TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Applied Materials Pullback A Buying Opportunity!

“Up-and-Coming Traders”Members Make 152%!

Time TO Buy Again?

Thursday, June 10, 2021

by Ian Harvey

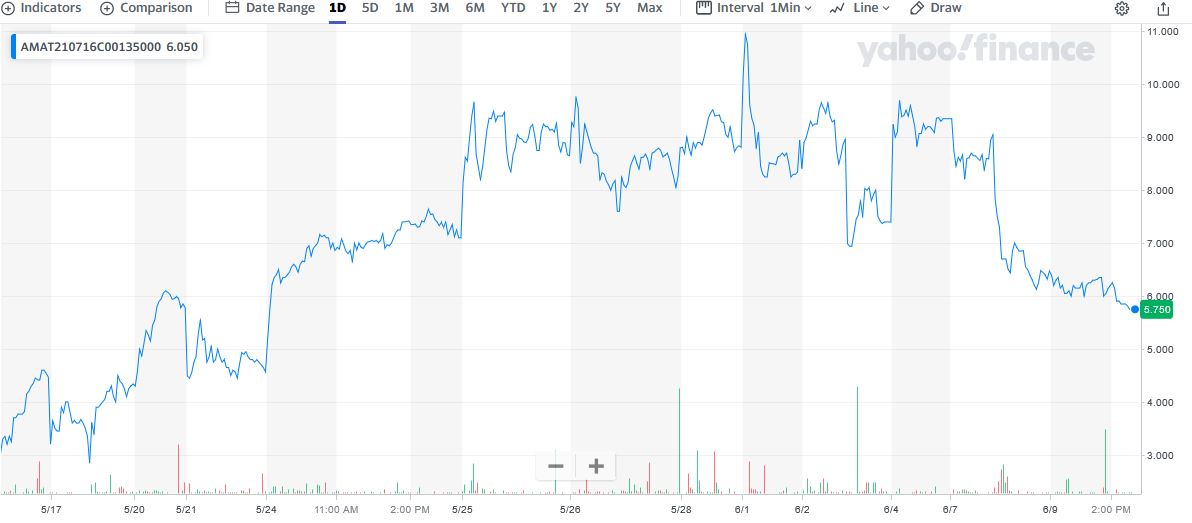

Applied Materials option hit a high of $10.95 on June 01; and then last Friday, for those that missed selling, up $9.75. The stock has now pulled back from the high of $140.85, at the time, to $135.37 as of yesterday.

Another opportunity for further profit presents itself after “Up-and-Coming Traders”Members, using an options call trade, made potential profits of 152% on June 01, and 124% last Friday.

Applied Materials, Inc. (NASDAQ:AMAT)

Prelude…..

Applied Materials continued to benefit from the shortage in semiconductors at the start of 2021, as quarterly revenue hit a record high and shares moved higher in late trading Thursday. AMAT has gained more than 150% over the last 52 weeks, boosted by this global shortage of chip-making capacity.

Applied Materials reported fiscal second-quarter net income of $1.33 billion, or $1.43 a share, compared with $755 million, or 82 cents a share, in the year-ago period. Adjusted earnings, which excluded a $154 million termination fee that Applied Materials paid to a former acquisition target and other items, were $1.63 a share, compared with 89 cents a share in the year-ago period.

Revenue jumped to $5.58 billion from $3.96 billion in the year-ago quarter. Analysts surveyed by FactSet had forecast $1.51 a share on revenue of $5.41 billion.

Applied Materials makes equipment to manufacture semiconductors, which have been in short supply recently as demand for electronics, cars and other products that rely on chips has spiked amid the COVID-19 pandemic. In a statement, Chief Executive Gary Dickerson noted “broad-based strength” for the company amid the shortage.

The Recommended Applied Materials Options Trade.....

** Applied Materials OPTIONS TRADE: Buy AMAT JUL 16 2021 135.000 CALLS at approximately $5.80. (Actually bought for $4.35)

Applied Materials Options Trade Call Success Explained.....

On Friday, May 21, 2021, “Up-and-Coming Traders” Members entered the trade mentioned above for $4.35.

On June 01 this options trade price hit a high of $10.95 - potential profit of 152%.

Also, this options trade price reached a high of $9.75 last Friday, June 04, 2021, providing members with a potential profit of 124% if they missed selling beforehand.

Why the Jump for the Applied Materials Options Trade

Applied Materials was provided a huge opportunity last year as global demand for semiconductor chips shot up to support the shift to remote work and online education. Semiconductor sales jumped 6.5% worldwide to $439 billion in 2020, over-straining a supply chain that was already impaired by the COVID-19 crisis.

In helping to meet this surging demand, Applied Materials benefited and finished its fiscal 2020 with an 18% increase in revenue and a 37% increase in adjusted earnings per share. Fiscal 2021 so far is turning out to be an even better year as semiconductor companies continue to spend billions of dollars to ramp up production capacity.

Applied Materials surge is far from over despite a slight pullback that has occurred this week. The company anticipates non-GAAP earnings of $1.76 per share this quarter on revenue of $5.92 billion, which is much higher than Wall Street's expectations of $1.56 per share in earnings on $5.53 billion revenue.

Semiconductor demand is expected to rise by a double-digit percentage this year, estimated to be an 11% increase in chip demand in 2021 following last year's 7% increase. This supply shortage will persist into the second half of the year; which means that chipmakers are expected to keep adding more capacity.

As well, faced with limited manufacturing options, many microchip designers are paying top dollar for the materials and processes they can get their hands on today.

"We're still in the early innings of major secular trends that will play out over the next decade and drive the semiconductor and semi-equipment markets structurally higher," CEO Gary Dickerson said on the earnings call. "For the first time, customers are providing capital spending guidance for multiple years into the future, which is a new leading indicator for demand sustainability."

Applied Materials' stock returns are supported by fantastic business results. The stock doesn't look expensive after that massive 52-week rush, trading at a modest 19 times forward earnings and seven times trailing sales. This company enjoys both an artificial short-term boost from the semiconductor shortage situation and a healthy long-term growth market.

For the Original Reasoning Behind the Applied Materials Options Trade.....

To best understand why we recommended a Applied Materials Options Trade it would be best to read.....

"“Up-and-Coming Traders” Recommendations Week Beginning Monday, May 17, 2021."

Summary…..

Applied Materials looks well-positioned to beat the broader market's revenue and earnings growth over the next decade, which could lead to even stronger stock price growth than it delivered in the last one.

Applied Materials' growth has accelerated over the past year as semiconductor demand has increased. More importantly, the massive end-market opportunity indicates that it could keep growing at similarly high rates for a long time to come.

Therefore…..

This Applied Materials Options Trade Is A Big Winner!

Will Applied Materials Stock Price Reverse Its Downward Momentum?

Will We Recommend Another Applied Materials Options Trade?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Weekly Options USA, and get the full details on the next trade.

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!

Back to Weekly Options USA Home Page from Applied Materials