TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Will Coinbase Global Continue Upwards?

“Weekly Options” Members

Profit Up 258%!

More Growth Expected! A NEW TRADE ANTICIPATED!

Coinbase Global is enjoying the advantage of being the first-mover within the realm of different crypto assets.

As investment in crypto gains popularity, the platform will generate higher revenue and enjoy a wide user base.

And Weekly Options Members will have the opportunity to gain further on their already potential profit of 258% with this follow-up weekly options trade.

Are you on-board to profit as well?

Coinbase Global Inc (NASDAQ: COIN)

Prelude…..

On Thursday, August 26, 2021, a Coinbase Global Weekly Options trade was recommended to our members based on several catalysts.

READ Details of the Original Coinbase Global Weekly Options Recommendation Further Below.....

As cryptocurrency prices rebound from their summer lows, companies that profit off trading volatility stand to benefit. Coinbase Global Inc (NASDAQ: COIN) has continued to stay at the helm of the crypto financial services industry by diversifying its products offered, frequently adding new currencies, and complying with regulatory authorities.

Calling it the “leading provider of financial services, infrastructure, technology, and custodial services for the high-growth, crypto asset universe,” John Todaro of Needham & Co. published his bullish hypothesis.

The analyst rated the stock a Buy, and assigned a price target of $420.

The crypto giant launched its direct listing on the Nasdaq on April 14, pricing at 250 a share. Coinbase stock shot up nearly 72% to 429.54 before closing its first day of trading at 328.28, up 31.3%, for a valuation of $87.3 billion.

Analysts expect the Coinbase IPO to give the cryptocurrency market increased validation.

"The Coinbase IPO is potentially a watershed event for the crypto industry and will be something the Street will be laser-focused on to gauge investor appetite," Wedbush analyst Dan Ives wrote in a note to clients. "Coinbase is a foundational piece of the crypto ecosystem and is a barometer for the growing mainstream adoption of Bitcoin and crypto for the coming years."

The rapid expansion of the exchange business will continue, with Coinbase poised to capture a significant portion of it. COIN has been making a name for itself with both household and institutional users, and is increasing its market share.

The “one-stop shop for crypto financial services” has been encouragingly secure with its liquidity and platform security, and thus far, has held off high-profile hackers.

Coinbase is the largest U.S. cryptocurrency exchange. It lists about 50 cryptocurrencies for trading, led by Bitcoin and Ethereum. Bitcoin is the largest digital coin by market value and is up just 2% this year after falling sharply in recent months. Ethereum has more than doubled in 2021, according to Coindesk.

The Actual Recommended Coinbase Global Weekly Options Trade.....

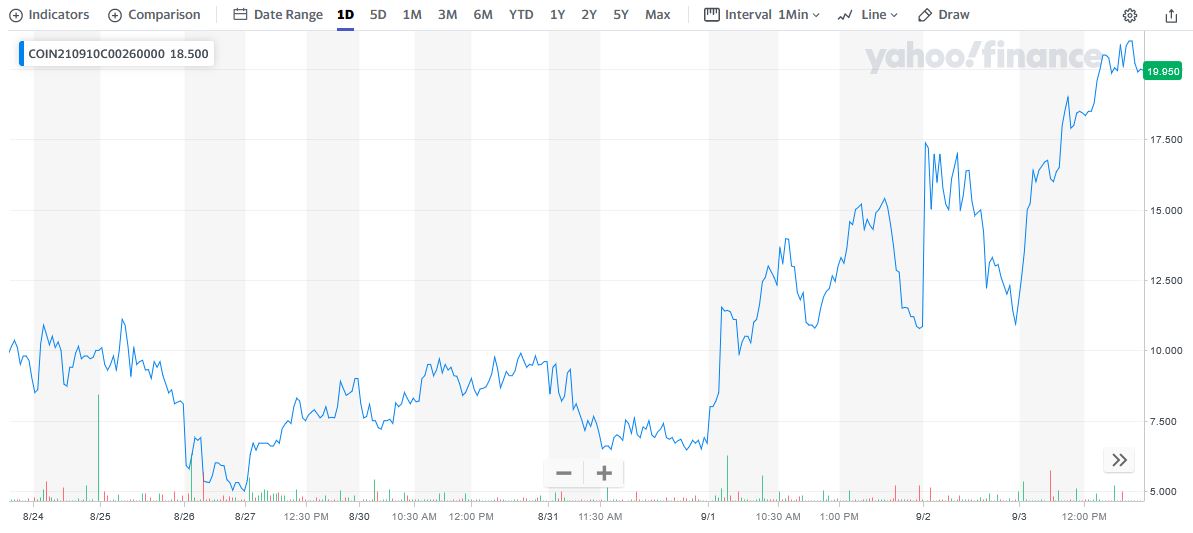

** OPTION TRADE: Buy COIN SEP 10 2021 260.000 CALLS at approximately $8.00.

(Actually bought for $5.79)

NOTE: The actual entry and exit prices will vary among individual traders – this will depend on their risk tolerance and exit strategy. The lowest price of the recommendation at the beginning of the day was $5.79; and the exit on Friday, September 03, was the highest for the day.

Coinbase Global Weekly Options Trade Call Success Explained.....

On Thursday, August 26, 2021, “Weekly Options Members,” entered the Coinbase Global Weekly Options trade mentioned above for $5.79 shortly after the market opened – 9:37am.

On Friday, September 03, 2021, at 3:00pm (approx.) the price of the option hit $21.00 – up 258%.

It is very likely that a new Coinbase Global Weekly Options trade, moving forward, will be also successful.

Join us and see what we are proposing!

The Original Major Catalysts for the Coinbase Global Weekly Options Trade…..

1. Earnings Report August 09, 2021.....

Coinbase Global last announced its earnings results on August 9th, 2021.

In its first earnings report as a public company, Coinbase blew away second-quarter estimates.

The cryptocurrency exchange reported $6.42 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $2.26 by $4.16.

The company had revenue of $2.03 billion for the quarter, compared to analysts' expectations of $1.83 billion. Its revenue was up 1040.2% on a year-over-year basis.

Coinbase saw monthly transacting users jump to 8.8 million, up 44% from the first quarter. Trading volume increased to $462 billion from $335 billion.

While the company didn't provide guidance, it did project lower monthly transacting users and lower trading volumes during the third quarter.

2. Assets Offered.....

Coinbase’s roadmap includes it releasing several yield-bearing products, and is expected to continue offering new assets for staking. This practice is described on Coinbase’s website as “a way of earning rewards for holding certain cryptocurrencies.” Quarter-over-quarter by its Q2 earnings release, staking revenues had increased 271%.

The growth of Coinbase’s staking business allows people to earn yield on their crypto assets. This part of the business grew sharply in the second quarter and there appears to be more expansion ahead as the company adds more staking assets and other yield-bearing offerings.

COIN’s opportunities in staking, custody, and interest-bearing accounts will accelerate its positioning as a one-stop shop for crypto financial services.

3. Fees.....

The relatively high fees COIN charges per transaction have not appeared to scare away its user base. Users seemingly place more priority on the quality of the platform, as well as the ability to trade a variety and availability of cryptocurrencies.

Coinbase’s fees don’t seem to be a concern because the non-commoditized nature of crypto exchanges differentiates them from traditional brokerage firms, where fee compression has occurred in recent years.

Institutional investors and retail traders seem most focused on factors like the availability of tokens, the reliability of a platform, and liquidity when determining where to conduct crypto activities.

4. Bullish on Bitcoin.....

The price of

Bitcoin (BTCUSD) advanced beyond the $50,000 milestone on Aug. 22, 2021—the

first time it has traded above this level since mid-May.

Among the

factors that may be fueling bullish sentiment about Bitcoin and other

cryptocurrencies such as Ethereum (ETHUSD) and Dogecoin (DOGEUSD) are

supportive remarks by Elon Musk, CEO of advanced electric carmaker Tesla, Inc.

(TSLA), and expectations that the U.S. Federal Reserve may continue to strike a

dovish stance that will keep interest rates low, thus reducing the comparative

appeal of other financial assets. Musk has indicated that he holds Bitcoin,

Ethereum, and Dogecoin.

5. Mining and Processing Rebound.....

Indications are that the mining and processing of Bitcoin has rebounded from a low in July, when the Chinese government announced a crackdown. This is significant since roughly 65% of Bitcoin mining takes place in China.

Also, driving the rebound in the prices of Bitcoin and other cryptocurrencies is the growing mainstream acceptance among banks and brokerage firms.

As well, leading companies outside the financial sector—most notably Amazon.com, Inc. (AMZN) and Walmart Inc. (WMT)—have recently posted job advertisements related to the development of strategies concerning digital currencies. Online marketplace PayPal Holdings, Inc. (PYPL) has announced that it is moving toward allowing Bitcoin and other digital currencies as a form of payment.

6. Launching a Crypto Exchange Business in Japan.....

Coinbase

announced last week it is launching a crypto exchange business in Japan, in

partnership with Mitsubishi UFJ Financial Group.

The

partnership allows users to deposit money through MUFG Quick Deposit to

purchase crypto. Quick Deposit allows users to make yen deposits 24 hours a

day/365 days a year through internet banking, convenience stores and ATMs.

Coinbase

will initially launch retail products such as a suite of five top assets based

on trading volume. Down the line, the exchange will add new products including

more localized versions of advanced trading and Coinbase for institutions, he

added.

7. Growth.....

Japan is only the first stop in Coinbase's international expansion strategy and Germany will likely be next.

Coinbase obtained a crypto license in Germany and its subsidiary was awarded a crypto custody and trading license from the German Federal Financial Authority.

Coinbase's international expansion strategy presents a meaningful opportunity and upside to the stock if it goes well.

8. Purchase of Cryptocurrencies.....

Last week, Coinbase announced the board had approved the purchase of $500 million in cryptocurrencies to be added to the balance sheet. Bitcoin will take its place among other crypto investments such as Ethereum, Proof of Stake assets, DeFi tokens and other cryptocurrencies. That’s not where it ends, though. The company also said it intends to build a crypto assets portfolio, allocating 10% of its quarterly profits to the endeavor.

Coinbase expects to further integrate crypto into its day-to-day activities. Oppenheimer’s Owen Lau notes this could eventually mean paying its vendors and employees in digital assets, among other “financial transactions.” It is this aspect which Lau thinks investors should really take note of.

“Buying crypto on the balance sheet is definitely a testament, but further integration of digital assets into COIN's corporate practice has a deeper influence not just on COIN but on the whole cryptoeconomy,” the analyst said. “COIN is in a good position to introduce new products (e.g., credit/debit cards) to support retail transactions in crypto and to influence crypto adoption in institutional transactions.”

Lau reiterated an Outperform (i.e. Buy) rating on COIN shares, whilst sticking with a $444 price target.

9. Analysts Opinions.....

John Todaro, vice president of crypto asset and blockchain research at Needham & Co., initiated coverage of Nasdaq-listed Coinbase (COIN) with a “Buy” rating, setting a $420 price target based on opportunities beyond exchange services.

Coinbase is a market-leading crypto exchange with “significant future opportunities beyond exchange service, which include staking, custody, yield bearing products, and more,” Todaro wrote in a note.

The research firm projects a 467% increase in 2021 revenue and a 9% increase in 2022.

“We view COIN as the leading, fiat-crypto on-ramp, and expect the company's exchange business to grow rapidly and sustainably as new investors adopt its crypto assets and services,” Todaro wrote. “COIN ranks as the largest crypto exchange by trading volume.”

Coinbase's opportunities in staking, custody and interest-bearing accounts will accelerate its position as a one-stop shop for crypto financial services, according to the analyst.

Investor concerns over fees are misplaced, according to the note. The non-commoditized nature of crypto exchanges differentiates them from traditional brokerage firms, where fee compression has occurred in recent years.

"The Coinbase IPO is potentially a watershed event for the crypto industry and will be something the Street will be laser-focused on to gauge investor appetite," Wedbush analyst Dan Ives wrote in a note to clients. "Coinbase is a foundational piece of the crypto ecosystem and is a barometer for the growing mainstream adoption of Bitcoin and crypto for the coming years."

A number of other brokerages have recently commented on PLTR......

- On April 22, Mizuho analyst Dan Dolev initiated coverage on the stock with a neutral rating and a $285 price target. "Over time, Coinbase pricing — and industry pricing in general — may face downward pressure from platforms like PayPal and Cash App," Dolev commented. "This is because PayPal and Cash App primarily use their crypto trading products as engagement tools, whereas Coinbase relies on its crypto trading products as its main source of revenue and profitability."

- On May 24, Goldman Sachs initiated coverage with a buy rating and a $306 price target. Goldman analyst Will Nance said in a note to clients that Coinbase is the best way to gain exposure to cryptocurrency ecosystems.

- On May 25, JPMorgan initiated coverage on Coinbase with an overweight rating and a 371 price target. In response, Coinbase stock surged 7.6%.

- On June 16, Canaccord Genuity started the stock with a buy rating and a 285 price target.

Summary.....

Coinbase has done a good job of offering new assets and new products in a regulatory compliant manner, maintaining uptime, offering deep liquidity pools, and ensuring exchange reliability, as evidenced by the lack of a successful exchange hack.With an increasing serviceable addressable market and continued crypto adoption, Coinbase is well-positioned to become an enabler of crypto innovation.

Further Catalysts To Consider.....

1.

China Regulations…..

Relief that China looks as if its crackdown on cryptocurrencies has come to an end with the crypto mining hubs in the country having been shut down, and the government telling financial institutions to refrain from "conducting or enabling virtual currency transactions and trading," no further regulations on cryptocurrencies are anticipated.

Therefore, China doesn't seem to be planning to wreak any further havoc on the market -- and so crypto investors can heave a sigh of relief on that score.

2. India’s Regulations…..

Indian legislators are hard at work on a new bill that will break cryptocurrencies into one of three categories: those used for investment, for payments, or serving as a form of "utility." The bill will also, if it becomes law, classify all cryptocurrencies as a form of commodity asset.

3. Cryptocurrency

Surge…..

Bitcoin (BTC) was trading

around $50,500 on Friday, up 1.7% in 24 hours for a gain of more than 30% over

the past month. Ethereum (ETH) was hitting record highs with a gain of 5%,

topping $4,000 for the first time. Other cryptos are rallying too: Solana (SOL),

Litecoin (LTC), and Avalanche (AVAX) had all gained more than 10% over the last

24 hours.

4. Big

Investors…..

Some large investors

appear to be buying more Bitcoin…..

- Bill Miller, the veteran value-fund manager, had amassed 1.5 million shares of the Grayscale Bitcoin Trust (GBTC) in his Miller Opportunity Trust mutual fund (LGOAX), according to securities filings.

- Ethereum, meanwhile, is benefiting from a technical upgrade to its underlying network a month ago. According to Fundstrat, over 180,000 ETH tokens—about $720 million at recent market prices—have been “burned,” or taken out of supply since then, resulting in pressures that may be lifting the price.

- Crypto apostles like Jack Dorsey, CEO of Twitter (TWTR) and Square (SQ), are expanding their investments, aiming to build out crypo-related revenue streams.

- Some small banks are also getting into cyrpto. Vast Bank, based in Oklahoma, has become the first federally chartered lender, backed by the Federal Deposit Insurance Corp., to offer crypto banking, according to Vast CEO Brad Scrivner. The bank offers crypto trading on a mobile app, acts as a custodian, and offers insurance on crypto assets through Coinbase.

Conclusion.....

The global crypto market has crossed $2 trillion and is expected to grow further. I believe Coinbase has the right platform and the potential to attract users and help them with crypto investment.

The risks associated with crypto certainly apply to all investors but investing in COIN stock is an ideal way to diversify your portfolio.

Whenever a crypto asset makes a strong move, investors will be drawn towards it and Coinbase will make money through the transaction.

Therefore…..

The Coinbase Weekly Options Trade Has Been A Big Winner!

What Further Coinbase Weekly Trades Will We Recommend?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Weekly Options USA, and get the full details on the next trade.

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!

Back to Weekly Options USA Home Page from Coinbase