TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

COSTCO Earnings

Costco earnings are set for approximately 4:15 PM ET on Thursday, December 9, 2021.

expectations for COSTCO Earnings

Costco is expected to deliver a year-over-year increase in earnings on higher revenues when it reports results for the quarter ended November 2021.

The consensus earnings estimate is for $2.59 per share on revenue of $49.05 billion; but the Whisper number is higher at $2.77 per share.

Consensus estimates are for year-over-year earnings growth of 13.10% with revenue increasing by 13.52%.

For the last reported quarter, it was expected that Costco would post earnings of $3.55 per share when it actually produced earnings of $3.90, delivering a surprise of +9.86%.

Over the last four quarters, the company has beaten consensus EPS estimates three times.

Short interest has decreased by 17.1% and overall earnings estimates have been revised higher since the company's last earnings release.

About Costco Wholesale Corporation (NASDAQ: COST)

Costco

Wholesale Corp. engages in the operation of membership warehouses.

The firm's product categories include food and sundries, hardlines, fresh foods, softlines, and ancillary. It operates through the following segments: Unites States Operations, Canadian Operations, and Other International Operations.

Costco currently operates 824 warehouses, including 571 in the United States and Puerto Rico, 105 in Canada, 40 in Mexico, 30 in Japan, 29 in the United Kingdom, 16 in Korea, 14 in Taiwan, 13 in Australia, three in Spain, and one each in Iceland, France, and China. Costco also operates e-commerce sites in the U.S., Canada, the United Kingdom, Mexico, Korea, Taiwan, Japan, and Australia.

The company was founded by James D. Sinegal and Jeffrey H. Brotman in 1983 and is headquartered in Issaquah, WA.

Influencing Factors for COSTCO Earnings

Membership.....

The retailer

requires people to pay for annual memberships that grant the privilege to shop

at its warehouse stores. Impressively, Costco offers enough good deals to make

the membership worthwhile for over 60 million households.

As of its

fiscal fourth quarter, which ended Aug. 29, Costco boasted 61.7 million paying

membership households. That was up by 1.1 million from just 16 weeks earlier.

It offers two membership tiers -- standard and executive.

The standard

membership runs $60 for the year and gives households access to shop inside

Costco warehouses. The executive membership costs $120 per year, and in

addition to shopping privileges, gives customers 2% cash back on purchases at

Costco.

The company

generated $1.2 billion in membership fee income in Q4. Note, this revenue has

exceptionally high profit margins. Besides the initial costs to set up a

customer with a picture and a physical card, there is little expense associated

with membership fees. Costco reported $2.3 billion in operating income in Q4,

and it would not be surprising if nearly 50% of that came from membership fee

income.

Will Costco Raise The Cost of Membership?.....

Costco has historically increased membership prices roughly every five years, and the last time the company raised prices was in 2017, so that time is approaching. Management might announce when the next price increase will be or discuss its thought process around the decision.

Costco reported North American membership retention rates of 91.3% in its most recent quarter. If a similar percentage of members renew their subscriptions at a higher price, that will boost operating profits meaningfully.

History of Beating Earnings....

Costco has a solid history of beating earnings estimates and is in a good position to maintain the trend in its next quarterly report.

When looking at the last two reports, this warehouse club operator has recorded a strong streak of surpassing earnings estimates. The company has topped estimates by 14.97%, on average, in the last two quarters.

For the most recent quarter, Costco was expected to post earnings of $3.55 per share, but it reported $3.90 per share instead, representing a surprise of 9.86%. For the previous quarter, the consensus estimate was $2.29 per share, while it actually produced $2.75 per share, a surprise of 20.09%.

Inflation Easing....

Costco Wholesale Corp. said Wednesday that its November sales rose to $18.13 billion from $15.67 billion last year, up 15.7%, as inflation eased from the month prior.

Costco’s same-store sales for the month increased 14.1%, with online sales climbing 12.2%. There was some inflation moderation in November compared to October, a company investor relations representative said on a pre-recorded call. October sales increased 19.2%, Costco reported last month.

For the 12-week first quarter ended Nov. 21, the company’s net sales were $49.42 billion, a 16.7% increase from $42.35 billion last year. For the 13 weeks ended Nov. 28, Costco reported net sales of $54.10 billion, a 16.8% rise from $46.33 billion last year.

Supply Chain Issues....

Cowen analysts, like many others, believe supply chain disruption will continue through 2022, and they think that will benefit Costco earnings.

“We believe there are many factors that have led to the crisis at the ports and that a fix is not something that will come overnight,” the analysts, led by Jason Seidl, wrote in a commentary.

As for Costco, it is “well positioned to manage rising supply chain costs given its scale, importance to vendors, majority localized sourcing, and cash considerations,” Cowen’s Oliver Chen wrote.

Analyst

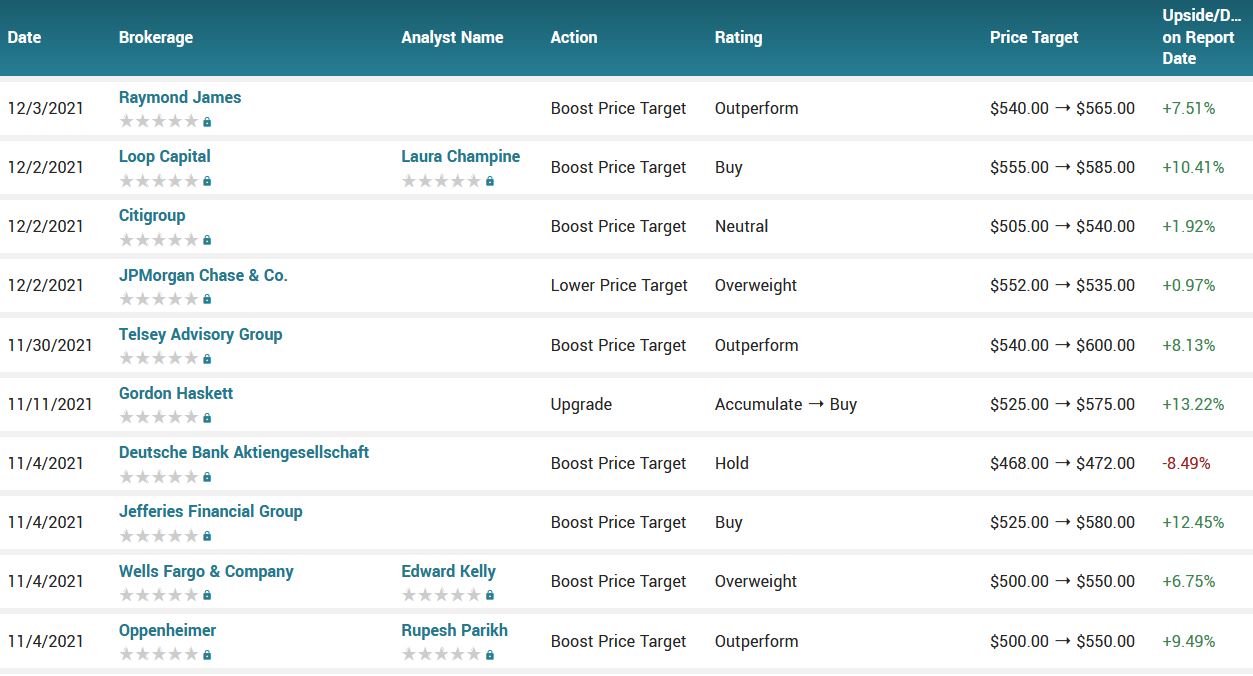

Thoughts about Costco Earnings....

Costco Wholesale had its price target raised by investment analysts at Raymond James from $540.00 to $565.00 in a report released on Friday. The brokerage presently has an “outperform” rating on the retailer’s stock. Raymond James’ price target indicates a potential upside of 7.51% from the company’s previous close.

Also, Costco had its price target raised by stock analysts at Loop Capital from $555.00 to $585.00 in a research note issued to investors on Thursday. The brokerage currently has a “buy” rating on the retailer’s stock. Loop Capital’s price objective would suggest a potential upside of 13.34% from the stock’s current price. The analysts noted that the move was a valuation call.

As well, Costco had its target price lifted by stock analysts at Citigroup from $505.00 to $540.00 in a report released on Thursday. The firm presently has a “neutral” rating on the retailer’s stock. Citigroup’s price target would suggest a potential upside of 1.92% from the company’s previous close.

According to the issued ratings of 23 analysts in the last year, the consensus rating for Costco Wholesale stock is Buy based on the current 5 hold ratings and 18 buy ratings for COST. The average twelve-month price target for Costco Wholesale is $510.35 with a high price target of $600.00 and a low price target of $385.00.

Summary for Costco Earnings.....

Growth rate

in EPS would be right in line with its compound annual growth rate in the

metric over the last decade of 13.1%. Costco's unique business model of

providing customers an excellent value in exchange for a yearly membership fee

works well for the retailer. As a result, Costco's stock is working well for

shareholders -- it's up 46% year to date. If the reports for Costco earnings increase in

the rate of membership growth in Q1 or a membership price increase, it could

send the stock higher still.

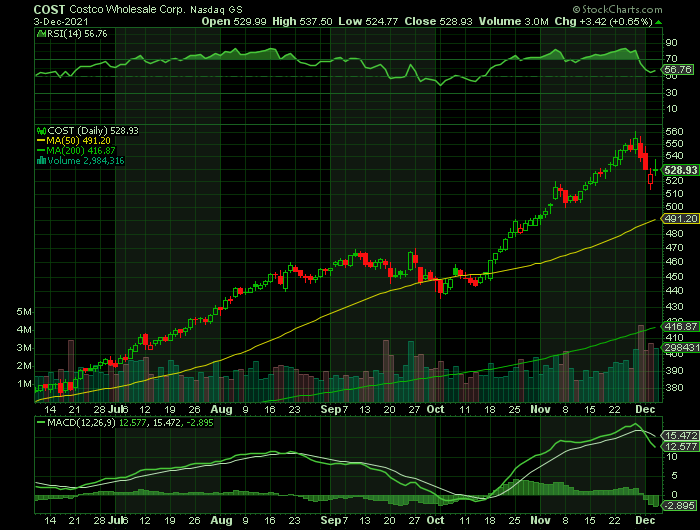

Costco has a market capitalization of $233.58 billion, a price-to-earnings ratio of 46.63, a PEG ratio of 5.20 and a beta of 0.65. Costco Wholesale Co. has a one year low of $307.00 and a one year high of $560.78. The company’s 50-day simple moving average is $491.87 and its 200-day simple moving average is $444.57. The company has a debt-to-equity ratio of 0.37, a quick ratio of 0.52 and a current ratio of 1.00.

FINALLY.....

To see what we are proposing for Costco Earnings CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from Costco Earnings

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!