TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Apple Weekly Options Trade Pays-Off!

“Weekly Options” Members

Profit Up 175%!

Another Trade Anticipated!

Sunday, July 18, 2021

by Ian Harvey

An Apple Weekly Options trade provided members with a potential profit of 175% on Thursday after bullish analyst commentary and reports of substantially higher iPhone production rates.

Another weekly options trade is now being anticipated based on the original catalysts, as well as further positive developments during the past week.

Apple Inc. (NASDAQ:AAPL)

Prelude…..

On Monday, July 12, 2021, an Apple Weekly Options trade was recommended to our members based on several catalysts.

READ Details of Original Apple Weekly Options Recommendation Further Below.....

However, since that report there has been several new developments to bolster the recommended trade – and since the pullback on Friday a new Apple weekly options trade has become a very viable proposition.

1. Apple Pay Later - Apple is working on a new service that will let consumers pay for any Apple Pay purchase in installments over time, rivaling the “buy now, pay later” offerings popularized by services from Affirm Holdings Inc. and PayPal Holdings Inc.

The upcoming service, known internally as Apple Pay Later, will use Goldman Sachs Group Inc. as the lender for the loans needed for the installment offerings.

The buy now, pay later system could help drive Apple Pay adoption and convince more users to use their iPhone to pay for items instead of standard credit cards.

, instructing manufacturers to build 90 million iPhones this year, a 20% increase on the 75 million units it produced last year.

Credit

Suisse expects iPhone sales of 234 million units this year, 237 million units

in 2022 and 249 million units in 2023. Though Apple no longer reports iPhone

unit sales, it declared $47.94 billion in iPhone revenue in its fiscal Q2

earnings, up 65.5% year over year.

The renewed optimism in all things Apple is not surprising to J.P. Morgan’s Samik Chatterjee. The analyst recently told investors Apple is well set up to outperform in 2H21. In fact, the growing confidence means Chatterjee has added Apple to the firm’s Analyst Focus List as “a Growth idea.”

“The recent momentum led by better market share, drives us to also estimate higher sustainable volumes in future quarters, leading us to see a path to Apple outperforming investor expectations over a longer time horizon rather than just the upcoming earnings print,” the analyst said, confirming Apple is also a Top Pick.

To reflect the increase in build rates, Chatterjee has “modestly” increased iPhone volume expectations, but of more importance to the analyst is the “path to upside” for the shares in the medium-term.

To this end, Chatterjee rates Apple shares an Overweight (i.e. Buy), while slightly lifting the price target from $170 to $175. The revised figure implying shares will add 19.5% from current levels.

3. Apple stock has heavy exposure to ETF’s.....

- iShares Dow Jones US Technology ETF IYW – APPL takes the second spot with 17.72% weight.

- Select Sector SPDR Technology ETF XLK – APPL holds the top spot with 21.13% weight.

- Vanguard Information Technology ETF VGT – APPL occupies the first location with 20.13% weight.

4. Momentum is expected to continue in the Services segment driven by App Store, Cloud Services, Music, advertising and AppleCare. The company recently launched Apple Podcast Subscriptions for listeners in more than 170 countries.

Apple’s endeavors to open up its ecosystem through partnerships with the likes of Samsung and Amazon are positives for its Services segment. The subscription-based Apple TV+, Apple News and Apple Arcade services are expected to benefit from the company’s strong installed base. Markedly, Apple currently has more than 660 million paid subscribers across its Services portfolio.

5. Future Development - Apple’s focus on user privacy, as reflected by its latest iOS 15, iPadOS 15, macOS Monterey, and watchOS 8 updates (all to be launched later this year), is a game changer.

6. Expected Earnings - Apple stock has an impressive record of positive earnings surprises, as it hasn't missed earnings consensus estimate in any of the last four quarters. In its last earnings report on April 28, 2021, Apple reported EPS of $1.4 versus consensus estimate of $1 while it beat the consensus revenue estimate by 15.41%.

For the current fiscal year, Apple is expected to post earnings of $5.19 per share on $356.51 billion in revenues. This represents a 58.23% change in EPS on a 29.87% change in revenues. For the next fiscal year, the company is expected to earn $5.36 per share on $372.87 billion in revenues. This represents a year-over-year change of 3.29% and 4.59%, respectively.

Two analysts revised their earnings estimate upwards in the last 60 days for fiscal 2021. The Consensus Estimate has increased $0.09 to $5.19 per share. AAPL boasts an average earnings surprise of 23%.

7. Other Analysts Positivity - Loup Ventures’ co-founder and managing partner Gene Munster is of the opinion that Apple’s stock will rally higher in the coming months. he stated that “ultimately that I think the best days are still ahead of the company, whether it’s 5G, augmented reality, what they’re going to do in health care and transportation and other additional services.”

The growth recorded by Apple in various aspects of its business could see its stock price reach $200 by the end of 2021, Munster added. He is predicting a 40% increase in the stock price over the coming months.

Jim Suva, a senior tech analyst at Citigroup, expects the company to experience an increase in revenue and sales. As such, the expected increase in Apple’s stock price will come from the increase in revenue and sales over the coming months.

As well, Morgan Stanley's Kathy Huberty, on Thursday, lifted Apple’s price target by $4 to $166 per share, citing stronger demand forecasts and improving supply-chain dynamics heading into Apple's iPhone 13 launch in the fall.

"While share price performance post earnings may be more muted given Apple's recent outperformance, we are buyers heading into the iPhone 13 launch in September," Huberty said in a client note. "We see the combination of mature replacement cycles, increasing 5G adoption, improving retail store traffic, longer battery life and camera quality, and share gains against Huawei as drivers of iPhone outperformance relative to past cycles."

Huberty has June quarter revenues for Apple pegged at $74.7 billion, around 2% ahead of consensus, and September quarter earnings at $83.2 billion.

Apple shares

are up nearly 12.4% year to date, with most of that surge coming the past few

weeks. Incredibly, since June 1, Apple shares have rocketed 18%.

The Recommended Apple Weekly Options Trade.....

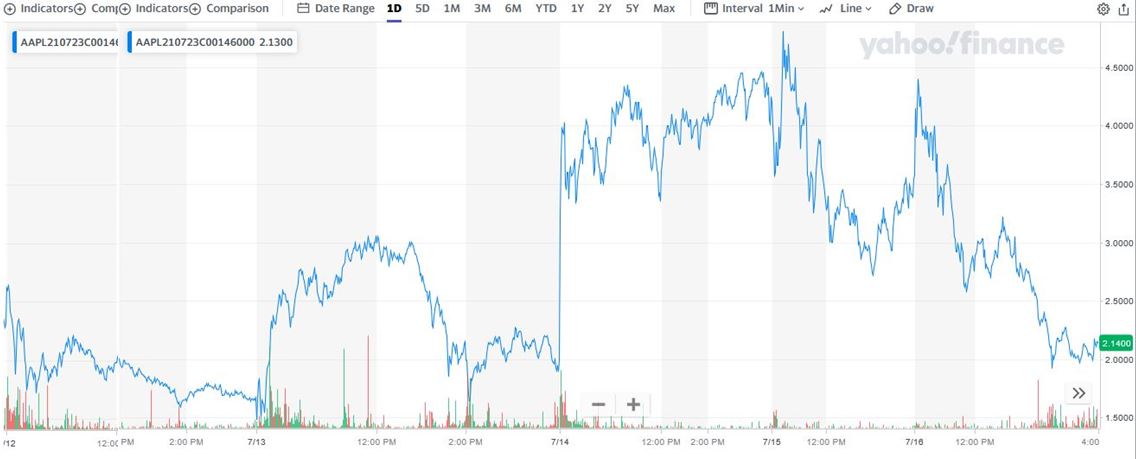

** Apple Weekly OPTIONS TRADE: Buy AAPL JUL 23 2021 146.000 CALLS at approximately $2.30.

(Actually bought for $1.75)

Apple Weekly Options Trade Call Success Explained.....

On Monday, July 12, 2021, “Weekly Options Members,” entered the Apple Weekly Options trade mentioned above for $1.75.

On Thursday, July 15, Apple Weekly Options trade had reached a high of $4.81 – up 175%.

The Apple weekly options trade declined on Friday, along with most of the market, to close at $2.14.

All set for another Apple weekly options trade – as the catalysts are still applicable.

SEE WHAT WE WILL BE

RECOMMENDING FOR A NEW

Apple Weekly Options Trade

Why the Recommendation and

the Reasoning behind

the Apple Weekly Options Trade

Shares of tech giant Apple have risen sharply in recent weeks. The stock has climbed about 15% in the last 30 days alone, to its record intraday high of $144, recovering from a slump that has persisted since late January.

Bullishness in the market for the tech stock comes ahead of Apple's fiscal third-quarter earnings report, which is set to be released on July 27.

Shares of the iPhone maker are up 7.5% in last six sessions. The advance marks the longest stretch of positive sessions for Apple since April, according to Bloomberg data.

Apple stock continues to trend very strongly toward making fresh all-time highs.

Apple gained its popularity and size by being a consummate innovator and marketer. The company enjoys a solid moat thanks largely to the stickiness of its iPhone-centric ecosystem. But despite its size, Apple still can grow much larger.

Augmented reality devices, foldable iPhones, and even a self-driving car are high on the list of potential new products on the way from Apple. The company also has opportunities in major markets where it doesn't already dominate, notably including India.

Even though Apple operates in the cyclical tech sector, the company's exceptionally loyal following has turned its products into basic-need goods. Anytime Apple unveils a new product, lines typically wrap around its stores, demonstrating the customer loyalty and innovation that are at the heart of Apple's operating model.

Legendary

investor Warren Buffett has praised Apple as "probably the best business I

know in the world," and he has a good point. The company's iPhone

ecosystem is a cash cow, and many of its customers are die-hard fans who

wouldn't consider switching to a rival.

The Major Catalysts BEHIND THE APPLE WEEKLY OPTIONS TRADE

1. Buying An Apple Weekly Options Trade Before Earnings…..

Bullishness in the market for the tech stock comes ahead of Apple's fiscal third-quarter earnings report, which is set to be released on July 27.

Analysts on average expect Apple to set a new third quarter revenue record of $72.9 billion, up around 22% from $59.7 billion in the year-ago quarter.

Based on 10 analysts' forecasts, the consensus EPS forecast for the quarter is $0.99. The reported EPS for the same quarter last year was $0.64.

2. Impressive

Growth Helps Set Up For This Apple Weekly Options Trade.....

Apple set a high bar when it reported its fiscal second-quarter results in April. Revenue during the period soared 54% year over year, crushing analysts' estimates. Of course, the period was expected to be somewhat of an anomaly due to an easy comparison in the year-ago quarter when Apple was facing supply shortages and weak demand in China amid COVID-19 lockdowns. Still, growth was higher than expected -- far higher. On average, analysts expected revenue of $77.4 billion yet the tech company's actual top line came in at an incredible $89.6 billion. Earnings per share were $1.40, beating a consensus forecast for $0.99.

It was a blockbuster quarter, to say the least.

Of course, these

strong results mean expectations are high for Apple's fiscal Q3. On average,

analysts expect Apple's fiscal third-quarter revenue to increase 22% year over

year. While this is a much lower growth rate than what Apple saw in fiscal Q2,

investors should note that the tech giant is up against a tougher year-ago

comparison. Great for our Apple weekly options trade!

3. Capital…..

Apple may have an astounding $2.4 trillion dollar market capitalization. But it also notably has more than $204 billion in cash and marketable securities ($83 billion net of its debt) and it is generating over $90 billion of free cash flow on a trailing-12-month basis. Further, Apple's gross profit margin has been expanding recently thanks to its fast-growing services business, which commands a gross profit margin that is about twice that of its products business.

Based on the company's recent growth and its fundamentals, Apple shares seem to justify their high price-to-earnings ratio of 32. This doesn't mean the stock may not trade lower at some point in the future. But the long-term prospects for the stock from this level do seem compelling.

4. Resistance…..

Now that the last big resistance at $137 before all-time highs has been taken out, it paves the way for an easier ascent for AAPL stock. The volume profile has dropped off significantly above this $137 level. The trend has gained strength above $135 and then again above $137. This is exactly what should happen given the volume profile drops off each time above these resistance levels.

There is very little volume and price resistance to stop AAPL from breaking record highs above $145.09.

5. Growth In India.....

India is the second-most-populous country in the world, counting nearly 1.34 billion people as citizens, trailing China's population of almost 1.4 billion by a small margin. Not surprisingly, global companies are competing hard for a portion of India's substantial private consumption expenditure pie, which was reportedly worth more than $460 billion in March this year, according to database provider CEIC.

Apple is one of the many companies that have been trying to crack the Indian market for a long time now, albeit with mixed results. The iPhone is still a bit player in the booming Indian smartphone space despite being in the country for many years. Apple reportedly held just 4% of India's smartphone market in the fourth quarter of 2020.

However, there are signs that Apple's fortunes in India are changing thanks to a series of smart steps, as well as the huge opportunities afforded by the upwardly mobile population that's getting exposure to new technologies. India's massive population presents a huge revenue opportunity for Apple across various device categories, and the good part is that the company is already on track to take advantage of it.

Technology market analysis firm Canalys points out that the launch of the online Apple store in India in September last year has triggered its impressive sales growth. That's not surprising, as Apple is offering trade-ins, discounts, and no-cost equated monthly installments (EMIs) through its online store, which seems to be bringing more consumers into its fold. Additionally, discounts offered by e-commerce platforms on popular Apple products are also driving sales.

More importantly, Apple is taking steps to ensure that it sustains its terrific momentum in India.

Encouraged by the sales growth spurred by its online store, Apple is now working toward opening physical stores in India. CEO Tim Cook had said in January this year that the company has plans to launch physical stores in India, and it will continue to expand that network over the long run. Sources cited by the Indian daily newspaper Business Standard suggest that Apple may be planning to open physical stores in the three metro cities of Mumbai, Bengaluru, and Delhi.

6. Strong Growth…..

Apple will continue to deliver strong growth. The rollout of high-speed 5G wireless networks is fueling a surge in demand for the latest iPhone versions. That, in turn, has helped boost Apple's sales for other products and services, including apps and EarPods.

Innovation will be the key to Apple's fortunes going forward. Look for the company to launch a foldable iPhone within the next couple of years. Apple is also building its augmented reality (AR) capabilities, with CEO Tim Cook stating publicly that AR is "critically important" for the company's future.

7. Analysts’ Opinions Bolstering Our Apple Weekly Options Trade.....

Apple's stock has caught an under-the-radar bid over the past four weeks, and the momentum may be sticking around says JPMorgan (JPM) telecom and networking analyst Samik Chatterjee.

"The upside pressure on volumes for the iPhone 12 series, historical outperformance in the July-September time period heading into launch event, and further catalysts in relation to outperformance for iPhone 13 volumes relative to lowered investor expectations implies a very attractive set up for the shares in the second half of the year and thus expect Apple shares to outperform the broader market materially in 2H21," Chatterjee wrote in a new research note last Tuesday.

The analyst reiterated his Outperform rating and raised the price target to $170 from $165. He also lifted his estimates modestly higher on iPhone and iPad volumes.

Chatterjee is particularly bullish near-term on Apple (AAPL) as it gears up for its typical barrage of new product launches this fall.

Says Chatterjee, "The historical track record for Apple shares heading into the September iPhone launch event has been to outperform the broader market consistently each year. While the magnitude of the outperformance in July-September is generally driven by investor expectations heading into the next iPhone cycle, we believe the setup is attractive and Apple shares are positioned for a significant outperformance over the next 2-3 months given the 1H underperformance as well as the near-term upside on volume expectations for iPhone 12 series from recent share gains, particularly in China."

As well, Wedbush tech analyst Dan Ives says, "The tech bull cycle will continue in our opinion its upward move in 2H2021/2022 given the scarcity of growth names/winners in this market looking ahead on the heels of the 4th Industrial Revolution playing out among enterprises/consumers. Our favorite large cap tech name to play the 5G transformational cycle is Apple, with the 1-2 punch of its massive services business and iPhone product cycle translating into a $3 trillion market cap for Cupertino in 2022 in our opinion."

Ives rates Apple's stock at an Outperform with a $185 price target.

Moving Forward.....

For the next couple of years, the iPhone should remain Apple's core cash flow driver. As wireless companies upgrade their infrastructure to handle 5G speeds, consumers and businesses are liable to spend years upgrading their devices. Let's not forget that it's been a decade since we last witnessed a notable improvement in wireless download speeds.

Apple CEO Tim Cook is also overseeing a transition that should result in less lumpy revenue recognition and higher margins over time. While Apple will continue to be a leader in products, Cook is spearheading a shift that emphasizes Apple's services and platforms. Services are a sustainable double-digit growth opportunity.

Having generated nearly $100 billion in operating cash flow over the trailing 12-month period, Apple continues to prove to investors why it's such a winner.

Summary for the Apple Weekly Options Trade.....

Apple climb upwards is boosting its market cap lead significantly bringing the Cupertino-based tech company to within striking distance of where it traded in January.

The move up comes after a quiet time for Apple stock, which had fallen 20% from its highs during the late winter and early spring.

Now, though, investors seem to be focusing on the coming debut of the iPhone 13. Rumors about potential features are making the usual rounds, but what's clear is that Apple fans seem just as excited about future releases as they have been about recent ones.

That level of loyalty is Apple's greatest asset, and it'll be the key to drive further gains for the stock. If the holiday season goes well, then Apple could easily make further progress on the path to $3 trillion and beyond.

Conclusion for the Apple Weekly Options Trade.....

Apple has a history of beating analyst estimates for earnings. And the current quarter's EPS trend is ticking higher with analysts. Additionally, money appears to be pouring into the stock as it breaks out to all-time highs. Those are bullish signs that there may be more upside in the coming weeks and months.

Therefore…..

The Apple Weekly Options Trade Was A Winner!

What Further Apple Weekly Trades Will We Recommend?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Weekly Options USA, and get the full details on the next trade.

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!

Back to Weekly Options USA Home Page from Apple Weekly Options