TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Advanced Micro Devices MONTHLY PUT Option Up 163%!

Become a Member and Get future Trades.

Advanced Micro Devices, Inc. (NASDAQ AMD) was expected to only report a slight year-over-year improvement in revenue when it hands down its first quarter earnings after Tuesday’s closing bell.

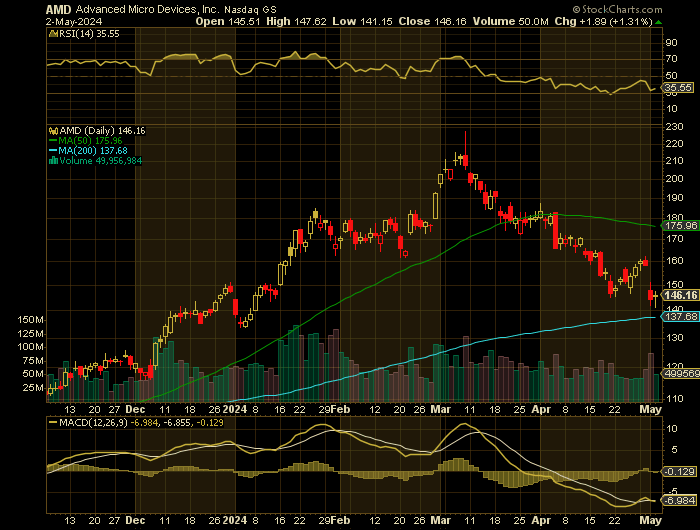

However, AMD stock sank Wednesday following the company's first-quarter earnings release. The semiconductor company's share price ended the daily trading session down 9%.

Morgan Stanley analysts cut their price target on AMD to $177 from $193 while keeping an overweight rating on the shares.

This set the scene for Monthly Options USA Members to profit by 163% using an AMD Monthly Options trade!

Become a Member Today and get future trades!

Thursday, May 02, 2024

by Ian Harvey

UPDATE

Advanced Micro Devices (NASDAQ: AMD) stock sank Wednesday following the company's first-quarter earnings release. The semiconductor company's share price ended the daily trading session down 9%.

AMD recorded non-GAAP (adjusted) earnings per share of $0.62 on sales of $5.47 billion in the first quarter. Meanwhile, the average analyst estimate had called for the business to post per-share earnings of $0.61 on revenue of $5.45 billion.

Performance came in below the levels that some analysts were anticipating, and questions remain about how much of a boost from artificial intelligence (AI) the business is poised to see in the near term.

AMD's data center business posted some encouraging year-over-year growth, big declines in other segments mean the processing specialist recorded relatively muted growth in Q1. AMD remains significantly behind Nvidia in the market for data center graphics-processing units, and its relatively slow growth momentum is causing some investors to sell out of the stock today.

Why the Advanced Micro Devices Monthly Options Trade was Originally Executed!

Advanced Micro Devices, Inc. (NASDAQ AMD) is expected to only report a slight year-over-year improvement in revenue when it hands down its first quarter earnings after Tuesday’s closing bell.

The chip maker is expected to report a modest 1.2% increase in revenue from $5.35 billion in Q1 2023 to $5.42 billion, in line with AMD’s guidance of $5.4 billion.

Earnings per share (EPS) are expected to be flat year-over-year at $0.61.

Analysts reviewed their stock price targets for AMD ahead of the Santa Clara, Calif.-based company's earnings report.

Morgan Stanley analysts cut their price target on AMD to $177 from $193 while keeping an overweight rating on the shares.

Analysts said that, regarding its core business, chips for PCs and laptops, they believe that AMD's first-quarter and second-quarter guidance should be roughly in line.

Demand for chips used in PCs looks slightly weaker than seasonality suggests ahead of the second quarter, but servers should be stronger. Also, XLNX is bottoming out, the firm said, referring to AMD’s $49 billion acquisition of chip company Xilinx, completed in 2022 and described as the largest chip deal in history.

The AMD MONTHLY Options Potential Profit Explained.....

** OPTION TRADE: Buy AMD MAY 17 2024 150.000 PUTS - price at last close was $5.30 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the AMD Monthly Options (PUT) Trade on Tuesday, April 30, 2024 for $3.95.

Sold the AMD Monthly options contracts on Thursday, May 02, 2024 for $10.00; a potential profit of163%.

(This will vary for members depending on their entry and exit strategies).

Don’t miss out on further trades – become a member today!

Further Catalysts for the AMD Monthly Options Trade…..

AMD is slated to report first-quarter earnings on Tuesday and one Wall Street firm sees the semiconductor company as a "battleground" stock worth tracking.

Analysts expect AMD, engaged in an ongoing war for market share with AI chip-making titan Nvidia (NVDA) , to report 62 cents per share on $5.48 billion in revenue.

In January, AMD reported fourth-quarter earnings of 77 cents per share, up from 69 cents in the year-ago quarter.

Revenue totaled $6.17 billion, up from $5.60 billion in the year ago quarter and beating FactSet's call for $6.13 billion in sales.

AMD said data center revenue would be flat in the first quarter, with seasonal declines in server central processing units (CPUs) offset by sales of graphics processing units (GPUs), which are needed to train and deploy generative AI models.

Analysts Opinions.....

Morgan Stanley said its view is constructive in the longer term, but given those factors, it doesn't see this quarter as a catalyst.

Analysts at Bank of America maintained their buy rating on AMD and a $195 per share price target. The firm expects continued server strengths to more than offset the ongoing PC correction and embedded/gaming resets in the first and second quarters.

In a note entitled "Core Wars," BofA said it expects server CPU inventories to normalize generally following a 33% year-over-year shipment decline in 2023.

By the second half, BofA said it expects a “broad-based cyclical recovery of non-AI segments” on easier half-on-half versus year-over-year comparisons, with AI revenues accelerating on new Epyc Turin, MI300X ramps.

Susquehanna lowered the firm's price target on AMD to $185 from $200 while keeping a positive rating on the shares.

The firm expects in-line guidance to be slightly weaker as Server/PC/XLNX/Gaming continue to weigh on results

Guidance for its MI300x AI chips will be a key focus for investors.

Last week, Deutsche Bank analysts maintained their hold rating and $150 price target on AMD, telling investors that the firm expected the company's fundamentals to "remain bifurcated" as data center and AI goodness is partially offset by ongoing cyclical challenges across client, gaming, and embedded.

"Overall, the dimming of AI enthusiasm in recent weeks has presented an intriguing pullback in AMD shares for some, and we have high confidence in management's ability to continue to convey a positive AI-related message on the earnings call," said Deutsche Bank.

"However, with shares still in-line with our price targets, we believe AMD is fairly valued and thus maintain our Hold rating," the firm said.

Therefore…..

For future trades, join us here at Monthly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from Advanced Micro Devices

Recent Articles

-

191% Weekly Option Win on Super Micro Computer Amid Market Mayhem

191% Weekly Option Win on Super Micro Computer Amid Market Mayhem – What’s Next? -

Tariffs and the Stock Market: Positive and Negative Impacts in 2025

Tariffs and the Stock Market: Positive and Negative Impacts in 2025. This article explores both the positive and negative effects of tariffs on the stock market based on recent data, forecasts, and ma… -

SMCI’s Wild Ride: Options Traders Are Profiting From the Ups and Downs

SMCI’s Wild Ride: How Options Traders Are Profiting From the Ups and Downs