TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Block Inc Weekly Options Trade Provides 28%

Potential Profit In 25 Minutes!

Members of “Weekly Options USA,” Using A Weekly put Option, Are

Up 28%,

Due To Resistant Fears

Of A Business Downturn Versus Other Digital Payment Companies.

More profit to come?

Join

Us and GET FUTURE TRADEs!

Block Inc (NYSE: SQ) stock may be set for a downturn versus other digital payment companies.

Also, the price of Bitcoin has again dropped below a key level of $20,000.

This set the scene for Weekly Options USA Members to profit by 28%, in as little as 25 minutes, using a Weekly Put Option!

Join Us And Get The Trades – become a member today!

Sunday, September 25, 2022

by Ian Harvey

Why the Profit on Block Inc Stock?

Amid rising fears of a U.S. recession, one question is how resistant Square-parent Block Inc (NYSE: SQ) will be to a business downturn versus other digital payment companies. Also, the price of Bitcoin has again dropped below a key level of $20,000.

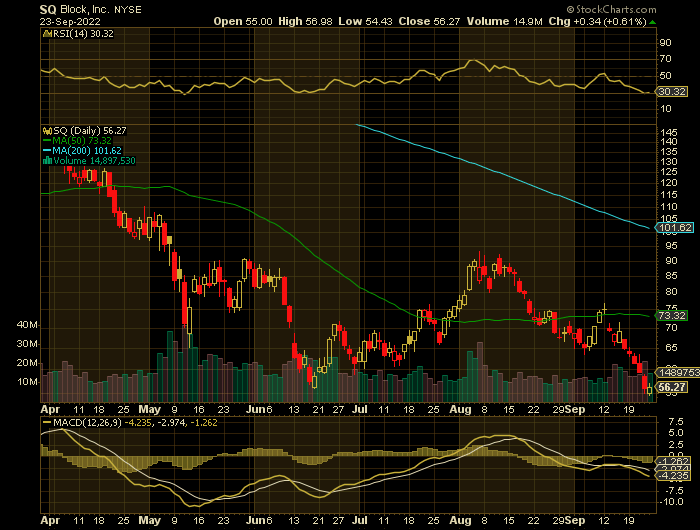

Meanwhile, Block stock has retreated about 64% in 2022. Square stock hit a new 52-week low on Sept. 22. SQ stock has under-performed versus the S&P 500, which is down nearly 22%.

Square on Jan. 31 closed the acquisition of Australia-based consumer lending startup Afterpay. Its growth has slowed. And, "buy now, pay later (BNPL) fintech companies like Afterpay face increased regulation.

The Profits Explained.....

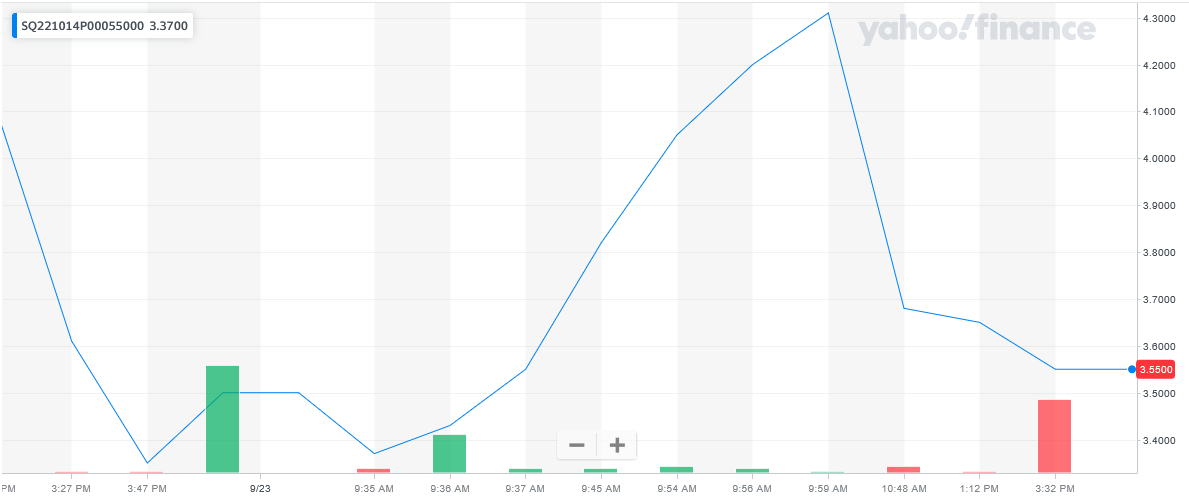

Entered the Block Inc stock trade on Friday, September 23, 2022 at 9:35am for $3.37.

Exited the trade Friday, September 23 at 9:59am for $4.31, a potential profit of 28%.

Important to Note: As this was a very quick trade many members may not have been able to exit in time – but if the market continues its downward spiral in the week ahead then further profits are expected.

Don’t miss out on further trades – become a member today!

About Block.....

Square, Inc. provides payment and point-of-sale solutions in the United States and internationally. The company's commerce ecosystem includes point-of-sale software and hardware that enables sellers to turn mobile and computing devices into payment and point-of-sale solutions.

It offers hardware products, including Magstripe reader, which enables swiped transactions of magnetic stripe cards; Contactless and chip reader that accepts EMV® chip cards and Near Field Communication payments; Chip card reader, which accepts EMV® chip cards and enables swiped transactions of magnetic stripe cards; Square Stand, which enables an iPad to be used as a payment terminal or full point of sale solution; and Square Register that combines its hardware, point-of-sale software, and payments technology, as well as managed payments solutions.

The company also provides Square Point of Sale software; Cash App, which provides access to the financial system, allowing customers to electronically send, store, and spend money; Caviar, a food ordering platform for restaurants to offer food ordering, pickup and delivery, to their customers; and Square Capital that facilitates loans to sellers based on real-time payment and point-of-sale data.

Square, Inc. was founded in 2009 and is headquartered in San Francisco, California.

More Reasons Why The Initial Weekly Options Put Trade

on SQ Stock.....

Earnings Expectations.....

In Q2, Square earnings were 18 cents per share on an adjusted basis, down 72% from the year-earlier period. Analysts had projected earnings of 16 cents a share.

Also, Square said revenue dropped 6% to $4.4 billion, as Cash App transactions for digital cryptocurrency Bitcoin fell. Analysts had predicted revenue of $4.33 billion.

Operating profit came in at $1.47 billion, up 29%, vs. estimates of $1.495 billion.

Gross payment volume from merchant customers rose 23% to $52.5 billion, vs. estimates of $53.187 billion.

"The company has pulled back on experimental and less efficient spend, along with adjusting its risk loss modelling and slowing the pace of hiring," Deutsche Bank analyst Bryan Keane said in a note to clients. "Due to scale and a new cost discipline focus, we believe SQ stock is positioning for material margin expansion in 2023 and 2024."

Name Change.....

Square on Dec. 1 changed its name to Block, while retaining the ticker SQ. In part, the move reflected the company's commitment to blockchain technology, which underpins cryptocurrency. SQ stock has dropped 72% since the rebranding to Block.

Meanwhile, the price of Bitcoin stood at $19,240 on Sept. 22. In June, Bitcoin fell below $19,000. Crypto assets have been under pressure.

The price of Bitcoin has retreated 71% since peaking around $68,900 in November. For investors in Square stock, a key question is when the price of Bitcoin will bottom.

Afterpay.....

Announced Aug. 1, the Afterpay deal was originally valued at $29 billion. With the big drop in Block stock, the deal was valued at less than $15 billion at closing.

Afterpay competes in the emerging "buy now, pay later" market that encroaches on credit card networks. Apple (AAPL) has emerged as a rival to Afterpay. Another rival of Afterpay is Affirm Holdings (AFRM).

Some investors questioned whether Block needed to buy a company in this sector as opposed to building up its own capabilities or partnering. Competition is heating up in the buy now, pay later market.

Block's 2022 guidance includes an expected $1 billion in Afterpay operating expenses. UBS analyst Rayna Kumar in a report said the "risk profile" of Afterpay has changed amid rising interest rates and the potential of increased regulation.

Competition.....

With multiple products, SQ stock faces stiff competition in both consumer financial apps and the small business market. Analysts expect Square's rivalry with PayPal Holdings (PYPL) to heat up as they improve digital wallets.

What's more, Apple (AAPL) on Feb. 8 said it's rolling out a new iPhone app. The new app will turn iPhones into a point-of-sale terminal. The service will allow merchants to accept contactless credit or debit cards. And, Apple is moving into the buy now, pay later market.

Other rivals include First Data's (FDC) Clover unit, Shopify (SHOP), merchant acquirers, and well-funded startup Stripe.

Bitcoin.....

Square disclosed a new $170 million investment in Bitcoin in early 2021 on top of its $50 million purchase in October 2020. The company reports Bitcoin holdings as unrealized gains on investments, and they will be excluded from adjusted earnings, analysts say.

The company also is interested in developing a Bitcoin hardware wallet.

Cash App users are able to buy, hold and sell Bitcoin. Square's adjusted revenues from Bitcoin are sales to app users, minus the cost of purchasing the digital currency.

But Square's Bitcoin business has gross profit margins of only around 2%, analysts say.

Insider Selling.....

Insider Alyssa Henry sold 30,770 shares of the firm’s stock in a transaction on Wednesday, June 22nd. The stock was sold at an average price of $60.14, for a total transaction of $1,850,507.80.

Also, CFO Amrita Ahuja sold 8,130 shares of the company’s stock in a transaction dated Monday, August 8th. The stock was sold at an average price of $88.13, for a total transaction of $716,496.90.

In the last 90 days, insiders have sold 330,042 shares of company stock valued at $23,659,951. Corporate insiders own 11.52% of the company’s stock.

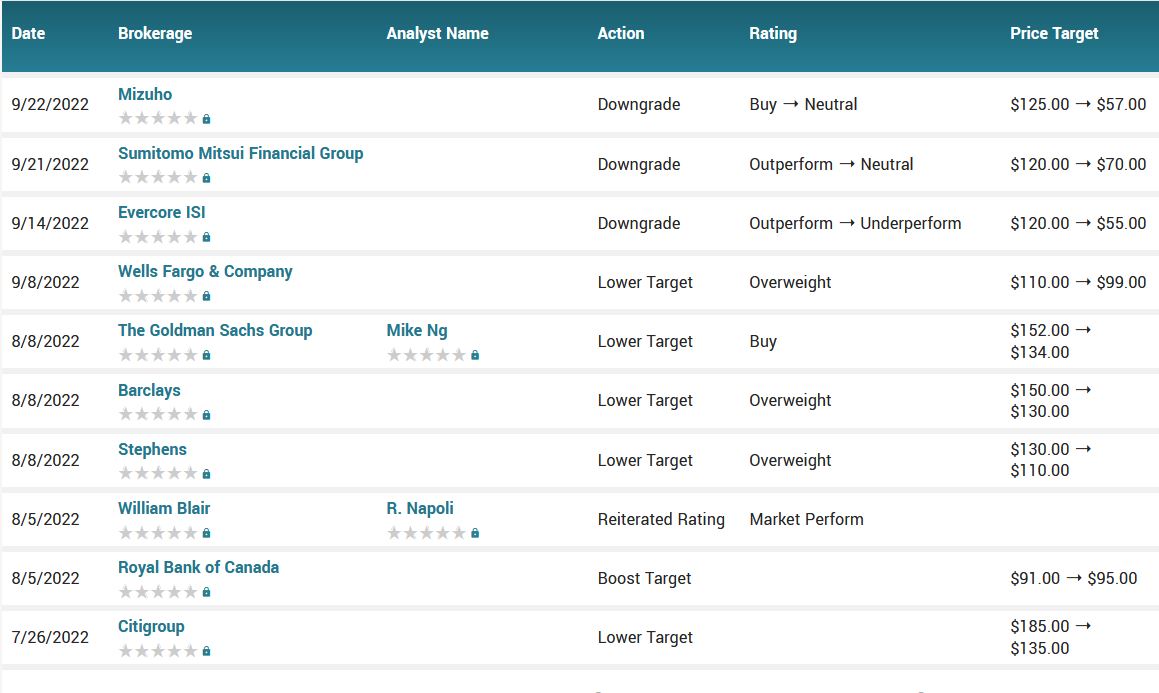

Analysts.....

At Mizuho Securities, analyst Dan Dolev downgraded Block stock on Sept. 22 to neutral. They now have a $57.00 price target on the stock, down previously from $125.00.

"After years of rightfully being deemed the most innovative name in payments, we believe user fatigue, plateauing inflows, loss of the best-of-breed POS status, and BNPL mis-execution are blocking SQ's growth," Dolev said in a report.

"SQ still has enormous potential, but it is not being realized. Instead, BNPL estimates continue to come down and projects like Bitcoin — which accounts for 5% of gross profit — seem to disproportionately preoccupy management's attention," he added.

Also, SMBC Nikko downgraded Block (NYSE:SQ) to Neutral as a number of crosscurrents clouds its near- to medium-term prospects.

The firm believes that the company is one of the highest quality long-term names in its fintech coverage, but pointed to Block's (SQ) "hard-to-quantify, but material crypto exposure, lack of medium-term visibility, and uncertainty around the potential impact of SQ's more conservative investment strategy on medium-term growth." Note Block's (SQ) guidance in August reduced its planned investments for 2022.

The company's analyst sees the knock-on impact of crypto more important than its Cash App bitcoin (BTC-USD) revenue. For example, a Cash App user buying $100 of bitcoin when the price was $10K and selling at $60K would result in $500 of Cash App inflows. That could then increase Cash Card spend, instant deposit and stock trading.

"Unfortunately, now that the price of bitcoin (BTC-USD) is ~70% off its highs, we suspect the inverse dynamic is underway," the SMBC Nikko analyst wrote in a note to clients.

Recently, the crypto sensitivity has been "somewhat masked" by increased instant transfer pricing, Cash App borrowing, and tailwinds from Cash App tailwinds. "That said, we think this creates a high bar for Cash App in the quarters ahead and suspect any hiccup in results will put further pressure on shares," the note said.

According to the issued ratings of 40 analysts in the last year, the consensus rating for Block stock is Moderate Buy based on the current 1 sell rating, 7 hold ratings and 32 buy ratings for SQ. The average twelve-month price prediction for Block is $135.76 with a high price target of $310.00 and a low price target of $55.00.

Summary.....

Block stock disappointed in 2021, especially in the back half of the year.

Square has wrestled with finding the right balance of revenue growth, investments and profitability.

Block's stock has struggled enormously this year and is down more than 65%. In its most recent quarterly earnings report, Block reported a net loss of about $208 million, which is in stark contrast to the $204 million profit it reported in the second quarter of 2021. Gross payment volume grew almost $10 billion from the year prior but came in below what analysts had been expecting.

Block has a market cap of $32.44 billion, a price-to-earnings ratio of -61.46 and a beta of 2.45. Block has a 52 week low of $55.02 and a 52 week high of $270.16. The business’s 50 day moving average is $73.52 and its two-hundred day moving average is $87.82. The company has a quick ratio of 1.80, a current ratio of 1.80 and a debt-to-equity ratio of 0.24.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from Block Inc Stock

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!