TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Apple

MONTHLY Call Option Up 261%!

Become a Member and Get future Trades.

Apple Inc. (NASDAQ:AAPL) was expected to release earnings results for its second quarter, after the closing bell on May 2.

Apple was able to exceed quarterly expectations for its fiscal second quarter Thursday after the market closed and announced an increase in its dividend and stock buybacks.

This set the scene for Monthly Options USA Members to profit by 261% using an APPL Monthly Options trade!

Become a Member Today and get future trades!

Saturday, May 04, 2024

by Ian Harvey

UPDATE

Apple Inc. (NASDAQ:AAPL) was able to exceed quarterly expectations for its fiscal second quarter Thursday after the market closed and announced an increase in its dividend and stock buybacks.

Revenue records in more than a dozen countries helped Apple post an all-time high for Q2 EPS at $1.53 which edged estimates of $1.51 a share and rose a percentage point from the comparative quarter. Canada, Latin America, and the Middle East were some of the international segments that saw record growth with Q2 sales of $90.75 billion beating estimates by 1% despite decreasing from $94.83 billion a year ago.

Apple’s board authorized an additional $110 billion for share repurchases given continued confidence in its business as the tech giant aims to be cash-neutral. Additionally, Apple will be raising its dividend by 4% to $0.25 per share (quarterly) and is planning for more annual payout increases going forward.

Why the Apple Monthly Options Trade was Originally Executed!

Apple Inc. (NASDAQ:AAPL) is expected to release earnings results for its second quarter, after the closing bell on May 2.

Analysts expect the Cupertino, California-based company to report quarterly earnings at $1.50 per share, up from $1.42 per share in the year-ago quarter. Apple is projected to report quarterly revenue of $90.01 billion, compared to $88.5 billion in the year-earlier quarter.

Apple recently acknowledged a recurring issue with iPhone alarms failing to sound, following complaints from users on social media platforms like Twitter and TikTok.

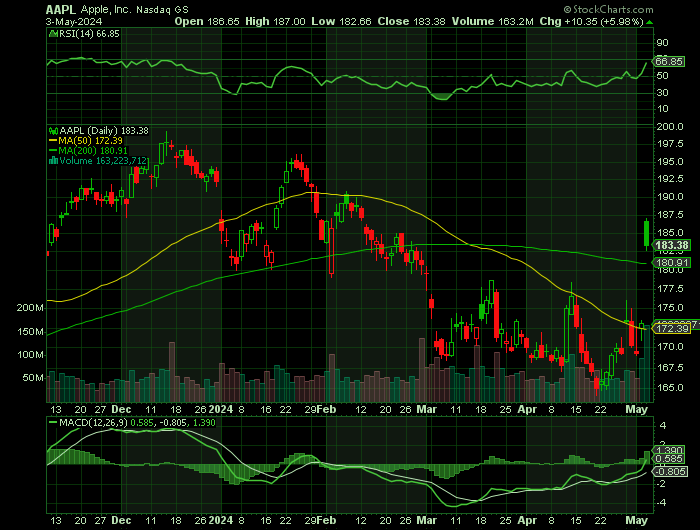

Apple stock is down 11.53% year-to-date, weighed down by a weak iPhone 15 cycle.

The consensus analyst rating on Apple stock stands at an Outperform currently with a price target of $196.77 a share. The more recent analyst reviews on the stock, April 22 onwards, came from Citigroup, Bernstein, and Morgan Stanley. These three firms have an average price target of $205 per share, implying a 20.62% upside for Apple stock.

Bernstein analyst Toni Sacconaghi suggests “buying the fear” in Apple stock, anticipating a strong iPhone 16 cycle.

The AAPL MONTHLY Options Potential Profit Explained.....

** OPTION TRADE: Buy AAPL JUN 21 2024 180.000 CALLS - price at last close was $5.30 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the AAPL Monthly Options (CALL) Trade on Wednesday, May 01, 2024 for $3.10.

Sold the AAPL Monthly options contracts on Friday, May 03, 2024 for $11.20; a potential profit of261%.

(This will vary for members depending on their entry and exit strategies).

Don’t miss out on further trades – become a member today!

Therefore…..

For future trades, join us here at Monthly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from APPLE

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!