TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

COSTCO Weekly Call Option Provides 42% Profit!

This Is On-Top Of Previous 37% Profit On Day 1!

Join Us and Get the Trades!

Costco Wholesale Corporation (NASDAQ:COST), the warehouse club retailing giant, has outperformed the market by consistently gaining share in a highly competitive industry. Costco's growth rate rarely disappoints, and its earnings are much more stable than its peers thanks to a steady stream of subscription fee income.

The stock is up 14% year-to-date and 49% in the past 12 months. It also pays a dividend and has a yield of 0.62%. It announced a hike from $1.02 to $1.16 per share, a 13.7% YOY rise.

This set the scene for Weekly Options USA Members to profit by 42% using a COST Weekly Options trade!

Join Us And Get The Trades – become a member today!

Monday, May 06, 2024

by Ian Harvey

UPDATE

Costco Wholesale Corporation (NASDAQ:COST) has survived inflation and recessions and is standing strong today. The company is popular because it sells products at a low cost and generates profits from membership fees. The best thing about Costco is that it has not raised membership prices since 2017, which has helped gain new members and maintain high renewal rates.

The company is also growing its physical stores and has 875 stores right now. It is expanding across Europe and Asia with more warehouses, and the growing number of stores should help improve revenue. It plans to open stores at another 31 new locations this year.

The stock is up 14% year-to-date and 49% in the past 12 months. It also pays a dividend and has a yield of 0.62%. It announced a hike from $1.02 to $1.16 per share, a 13.7% YOY rise.

Why the Costco Weekly Options Trade was Originally Executed!

Warehouse club Costco Wholesale Corporation (NASDAQ:COST) has been a tremendous investment virtually any time you bought shares but especially when its stock dipped lower.

The warehouse club retailing giant has outperformed the market by consistently gaining share in a highly competitive industry. Costco's growth rate rarely disappoints, and its earnings are much more stable than its peers thanks to a steady stream of subscription fee income.

During the Great Recession of the late-2000s, Costco lost half its value. But beginning in March 2009, the warehouse club mounted a comeback that would go on for 12 years and generate total returns far above 1,100%. Another brief detour south in 2021 was only a prelude to another 150% run higher. And it lost 20% of its value last year but is now up 50% over the past 12 months.

After hitting an all-time high last month, Costco stock has pulled back 8%. That makes it another great chance to buy in with this weekly option. The warehouse club’s low-margin business gets hurt in high inflation, high-interest rate environments like we’re in but can make up in volume what it loses on each individual sale. Indeed, the warehouse club’s earnings have tripled over the past decade.

Costco's surest path to positive shareholder returns is to boost sales at a faster clip than its peers. It's been doing a great job on this score lately, with same-store sales rising 6% in the most recent quarter, compared to Walmart's 4% uptick.

Also, there is a lever Costco is waiting to pull that will see an immediate effect on its top and bottom lines. An increase in membership prices typically happens every five or six years. We’re way past that threshold now and the retailer will pull that lever soon. The influx of revenue it causes will flow through its financial statements without losing any momentum and should spark the next big rally.

The Costco Weekly Options Potential Profit Explained.....

** OPTION TRADE: Buy COST MAY 10 2024 750.000 CALLS - price at last close was $7.70 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the COST Weekly Options (CALL) Trade on Friday, April 12, 2024 for $7.60.

Sold half the COST weekly options contracts on Friday, April 12, 2024 for $10.42; a potential profit of37%.

Sold the remaining COST weekly options contracts on Monday, May 06, 2024 for $10.78; a potential profit of 42%.

(This result will vary for members depending on their entry and exit strategies).

Don’t miss out on further trades – become a member today!

About Costco……

Costco Wholesale Corporation is central to the global warehouse membership club story. The company was founded in 1983 by Jim Sinegal and Jeffrey Brotman but its history dates back to 1976 because of the merger with Price Club. Costco, originally known as Costco Companies, quickly grew in its first two years and became the 1st company to go from $0 to $3 billion in revenue within the 1st 3 years. The company held its IPO in 1985.

Price Club was founded in 1976 by the Price family. It was among the very first warehouse membership clubs and targeted small merchants and businesses. It also saw quick success and went public in 1980. The Price family turned down an offer to merge with Walmart’s Sam’s Club in favor of a more suitable match-up with Costco. Coincidentally, Costco founder Jim Sinegal got his start in the retail business working for Sol Price at his original membership club, FedMart.

The new company was formed in 1993. It owned 206 stores and was called PriceCostco for a time. The Price family eventually exit the business in favor of new operations resulting in the rebranding to Costco Wholesale Corporation. The Price family's new business is called PriceSmart and operates a chain of membership clubs in the Caribbean and Central America. Price Club’s first store, opened in an old Howard Hughes airplane hangar, is still in operation and known as Costco #401.

Today, Costco is based in Issaquah, Washington and it is among the largest businesses in the world. The company operates as a member-only big-box retailer claiming more than 118 million members, it is ranked #10 on the Forbes Fortune 500 list and is the 5th largest retailer internationally. In terms of scale, it is the largest retailer of choice and prime beef, organic foods and rotisserie chickens. Rotisserie chickens are a long-standing tradition at Costco which pioneered their use. The chickens are sold for less than cost and used to attract business into the store.

The company operates through a network of subsidiaries that own warehouses in 11 countries, including the US and Puerto Rico. The company retails branded and private-label merchandise across verticals and categories and at “discounted” or bulk-rate prices. Product categories include grocery and frozen foods, apparel, sporting goods, electronics, auto care, appliances, housewares and even furniture. Nearly 70% of the stores are located in the US with another 13% in Canada and the remainder scattered around the globe.

In addition to retail, the company also provides many services including pharmacy, eye care, food & beverage and auto care centers. The company also operates more than 665 gas stations across its footprint and a robust eCommerce channel. Other services include delivery, travel and curbside pickup. As of the year-end calendar 2022, the company operated more than 840 stores and was on track to open new stores in the coming years. Total revenue in 2022 topped $226 billion, the company employs more than 304,000 individuals and it is a member of the S&P 500, the S&P 100 and the NASDAQ 100.

The Major Catalysts for the COST Weekly Options Trade…..

Costco has some additional advantages over its larger rival that should support higher investor returns. Its mix of consumer essentials and luxury discretionary items allows it to cater to a wide range of shoppers, for one.

Costco has shown that it can be nimble, too. Its recent offering of precious metals like gold and silver helped the e-commerce niche expand at a blazing 18% rate last quarter. Look for Costco to press those advantages over the next few years, ideally keeping same-store sales gains near the top of its industry.

Other Catalysts.....

One underappreciated fact driving stock returns is that Costco is a membership club first and a retailer second. Most of its earnings come from subscriber fees that aren't nearly as volatile as the profits that come from merchandise sales.

That's why it matters where Costco's membership metrics shift over the next several years. Costco recently achieved a record 93% renewal rate, meaning that essentially all its subscribers are getting plenty of value from their memberships. If the company can maintain that high level of renewals over the next few years, the stock will likely keep beating the market. That's especially true given the fact that Costco will almost certainly hike its annual fees in 2024 or 2025. Higher fees, combined with a rising membership base, bode well for the retailer's earnings power.

Financials .....

Costco’s 2024 financials are off to a great start, with Q1 EPS growth at 18.79% YOY. Additionally, revenue is strong and steady, with consistent positive revenue growth. Last year, Costco ended with a free cash flow (FCF) of $6.745 million, almost doubling the FCF per share from 2022.

Costco, one of the few national retailers that charge shoppers membership fees to shop online or in its stores, has posted a large increase in sales for March. Online sales surged.

For the five weeks that ended April 7, revenue rose 9.4% to $21.5 billion. Comparable store sales rose 7.7%. E-commerce sales jumped, up 28.3%. That compares to a 14.8% e-commerce increase for the 31 weeks that ended the same day. Easter was a tiny contributor. It was in April last year and March this year. That positively affected sales by 0.5%, which does not explain the increase in e-commerce.

Moving Ahead…..

With online shopping rates increasing, Costco is at a disadvantage. However, it has announced that it plans to start opening stores dedicated to furniture and appliances. Generally, furniture shopping occurs in person, making this idea a potential advantage for Costco. The company is reported to have an expansion plan for this project already developed.

Costco Wholesale shows strong financials and takes the initiative with innovative new ideas, making it a strong buy.

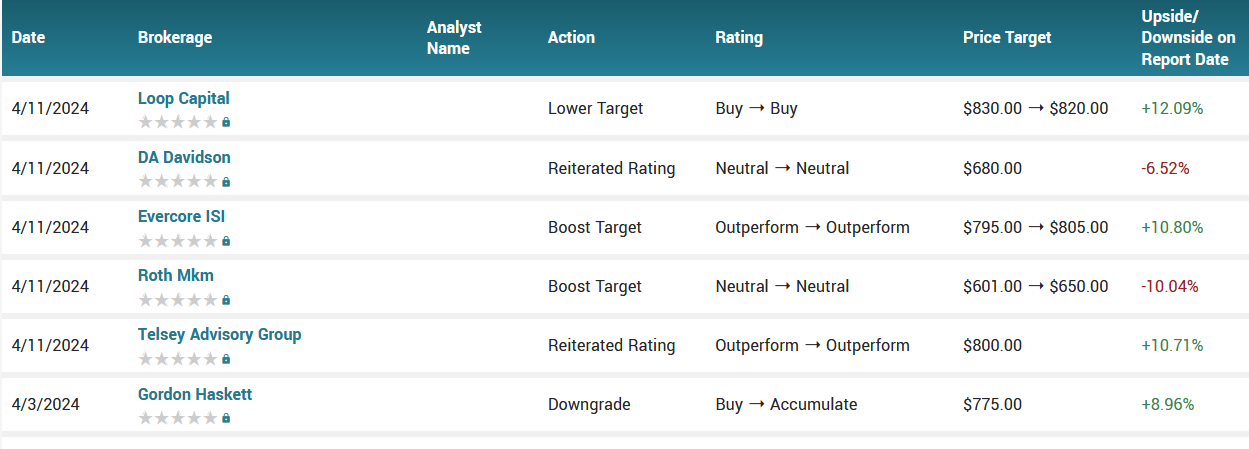

Analysts.....

According to the issued ratings of 25 analysts in the last year, the consensus rating for Costco Wholesale stock is Moderate Buy based on the current 6 hold ratings and 19 buy ratings for COST. The average twelve-month price prediction for Costco Wholesale is $691.28 with a high price target of $870.00 and a low price target of $550.00.

Summary.....

Costco’s stock has had an impressive run-up in the past year, rising 46%, compared to the S&P 500’s 26%.

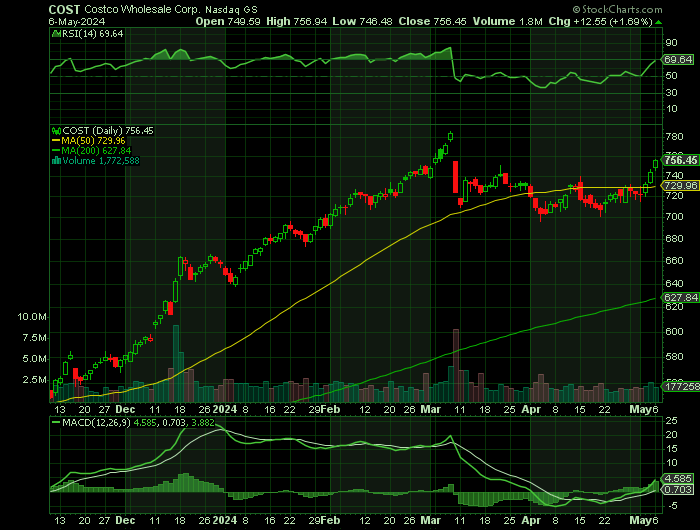

Costco Wholesale traded up $9.77 during trading hours on Thursday, hitting $732.35. 2,106,066 shares of the stock traded hands, compared to its average volume of 2,133,530. The stock has a 50-day simple moving average of $729.68 and a 200 day simple moving average of $653.60. The company has a market cap of $324.80 billion, a P/E ratio of 47.84, and a P/E/G ratio of 4.93 and a beta of 0.77. Costco Wholesale Co. has a one year low of $476.75 and a one year high of $787.08. The company has a current ratio of 0.93, a quick ratio of 0.43 and a debt-to-equity ratio of 0.28.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from COSTCO

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!