TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Boeing

Soars On Earnings!

Members Make Potential

Profit of 97%, In 1 Day, Using A

Weekly Call Option!

Shares Of Boeing Co (NYSE: BA) Jumped 8.72% On Wednesday To Their Highest Level Since November 2021 Following The Earnings News. And Continued To Climb Thursday Hitting A High Of $238.67.

As Well, Bofa Upgraded Boeing To Buy From Neutral With A Price Target Of $300, Up From $225. The Firm, "Along With The Broader Market," Maintains Some Reservations Around Execution, But It "Appears As Though The Worst May Be Behind" For Boeing, The Firm Says.

This set the scene for Weekly Options USA Members Make Potential Profit Of 97%, in 1 day, using a BA Weekly Options trade!

Join Us and Get Future Trades!

Thursday, July 27, 2023

by Ian Harvey

Why the BA Weekly Options Trade was Originally Executed?

Shares of Boeing Co (NYSE: BA) jumped 8.72% on Wednesday to their highest level since November 2021 following the earnings news.

And there seems to be plenty of gas in the tank for the stock to fly higher.

Boeing was the best-performing stock in the Dow after the plane maker reported a lower-than-expected quarterly loss and a big jump in aircraft deliveries.

Boeing posted a fiscal 2023 second quarter loss of $0.82 per share, with revenue up 18% to $19.75 billion. Free cash flow came in at $2.6 billion. All three were better than analysts’ estimates.

Deliveries at the commercial airplane division rose 12% to 136, and revenue soared 41% to $8.84 billion. The defense, space, and security unit had sales of $6.17 billion, virtually the same as a year ago. Global services revenue added $4.75 billion, a gain of 10%.

CEO Dave Calhoun said the company is “well positioned to meet the operational and financial goals we set for this year and for the long term.” He added that because of strong demand, Boeing is “steadily increasing our production rates and growing investments in our people, products, and technologies.”

The BA Weekly Options Trade Explained.....

** OPTION TRADE: Buy BA AUG 25 2023 240.000 CALLS - price at last close was $4.00 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the BA Weekly Options (CALL) Trade on Thursday, July 27, 2023, at 9:50, for $3.51.

Sold half the BA Weekly Options contracts on Thursday, July 27, 2023, at 10:43, for $6.90; a potential profit of 97%.

Holding the remaining BA weekly options contracts for further profit before expiry.

Don’t miss out on further trades – become a member today!

About Boeing.....

The Boeing Company is the world’s largest manufacturer of airplanes and commands more than 50% of the market in some channels and categories. The company and its family of subsidiaries design, develops, manufacture, sell, service, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight, and related services worldwide. The company operates through four segments including Commercial Airplanes; Defense, Space & Security; Global Services; and Boeing Capital providing products and services to end-users in 150 countries.

Boeing got its start in 1910 when William E. Boeing developed a love for aircraft. Soon after he takes his first plane ride which leads him to build a hangar and begin construction of his first plane. The onset of WWI helped spur the company’s growth but business was cut drastically in its wake. The start of WWII was another milestone for the company and one that led to its current position of dominance. The company was incorporated in 1916 and is based in Chicago, Illinois. Boeing employs over 140,000 people in 65 countries making it one of the most diverse employers on the planet.

The Commercial Airplanes segment is built around the iconic 7-series which includes the 737, 747, and 787. The segment provides commercial jet aircraft for passenger and cargo requirements, as well as fleet support services for regional, national, and international air carriers and logistics and freight companies. In terms of global volume, the company estimates about 90% of all air freight is carried aboard one of its jets. This segment also includes the Dreamliner family of planes. The Dreamliner is a game-changing airplane for many carriers as it opens up the potential for new one-stop destinations because of its capacity and range.

The Defense, Space & Security segment develops and manufactures a range of systems including manned and unmanned aircraft, missiles, missile defense systems, satellites, communications equipment, and intelligence systems for governments. Among the many iconic brands within this segment are the AH-64 Apache, Air Force One, B-52, C-17 Globemaster, Chinook, F/A-18, and the V-22 Osprey VTOL aircraft used by the Marines.

The Global Services segment offers a range of products and services that include supply chain and logistics management, engineering, maintenance, upgrades, conversions, spare parts, pilot and maintenance training, technical and maintenance documents, and data analytics to its commercial and defense customers.

Boeing is also a leader in innovation, leveraging its many decades and avenues of experience to further aerospace and defense technology. Among the many innovations is the MQ-25 Stingray which will be the world’s first autonomous aircraft. The Stingray is only one of many areas of research that also include drones and undersea vehicles.

Further Catalysts for the BA Weekly Options Trade…..

After being in an official bear market (defined as a 20% retracement from all-time or recent highs), Boeing stock could be setting up to break a near five-year price action spell, and perhaps doubling. As bullish as this assumption may seem, markets are pointing toward this scenario carrying high probabilities, backed by expanding financials.

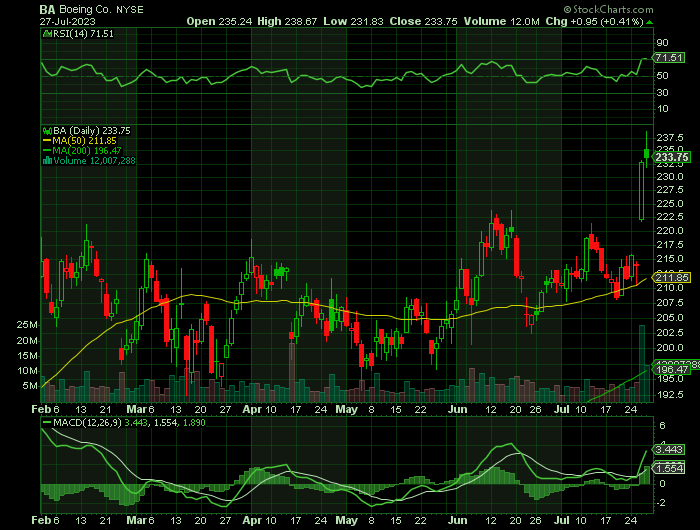

Boeing stock reached an all-time high price of $446.01 back in the first half of 2019 and has suffered from a bear winter ever since, though this may be about to change. Yesterday the stock has not only touched but also crossed with significant momentum, its 200-day moving average level.

Understanding what this means can begin to lay the foundation for what could become a monster rally in Boeing stock. Typically, the 200-day moving average acts as a secondary proxy for bull or bear markets when a stock goes above and below it. Crossing above it with as much momentum as seen today can be taken as a majorly optimistic signal by investors.

Other Catalysts.....

Boeing stock has outperformed the closest competitor Lockheed Martin by as much as 31% during the past twelve months, a massive gap pointing to which of the two stocks is the most popular in the eyes of the market today. Furthermore, forward-looking valuation metrics, such as the forward P/E, also provide a reliable gauge of what may be expected.

Boeing stock trades today for a 43.9x forward P/E, while Lockheed stock trades for an inferior 16.2x.

Financials.....

Boeing has flipped its free cash flow figures on their head, going from negative $182 million a year ago to today's $2.5 billion.

The earnings report only gets better from there; revenues beat estimates by advancing 18% during the year. This growth is backed by a similar margin expansion, where gross margins grew from 8% to 10% as efficiency initiatives took effect. Boeing also used some of this new free cash flow and some of the existing cash balances to reduce the company's debt burden by a hefty $3.1 billion.

Deliveries for the aircraft maker grew by an astonishing 12%, pushing the CEO's target to generate as much as $10 billion in free cash flow by 2025. Management commented that "... We are well positioned to meet the operational and financial goals we set for this year and for the long term," reiterating confidence that these targets will be met.

Ramping Up Manufacturing.....

Boeing noted it was ramping up manufacturing of its best-selling 737 Max aircraft to 38 a month from 31, and from three to four a month for the 787 Dreamliner.

Production has been running around 31 a month in recent quarters. Investors want to see higher production because that is a sign that supply-chain issues affecting the industry are abating.

More planes, of course, also mean more sales and earnings.

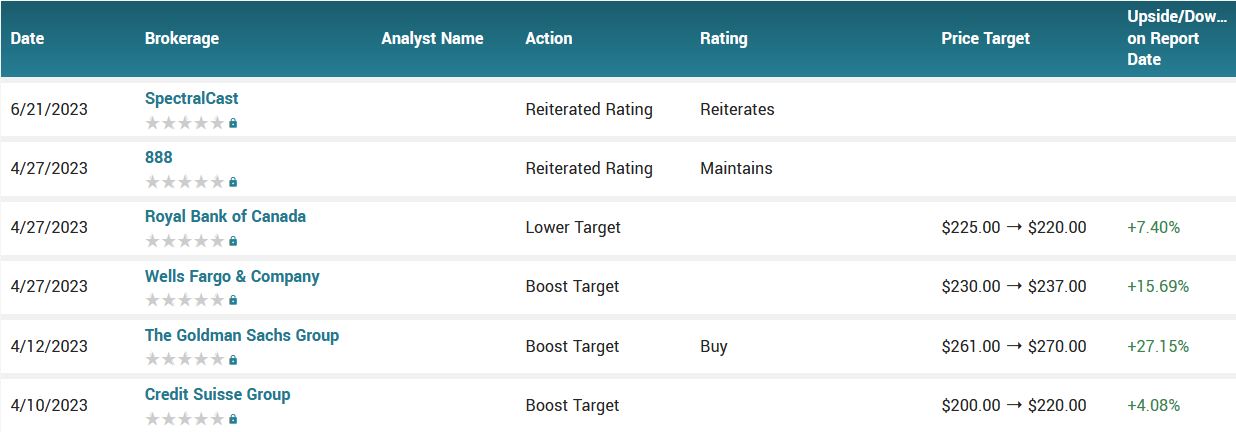

Analysts.....

According to the issued ratings of 15 analysts in the last year, the consensus rating for Boeing stock is Moderate Buy based on the current 6 hold ratings and 9 buy ratings for BA. The average twelve-month price prediction for Boeing is $223.14 with a high price target of $270.00 and a low price target of $180.00.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from BOEING

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!