost of expanding semiconductor production in Arizona, New Mexico, Ohio, and Oregon.

This means fully 16% of the $53 billion in government money authorized by the 2022 "Chips Act" will go to Intel alone. Global Equities Research analyst Trip Chowdhry is looking at the news positively and, on Thursday, he raised his price target on Intel stock to $100.

Considering Intel stock costs roughly $42 today, that's a huge vote of confidence. Chowdhry's price target implies this $182 billion company will more than double in value over the next 12 months or so.

Besides the $8.5 billion in free government money Chowdhry says Intel is the only company today that can build the kind of power-efficient "next generation" 18A and 14A artificial intelligence processors needed to keep the AI revolution going. ("18A" refers to both the size of the processor -- 1.8 nanometers -- and also its 3D stacked layout).

The Intel Corporation Weekly Options Potential Profit Explained.....

** OPTION TRADE: Buy INTC APR 26 2024 43.000 CALLS - price at last close was $2.25 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the INTC Weekly Options (CALL) Trade on Friday, March 22, 2024 for $2.09.

Sold HALF the MU weekly options contracts on Monday, April 01, 2024 for $3.70; a potential profit of 78%.

(This result will vary for members depending on their entry and exit strategies).

Holding the remaining contracts for further profit!

Don’t miss out on further trades – become a member today!

About Intel.....

Intel Corporation is among the world’s leading manufacturers of microchips and microchip-enabled products and services. The company engages in the design, manufacture, and sale of computer products and technologies to original equipment manufacturers, original design manufacturers, and cloud service providers. The company was incorporated in 1968 and is headquartered in Santa Clara, California, and is widely regarded as having put the “silicon” in “Silicon Valley”.

Intel was originally a PC-centric semiconductor company but has branched out over its more than 50-year history. The company is now engaged in global digital transformation and is working to provide end-to-end solutions from the largest digital clouds to the smallest IoT and Edge devices. Specifically, Intel is working to advance AI, 5G connectivity, and the digitization of everything.

The now data-centric company operates through 7 segments and is one of the most diversified publicly-traded chipmakers on the market. The company’s 7 segments are CCG (client computing group), DCG (data center group), IOTG (internet of things group), Mobileye (autonomous driving), NSG (non-volatile memory group), PSG (programable solutions group), and All Other segments.

The company operates 6 wafer fabrication sites and 4 assembly test manufacturing sites to ensure the highest standards of quality. The company’s products evolve on the basis of Moore’s law becoming smaller, faster, and more powerful with each generation.

Intel offers platform products such as central processing units and chipsets, and system-on-chip and multichip packages meant to power computers ranging from tablets to supercomputers. Intel also offers non-platform or peripheral products that include accelerators, circuit boards and systems, connectivity products, graphics cards, and memory and storage products. The company’s specialty divisions also provide high-performance computing solutions for targeted verticals as well as embedded solutions for business, industry, and healthcare.

Intel is central to the growth of data centers and the Cloud. The company once boasted a near-100% market share of cloud-based microchip demand but that figure has slipped over the years due to mounting competition. Intel’s cloud solutions provide workload-optimized platforms and related products for cloud service providers, enterprise and government, and communications service providers.

Among the many technologies that Intel is working to advance are self-driving vehicles. Solutions for assisted and autonomous driving include computing platforms, computer vision, and machine learning-based sensing, mapping, and geolocation. Intel Corporation also has a strategic partnership with MILA to develop and apply advances in artificial intelligence methods for improving the search for new drug therapies and applications.

Intel Corporation is committed to corporate responsibility and environmentally sustainable practices. The company seeks to leverage its position to advance not only itself but the industry for the good of mankind.

Further Catalysts for the INTC Weekly Options Trade…..

Micron Technology (NASDAQ: MU) released the results of its fiscal 2024 second quarter (ended Feb. 29) on Wednesday, and investors were clearly impressed. The computer memory specialist generated revenue of $5.8 billion, an increase of 23% year over year, resulting in adjusted earnings per share (EPS) of $0.42, much improved from a loss of $1.91 in the prior-year quarter. Driving the results was surging demand for high-bandwidth memory, which helped boost Micron's profit margins.

The results blew past Wall Street's most bullish expectations, as analysts' consensus estimates were calling for revenue of $5.35 billion and adjusted EPS of $0.24.

When one company in the AI space reports strong financial results, other stocks in the space get a lift as investors expect a rising tide to lift all boats, which was apparent with Micron Technology.

Intel is likely still riding the wave of optimism from yesterday's announcement that it had been awarded $8.5 billion in direct funding under the CHIPS and Science Act to build leading-edge chip factories in the U.S.

These developments suggest that the accelerating adoption of AI continues to increase the fortunes of companies in the space.

Other Catalysts.....

Intel wants to lead the wave of in-house chip manufacturing in the U.S. with its dynamic IDM 2.0 strategy. It aims to become the second-largest external foundry within the next six years, boasting agreements with more than 40 partners in various domains. The move is imperative to cater to the supply/demand gap for AI chips and other cutting-edge technologies.

From a fundamentals perspective, the company is progressing in the right direction. Revenues jumped 15.4 billion, up a healthy 10% on a YOY basis. These results point to positive momentum for the company based on solid product offerings and healthy market demand.

Analysts.....

According to the issued ratings of 29 analysts in the last year, the consensus rating for Intel stock is Hold based on the current 4 sell ratings, 20 hold ratings and 5 buy ratings for INTC. The average twelve-month price prediction for Intel is $41.48 with a high price target of $62.00 and a low price target of $17.00.

Summary.....

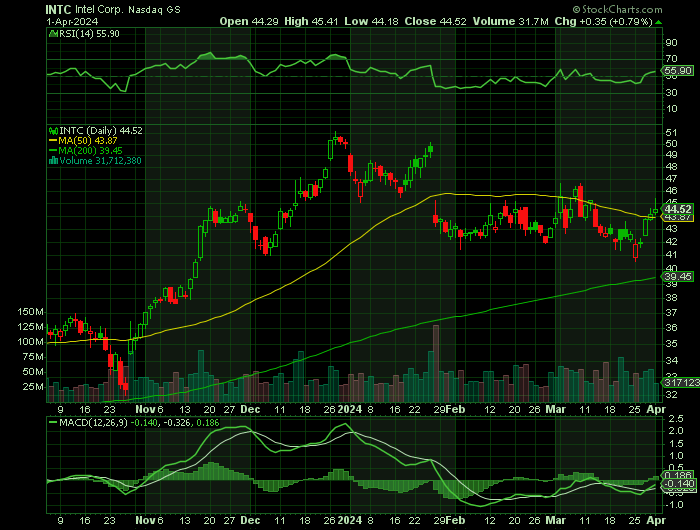

Intel has a market cap of $179.35 billion, a P/E ratio of 108.77, a P/E/G ratio of 4.38 and a beta of 1.00. Intel Co. has a 1-year low of $26.85 and a 1-year high of $51.28. The firm’s fifty day moving average price is $44.39 and its 200-day moving average price is $41.84. The company has a debt-to-equity ratio of 0.43, a quick ratio of 1.15 and a current ratio of 1.54.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from INTEL CORPORATION

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!