TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

85%

Profit

as Walmart Sells JD.com!

More Profit Is

Expected!

Wal-Mart Stores Inc. (NYSE:WMT) in an unexpected move late Tuesday sold its 9.4% stake in China-based e-commerce company JD.com for $3.6 billion, according to reports. The supermarket chain is seeking to raise about $3.74 billion by selling its stake in JD.com.

The announcement comes after Walmart cleared Q2 forecasts last Thursday with a beat-and-raise report.

Walmart stock climbed about 1% Wednesday. WMT stock has rallied 43% in 2024, making it the Dow's fastest-moving stock this year.

This set the scene for Weekly Options USA Members to profit by 85 using a WMT Weekly Options trade!

Join Us And Get The Trades – become a member today!

Thursday, August 22, 2024

by Ian Harvey

UPDATE

Wal-Mart Stores Inc. (NYSE:WMT) in an unexpected move late Tuesday sold its 9.4% stake in China-based e-commerce company JD.com for $3.6 billion, according to reports. The supermarket chain is seeking to raise about $3.74 billion by selling its stake in JD.com.

The Dow Jones retailer said it will focus on its own China operations for Walmart China and Sam's Club, as well as deploy capital toward other priorities. Reuters reported that Walmart plans to double down on its Sam's Club business in China following the stake sale.

"This decision allows us to focus on our strong China operations for Walmart China and Sam's Club, and deploy capital towards other priorities," Walmart said.

The U.S. retailer owns a 5.19% stake in JD.com, according to LSEG data, with the partnership beginning in 2016 when Walmart sold its Chinese online grocery store, Yihaodian in return for a 5% stake in JD.com.

Walmart offered 144.5 million American depositary shares of JD.com at a range of 24.85 to 25.85 per share, which represents up to an 11.8% discount from JD's Tuesday closing price of 28.19. The top end of the range would put the sale around $3.74 billion.

The announcement comes after Walmart cleared Q2 forecasts last Thursday with a beat-and-raise report.

JD.com reported a better-than-expected second-quarter profit, but China's retail market has been hit by a persistent downturn in consumer confidence amid concerns about employment and incomes.

Walmart stock climbed about 1% Wednesday. WMT stock has rallied 43% in 2024, making it the Dow's fastest-moving stock this year.

The WMT Weekly Options Potential Profit Explained.....

** OPTION TRADE: Buy WMT SEP 27 2024 75.000 CALLS - price at last close was $0.71 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

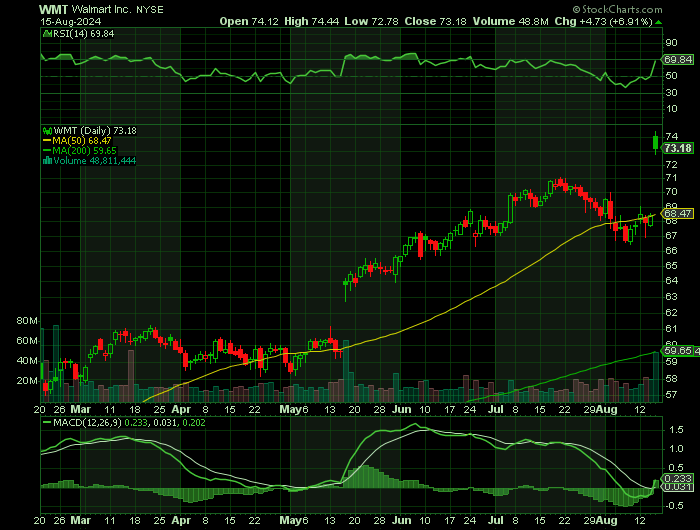

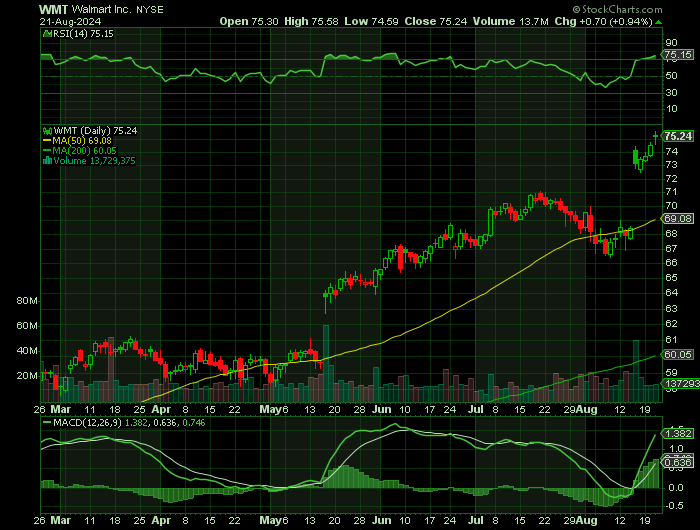

Entered the WMT Weekly Options (CALL) Trade on Friday, August 16, 2024 for $0.95.

Sold half the WMT Weekly options contracts on Wednesday, August 21, 2024 for $1.76; a potential profit of85%.

(This will vary for members depending on their entry and exit strategies).

Holding remaining contracts for further profit.

Don’t miss out on further trades – become a member today!

Why the WALMART Weekly Options Trade was Originally Executed!

Weekly Options Trade – Wal-Mart Stores Inc. (NYSE:WMT) CALLS

Date: Friday, August 16, 2024

Trade Details

Option Type: CALL

Expiration Date: September 27, 2024

Strike Price: $75.00

Premium: $0.71 (price at last close)

Risk Management:

- Establish a pre-determined selling point at approximately 50% of the purchase price, or modify based on your individual strategy.

- Implement a protective stop loss at -60% of the entry price to mitigate significant losses.

- CAUTION: Assess the direction of the stock movement before executing – enter at the most favorable price as the current stock market is highly volatile and unpredictable!

- NOTE: Personally, due to the market's volatility and my hands-on approach, I do not use a protective stop loss, but instead have a flexible pre-determined selling point.

- Exiting Trades: Most members have their own risk strategies, some are content with a 20% gain while others aim for higher returns!

- In some scenarios, it may be prudent to have a stop-loss order in place to minimize potential losses.

- Monitor the market actively if you can. A shift in market dynamics can be crucial for adjusting your exit strategy.

- If the market trends negatively, consider exiting early to avoid losses and potentially re-enter at a more favorable time.

- Another strategy is to set a lower exit price and then re-enter the market as conditions improve.

- Often, I exit trades based on my instincts and rarely use a stop-loss order. I prefer to monitor daily chart movements closely.

- One common approach I use is to sell half of my position when it reaches a satisfactory level, then wait to see where the rest of the contracts go.

ADJUST TO YOUR OWN RISK TOLERANCE!

Trade Analysis

Current Situation

Walmart (NYSE: WMT) shares surged Thursday after the company reported second-quarter earnings that exceeded estimates and raised its full-year outlook, as cost-conscious consumers turned to the discount retailer for purchasing essential items. The stock gained 6.6% to $73.18, a new record closing high.

Key Insights from Earnings Call

During the latest earnings call, Walmart's management highlighted the expanding demand for its value offerings. CFO John Rainey emphasized the company's robust performance and upgraded outlook, reflecting confidence in the broad economy. "In this environment, it’s responsible or prudent to be a little bit guarded with the outlook, but we’re not projecting a recession," he stated, providing a positive view despite recent market volatility.

Catalysts for the Trade

- Robust Earnings Performance: Walmart's stronger-than-expected Q2 results and the raised full-year guidance suggest a solid financial footing and potential for continued growth.

- Consumer Behavior: With a focus on cost-saving, consumers are increasingly turning to Walmart for essential purchases, which could drive sales higher.

- Market Position: As the largest retailer, Walmart's scale and market penetration provide a competitive edge that is difficult for competitors to match.

Further Catalysts

Walmart's recent performance and strategic initiatives position it well for future growth. The company's emphasis on value and efficiency continues to attract a broad customer base, from low to high income, enhancing its market share and sales potential.

Analyst Reactions

Following the earnings release, several analysts have revised their outlook on Walmart. Notably, Jefferies Financial Group raised their price target from $77.00 to $80.00, maintaining a buy rating on the stock. Other analysts have also issued positive updates, reflecting a strong consensus on the stock's upward trajectory.

Company Overview

Walmart Inc., founded in 1962 by Sam Walton in Rogers, Arkansas, has grown to become the world's largest retailer by revenue. The company operates a chain of hypermarkets, discount department stores, and grocery stores globally. Known for its "Every Day Low Prices" philosophy, Walmart continues to attract a diverse customer base across various income levels.

Technical Analysis

- Market Capitalization: $588.63 billion

- PE Ratio: 31.31

- Beta: 0.50

- 52-Week Low: $49.85

- 52-Week High: $74.44

- Fifty-Day SMA: $68.58

- Two-Hundred-Day SMA: $63.12

Summary

Walmart presents a compelling investment opportunity in the retail sector. The company's strong financial performance, robust growth in consumer engagement, and strategic market positioning make it a favorable option for stock appreciation. The current market dynamics and positive analyst sentiment further bolster the case for investing in Walmart.

Trade Execution

Consider placing a buy order for WMT SEP 27 2024 75.000 CALLS, with a premium of $0.71. Adjust your sell point and stop loss according to your risk tolerance.

Disclaimer

This trade suggestion is based on the current market analysis and is not a guaranteed success. Always consider your risk tolerance and consult with a financial advisor if necessary.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from WALMART

Recent Articles

-

191% Weekly Option Win on Super Micro Computer Amid Market Mayhem

191% Weekly Option Win on Super Micro Computer Amid Market Mayhem – What’s Next? -

Tariffs and the Stock Market: Positive and Negative Impacts in 2025

Tariffs and the Stock Market: Positive and Negative Impacts in 2025. This article explores both the positive and negative effects of tariffs on the stock market based on recent data, forecasts, and ma… -

SMCI’s Wild Ride: Options Traders Are Profiting From the Ups and Downs

SMCI’s Wild Ride: How Options Traders Are Profiting From the Ups and Downs