TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Alcoa Weekly Call Option up 133% Profit!

Is There More To Come?

Join Us and Get the Trades!

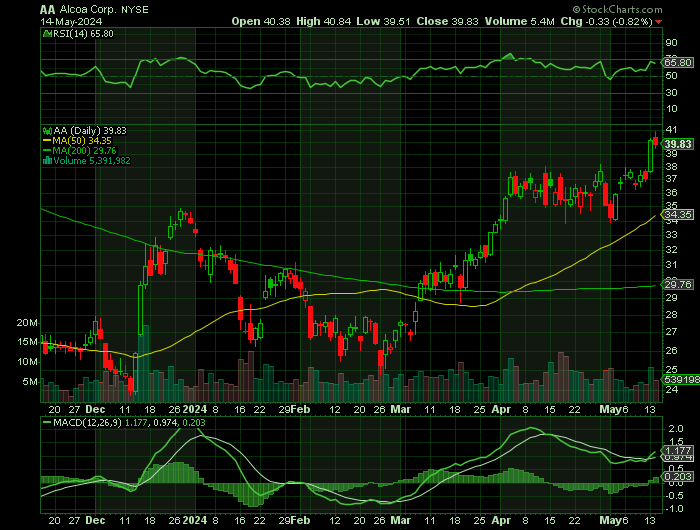

Shares of Alcoa Corp (NYSE: AA) hit a new 52-week high during mid-day trading on Monday.

Alcoa pre-market Tuesday, poised to potentially add to recent gains after posting a 52-week intraday high of $40.31 on Monday, as the Biden administration unveiled new tariffs on Chinese electric vehicles, semiconductors, batteries, solar cells, steel and aluminum.

This set the scene for Weekly Options USA Members to profit by 133% using an AA Weekly Options trade!

Join Us And Get The Trades – become a member today!

Tuesday, May 14, 2024

by Ian Harvey

UPDATE

Shares of Alcoa Corp (NYSE: AA) hit a new 52-week high during mid-day trading on Monday.

Alcoa pre-market Tuesday, poised to potentially add to recent gains after posting a 52-week intraday high of $40.31 on Monday, as the Biden administration unveiled new tariffs on Chinese electric vehicles, semiconductors, batteries, solar cells, steel and aluminum.

Also, the London Metal Exchange reported aluminum stocks rose to their highest since November 2021 following a second large delivery into warehouses in Malaysia’s Port Klang in recent days.

Why the Alcoa Weekly Options Trade was Originally Executed!

Alcoa Corp (NYSE: AA) shares now look ready to bounce, according to a historically bullish signal.

Specifically, the equity's recent peak comes amid historically low implied volatility (IV), which has been a bullish combination for Alcoa stock in the past. There have been three other times in the past five years when the stock was trading within 2% of its 52-week high.

Data shows that one month after these signals, the stock was higher, averaging a 10.4% return for that time period. From its current perch, a move of similar magnitude would put Alcoa stock at a fresh 52-week high of $40.

An unwinding of short interest could push the equity even higher. Short interest added 17% in the last two reporting periods, and the 15.41 million shares sold short make up 8.7% of the stock's available float.

A sentiment shift in the options pits could also generate tailwinds. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), AA's 50-day call/put volume ratio sits higher than 87% of readings from the last 12 months.

Shares of this bauxite, alumina and aluminum products company have returned +10.7% over the past month.

The Alcoa Weekly Options Potential Profit Explained.....

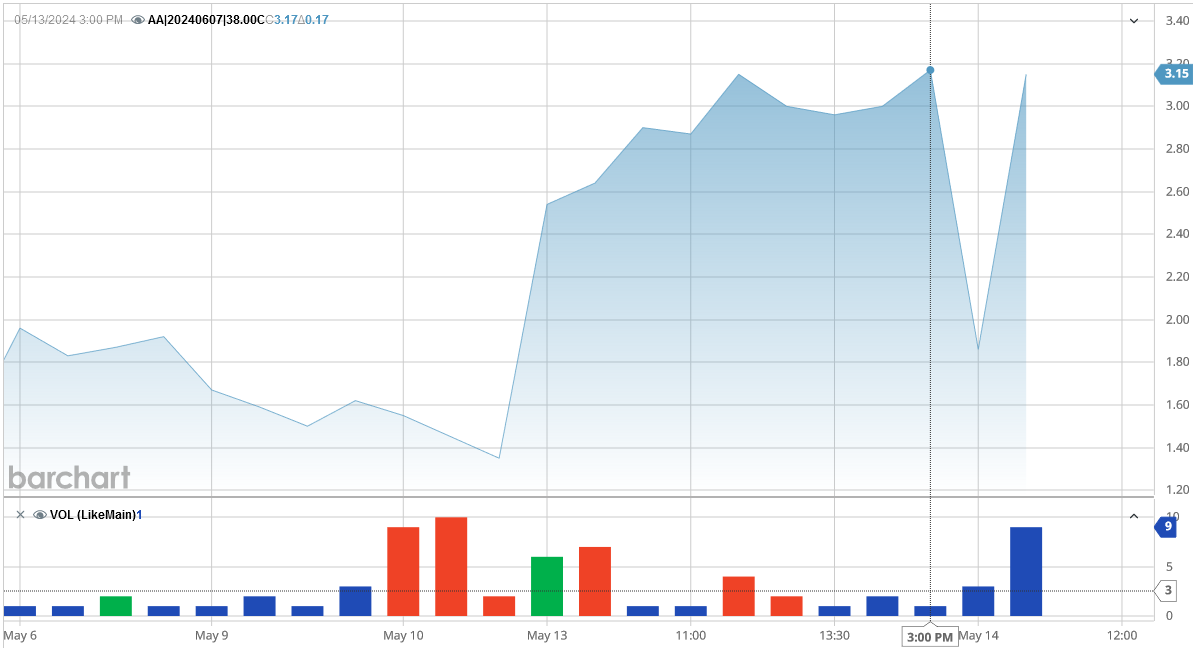

** OPTION TRADE: Buy AA JUN 07 2024 38.000 CALLS - price at last close was $1.62 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the AA Weekly Options (CALL) Trade on Friday, May 10, 2024 for $1.35.

Sold the AA weekly options contracts on Monday, May 13, 2024 for $3.15; a potential profit of133%.

(This result will vary for members depending on their entry and exit strategies).

Don’t miss out on further trades – become a member today!

About Alcoa.....

Alcoa Corporation, together with its subsidiaries, produces and sells bauxite, alumina, and aluminum products in the United States, Spain, Australia, Iceland, Norway, Brazil, Canada, and internationally.

The company operates through two segments, Alumina and Aluminum. It engages in bauxite mining operations; and processes bauxite into alumina and sells it to customers who process it into industrial chemical products, as well as aluminum smelting and casting businesses. The company offers primary aluminum in the form of alloy ingot or value-add ingot to customers that produce products for the transportation, building and construction, packaging, wire, and other industrial markets; and flat-rolled aluminum in the form of sheet, which is sold primarily to customers that produce beverage and food cans.

In addition, it owns hydro power plants that generates and sells electricity in the wholesale market to traders, large industrial consumers, distribution companies, and other generation companies.

The company was formerly known as Alcoa Upstream Corporation and changed its name to Alcoa Corporation in October 2016. The company was founded in 1886 and is headquartered in Pittsburgh, Pennsylvania.

Further Catalysts for the AA Weekly Options Trade…..

The White House issued the following statement on the necessity of Biden’s proposed steel tariffs:

“Chinese policies and subsidies for their domestic steel and aluminum industries means high-quality U.S. products are undercut by artificially low-priced Chinese alternatives produced with higher emissions. To the extent consistent with the United States Trade Representative’s (USTR) review of Section 301 tariffs and findings of her investigation, President Biden is calling for USTR to consider enhancing the effectiveness of tariffs on Chinese steel and aluminum products by tripling them.”

This type of economic measure has the potential to significantly strengthen the U.S. steel and aluminum industry. As Axios reports, it won’t happen overnight. However, Biden is making clear what he sees as the best course of action to safeguard one of the American industries that has suffered as Chinese competition has intensified.

As Pennsylvania is a key swing state, it is likely that Biden will prioritize protecting the jobs of its workers. But this focus will likely benefit the entire industry, creating positive momentum for steel stocks.

Alcoa will likely have a clear advantage if Biden’s tariffs are implemented. Carlos De Albea, an analyst at Morgan Stanley, recently noted that the Wall Street firms expects to see domestic aluminum companies benefit more than their steelmaking peers as their sensitivity to metal prices is higher. If that proves to be true, Alcoa will be in an excellent position to continue growing, after gaining nearly 50% over the past six months.

Other Catalysts.....

Alcoa is a global leader in bauxite mining and alumina refining with significant initiatives in green technologies and low-carbon alumina production.

The company has announced a robust technology roadmap, which includes the ASTRAEA technology for recycling aluminum scrap to higher purity levels and the “Refinery of the Future” project aiming for zero-carbon emissions in alumina refining.

AA has set its production guidance for 2024, projecting alumina production to be between 9.8 and 10.0 million metric tons, with alumina shipments expected to range between 12.7 and 12.9 million metric tons.

Furthermore, Alcoa’s financial outlook for 2024 anticipates challenges, projecting a net loss. However, for 2025, the company is expected to see a positive turnaround with a substantial net income.

It seems that AA’s valuation has been discounted too harshly given that its fundamentals are set to increase. This then make it one of those undervalued materials stocks.

Earnings.....

Alcoa reported revenues of $2.6 billion in the last reported quarter, representing a year-over-year change of -2.7%. EPS of -$0.81 for the same period compares with -$0.23 a year ago.

Compared to the Consensus Estimate of $2.52 billion, the reported revenues represent a surprise of +3.14%. The EPS surprise was -30.65%.

Over the last four quarters, Alcoa surpassed consensus EPS estimates two times. The company topped consensus revenue estimates three times over this period.

Earnings Expectations.....

Alcoa is expected to post earnings of $0.11 per share for the current quarter, representing a year-over-year change of +131.4%. Over the last 30 days, the Consensus Estimate has changed +126.7%.

The consensus earnings estimate of $0.20 for the current fiscal year indicates a year-over-year change of +108.8%. This estimate has changed -60.3% over the last 30 days.

For the next fiscal year, the consensus earnings estimate of $2.16 indicates a change of +980% from what Alcoa is expected to report a year ago. Over the past month, the estimate has changed +10.2%.

The consensus sales estimate of $2.73 billion for the current quarter points to a year-over-year change of +1.7%. The $10.96 billion and $11.47 billion estimates for the current and next fiscal years indicate changes of +3.9% and +4.7%, respectively.

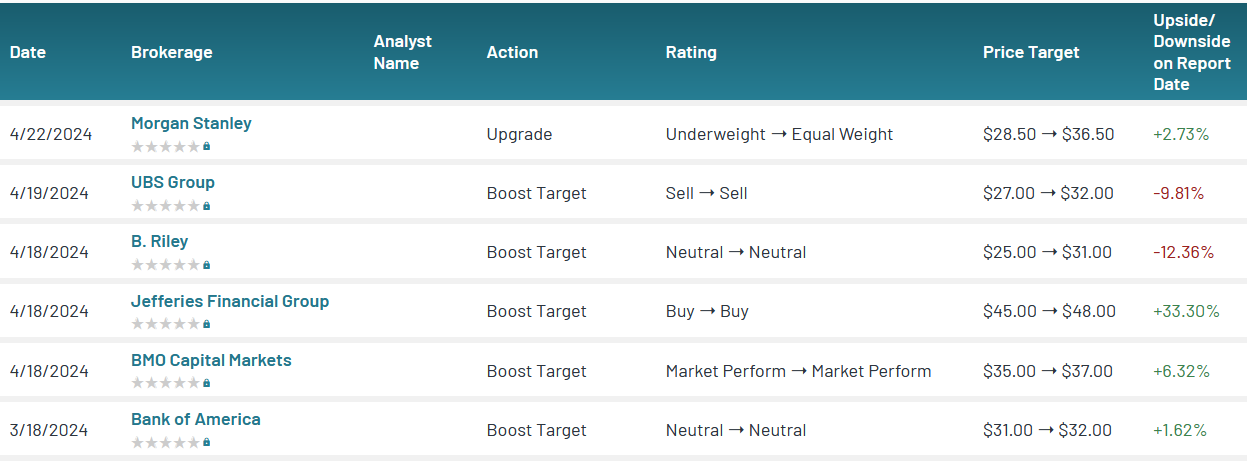

Analysts.....

According to the issued ratings of 13 analysts in the last year, the consensus rating for Alcoa stock is Hold based on the current 2 sell ratings, 8 hold ratings and 3 buy ratings for AA. The average twelve-month price prediction for Alcoa is $33.54 with a high price target of $48.00 and a low price target of $25.00.

Summary.....

Alcoa shares traded up $0.72 during trading on Thursday, reaching $37.36. 4,532,336 shares of the stock traded hands, compared to its average volume of 6,342,817. The company has a 50-day moving average of $33.59 and a 200-day moving average of $29.95. Alcoa has a 52-week low of $23.07 and a 52-week high of $38.20. The stock has a market capitalization of $6.71 billion, a P/E ratio of -9.74, and a price-to-earnings-growth ratio of 3.77 and a beta of 2.45. The company has a debt-to-equity ratio of 0.45, a current ratio of 1.61 and a quick ratio of 0.93.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from ALCOA

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!