TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Carnival Cruise Experiences Highest Booking

Volumes!

And Members Are Already Up 100% Potential Profit, For The Week,

Using A Weekly

Call Option!

Members of “Weekly Options USA,”

Using A Weekly Call Option, Make Potential Profit Of 100%,

For The Week, As Carnival Cruise Receives Several Upgrades,

As Well As Experiencing The Highest Booking Volumes

For Any Quarter In Its History,

A Clear Sign Demand Is Returning In Full Force.

Where To Now?

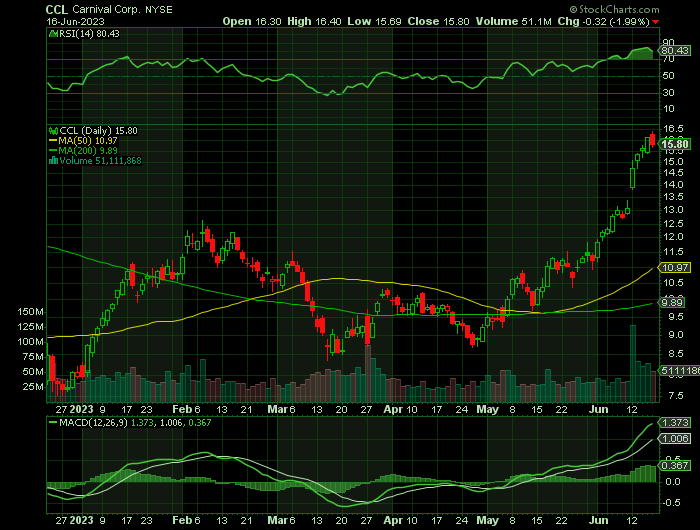

Carnival Cruise (NYSE: CCL) has scored several upgrades in recent weeks as analysts noted that booking trends continue to be robust.

The company said customer deposits reached a first-quarter record of $5.7 billion, 16% above the previous level in its history.

It also experienced the highest booking volumes for any quarter in its history, a clear sign demand is returning in full force.

This set the scene for Weekly Options USA Members to profit by 100%, for the week, using a CCL Weekly Options trade!

Join Us And Get The Trades – become a member today!

Saturday, June 17, 2023

by Ian Harvey

Prelude.....

Carnival Corp (NYSE: CCL, the cruise operator, has scored several upgrades in recent weeks as analysts noted that booking trends continue to be robust.

JPMorgan Chase & Co. analyst Matthew Boss upgraded shares of Carnival Corp from a neutral rating to an overweight rating in a report released on Monday morning.

BofA Securities analyst Andrew Didora upgraded the rating from Neutral to Buy, while raising the price target from $11 to $20.

Finally, Citigroup joined the bullish chorus on Thursday as analyst James Hardiman upped his price target from $14 to $18 and maintained a buy rating on the stock. He's also on the lookout for positive catalysts from the stock.

The company said customer deposits reached a first-quarter record of $5.7 billion, 16% above the previous level in its history. It also experienced the highest booking volumes for any quarter in its history, a clear sign demand is returning in full force.

If the economy is truly on the mend, interest rates are stabilizing, and consumer spending remains strong, Carnival looks well positioned to capitalize on a new bull market. Profits could easily soar in the next year or two.

The stock finished the week up 20.7%.

Why the Carnival Corp Weekly Options Trade was Executed?

Read the previous article “Carnival Cruise Line Sails Higher On Upgrades!”

The CCL Weekly Options Trade Explained.....

** OPTION TRADE: Buy CCL JUL 07 2023 15.000 CALLS - price at last close was $0.92 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

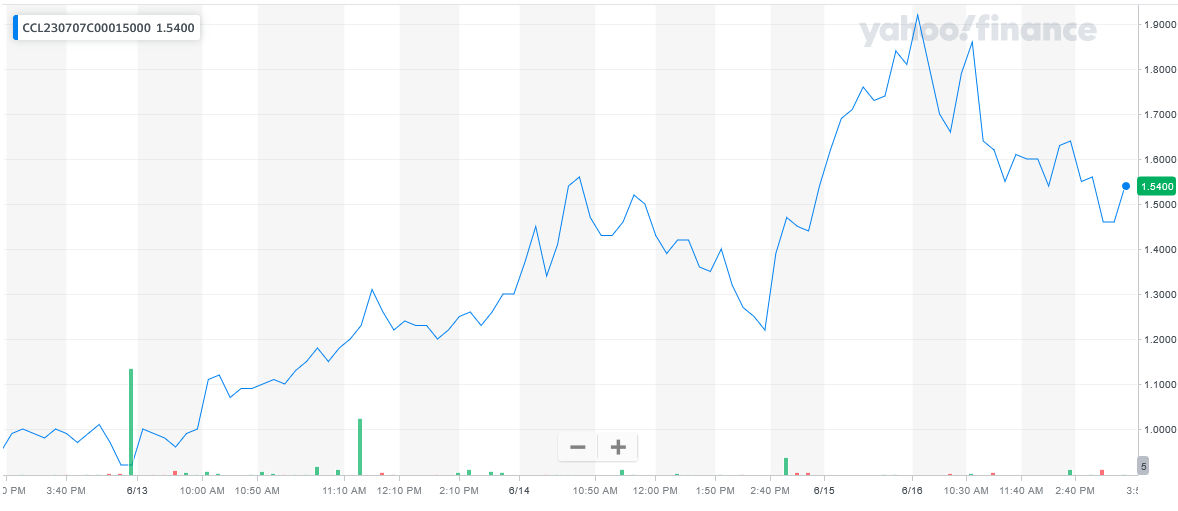

Entered the CCL Weekly Options (CALL) Trade on Tuesday, June 13, 2023, at 9:50, for $0.96.

Sold half the CCL weekly options contracts on Tuesday, June 13, 2023, at 11:45, for $1.31; a potential profit of 60%.

Total Dollar Profit is $131 - $96 (cost of contract) = $35

Sold the remaining CCL weekly options contracts on Friday, June 16, 2023, for $1.92; a potential profit of 100%.

Total Dollar Profit is $1.92 - $96 (cost of contract) = $96

Tuesday + Friday Profits = $131

Don’t miss out on further trades – become a member today!

Further Positive Information for Carnival Corps.....

Demand for cruises is going through the roof right now, a sign that after an extended disruption from the pandemic, the cruise industry is in a bull market, even if the rest of the economy hasn't gotten there yet.

With travel restrictions, masking, social distancing, and other pandemic-related headwinds having now receded, Carnival's business is seeing some strong rebound momentum. In the cruise line company's first quarter, revenue rose 173% year over year to reach $4.43 billion and beat the average analyst sales estimate by roughly $130 million.

Sales for the period have now nearly recovered to pre-pandemic levels, and the company's loss per share of $0.55 was also significantly lower than the average analyst forecast for a per-share loss of $0.61.

The cruise business also shifted into posting positive free cash flow on an adjusted basis in Q1, and management expects to record positive adjusted FCF this year.

Analysts see revenue nearly doubling from the year-ago quarter to $4.76 billion and are calling for a loss of $0.34 a share.

High booking volume points to record profits in the near future and Carnival should be able to leverage those gains to pay down debt and buy back stock, restoring its balance sheet. As long as demand remains strong, the stock should continue its rebound, as it's still well below pre-pandemic levels.

Also, on Wednesday the Federal Reserve held benchmark interest rates steady for the first time in more than a year, a sign that interest rates could ease in the near future, which would lower the company's variable interest rate payments and potentially allow it to refinance its fixed-rate debt.

Conclusion.....

If the economy is truly on the mend, interest rates are stabilizing, and consumer spending remains strong, Carnival looks well positioned to capitalize on a new bull market. Profits could easily soar in the next year or two.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from CARNIVAL

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!