TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

99% Profit From An Alphabet Weekly Options Trade!

Google accounts for 91.5% of worldwide internet search share.

In the fourth quarter of 2023, Alphabet reported digital advertising revenue of $65.5 billion, which was up 11% year over year.

Several analysts have reiterated their bullishness for Alphabet shares, and have raised their respective price targets.

This set the scene for Weekly Options USA Members to profit by 99% using a GOOG Options trade!

Join Us And Get The Trades – become a member today!

Sunday, February 12, 2024

by Ian Harvey

UPDATE

In the fourth quarter of 2023, Alphabet reported digital advertising revenue of $65.5 billion, which was up 11% year over year.

CEO Sundar Pichai said “In the next 10 years, we will shift to a world that is AI-first, a world where computing becomes universally available -- be it at home, at work, in the car, or on the go -- and interacting with all of these surfaces becomes much more natural and intuitive, and above all, more intelligent."

Looking ahead, there are a lot more robust AI features in the pipeline. When it comes to the cloud segment, the recent introduction of Gemini, a generative AI platform, can help clients build and launch their own apps for their own customers.

Alphabet is incredibly profitable, generating $102 billion of operating cash flow in 2023, and currently sitting on a net cash balance of $98 billion. This gives it the financial resources to keep plowing capital into research and development initiatives.

Why the Google Weekly Options Trade was Originally Executed!

Post-earnings, investors bailed on Alphabet Inc (NASDAQ: GOOG, GOOGL), but taking a closer look at Google’s stock analysis, there was no need to head for the exits. Taking a closer look at the report itself, one thing’s clear. The results didn’t exactly warrant such a negative reaction.

On Jan. 30, Alphabet released its results for the quarter ending Dec. 31, 2023. Revenue came in at $86.3 billion, representing a 13% increase compared to the prior year’s quarter. Earnings per share came in at $1.64, an over 56% increase compared to Q4 2022. Revenue and earnings also came in ahead of sell-side forecasts.

Although overall results beat forecasts, Alphabet’s advertising revenue during the quarter did not. Advertising revenue came in at $65.5 billion for the quarter. While representing a nearly 11% year-over-year increase, analysts were expecting ad revenue of $65.8 billion.

However, this pullback should prove temporary. There’s plenty on tap that could drive resurgence in bullishness pretty soon.

The GOOG Weekly Options Potential Profit Explained.....

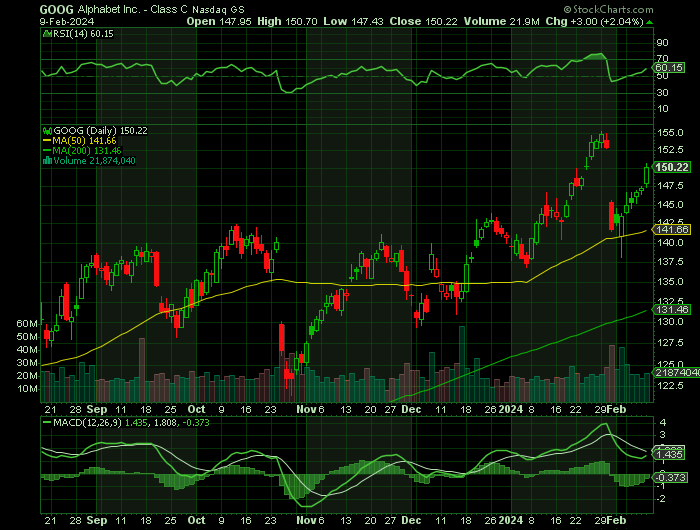

** OPTION TRADE: Buy GOOG MAR 08 2024 150.000 CALLS - price at last close was $2.14 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the GOOG Weekly Options (CALL) Trade on Tuesday, February 06, 2024 for $2.14.

Sold half the GOOG weekly options contracts on Friday, February 09, 2024 for $4.25; a potential profit of 99%.

(This result will vary for members depending on their entry and exit strategies).

Holding the remaining contracts for further profit!

Don’t miss out on further trades – become a member today!

About Alphabet Stock (NASDAQ:GOOG).....

Alphabet Inc. is a holding company formed in 2015 with the restructuring of Google. The move was made to allow the company more flexibility in its business pursuits and to create more transparency in the core Google business. Google, which began as a simple search engine, is now synonymous with the Internet, cloud, and services related to each. Today, Alphabet is the 3rd largest tech company globally and the G in FAANG.

Google began in 1996 as a research project into Internet search. Founders Lary Page and Sergey Brin thought there was a better way to search and rank web pages than simply counting the number of times a keyword was used. The original algorithm was called Page Rank and the system Back Rub but those monickers did not last long. The new system instead determined a page's relevance by analyzing the websites that linked back to it. The more websites with higher rankings linking back to the original site the better.

The original prototype of the Google search engine was launched in 1997. The name Google was chosen because it is a very large number and refers to a large amount of information a Google search can provide. If not for an investment Andy Bechtolsheim, co-founder of Sun Microsystems, the company may never have incorporated and become the behemoth it is today.

The company grew over the next few years, changed it headquarters to Palo Alto and then began selling ad space. It was The shift to an ad-based and supported model that provided the income and earnings to grow the company to its current size. Advertising still makes up more than 80% of the revenue. In 2000, the company became the default search engine for Yahoo! and then in 2004 Google went public.

At the time of the IPO, company founders and then-CEO Eric Schmidt agreed to work together for the next 20 years. While that did not come to pass, the trio helped get the company on its current path. In the time since the IPO, Google has not only grown to surpass 3 billion daily searches and 1 billion unique monthly active users it has also acquired other businesses to enhance that growth. The two most notable are the acquisition of Youtube (which is included in the ad-generated revenue) and Motorola. The addition of Motorola was strategic in many ways that include the acquisition of intellectual property and better positioning in patent and other disputes with other tech companies.

Alphabet now operates in 3 core segments providing Internet and Internet-based services globally. Those segments are Google Services, Google Cloud, and Other Bets. The Google Services business is the core Google business and includes search, ads, Google Home, and Youtube among others. The Google Cloud segment is a host of cloud-based services for businesses and individuals that include software suites, security, and cloud-based operations. The Other Bets segment includes a variety of applications and services that do not have a direct bearing on the core business and/or are immaterial to revenue on an individual basis.

Further Catalysts for the GOOG Weekly Options Trade…..

Google accounts for 91.5% of worldwide internet search share. You have to go back almost nine years to find the last time Google didn't comprise at least 90% of global search on a monthly basis. It's the undisputed leader in search, which makes it a hot commodity for businesses wanting to target their advertising. In short, it gives Alphabet virtually unparalleled ad-pricing power.

However, Alphabet's future cash-flow drivers are likely found in its ancillary operating segments. Daily views of YouTube Shorts catapulted from 6.5 billion in 2021 to more than 50 billion by early last year. This new monetization channel has been a nice lift for YouTube's ad revenue.

Meanwhile, Google Cloud just delivered its fourth consecutive quarter of operating income following years of operating losses. Enterprise cloud spending is still in its early innings, which suggests there's a double-digit, exceptionally high-margin growth opportunity to be had with cloud infrastructure services.

But the top selling point for Alphabet might just be that it remains cheap. Its forward price-to-earnings (P/E) ratio of 18 is actually lower than the forward P/E of the benchmark S&P 500 -- despite Alphabet's offering a higher growth rate. Furthermore, it's valued at less than 13 times forward-year cash flow, which compares to an average cash flow multiple of 18 times over the previous five years.

Tack on a $97.7 billion net cash buffer and it's easy to see why Alphabet is a screaming bargain in February (and beyond).

Analysts.....

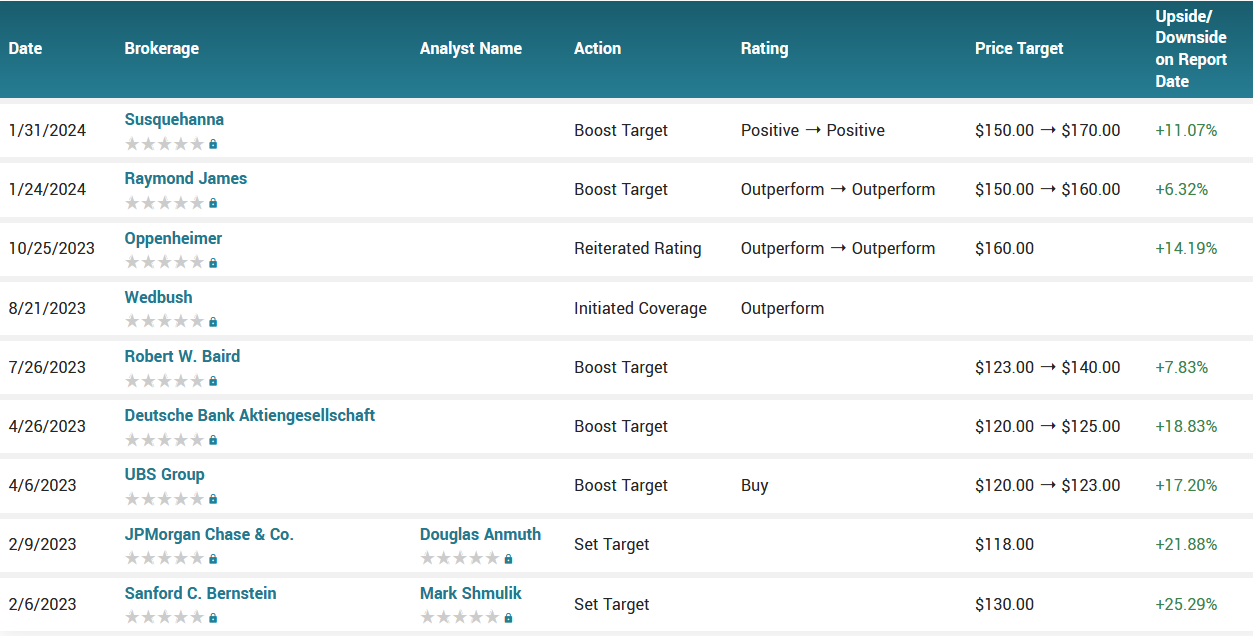

Several analysts have reiterated their bullishness for Alphabet shares, and have raised their respective price targets.

A big reason for this is the perceived potential growth upside from the company integrating generative AI features into its Search platform, but that’s not the only reason.

Citi’s Ronald Josey, who increased his price target for GOOG from $153 to $168 per share, also cited “improving trends” for Alphabet’s non-search businesses, such as Google Cloud and YouTube. Given earnings forecasts, it’s easy to see this stock not only hit this analyst’s price target, but rise to levels well above it.

If the company delivers earnings in 2024 ahead of current consensus forecasts ($6.74 per share), and makes major progress integrating/monetizing its AI technology (such as its Gemini AI model), shares could really make a big move higher.

According to the issued ratings of 5 analysts in the last year, the consensus rating for Alphabet stock is Buy based on the current 5 buy ratings for GOOG. The average twelve-month price prediction for Alphabet is $140.75 with a high price target of $170.00 and a low price target of $118.00.

Summary.....

Alphabet Inc. has a twelve month low of $88.86 and a twelve month high of $155.20. The company has a debt-to-equity ratio of 0.05, a quick ratio of 2.10 and a current ratio of 2.10. The stock has a market cap of $1.82 trillion, a price-to-earnings ratio of 24.75, and a PEG ratio of 1.33 and a beta of 1.06. The firm's 50 day moving average price is $141.06 and its two-hundred day moving average price is $136.08.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from ALPHABET

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!