TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

80% Profit - Nvidia

Bounces Back With A Vengeance!

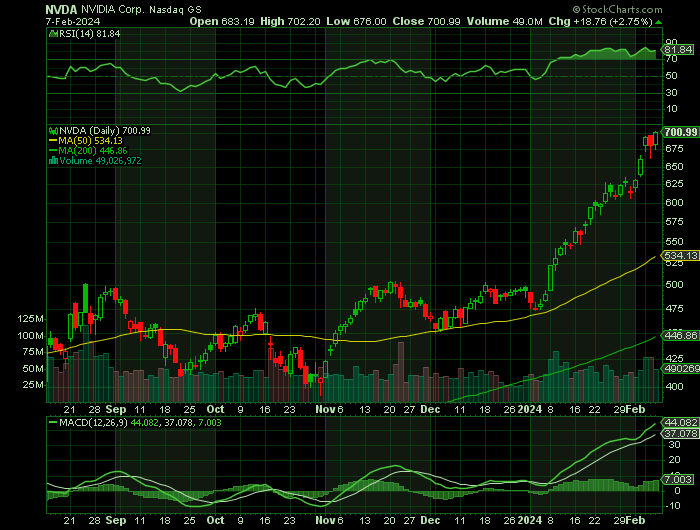

After a bad start on Tuesday for NVIDIA Corporation (NASDAQ:NVDA), shares bounced Wednesday to close the day at $700.99, up $18.76 or 2.75%.

Nvidia stock gained 24% in January alone and is up more than 12% in February so far.

Nvidia has earned a reputation for being a trailblazer. The company was an early pioneer in the graphics processors that many say drastically improved computer gaming. Along with gaming, Nvidia chips now are used in such industries as health care, automobiles and robotics.

This set the scene for Weekly Options USA Members to profit by 80% using a NVDA Options trade!

Join Us And Get The Trades – become a member today!

Wednesday, February 07, 2024

by Ian Harvey

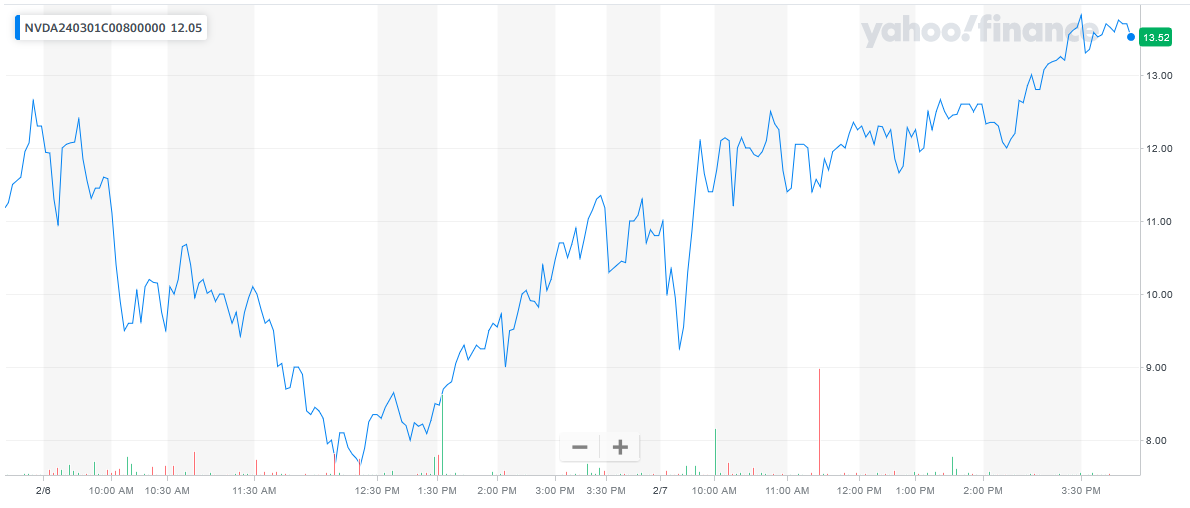

As the shares of Nvidia fell Tuesday, an opportunity was provided to enter a WEEKLY CALL OPTION at a greatly reduced price, as is revealed in information further below.

Why the NVIDIA Weekly Options Trade was Originally Executed!

NVIDIA Corporation (NASDAQ:NVDA) stock has risen nearly sixfold since its October 2022 low. On the stock market yesterday, Nvidia stock rose 4.8% to close at 693.32. Earlier in the session, it notched a record high 694.97.

Nvidia's dominant position in the artificial intelligence (AI) chip market has buoyed the stock. This led to massive revenue growth for the company. In the first nine months of fiscal 2024 (ended Oct. 29. 2023), revenue of $39 billion surged 86% higher compared with the same period in fiscal 2023.

Consequently, net income reached more than $17 billion in the first three quarters of fiscal 2024. Nvidia earned only $3 billion during the same time frame in 2023. Between AI's rising popularity and Nvidia's history this looks as it will provide another profit using a weekly option.

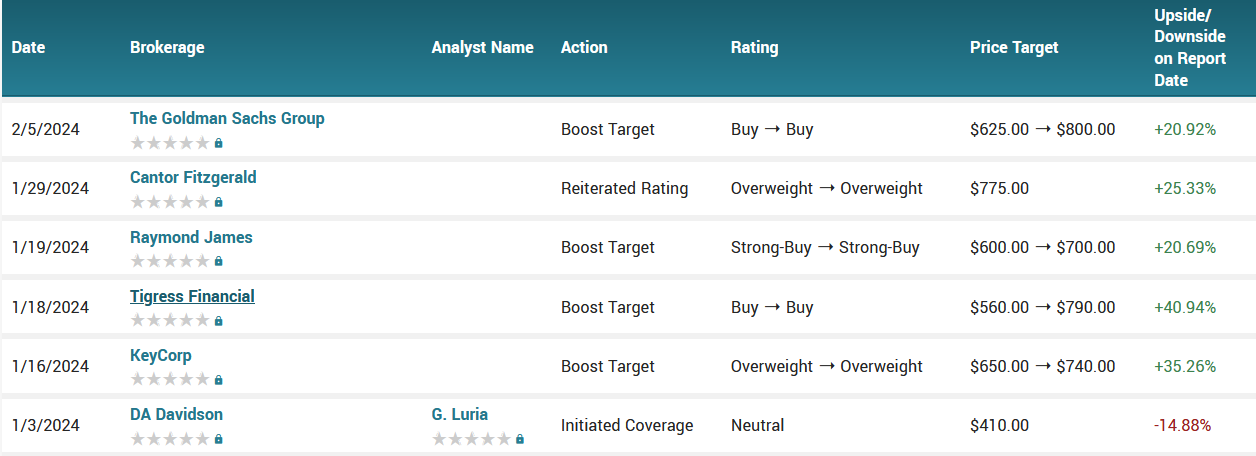

Nvidia's 218% rally over the past year isn't stopping Goldman Sachs from increasing its price target on the semiconductor company.

In a Monday note, Goldman Sachs analyst Toshiya Hari raised his Nvidia price target from $625 to $800, representing potential upside of 21% from Friday's close. He also reiterated his buy rating and kept Nvidia on the firm's "conviction list" of top stock picks. Nvidia stock jumped as much as 5% on Monday to a record valuation of $1.7 trillion.

Goldman Sachs analysts believe that Nvidia's Data Center revenue won't "drop off" in the second half of 2024 as it previously forecast.

Instead, according to Goldman Sachs, Nvidia will consistently increase its Data Center revenue through the first half of 2025 thanks to "continued spending on generative AI infrastructure by the large cloud service providers, a broadening customer profile, and multiple new product cycles."

"We are encouraged by various data points from the broader eco-system that point to sustained strength in demand for accelerated computing," Goldman Sachs analyst Toshiya Hari wrote.

Reasons Goldman Sachs is growing more bullish on Nvidia.....

- "Early evidence of AI monetization at the likes of Microsoft (6% point contribution toward Azure growth in the December quarter + Copilot adoption) and Meta Platforms (increased monetization across Reels, messaging and commerce)."

- "Constructive commentary on AI-related capital spending by the hyperscalers (note Meta increased its 2024 capex guidance from $30-35bn prior to $30-37bn)."

- "Super Micro's forward guidance that implies an acceleration in its sequential revenue growth rate from 7% qoq in 1QCY24 to 24% qoq in 2QCY24 at the midpoint of guidance."

- "AMD's positive revision to its 2024 Data Center GPU revenue outlook to ~$3.5bn from $2bn+ as of three months ago."

- "Marvell's recent upbeat comments regarding its optical DSP and custom compute businesses (note that we revised up our FY2025-26 Data Center segment revenue forecasts by 5%)."

- "Nvidia's reiteration at CES of its conviction in growing Data Center revenue beyond CY2024 — a view predicated on strong visibility as it pertains to capital spending patterns at the large cloud service providers."

The NVDA Weekly Options Potential Profit Explained.....

** OPTION TRADE: Buy NVDA MAR 01 2024 800.000 CALLS - price at last close was $12.30 - adjust accordingly.

NOTE: It is not necessary for the stock price to hit $800 – we are after the profit generated as it makes its way there.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the NVDA Weekly Options (CALL) Trade on Tuesday, February 06, 2024 for $7.70.

Sold HALF the NVDA weekly options contracts on Wednesday, February 07, 2024 for $13.85; a potential profit of80%.

(This will vary for members depending on their entry and exit strategies).

Holding the remaining contracts for further profit!

Don’t miss out on further trades – become a member today!

About Nvidia.....

NVIDIA Corporation ranks among the world’s leading microchip manufacturers and is best known for its contributions in the fields of graphics and gaming. Its chips and related software power the fastest, highest-resolution graphics and are featured in a line of products that include solutions for all end-market uses. Along with gaming, NVIDIA microchips are used in visualization, datacenter, AI, and autonomous vehicles just to name a few.

NVIDIA was founded in 1993 by three friends and is headquartered in Santa Clara, California. The company was intended to focus on chips for the budding gaming and entertainment industry that was spawned by the rise of the personal computer and the Internet. At the time of its founding, there were less than 30 graphics-focused independent operators and that figure would more than double over the next few years.

NVIDIA launched its first product in 1995 called the NV1 and paved the way for 3-D games like Sega’s Virtual Fighter. The next big break came in 1996 with the launch of Microsoft DirectX Drivers which changed how Windows interfaced with games. The next year, in 1997, the company will release the world’s first 128-bit 3-D processor. It quickly gains acceptance gaming OEMs and more than 1 million units are shipped the first four months. Later, in 199, the company will invet the GPU and change the world of computing forever. The GPU will not only enhance the graphics capabilities of the PC but lead to accelerated-computing and AI as well. NVIDIA also held its IPO that same year.

Founders Jensen Huang and Chris Malachowsky are still in leadership positions. Mr. Huang has served as the company’s CEO, president, and board member since the company’s founding. Mr. Malachowsky serves as a member of the company’s executive staff and is a senior technology executive.

Today, NVIDIA Corporation is the only remaining independently operating graphics-focused microchip company in operation. The company’s business has evolved from the core gaming-oriented business to include graphics-oriented computing, and networking solutions in the United States, Taiwan, China, and internationally but gaming is still a pillar of the business.

NVIDIA’s Graphics segment offers GeForce GPUs for gaming and PCs, the GeForce NOW game streaming service and related infrastructure, and software solutions for gaming platforms. The company also offers the Quadro/NVIDIA RTX GPUs for enterprise-level workstation graphics, the vGPU software for cloud-based visual and virtual computing, and entertainment platforms for OEM auto manufacturers, and Omniverse software for 3-D world-building.

NVIDIA’s Compute & Networking segment provides a wide range of solutions for interconnect, AI/autonomous driving, cryptocurrency mining, robotics, Data Center platforms and accelerated computing. Products include Mellanox for networking and interconnect, Jetson for robotics and embedded applications, and AI Enterprise software among others.

Further Catalysts for the NVDA Weekly Options Trade…..

"We no longer assume a drop-off in data center revenue in second-half calendar year 2024 and instead model consistent growth through first-half calendar 2025, driven by continued spending on Gen AI infrastructure by the large cloud service providers, a broadening customer profile, and multiple new product cycles," Toshiya Hari said.

Meanwhile, Nvidia is likely to outperform rival Advanced Micro Devices (AMD) in the AI chip market, he said.

"From a competitive standpoint, although AMD is making good progress with its MI300 platform, we believe Nvidia will remain as the industry gold standard for the foreseeable future given its robust hardware and software offerings and, importantly, the pace at which it continues to innovate."

The next potential catalyst for Nvidia stock will be the company's fiscal fourth quarter report, due on Feb. 21, which is likely to see revenue rise to more than $20.2 billion, a more than three-fold increase from a year earlier, amid the surge in AI demand.

Other Catalysts.....

Nvidia, which has seen its market value more than triple over the past year, has cemented its place at the world's biggest producer of chips for artificial-intelligence applications.

Its lineup of powerful semiconductors is integral to the expansion plans of cloud-computing giants such as Microsoft and Alphabet as well as Magnificent 7 peers Meta Platforms and Amazon.

In fact, Meta Founder and CEO Mark Zuckerberg told investors earlier this month that the company would have around 350,000 H100 graphics-processing units, the AI-focused chips Nvidia makes, in place by the end of the year.

That would take Meta's total of Nvidia GPUs to around 600,000, a level that would establish it as one of the largest AI systems in the world, as the company consolidates its AI-research team more closely to its business unit.

Analysts.....

According to the issued ratings of 39 analysts in the last year, the consensus rating for NVIDIA stock is Moderate Buy based on the current 1 sell rating, 3 hold ratings, 34 buy ratings and 1 strong buy rating for NVDA. The average twelve-month price prediction for NVIDIA is $612.68 with a high price target of $800.00 and a low price target of $195.00.

Summary.....

NVIDIA has a quick ratio of 3.06, a current ratio of 3.59 and a debt-to-equity ratio of 0.25. NVIDIA has a 52 week low of $204.21 and a 52 week high of $694.97. The firm has a 50 day moving average of $527.43 and a 200 day moving average of $478.63. The stock has a market capitalization of $1.71 trillion, a PE ratio of 91.47, and a price-to-earnings-growth ratio of 2.65 and a beta of 1.69.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from NVIDIA

Recent Articles

-

191% Weekly Option Win on Super Micro Computer Amid Market Mayhem

191% Weekly Option Win on Super Micro Computer Amid Market Mayhem – What’s Next? -

Tariffs and the Stock Market: Positive and Negative Impacts in 2025

Tariffs and the Stock Market: Positive and Negative Impacts in 2025. This article explores both the positive and negative effects of tariffs on the stock market based on recent data, forecasts, and ma… -

SMCI’s Wild Ride: Options Traders Are Profiting From the Ups and Downs

SMCI’s Wild Ride: How Options Traders Are Profiting From the Ups and Downs