TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Apple Stock In Recovery Mode!

“Weekly Options”Members

Make 146% In 1 Day!

More Gains Expected?

Tuesday, June 15, 2021

by Ian Harvey

Apple stock jumped 2.5% Monday to retake the 50-day line which is bullish for the stock's prospects. This Dow Jones leader is approaching a new buy point after breaking out of its tight trading range that has occurred over the past several weeks.

“Weekly Options Members,” using an options call trade, made potential profits of 146% in 1 day!

Apple Inc. (NASDAQ:AAPL)

Prelude…..

At the beginning of May we had some great success with an Apple Inc. (NASDAQ:AAPL) options trade – 86% profit.

Since that time the stock had pulled back and was trading in an erratic tight range.

Apple reported excellent Q2 earnings that included a March quarter revenue record of $89.6 billion, up 54% year-over-year. Service and Mac revenue also reached a new all-time high for the company in Q2, and Apple's international sales continue to stand out. However, since this time the stock had pulled back which presented another great buying opportunity for this options trade.

Apple is a leading global consumer technology company that generates 40% of its revenue from the Americas and the remainder from around the world. The company is most famous for its wildly popular smart phone product series known as the iPhone, but it also sells computers, smart watches, tablets, and televisions along with a wide array of services.

AAPL’s main value comes from its incredibly strong brand name and sleek product designs. Its enduring popularity enables it to charge premium prices for its products and generate outsized profit margins while also enjoying a broad and very sticky customer network.

Thus far, the results have been terrific as the stock has generated total returns that exceed the S&P 500’s by over 18-to-1 since its IPO. Additionally, the company commands the vast majority of the world’s mobile phone profits.

Shares have risen 51.4% in the past year.

The Recommended Apple Options Trade.....

** OPTION

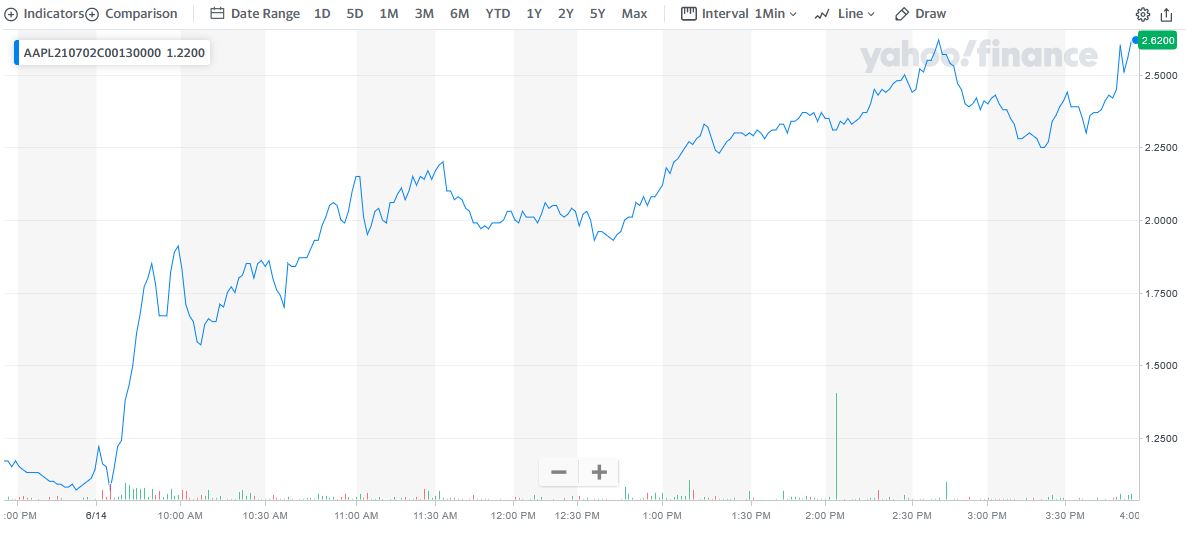

TRADE: Buy AAPL JUL 02 2021 130.000 CALLS at approximately $1.15. (Actually bought for $1.07)

Apple Options Trade Call Success Explained.....

Yesterday, Monday, June 14, 2021, “Weekly Options Members,”entered the trade mentioned above for $1.07.

On the day this options trade price hit a high of $2.63 - potential profit of 146%.

The question now is should we exit the trade or wait for more profit?

Why the Recommendation for an Apple Options Call Trade?

There are many catalysts that should be mentioned to understand the breakout reasoning.....

The Major Catalysts for This Trade.....

1. Wireless Networks.....

Tech stocks tend to outperform the broader market over long periods. The Nasdaq-100 Technology Sector has outperformed the S&P 500 and the Dow Jones Industrial Average handsomely over several years.

This is not surprising as companies operating in the technology space can create disruptive products and services that can give birth to entirely new market and revenue opportunities. Additionally, several hot trends could fuel long-term upside in tech stocks.

The arrival of fifth-generation (5G) wireless networks, for instance, has supercharged companies such as Apple that were earlier struggling to find growth. Apple's annual iPhone sales hit a peak back in 2015, after which the company's shipments plateaued and eventually declined. But its fortunes have now changed. The 5G-enabled iPhone 12 has given Apple's customers a solid reason to upgrade and sent the company to the top of the smartphone sales rankings.

Apple now commands 30% of the 5G smartphone market and is expected to set new sales records this year. What's more, the 5G smartphone market is expected to grow five times by 2025 as compared to last year, paving the way for long-term growth at Apple. Not surprisingly, Apple's projected earnings growth of 18% a year for the next five years is more than double what it has clocked in the past five years.

2. Competitive Advantages.....

AAPL still possesses considerable competitive advantages due to its world-renowned brand, immense financial resources, and an army of top tier engineer and artist employees. They will likely continue to fuel innovation and enable Apple to continue capturing the fascination of consumers.

Additionally, the Price to Forward Normalized Earnings looks pretty reasonable at 24.31x compared to the S&P 500’s forward Price to Earnings ratio of 21x. It actually looks cheap when you consider that U.S. long-term interest rates remain extremely low at just 1.63%.

AAPL is one of the strongest companies in the world and – aided by aggressive share buybacks and heavy investment in innovation – its earnings-per-share growth rate is likely to come in at ~10% on average for the foreseeable future.

3. Talks With Chinese Manufacturers…..

Apple is in talks with Chinese manufacturers for a car battery factory in the U.S. The company seems to be gradually working towards its first electric vehicle.

The tech giant is holding early discussions with China’s Contemporary Amperex Technology (SZ:300750) and electric vehicle maker BYD regarding the supply of batteries for its upcoming EV.

Apple is exploring use of lithium iron phosphate batteries in its planned electric vehicle because they are cheaper to manufacture compared to those that use nickel and cobalt.

CATL is the world’s largest lithium-ion battery manufacturer and plans to build a new major car battery plant in Shanghai.

4. Wearables.....

Apple has also witnessed strong growth in the wearables and services segment. Besides strong top-line growth, revenue is more diversified. At the same time, iPhone sales are likely to remain robust with 5G being a key growth driver.

Apple’s cash glut also implies sustained value creation through share repurchase and possibly higher dividends. Of course, the cash buffer gives the company ample headroom to invest in product innovation and possible acquisitions.

Overall, as strong growth sustains, it’s too risky to short AAPL stock. On the contrary, current levels look attractive for considering some long-term exposure.

In fiscal 2020 (ended Sept. 26, 2020), the company's wearables, home, and accessories segment grew 25% compared to 2019, generating a record $30 billion and accounting for more than 11% of Apple's total revenue. Not only that, but the segment ended the year on a high note, with each product category -- wearables, home, and accessories -- generating record sales. Apple noted at the time that its "wearables business is now the size of a Fortune 130 company."

Over the past six months, growth in the segment has accelerated. Wearables, home, and accessories revenue climbed nearly 28% year over year, led by strong demand for AirPods, AirPods Pro, and Apple Watch.

5. Services.....

Cook announced in early 2017 that Apple was aiming to double its services revenue by the end of 2020. In July 2020, he revealed that Apple had achieved that lofty goal a full six months ahead of schedule.

The business is off to a quick start in 2021. For Apple's fiscal 2021 second quarter (ended March 27, 2021), the services segment posted all-time record revenue of $16.9 billion, up nearly 27% year over year, and marking the fastest rate of growth in more than two years.

The gains were driven by 660 million paid subscribers across Apple's services segment, which includes Apple TV+, Apple Music, the App Store, and iCloud, among others. CFO Luca Maestri said that the company's video, music, games, and advertising businesses all had a record-setting quarter. The segment represents roughly 19% of Apple's total revenue -- even with the recent surge in iPhone sales.

6. Subscriptions.....

Subscription-based video streaming, news and gaming services are expected to benefit from Apple’s strong installed base. Moreover, its wearables and hearables businesses are expected to be driven by solid demand for Apple Watch and Airpods. Additionally, strong demand for 5G-enabled iPhone is a major growth driver.

Further, the Cupertino, CA-based company currently has more than 660 million paid subscribers across its Services portfolio. The App Store continues to draw the attention of prominent developers from around the world, helping the company offer appealing new apps that drive App Store traffic.

Further, a growing number of AI-infused apps will attract more subscribers on the App Store. This company’s Apple One bundled plan is expected to drive Services revenues further.

7. Innovation and the Ecosystem.....

Apple has a reputation for being an innovator. But there were portable music players, smart phones, and tablet computers even before its well-known products. What has been most revolutionary is how the company was able to drastically improve the user experience and weave the products into an ecosystem. For its customers, those products are now everywhere they turn as they live their lives -- and they are all integrated with each other.

With the installed base of devices, Apple has expertly moved into services offerings. In addition to the App Store, products like iCloud, Apple Music, and Apple Pay make it easier and easier for customers to spend more money with the company. In fact, services made up 18.5% of total revenue over the past 12 months. That number was only 11% in 2016. The higher mix of services isn't because product revenue is stagnating. Far from it.

Since 2016, overall revenue has climbed almost 51%. iPhone, iMac, and iPad have all grown respectably. The services category has impressed, with 147% growth. However, it's the wearables category that has grown the fastest. Sales in that segment are up 216%, going from $11 billion to $35 billion over that time.

Growth in those categories is important because the wearables and services make the devices much stickier -- customers are less likely to switch. In essence, it makes buying an Apple device a lifestyle choice instead of just a transaction. The continued success has allowed the company to give a lot of money back to shareholders. It's that capital return program that makes the stock a great fit for a tax-advantaged Roth IRA.

8 The Business Model.....

The company is benefiting from continued momentum in the Services segment, driven by strong App Store sales and robust adoption of Apple Music and Apple Pay. Non-iPhone devices, particularly Apple Watch and AirPod, are the other notable drivers in the long haul.

Apple’s focus on autonomous vehicles and augmented reality/virtual reality technologies presents growth opportunity for the long term. Apple has been transforming itself from a basic hardware company to a software services company.

New iPhones are also expected later this year, while an Apple Car is also in process.

9. Warren Buffett.....

Buffett has made no secret of his love of Apple, saying "It's probably the best business I know in the world." He's gone even further, noting:

We bought about 5% of the company. I'd love to own 100% of it. ... We like very much the economics of their activities. We like very much the management and the way they think.

That's nothing less than a ringing endorsement from one of the world's most successful investors.

As of June 2021, he has a net worth of over $109 billion. Buffett runs Berkshire Hathaway, which owns more than 60 companies. He believes in the value-based investing model and only invests in the stocks that exhibit solid fundaments, strong earnings power, and the potential for continued growth.

As of Q1 2021, Buffett’s stock portfolio is composed of 48 stocks and its value increased marginally from $270 billion to $270.4 billion.

Apple remains the biggest stake of Buffett, accounting for 40% of Berkshire’s entire Q1 portfolio. The fund owns 887.14 million shares of the company, worth $108.4 billion. This huge stake reflects the confidence Berkshire has in Apple whose stock is up over 400% in the last 5 years.

10. Analysts’ Opinions.....

Apple could touch a $3 trillion market capitalization in 2022, according to Wedbush analyst Dan Ives, as quoted on CNBC. Apple has a market cap of over $2 trillion, currently. It topped $1 trillion mark in 2018 and the $2 trillion threshold in 2020.

“We think ultimately 12 to 18 months from now,” Ives told ‘Street Signs Asia’ when asked about a possible timeline to the next milestone.

Apple is the world’s most valuable company, with a market cap of around $2.11 trillion.

Ives has a target of $185 for the Apple stock, an approximately 27% upside to its current price of $126.77.

The analyst values Apple’s software services business at about $1 trillion and sees it about $1.5 trillion under the $3-trillion valuation scenario.

Apple has also been the subject of a number of other research reports.....

- Monness Crespi & Hardt upped their price objective on Apple from $170.00 to $180.00 and gave the company a “buy” rating in a research report on Thursday, April 29th.

- Deutsche Bank Aktiengesellschaft upped their price objective on Apple from $160.00 to $165.00 and gave the company a “buy” rating in a research report on Thursday, April 29th.

- Morgan Stanley upped their price objective on Apple from $158.00 to $161.00 and gave the company an “overweight” rating in a research report on Monday, April 26th.

- Needham & Company LLC restated a “buy” rating and issued a $170.00 price objective on shares of Apple in a research report on Wednesday, April 21st. F

- Finally, New Street Research downgraded Apple from a “neutral” rating to a “sell” rating and set a $90.00 price objective on the stock in a research report on Friday, May 28th.

Two analysts have rated the stock with a sell rating, seven have issued a hold rating and twenty-six have issued a buy rating to the stock. Apple presently has a consensus rating of “Buy” and a consensus target price of $157.58 putting the upside potential at 25.17%.

Summary.....

Apple is an unshortable stock where short interest as a percentage of free float is approximately 1%. Apple is in a consolidation mode and there seems to be a high probability of a breakout on the upside.

The reasons for Apple being unshortable are strong fundamentals, high growth and strong cash flows. Additionally, there are ample positive business growth catalysts on the horizon.

Apple has a current ratio of 1.14, a quick ratio of 1.09 and a debt-to-equity ratio of 1.57. Apple Inc. has a 1 year low of $83.14 and a 1 year high of $145.09. The firm has a market capitalization of $2.13 trillion, a price-to-earnings ratio of 28.59, and a P/E/G ratio of 1.91 and a beta of 1.21. The company has a 50-day moving average of $128.75.

Therefore…..

This Apple Options Trade Is A Big Winner!

Will Apple Stock Price Continue To Climb?

Will We Recommend Another Apple Options Trade?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Weekly Options USA, and get the full details on the next trade.

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!

Back to Weekly Options USA Home Page from Apple