TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Advanced

Micro Devices (AMD) Shares Move Higher

Before Earnings!

Members Make

Potential Profit of 88%, in 1 day, Using A Weekly Call

Option!

Advanced Micro Devices, Inc. (NASDAQ AMD) was confirmed to report earnings Tuesday, August 1, 2023 after the market closes, and was expected to beat estimates.

This beat occurred with the chipmaker topping second-quarter estimates and touting inroads in artificial intelligence computing, putting it in closer competition with Nvidia Corp.

This set the scene for Weekly Options USA Members to Make Potential Profit Of 88%, using an AMD Weekly Options trade!

Join Us And Get The Trades – become a member today!

Wednesday, August 02, 2023

by Ian Harvey

Advanced Micro Devices, Inc. (NASDAQ AMD) was confirmed to report earnings Tuesday, August 1, 2023 after the market closes, and was expected to beat estimates.

Sales and profit both exceeded analysts’ projections last quarter, and AMD’s accelerators — a type of processor that speeds up the development of AI software — are drawing more interest from customers. That’s spurred optimism that the company can gain ground on Nvidia and capitalize on the rapid spread of artificial intelligence across industries.

The market for AI accelerators in data centers could top $150 billion by 2027, Chief Executive Officer Lisa Su said on a conference call with analysts. Customer “engagements” with AMD’s AI products increased more than seven times last quarter as clients prepared to bolster their infrastructure, she said.

“While we are still in the very early days of the new era of AI, it is clear that AI represents a multibillion-dollar growth opportunity for AMD,” she said.

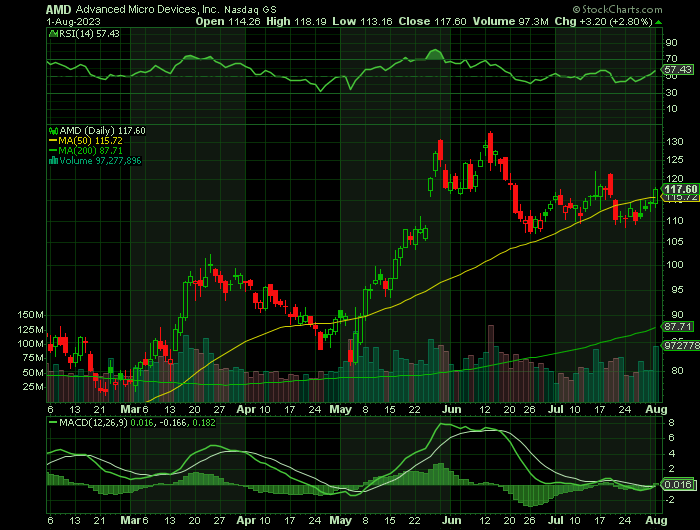

The upbeat outlook sent the shares up about 4% in late trading. Already, the stock had climbed 82% this year through the close, making AMD the second-best-performing member of the Philadelphia Stock Exchange Semiconductor Index. Its AI prospects have fueled much of that rally.

Why the AMD Weekly Options Trade was Originally Executed!

Advanced Micro Devices, Inc. (NASDAQ AMD) is confirmed to report earnings today, Tuesday, August 1, 2023 after the market closes, and is expected to beat estimates.

The consensus earnings estimate is $0.57 per share on revenue of $4.74 billion, a decline of 27.6% year-over-year, but the Whisper number is slightly better at $0.59 per share. The company's guidance was for revenue of $5.00 billion to $5.60 billion.

Short interest has decreased by 1.0% since the company's last earnings release.

Several other semiconductor names, including Intel INTC and NXP Semiconductors NXPI, have already unveiled their respective quarterly results, with both companies posting better-than-expected results and seeing buying pressure post-earnings.

For Advanced Micro Devices’ AMD quarter to be reported, analysts have primarily left their top and bottom line expectations unchanged, with both earnings and revenue forecasted to pull back from the year-ago quarter.

The AMD Weekly Options Trade Explained.....

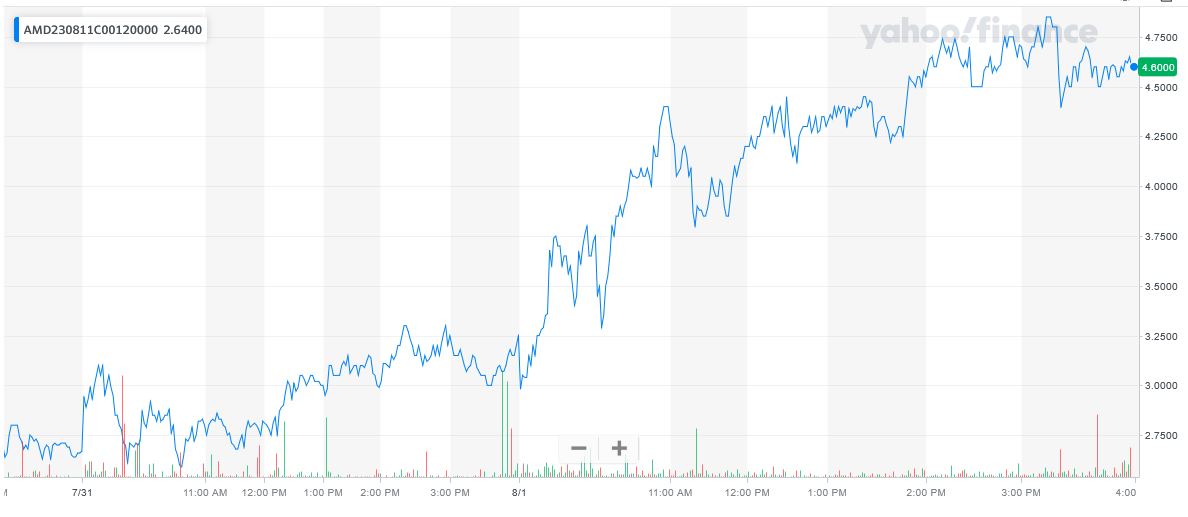

** OPTION TRADE: Buy AMD AUG 11 2023 120.000 CALLS - price at last close was $3.25 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the AMD Weekly Options (CALL) Trade on Tuesday, August 01, 2023, at 9:58, for $2.61.

Sold half the AMD weekly options contracts on Tuesday, August 01, 2023, at 3:14, for $4.90; a potential profit of 88%.

Holding the remaining AMD weekly options contracts for further profit due to an expected surge after reporting positive earnings.

Don’t miss out on further trades – become a member today!

Further Catalysts for the AMD Weekly Options Trade…..

For Advanced Micro Devices, the Q2'23 earnings report from Intel (INTC) provides great views on the surging demand for AI chips and a rebound in PC demand crucial for AMD.

The most immediate signal from Intel beating Q2'23 estimates and guiding up for Q3 is the rebound in PC demand. Most importantly, the inventory correction appears over with OEMs no longer digesting chip inventory.

Intel still reported Q2 Client Computing revenue was down 12% YoY to $6.8 billion, but the number was up $1.0 billion sequentially. The chip giant guided up Q3 revenue to $13.4 billion, up $0.5 billion sequentially.

In Q1'23, AMD reported that client revenues had fallen further to only $739 million. AMD CPU revenues are now far over $1 billion per quarter below the peak levels providing substantial upside potential when the PC market normalizes.

NXP Semiconductors also posted better-than-expected top and bottom line results, exceeding EPS expectations by 5% and delivering a 3% revenue beat. Similar to INTC, the company’s revenue results were at the high end of previous guidance, undoubtedly a positive.

And the market took the results well, with NXPI shares seeing bullish activity post-earnings.

Other Catalysts.....

AMD may see some suppressed data center demand while heading into 2024. Ultimately, the company should see upside from AI demand for the MI300 along with the Alveo AI accelerator.

Going back a few months, Morgan Stanley had estimated the AI potential for AMD was only $400 million with upside potential to $1.2 billion. The Intel forecasts would suggest the AI potential for AMD is far higher next year when the MI300 is in full-scale production.

A rebound in PC demand to more normalized levels places AMD back at the Q4'23 revenue target of $6.5 billion alone. A PC rebound to normal digestion ($2 billion quarterly run rate) along with higher data center or AI demand leads to vastly higher revenues in 2024.

Analysts.....

According to the issued ratings of 31 analysts in the last year, the consensus rating for Advanced Micro Devices stock is Moderate Buy based on the current 8 hold ratings, 22 buy ratings and 1 strong buy rating for AMD. The average twelve-month price prediction for Advanced Micro Devices is $130.03 with a high price target of $200.00 and a low price target of $80.00.

Summary.....

AMD has been a consistent earnings performer as of late, exceeding both earnings and revenue expectations in nine of its last ten releases. Just in its latest print, AMD delivered a 7% EPS beat paired with a modest revenue surprise.

It’s worth noting that the market has been impressed with the last two releases, with AMD shares seeing notable bullish momentum post-earnings.

Advanced Micro Devices traded up $0.95 during trading hours on Monday, reaching $113.91. The company’s stock had a trading volume of 47,066,970 shares, compared to its average volume of 64,021,328. The firm has a market capitalization of $183.44 billion, a price-to-earnings ratio of 491.61, and a P/E/G ratio of 8.59 and a beta of 1.86. Advanced Micro Devices, Inc. has a 1-year low of $54.57 and a 1-year high of $132.83. The company has a debt-to-equity ratio of 0.05, a current ratio of 2.38 and a quick ratio of 1.74. The company’s 50-day moving average is $116.22 and its two-hundred day moving average is $97.17.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from AMD

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!