TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Boeing Weekly Put Options Provide Profit In 20 Minutes!

Weekly Options Members

Are Up 59% Potential Profit

Using A Weekly put Option!

As if Boeing Co (NYSE: BA) needed any more bad news, a scathing report from Wall Street on Tuesday cast doubt on Boeing’s ability to pass a new federal safety audit, sending its stock sinking sharply.

Boeing has faced repeated quality and safety issues with its aircraft for five years now, leading to the long-term grounding of some jets and the halt in deliveries of others.

The Wells Fargo report, entitled “FAA audit opens up a whole new can of worms,” noted that Boeing’s quality control and engineering problems have been ongoing for years.

This set the scene for Weekly Options USA Members to profit by 59% using a BA Options trade!

Join Us And Get The Trades – become a member today!

Thursday, January 18, 2024

by Ian Harvey

As if Boeing Co (NYSE: BA) needed any more bad news, a scathing report from Wall Street on Tuesday cast doubt on Boeing’s ability to pass a new federal safety audit, sending its stock sinking sharply. Later Tuesday, Boeing announced an independent adviser who will lead a review of the company’s quality control.

Boeing has faced repeated quality and safety issues with its aircraft for five years now, leading to the long-term grounding of some jets and the halt in deliveries of others.

The 737 Max’s design was found to be responsible for two fatal crashes: one in Indonesia in October 2018 and the other in Ethiopia in March 2019. Together, the two crashes killed all 346 people aboard the two flights and led to a 20-month grounding of the company’s best-selling jets, which cost it more than $21 billion.

The Wells Fargo report, entitled “FAA audit opens up a whole new can of worms,” noted that Boeing’s quality control and engineering problems have been ongoing for years. After part of an Alaska Airlines] 737 Max 9 jet fell off the plane mid-flight, the likelihood of the US Federal Aviation Administration coming out of its investigation without significant findings was very low.

“Given Boeing’s recent track record, and greater incentive for the FAA to find problems, we think the odds of a clean audit are low,” the analysts said. “The FAA’s audit is limited to Max 9 for now, but it’s feasible that findings could expand the scope to other Max models sharing common parts.”

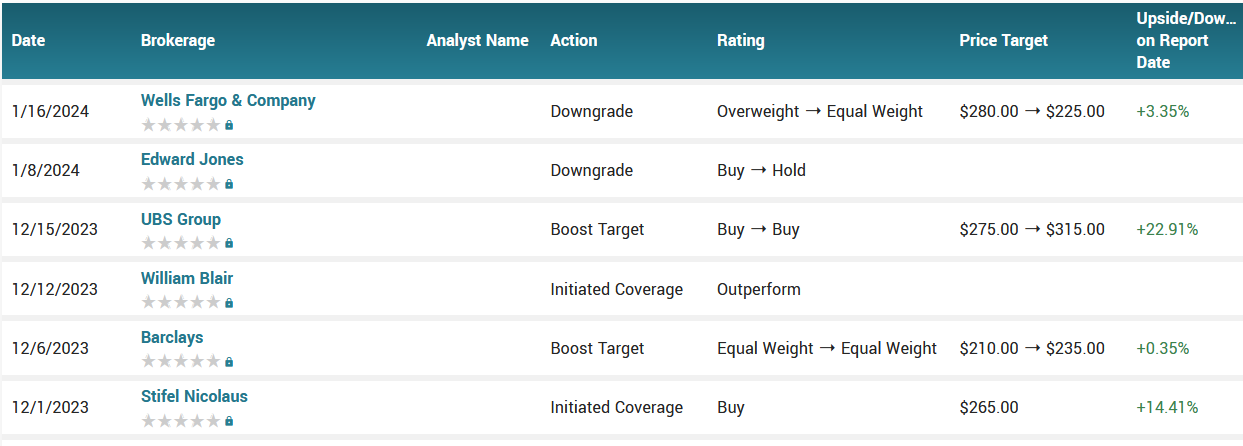

The analysts believe the investigation increases significantly the risk that Boeing takes a hit to its production and deliveries, and they downgraded the stock to “equal weight,” down from “overweight,” the equivalent of a “buy” rating.

Internal communications released during the 737 Max grounding showed one employee describing the jet as “designed by clowns, who in turn are supervised by monkeys.”

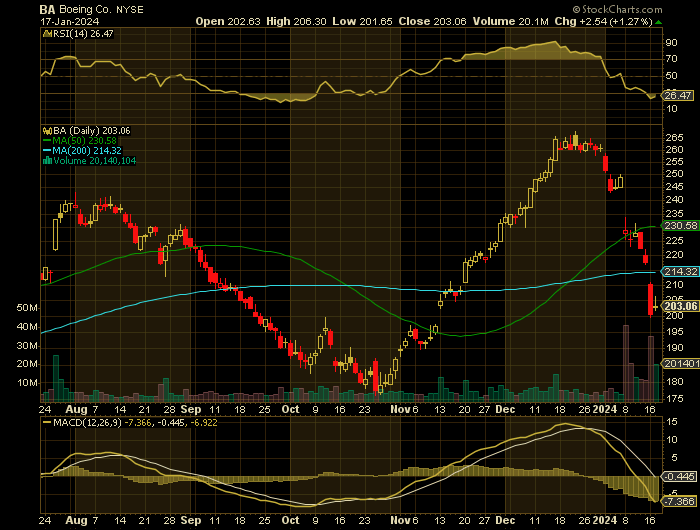

Boeing, which plunged nearly 8% in massive volume on Tuesday, has fallen 23% since Jan. 1 and dropped more than 7% below a 243.10 buy point in its recent cup base.

The Boeing Weekly Options Potential Profit Explained.....

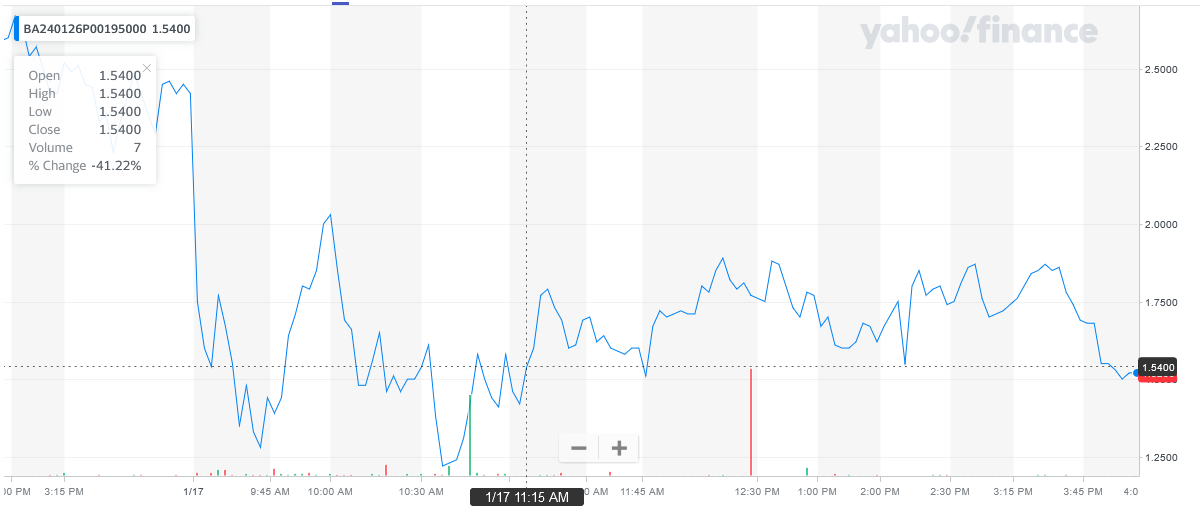

** OPTION TRADE: Buy BA JAN 26 2024 195.000 PUTS - price at last close was $2.42 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the BA Weekly Options (PUT) Trade on Wednesday, January 17, 2024, at 9:42, for $1.28.

Sold half the BA weekly options contracts on Wednesday, January 17, 2024, at 10:00, for $2.03; a potential profit of59%.

Holding the remaining contracts for further profit!

Don’t miss out on further trades – become a member today!

About Boeing.....

The Boeing Company is the world’s largest manufacturer of airplanes and commands more than 50% of the market in some channels and categories. The company and its family of subsidiaries design, develops, manufacture, sell, service, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight, and related services worldwide. The company operates through four segments including Commercial Airplanes; Defense, Space & Security; Global Services; and Boeing Capital providing products and services to end-users in 150 countries.

Boeing got its start in 1910 when William E. Boeing developed a love for aircraft. Soon after he takes his first plane ride which leads him to build a hangar and begin construction of his first plane. The onset of WWI helped spur the company’s growth but business was cut drastically in its wake. The start of WWII was another milestone for the company and one that led to its current position of dominance. The company was incorporated in 1916 and is based in Chicago, Illinois. Boeing employs over 140,000 people in 65 countries making it one of the most diverse employers on the planet.

The Commercial Airplanes segment is built around the iconic 7-series which includes the 737, 747, and 787. The segment provides commercial jet aircraft for passenger and cargo requirements, as well as fleet support services for regional, national, and international air carriers and logistics and freight companies. In terms of global volume, the company estimates about 90% of all air freight is carried aboard one of its jets. This segment also includes the Dreamliner family of planes. The Dreamliner is a game-changing airplane for many carriers as it opens up the potential for new one-stop destinations because of its capacity and range.

The Defense, Space & Security segment develops and manufactures a range of systems including manned and unmanned aircraft, missiles, missile defense systems, satellites, communications equipment, and intelligence systems for governments. Among the many iconic brands within this segment are the AH-64 Apache, Air Force One, B-52, C-17 Globemaster, Chinook, F/A-18, and the V-22 Osprey VTOL aircraft used by the Marines.

The Global Services segment offers a range of products and services that include supply chain and logistics management, engineering, maintenance, upgrades, conversions, spare parts, pilot and maintenance training, technical and maintenance documents, and data analytics to its commercial and defense customers.

Boeing is also a leader in innovation, leveraging its many decades and avenues of experience to further aerospace and defense technology. Among the many innovations is the MQ-25 Stingray which will be the world’s first autonomous aircraft. The Stingray is only one of many areas of research that also include drones and undersea vehicles.

Further Catalysts for the BA Weekly Options Trade…..

The FAA last week opened an investigation into Boeing’s quality control after the Alaska Airlines incident. The regulator said the dramatic in-flight blowout on Alaska Airlines 1282 “should have never happened and it cannot happen again.”

The door plug, which is supposed to cover up a space left by a removed emergency exit door in the side of the plane, blew off the aircraft and left a gaping hole in the side of the plane. The force of the explosive decompression and subsequent high-speed airflow inside the cabin ripped headrests off seats as the plane flew at 16,000 feet shortly after taking off from Portland, Oregon, carrying 177 people.

The FAA says the investigation will focus on whether Boeing “failed to ensure completed products conformed to its approved design and were in a condition for safe operation in compliance with FAA regulations.”

Other Catalysts.....

A week ago, Boeing CEO David Calhoun acknowledged the company’s “mistake” at a staff-wide “safety meeting,” but he did not specify what that mistake was. National Transportation Safety Board Chair Jennifer Homendy has demanded Boeing provide answers about any mistake it made as part of its safety investigation, which is separate from the FAA’s audit.

Wells Fargo analysts noted in their report that the FAA investigation could take some time to complete, noting many of its probes remain “under investigation” months after the original incidents.

All 737 Max 9 planes remain grounded as the FAA works to approve Boeing’s inspection criteria for airlines to assess the safety of the aircraft. The regulator has not provided a timeline of when the planes might return to service. Alaska and United have canceled more than 100 flights a day as they await an all-clear from the FAA.

China Southern Airlines.....

China Southern Airlines will reportedly increase the safety inspection regimen for new Boeing 737 Max aircraft, delivery of which the airline expects as early as this month, the Wall Street Journal reported. China Southern's jets on order from Boeing are reportedly not the same version of the 737 Max aircraft as the 737 Max 9 model that has been grounded, pending safety inspections following a fuselage panel blowout on an Alaskan Airlines (ALK) jet on Jan. 5.

The move would ostensibly hold up entry to service for the unspecified number of jets due for China this month. Chinese authorities have also required safety inspections for all 737 Max aircraft operating in China. China-based airlines currently own no 737 Max 9s. Still, it is unclear how long the new inspection protocols will take and how much time it will add to deliveries.

China is a critical market for Boeing, expected to account for 20% of global aircraft demand in the next two decades, according to Boeing forecasts. The new 737 Max models are key to ramping Boeing's business back up in the country, following the global grounding of the aircraft model following fatal crashes in Indonesia and Ethiopia in 2018 and 2019.

Analysts.....

Wells Fargo downgraded Boeing stock to equal weight from overweight early Tuesday after the China news and Monday's company update. The FAA inspection audit opens a "whole new can of worms" for Boeing and "significantly" increases the risk of delivery impacts, the firm wrote in a research note. Wells Fargo slashed its price target on Boeing to $225 from $280.

According to the issued ratings of 17 analysts in the last year, the consensus rating for Boeing stock is Moderate Buy based on the current 4 hold ratings and 13 buy ratings for BA. The average twelve-month price prediction for Boeing is $258.31 with a high price target of $315.00 and a low price target of $217.00.

Summary.....

Boeing opened at $200.51 on Tuesday. The firm’s 50-day moving average is $234.09 and its two-hundred day moving average is $218.05. Boeing has a 12 month low of $176.25 and a 12 month high of $267.54. The stock has a market capitalization of $121.30 billion, a P/E ratio of -42.66, and a PEG ratio of 14.41 and a beta of 1.60.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from Boeing

Recent Articles

-

191% Weekly Option Win on Super Micro Computer Amid Market Mayhem

191% Weekly Option Win on Super Micro Computer Amid Market Mayhem – What’s Next? -

Tariffs and the Stock Market: Positive and Negative Impacts in 2025

Tariffs and the Stock Market: Positive and Negative Impacts in 2025. This article explores both the positive and negative effects of tariffs on the stock market based on recent data, forecasts, and ma… -

SMCI’s Wild Ride: Options Traders Are Profiting From the Ups and Downs

SMCI’s Wild Ride: How Options Traders Are Profiting From the Ups and Downs