TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Apple Inc Screams Higher Then Falls Back!

However, Members Make

Potential Profit of 84%, Using A Weekly Call

Option!

Another Opportunity Presents Itself!

Apple kept the momentum going this week, and soared higher on Wednesday, after receiving a positive note from Morgan Stanley analyst Erik Woodring, who sees great prospects for Apple in India.

Woodring feels confident predicting that Apple stock will be worth $220 a share within a year (up ~14% from yesterday’s prices). And he’s “overweighting” the stock, and urging investors to buy Apple — Morgan Stanley’s new “top pick” in tech.

This set the scene for Weekly Options USA Members to Make Potential Profit Of 84%, using an AAPL Weekly Options trade!

Join Us And Get The Trades – become a member today!

Sunday, July 23, 2023

by Ian Harvey

Why the AAPL Weekly Options Trade was Executed?…..

With a share price up 55% above where it started the year, tech icon Apple Inc. (NASDAQ:AAPL) is easily eclipsing the S&P 500’s gains in 2023. Helping Apple keep the momentum going this week was a positive note from Morgan Stanley analyst Erik Woodring, who sees great prospects for Apple in… India.

With average per capita GDP of less than $2,900 (just 4% of America’s $76,400), you might not think India would be the best place to try and sell $1,000 iPhones — much less $3,500 “Vision Pro” virtual reality headsets! But according to Woodring, India actually is Apple’s “next growth frontier,” and a market in which the tech giant is gaining market share, selling more (and more expensive models of its) iPhones, and enjoying an overall positive “ecosystem effect.”

"Apple is riding this 'premiumization' wave, reaching record shares in multiple new markets which are typically not considered its core markets. A prime example is India, where it grew 50% YoY in Q2 2023," according to Counterpoint Research data.

The report shows the overall cell phone market is experiencing declines as consumers wait longer to upgrade or buy refurbished devices. However, Apple's premium status is helping it gain customers who are "opting for a superior experience, supported by the easy availability of finance options across key geographies."

As if all that weren’t good enough news, market forecasters believe that earlier this year, India probably passed China in total population, making it officially the world’s most populous nation — and the biggest (potential) market for iPhones on Earth.

Admittedly, Apple will be growing off of a very small base.

According to Woodring, Apple will sell only about $6 billion worth of products and services in India this year — about 1.5% of the company’s global total revenue, and barely a twelfth the size of the Chinese market. India’s number has been growing of late, but still amounts to only about 2% of total sales growth over the last five years, says the analyst. But this number is about to take off.

“Recent investments in brand awareness [by Apple in India], local manufacturing, and affordability programs, combined with India’s economic boom and growing digitization” all set the stage for India to grow significantly over the next half decade. Indeed, Woodring sees India alone accounting for as much as 20% of Apple’s total growth in “installed base” over the next five years, and in 10 years, predicts that one in 10 iPhones worldwide will have a phone number starting with “+91.”

Even with the company charging more “affordable” prices in the Indian market, 15% of Apple’s revenue growth over the next five years could come from the Subcontinent. Farther out, the analyst sees Apple signing up 170 million new users in India over the next 10 years, and growing its revenues to as much as $40 billion, a “7x” increase.

With these favorable demographic tailwinds to support his thesis, Woodring feels confident predicting today that Apple stock will be worth $220 a share within a year (up ~14% from yesterday’s prices). And he’s “overweighting” the stock, and urging investors to buy Apple — Morgan Stanley’s new “top pick” in tech.

The AAPL Weekly Options Trade Explained.....

** OPTION TRADE: Buy AAPL AUG 11 2023 195.000 CALLS - price at last close was $4.28 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the AAPL Weekly Options (CALL) Trade on Wednesday, July 19, 2023, for $3.90.

Sold the AAPL Weekly Options contracts on Wednesday, July 19, 2023, for $7.19; a potential profit of 84%.

By Friday, the share price had pulled back and is now setting up for another upward run if the market movement becomes favourable.

Don’t miss out on further trades – become a member today!

Further Catalysts for the AAPL Weekly Options Trade…..

Apple is slated to report fiscal third-quarter results on August 3 and investment firm Jefferies said the U.S. tech giant is likely to remain a "source of safety" for investors due to its predictability.

Analyst Andrew Uerkwitz, who has a buy rating on Apple, said "it’s moat has been, remains, and will be its ability to integrate software services with its hardware that builds a regular replacement cycle, ability to slowly raise prices, and take share," Uerkwitz wrote in an investor note. "This consistency is what makes it a buy-rated stock—especially in an uncertain economic environment."

For the coming June quarter, Uerkwitz, who raised raised his per-share price target to $225 from $210, expects Apple to generate $83.6B in revenue, above the Wall Street consensus, due in part to the iPhone and services, which he said are the " two most important drivers of the stock."

Other Catalysts.....

All eyes have been on artificial intelligence (AI) this year, with the market projected to expand at a compound annual growth rate of 37% through 2030.

Unlike many of its peers, Apple seems strategically intent on avoiding the term AI. While other companies are heavily using the phrase to garner investor support, the iPhone company is instead focused on debuting new software features that are quietly enabled by AI. In doing so, Apple is protecting its brand by making it harder to lump its business in with the other big names in AI and avoid comparisons. This strategy can reduce volatility in Apple's stock, as it won't be harshly affected by fluctuations in the AI market.

However, the dominance of its products means it will likely be the main driver of AI adoption by the public. At Apple's Worldwide Developer Conference in June, it unveiled several new AI-run software features. Improvements to the iPhone's autocorrect use a transformer language model, the same technology that led to OpenAI's ChatGPT. However, while other companies utilize massive server farms to run similar AI workloads, Apple impressively gets the job done directly on the iPhone.

In addition to its smartphone, the company has brought AI upgrades to the AirPod Pros, which can automatically turn off noise canceling when the user is in a conversation. As Apple continues to develop alongside AI, other products in its lineup will likely get upgrades, which could bolster consumer interest and revenue over the long term.

Equipment Bought.....

Hon Hai Precision Industry Co Ltd (OTC: HNHPF) Foxconn Technology Group has bought $33 million of equipment from an Apple unit for its operations in India since 2022.

An Indian subsidiary of the Taiwanese company acquired equipment from Apple Operations Ltd for operational needs

Foxconn's leading customer Apple sometimes helps finance the cost of equipment that the Taiwanese company uses to make the majority of the iPhones.

In May, India's Minister of State for Technology said that Apple looks to ramp up electronics production in the country, a month after CEO Tim Cook renewed a pledge to invest in the region.

Apple tripled iPhone production and assembled over $7 billion of iPhones in India last fiscal year, making almost 7% of its handsets in the country. Meanwhile, Foxconn plans to invest about $700 million to build a new plant in the southern Indian state of Karnataka, partly to ramp up local production of iPhone parts. Foxconn's investment is likely to create 25,000 jobs in the first phase.

Berkshire's Portfolio.....

Apple occupies an outsized position within Berkshire's portfolio, taking up 46% of its total value as of March 31, 2023. The technology company is responsible for revolutionizing the smartphone industry with the invention of its iconic iPhone back in 2007.

Technicals.....

Total revenue for the company rose steadily through the pandemic from $274.5 billion to $394.3 billion from fiscal 2020 (ending Sept. 30th) to fiscal 2022. Over the same period, net income jumped from $57.4 billion to $99.8 billion.

Free cash flow improved from $73.4 billion to $111.4 billion from the 2020 to 2022 fiscal year for an average of $92.6 billion in free cash flow generated. In tandem with rising free cash flow, Apple's annual dividend per share has also risen from $0.795 to $0.90.

The technology behemoth just released its latest new product Vision Pro, a mixed-reality headset that's easy to use and promises to revolutionize the wearable-technology sector. Apple has plans to sell it in 2024 at a retail price of $3,499. This will be the company's next big product and may bring in even higher revenue to support its dividend payouts.

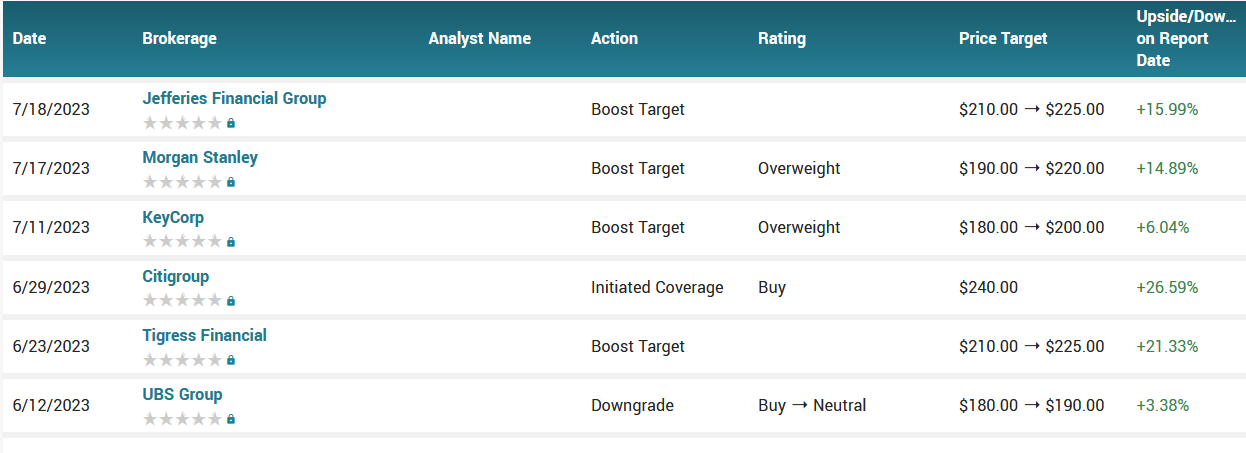

Analysts.....

According to the issued ratings of 33 analysts in the last year, the consensus rating for Apple stock is Moderate Buy based on the current 2 sell ratings, 7 hold ratings and 24 buy ratings for AAPL. The average twelve-month price prediction for Apple is $182.54 with a high price target of $240.00 and a low price target of $54.00.

Summary.....

Apple has made a lot of headlines this year after unveiling its highly anticipated virtual/augmented reality (VR/AR) headset and becoming the first company to achieve a market cap of $3 trillion.

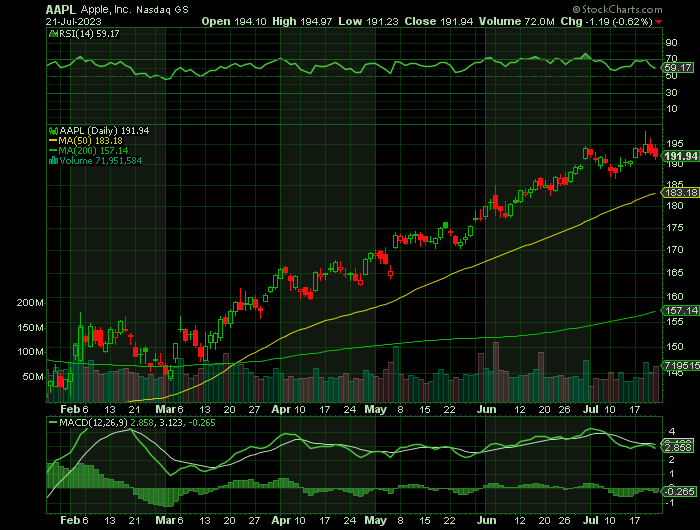

Shares of Apple stock opened at $193.73 on Wednesday. The company has a fifty day simple moving average of $182.64 and a 200-day simple moving average of $163.30. The company has a current ratio of 0.94, a quick ratio of 0.88 and a debt-to-equity ratio of 1.56. Apple Inc. has a 12-month low of $124.17 and a 12-month high of $194.48. The stock has a market cap of $3.05 trillion, a price-to-earnings ratio of 32.89, and a PEG ratio of 2.54 and a beta of 1.28.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from APPLE

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!