TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Amazon Stock

Jumps After Earnings Report!

Weekly

Options Members Profit Up 85%!

Amazon.com, Inc. (NASDAQ: AMZN)’s stock has rallied following a strong Q3 earnings report, reflecting the company’s robust financial health and investor confidence.

For Q3, Amazon reported earnings per share (EPS) of $1.43, substantially higher than analysts’ expectations of $1.16.

Revenue reached $158.9 billion, beating the forecasted $157.29 billion.

Amazon’s Q3 earnings report is a testament to its strategic agility and commitment to innovation.

This set the scene for Weekly Options USA Members to profit by 85% using an AMZN Weekly Options trade!

Join Us And Get The Trades – become a member today!

Friday, November 01, 2024

by Ian Harvey

UPDATE

Amazon.com, Inc. (NASDAQ: AMZN)’s recent Q3 earnings report has energized investor confidence, propelling its stock up by an impressive 6.2%. With revenue at $158.9 billion and earnings per share of $1.43—both exceeding analyst expectations—Amazon is showcasing resilience and strategic growth. Key drivers behind this momentum include the robust performance of Amazon Web Services (AWS), which reached $27.5 billion in revenue, and Amazon's strategic push in AI investments, supported by a projected $75 billion in capital expenditures for 2024.

CEO Andy Jassy underscored AI as a "once-in-a-lifetime opportunity," aiming to further strengthen AWS’s cloud capabilities and fuel demand. Additionally, Amazon's operating income hit $17.4 billion, a significant 18% above Wall Street estimates, alleviating prior concerns regarding profitability amidst heavy AI and infrastructure spending. This solid performance reinforces Amazon's role in Big Tech, with a market cap back over $2 trillion and shares rising 31% this year.

By maintaining efficiency in retail operations and capitalizing on emerging technologies, Amazon is well-positioned to continue delivering value to its shareholders.

READ THE FULL ARTICLE “Amazon Stock Has Rallied After Earnings Report!”

The AMZN Weekly Options Potential Profit Explained.....

** PROPOSED OPTION TRADE: Buy AMZN NOV 01 2024 190.000 CALLS - price at last close was $5.45 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the AMZN Weekly Options (CALL) Trade on Thursday, October 10, 2024 for $5.69.

Sold the AMZN Weekly Options contracts on Friday, November 01, 2024, for $10.50; a potential profit of85%.

miss out on further trades – become a member today!

Why the AMZN Weekly Options Trade was Originally Executed!

Trade Analysis

Current Situation

Amazon.com, Inc. (NASDAQ: AMZN) is a global leader in e-commerce and cloud computing, and is part of the prestigious FAANG group. Initially a bookstore, Amazon has diversified into virtually every sector of retail and has developed a substantial technological footprint with its Amazon Web Services (AWS).

The company's growth has been propelled by continuous innovation and expansion into new markets such as groceries, pharmaceuticals, and, more recently, AI and cloud computing. Amazon's market position allows it to leverage its size and data to maintain a competitive edge.

In recent developments, Amazon has added Apple TV+ to its Channels Store, enhancing its streaming service offerings. This strategic move is expected to attract more Prime subscribers and boost the company's revenue streams from content distribution.

Key Insights from Earnings Call

Amazon's latest earnings call highlighted significant growth in its AWS segment, which continues to outperform the broader market. The company's commitment to reinvesting in technology and infrastructure, particularly in AI and machine learning, positions it well for sustained long-term growth.

The introduction of new AI-powered shopping guides indicates Amazon's focus on enhancing consumer experience and personalization, utilizing AI to streamline shopping processes and improve customer satisfaction.

Catalysts for the Trade

- Expansion into New Markets: Amazon's recent foray into streaming and AI-driven services presents new revenue channels and potential market share expansion.

- Technological Advancements: Continued investment in AWS and AI technologies is set to bolster Amazon's competitive advantage and attract a larger customer base.

- Strategic Partnerships: Collaborations with major industry players like Apple enhance Amazon's service offerings and market reach.

Further Catalysts

Amazon's ongoing expansion into pharmaceuticals and healthcare could disrupt traditional industries and create new growth avenues. The company's ability to integrate these services into its existing ecosystem could significantly enhance its market position and profitability.

Analysts are optimistic about Amazon's growth trajectory, citing its robust business model and innovative capabilities. The consensus among market experts suggests a strong buy rating, reflecting confidence in its future performance.

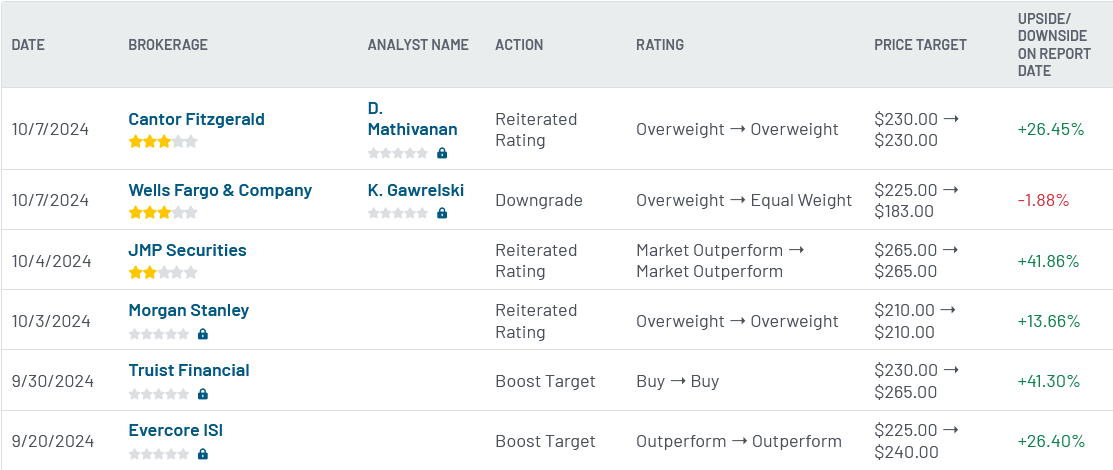

Analyst Reactions

Recent analyses by Wall Street experts have consistently rated Amazon as a strong buy, emphasizing its solid fundamentals and potential for stock price appreciation. Analysts highlight the company's agility in adapting to market demands and its strategic investments in technology as key drivers of its valuation.

Company Overview

Founded by Jeff Bezos in 1994, Amazon.com, Inc. has evolved from a small online bookstore to a behemoth in both e-commerce and cloud computing. Headquartered in Seattle, Washington, Amazon is known for its disruption of well-established industries through technological innovation and mass scale.

Amazon's business model includes a vast array of products and services, including retail goods, subscription services, and cloud infrastructure. The company's ability to scale its operations globally is a testament to its logistical prowess and forward-thinking approach.

Technical Analysis

- Market Capitalization: Approximately $1.5 trillion

- PE Ratio: Around 60, indicating growth expectations

- Beta: 1.32, showing moderate volatility

- 52-Week Range: $101.26 - $188.65

- 50-Day Moving Average: $176.50

- 200-Day Moving Average: $150.30

Summary

Amazon presents a compelling investment opportunity due to its market dominance, continuous innovation, and expansion into new business areas. The company's strategic initiatives, particularly in AI and cloud computing, are expected to drive significant growth, making it a favorable option for investors.

Trade Execution

Consider placing a buy order for AMZN NOV 01 2024 190.000 CALLS, with a premium of $5.45. Adjust your sell point and stop loss according to your risk tolerance.

Disclaimer

This trade suggestion is based on the current market analysis and is not a guaranteed success. Always consider your risk tolerance and consult with a financial advisor if necessary.