TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

78% Profit Using A Micron Technology Weekly Option!

Micron Technology, Inc. (NASDAQ: MU) shares moved firmly higher in early Monday trading as analysts continue to see added value from the makers of a crucial component to the rollout of AI technologies that could be worth billions over the coming years.

Bank of America Securities analyst Vivek Arya lifted his price target on Micron by $24 to $144 a share and affirmed a buy rating on MU.

This set the scene for Weekly Options USA Members to profit by 78% using a MU Options trade!

Join Us And Get The Trades – become a member today!

Monday, April 01, 2024

by Ian Harvey

UPDATE

Micron Technology, Inc. (NASDAQ: MU) shares moved firmly higher in early Monday trading as analysts continue to see added value from the makers of a crucial component to the rollout of AI technologies that could be worth billions over the coming years.

Micron is quickly transitioning into the AI sector with a new semiconductor designed to support generative-AI applications.

Micron, which unveiled a development deal with Nvidia to insert HBM (high-bandwidth-memory chips) into its new H200 semiconductors, said a growing surge in demand is likely to drive overall sales closer to levels for its legacy DRAM memory products over the next two years.

Micron CEO Sanjay Mehrotra sees "several hundred million dollars of revenue" from HBM sales over the current fiscal year.

Bank of America Securities analyst Vivek Arya is similarly bullish. He forecasts that HBM demand will take the overall market size to around $20 billion by 2027, with Micron's share growing to around 20% from 5% currently.

"The adoption of accelerated/AI servers represents a generational shift with Nvidia and Broadcom as the leaders," said Arya, who lifted his price target on Micron by $24 to $144 a share and affirmed a buy rating on MU.

Micron's products also stand out from the competition. For example, its high-memory HBM3E solution provides more than 20 times the memory bandwidth compared to standard server modules and it consumes 30% less power, an important quality in AI hardware, than competing products.

The company now expects record revenue in fiscal 2025 and a significant improvement in profitability. Based on that momentum and its leadership in memory chips, Micron could also grow by four times over the coming years from its current market cap of $130 billion, turning $250,000 into a million dollars.

Why the Micron Technology Weekly Options Trade was Originally Executed!

Micron Technology, Inc. (NASDAQ: MU) stock jumped 6.2% to 117.04, continuing its powerful move last week following a surprise profit and bullish guidance thanks to AI tailwinds. The memory-chip giant is now up 37.25% in 2024. That's No. 6 in the S&P 500 this year.

In February we executed a weekly call option on Micron Technology, expiring on March 22, providing a potential profit of 518%.

It appears that Micron has further to run so let us take advantage of this situation!

Micron is now up more than 23% since it reported fiscal second-quarter earnings last week that were much better than expected. It had been struggling with a secular downturn in the semiconductor sector, but last week's report made it clear that the company is turning the page on those challenges as it said that AI demand and tight supply accelerated its return to profitability.

Revenue jumped 58% to $5.82 billion, and it reported an adjusted profit of $476 million, or $0.42 per share, well above a loss of $2.08 billion in the quarter a year ago. CEO Sanjay Mehrotra said, "We believe Micron is one of the biggest beneficiaries in the semiconductor industry of the multi-year opportunity enabled by AI."

What seemed to drive Micron stock higher again yeterday was a bullish endorsement in Barron's over the weekend as the newsletter called it one of the best and least appreciated long-term opportunities in the AI boom.

The Micron Technology Weekly Options Potential Profit Explained.....

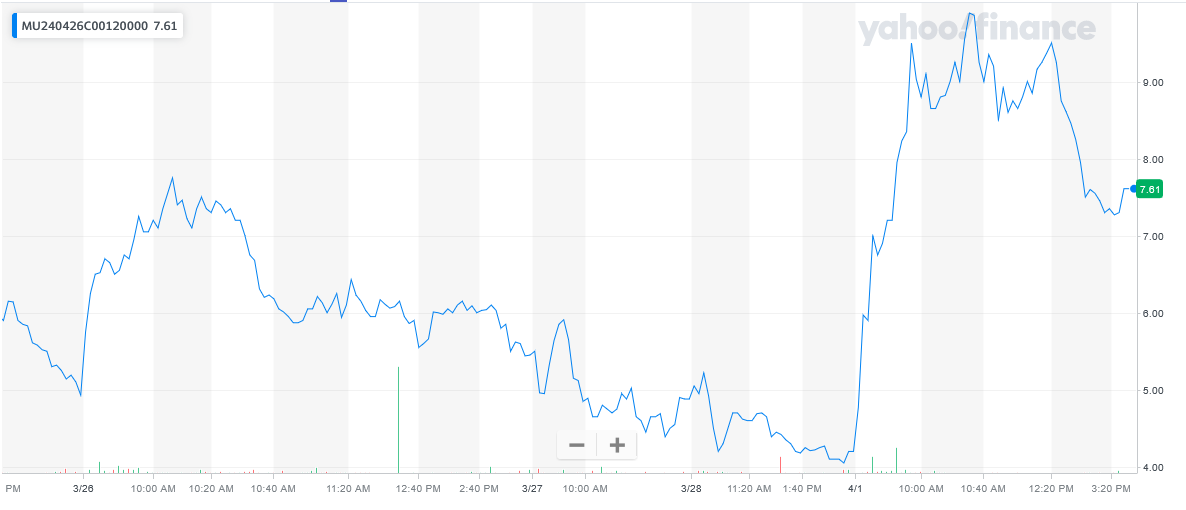

** OPTION TRADE: Buy MU APR 26 2024 120.000 CALLS - price at last close was $4.93 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the MU Weekly Options (CALL) Trade on Tuesday, March 26, 2024 for $5.55.

Sold HALF the MU weekly options contracts on Monday, April 01, 2024 for $9.89; a potential profit of 78%.

(This result will vary for members depending on their entry and exit strategies).

Holding the remaining contracts for further profit!

Don’t miss out on further trades – become a member today!

About Micron Technology.....

Micron Technology, Inc. was founded in 1978 by four friends in the basement of a dentist's office. The company was focused on making DRAM memory chips and began work on its first fabrication plant in 1981. Micron Technology came out with its first product a few years later and made history with the world's smallest DRAM microchip. By 1994 the company had earned a spot on the Fortune 500 and soon grew to be a leader in the microchip industry. Micron Technology went public in 1984 as well and is headquartered in Boise, Idaho.

Among Micron’s many achievements are the first 1-gigabyte DRAM product in 1987 and the shipping of the first 2-gigabyte NAND product in 2004. Among the latest innovations is the DDR5. The DDR5 is the next generation of DRAM chip for the server market and it can provide an 85% increase in the memory performance.

Today, Micron Technologies designs, manufactures, and sells memory and storage-focused microchip products worldwide. Its chips provide not only the power to store information but the foundation for new technologies like AI and 5G. Micron is the 4th largest semiconductor manufacturer in the world with revenue topping $27 billion in 2022. The company is ranked 127th on the Fortune 500 list and counts more than 50,000 patents and growing in the field of semiconductor manufacturing and storage solutions. The company operates in 17 countries with 11 manufacturing sites and employs more than 45,000 people.

The company operates through four segments that include Compute and Networking, Mobile, Storage, and Embedded. These solutions are marketed under the Micron and Crucial brands, as well as through private labels. In regard to the memory chip market, Micron Technologies is the only company offering all three types of memory storage products giving it the broadest portfolio and most experience and seamless interfaces.

The company manufactures memory and storage technologies including DRAM, NAND, and NOR microchips. The DRAM products are dynamic random access memory semiconductor devices with low latency that provide high-speed data retrieval. The NAND products are non-volatile and re-writeable semiconductor storage devices The NOR memory products are non-volatile re-writeable semiconductor memory devices that provide fast read speeds.

Micron Technologies memory products are in demand by industries ranging from the cloud server to enterprise, client, graphics, and networking markets, as well as for smartphone and other mobile-device markets including EVs and self-driving cars.

Among the more visible of Micron Technologies products are its line of SSDs and component-level solutions for the enterprise and cloud, client, and consumer storage markets. Often seen in movies and TV, these small-sized memory storage and transport devices can be as small as a key fob.

Further Catalysts for the MU Weekly Options Trade…..

Micron reported a 58% year-over-year increase in sales last quarter to $5.82 billion. Its rapid return back to its last peak sales cycle, which occurred in 2022 at the end of the pandemic-induced chip shortage, will continue in fiscal Q3 2024 (which ends in May). Management is predicting revenue of $6.6 billion at the midpoint of guidance, which would equal a 76% year-over-year jump.

Micron finally reported a GAAP net profit again of $793 million (or $476 million on an adjusted basis). The company has a lot to gain as it keeps ramping up manufacturing of HBM3e, the latest iteration of third-generation high-bandwidth memory. HBM3e is used in accelerated computing and AI -- like Nvidia's new systems just announced at its annual GTC event last week.

The market has been going wild over a business that up until just this quarter has been operating deep in the red. But investors were vindicated by this quote from Micron CEO Sanjay Mehrotra: "We are on track to generate several hundred million dollars of revenue from HBM in fiscal 2024 and expect HBM revenues to be accretive to our DRAM and overall gross margins starting in the fiscal third quarter. Our HBM is sold out for calendar 2024, and the overwhelming majority of our 2025 supply has already been allocated."

In other words, it looks like the good times will keep rolling for at least another year, if not longer.

Other Catalysts.....

Moving Ahead.....

Looking ahead to the fiscal third quarter, management expects the recovery to continue, calling for $6.6 billion in revenue, up 76% from the quarter a year ago, and it sees gross margins improving by 24% to 27%, up from 18.5% in the second quarter, a positive sign.

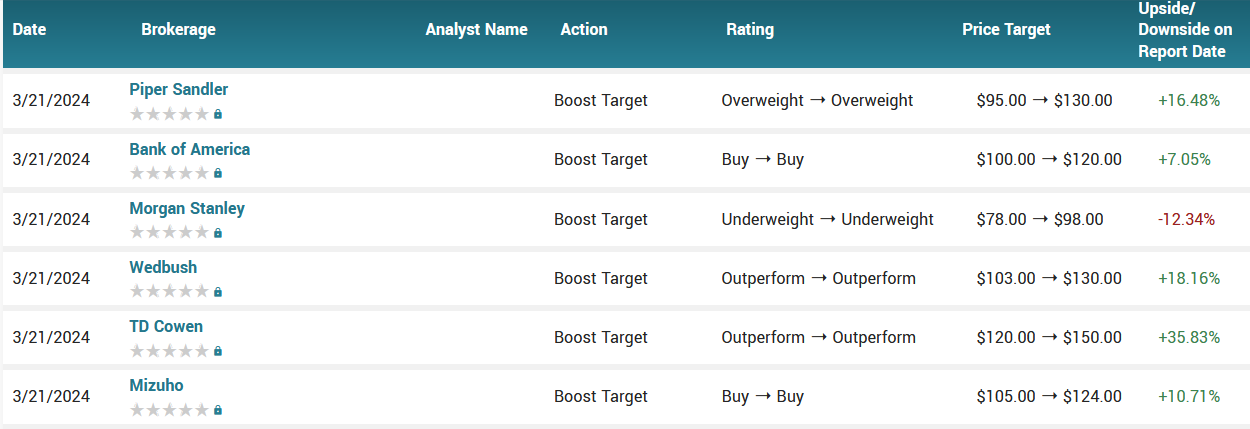

Analysts.....

Vijay Rakesh, an analyst from Mizuho Securities, reiterated the Buy rating on Micron. The associated price target is $130.00.

Vijay Rakesh has given his Buy rating due to a combination of factors including the anticipated growth in the High Bandwidth Memory (HBM) market and Micron’s competitive positioning within it. Rakesh projects a strong compounded annual growth rate for the HBM market, where Micron is expected to increase its market share significantly. The company is also expected to benefit from technological advancements in its HBM products that offer lower power consumption and cost advantages compared to competitors. Furthermore, Rakesh sees potential for upside in HBM pricing which, coupled with Micron’s expected market share gains, underpins his positive outlook.

Rakesh’s optimism is also reflected in the adjustment of Micron’s price target upward, indicating he believes the stock holds substantial value for investors. This reassessment is based on updated tax rate projections aligned with Micron’s guidance and a comprehensive analysis of the company’s revenue and earnings per share estimates. The Buy rating is further supported by Micron’s strategic positioning to capitalize on the surging demand for artificial intelligence (AI) capabilities, with the expectation that government funding and a balanced growth approach between the US and Asia will further bolster Micron’s market standing. Rakesh’s analysis suggests that Micron’s stock is attractively priced, considering the growth prospects and competitive advantages in the evolving memory market.

According to the issued ratings of 27 analysts in the last year, the consensus rating for Micron Technology stock is Moderate Buy based on the current 1 sell rating, 1 hold rating and 25 buy ratings for MU. The average twelve-month price prediction for Micron Technology is $118.69 with a high price target of $150.00 and a low price target of $80.00.

Summary.....

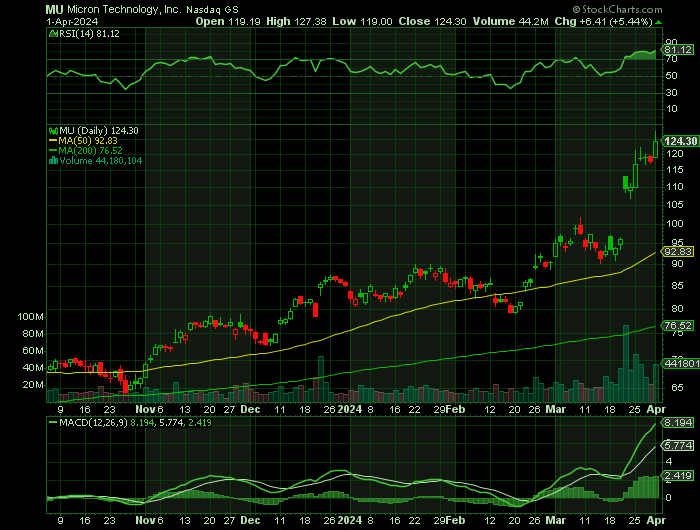

Micron Technology has a 50-day simple moving average of $89.26 and a 200 day simple moving average of $79.70. The company has a debt-to-equity ratio of 0.30, a current ratio of 3.74 and a quick ratio of 2.40. The company has a market capitalization of $129.71 billion, a PE ratio of -33.95 and a beta of 1.24.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from MICRON TECHNOLOGY

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!