TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Apple Inc

Shares Hit A Record Price!

And Members Are Up 124% Potential Profit

Using A Weekly Call Option!

Members of “Weekly Options USA,” Using A Weekly Call Option,

Make Potential Profit Of 124%,

After

Apple's Biggest Product Event In Years

Which Wasn't

Just About The Vision Pro.

Along The Way, The Company Also Outlined The Next

Major Ios Software Update,

A New Line Of Macbook Airs, And A $7,000 Mac Pro Desktop.

Where To Now?

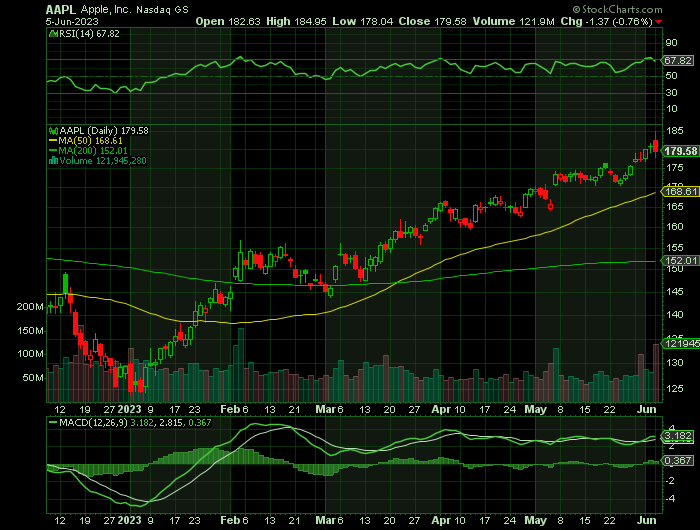

Apple Inc shares briefly shot to a record high of $184.36 during intraday trading yesterday.

This set the scene for Weekly Options USA Members to profit by 124%, using an AAPL Weekly Options trade!

Join Us And Get The Trades – become a member today!

Tuesday, June 06, 2023

by Ian Harvey

Prelude…..

Apple Inc. (NASDAQ:AAPL) debuted a number of updates for the software powering its popular Apple Watch during its Worldwide Developers Conference (WWDC) 2023 Monday.

Also, Apple finally unveiled its mixed-reality headset, dubbed Vision Pro and set for launch sometime early next year. The Cupertino company's share price briefly shot to a record high of $184.36 during intraday trading, with some speculating its market cap could soon hit $3 trillion.

Apple's biggest product event in years wasn't just about the Vision Pro. Along the way, the company also outlined the next major iOS software update, a new line of MacBook Airs, and a $7,000 Mac Pro desktop.

Why the Apple Weekly Options Trade was Executed?

Apple Inc. (NASDAQ:AAPL) is one of the most well-known tech companies in the world, best known for producing the iPhone series of cellphones, which maintains an estimated 53% share of the domestic smartphone market. Apple is also well-known for its Mac computers, iPad series of tablet devices and streaming services like Apple Music and Apple TV. In May of 2023, Apple had a total market capitalization of more than 2.7 trillion, qualifying it for inclusion in some of the largest tech ETFs on the market.

Apple's most recent earnings report may indicate a more conservative approach to growth moving forward. While the company reported revenue of $94.8 billion (down about 3% year after year), Apple CEO Tim Cook emphasized that continued expansion of service infrastructure meant investors could expect more growth in the future. Sustainability and responsible growth were also hot topics.

"We are pleased to report a record in services and a March quarter record for iPhone despite the challenging macroeconomic environment and to have our installed base of active devices reach an all-time high," said Cook. "We continue to invest for the long term and lead with our values, including making major progress toward building carbon-neutral products and supply chains by 2030."

The Apple Weekly Options Trade Explained.....

** OPTION TRADE: Buy AAPL JUN 23 2023 185.000 CALLS - price at last close was $2.00 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the AAPL Weekly Options (CALL) Trade on Friday, June 02, 2023, at 9:49, for $1.90.

Sold half the AAPL weekly options contracts on Monday, June 05, 2023, for $4.26; a potential profit of 124%.

Total Dollar Profit is $426 - $190 (cost of contract) = $236

Holding the remaining AAPL weekly options contracts for further profit before expiry.

Don’t miss out on further trades – become a member today!

About Apple.....

Apple Inc. designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide.

It also sells various related services. In addition, the company offers iPhone, a line of smartphones; Mac, a line of personal computers; iPad, a line of multi-purpose tablets; AirPods Max, an over-ear wireless headphone; and wearables, home, and accessories comprising AirPods, Apple TV, Apple Watch, Beats products, HomePod, and iPod touch.

Further, it provides AppleCare support services; cloud services store services; and operates various platforms, including the App Store that allow customers to discover and download applications and digital content, such as books, music, video, games, and podcasts.

Additionally, the company offers various services, such as Apple Arcade, a game subscription service; Apple Music, which offers users a curated listening experience with on-demand radio stations; Apple News+, a subscription news and magazine service; Apple TV+, which offers exclusive original content; Apple Card, a co-branded credit card; and Apple Pay, a cashless payment service, as well as licenses its intellectual property.

The company serves consumers, and small and mid-sized businesses; and the education, enterprise, and government markets. It distributes third-party applications for its products through the App Store. The company also sells its products through its retail and online stores, and direct sales force; and third-party cellular network carriers, wholesalers, retailers, and resellers.

Apple Inc. was incorporated in 1977 and is headquartered in Cupertino, California.

Further Catalysts for the AAPL Weekly Options Trade…..

Known for its innovation, Apple's continuous product releases and improvements contribute directly to its growth and stock value.

Apple's 2023 product lineup includes the iPhone 15 and 15 Pro, which will be the first two iPhone models to introduce USB-C instead of lightning charging features. The Apple Watch Series 9 is anticipated to be released in September of 2023 and may feature enhanced use of biometric data to provide personalized health data points.

Growth.....

As a major component of every tech index, Apple has several opportunities for growth across various areas. Geographically, Apple has been increasingly expanding its retail presence in countries like China and Idea, which present opportunities to access new customer bases.

Apple has also been investing heavily in augmented reality (AR) technologies and has already released AR-enabled apps for the iPhone and iPad. As AR continues to become more mainstream, Apple has an opportunity to develop new products and services that leverage this technology.

Apple has been making inroads in the growing healthcare industry with products like the Apple Watch, which can monitor heart rate and other health metrics. As healthcare becomes increasingly digitized and personalized, Apple has an opportunity to expand its offerings and develop new healthcare-focused products and services. Investors may see the potential for a personalized intersection of health improvement and tech in the Apple Watch in particular, which can do things like track sleep patterns and enable reminders to take medications.

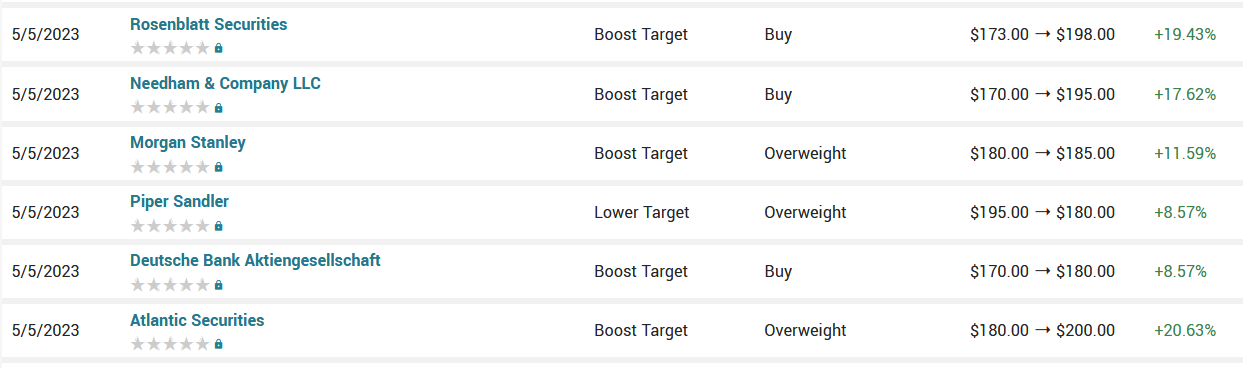

Analysts.....

Analyst ratings of Apple have remained consistently positive, awarding the company an average rating of a "moderate buy." While the stock's predicted upside has dropped in the last three years, this indicates that Apple stock has risen in price alongside analyst predictions.

According to the issued ratings of 33 analysts in the last year, the consensus rating for Apple stock is Moderate Buy based on the current 2 sell ratings, 5 hold ratings and 26 buy ratings for AAPL. The average twelve-month price prediction for Apple is $174.73 with a high price target of $205.00 and a low price target of $54.00.

Summary.....

The most

recent product rumor that may influence Apple's stock price is its new

mixed-reality headset. The headset, which should release in late 2023, is

anticipated to feature two 8K displays with a higher refresh rate, a powerful

processor and a fan to prevent overheating. It may also include a passthrough

camera, allowing users to see the real world without removing the headset. This

feature can be a useful safety function for use in small spaces or by

children.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from APPLE

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!