TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Crowdstrike Flies Higher!

Stock Climbs Tuesday

and Wednesday, And, “Weekly Options

Members” Make 114% Potential Profit In 3 Days!

Time To Exit Or Wait For The Earnings Report?

Thursday, May 27, 2021

by Ian Harvey

Wednesday saw Crowdstrike Weekly Options climb on further analyst action and pre-earnings enthusiasm. However, there are still several catalysts pushing these prices upwards. The major catalyst is CRWD’s earnings reports next Wednesday, June 03, after the market closes.

Meantime, “Weekly Options Members,” are already showing potential profits of 114%.

Is it time to exit these trades?

Crowdstrike Holdings Inc (NASDAQ: CRWD)

Prelude…..

Over the last two decades, software-as-a-service (SaaS) has become an increasingly popular business model. For customers, it cuts upfront costs and improves scalability; for providers, SaaS reduces the cost revenue, which means higher margin and greater profitability.

This is the reason why CrowdStrike is one of the fastest-growing SaaS businesses in history -- reaching $1 billion in annual recurring revenue (ARR) more quickly than any other SaaS provider.

In 2011,

George Kurtz served as chief technology officer at cybersecurity firm McAfee.

While on a business trip, Kurtz watched a fellow airline passenger start his

computer and wait 15 minutes for McAfee software to load. Kurtz knew he

could do better, so he left McAfee to start CrowdStrike.

Why Thursday’s Jump for the Crowdstrike Weekly Options Call Trades…..

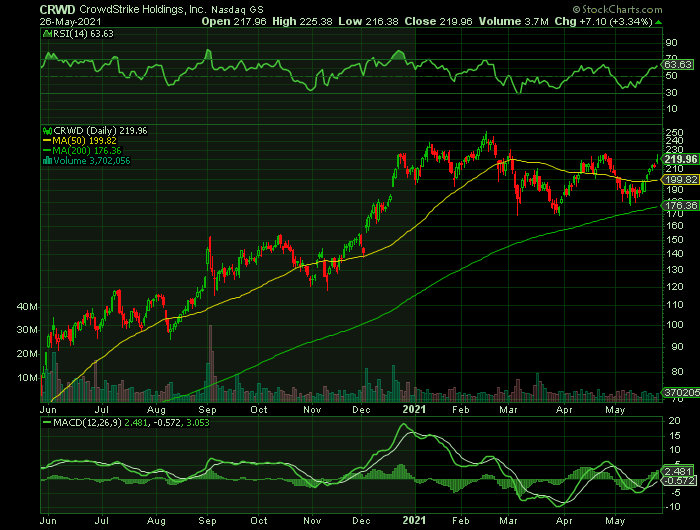

CrowdStrike has delivered a phenomenal performance in 2020, leading to its stock price more than tripling from its 52-week low last year to reach a high of over $250 a share in February. The stock was stubbornly hovering just near the $200 mark despite the broader stock market's recent pullback until this week.

Crowdstrike’s earnings report is due out next week and for FY 2022, CrowdStrike forecasts continued double-digit percentage revenue growth of at least $1.3 billion.

Its likely CrowdStrike will meet or exceed this guidance. It operates in the rapidly expanding cybersecurity sector. Forecasts predict the global cybersecurity market to rise from $184.2 billion last year to $248.3 billion by 2023. This gives CrowdStrike plenty of room to grow despite the droves of cybersecurity competitors in the market.

CrowdStrike has attributes to achieve outsized success. The company uses a software-as-a-service (SaaS) pricing model, generating most of its revenue from subscribers to its Falcon cloud-based security platform. The SaaS model gives CrowdStrike reliable recurring revenue, unlike the old software licensing model that dominated the industry before cloud computing transformed how businesses implemented technology infrastructure.

Analysts have been optimistic this week.....

- CrowdStrike had its price objective by JMP Securities set at $250.00 in a report published on Tuesday morning. They currently have a market outperform rating on the stock.

- CrowdStrike had its target price set by Jefferies Financial Group at $230.00 in a research note. Jefferies Financial Group currently has a buy rating on the stock.

The Actual Recommended Crowdstrike Weekly Options Call Trades…..

** Crowdstrike Weekly

Options Call: Buy CRWD JUN 04 2021 215.000 CALLS at approximately $7.50.

Crowdstrike Weekly Options Call Success Explained.....

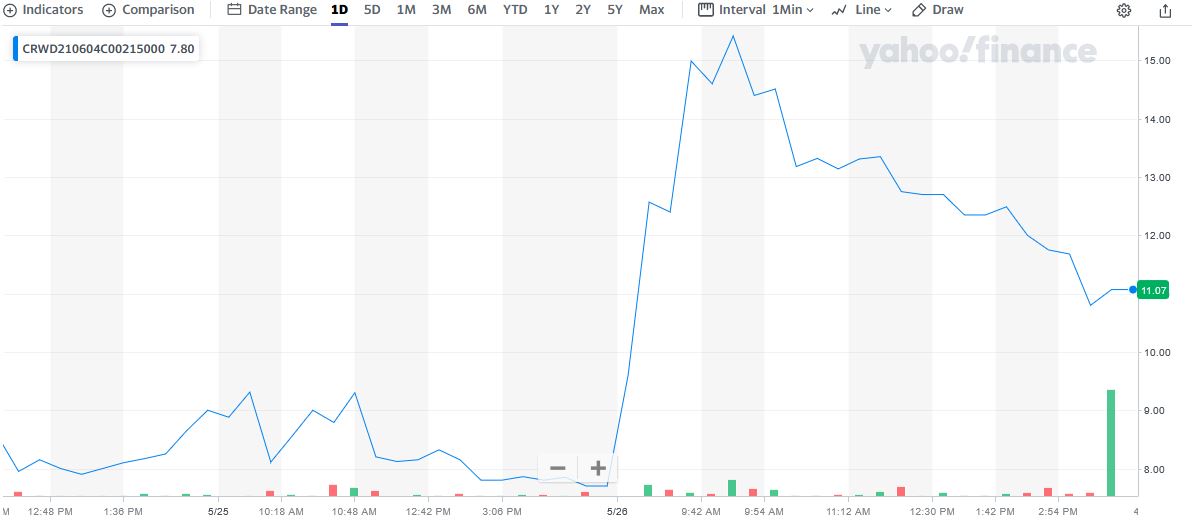

Weekly Options Members” entered a Crowdstrike weekly options trade on Monday, May 24, 2021 - for $7.50.

On Tuesday, May 25, 2021, our Crowdstrike weekly options trade climbed as high as $9.50 – a potential profit of 27%.

However, on Wednesday, May 26, 2021, our Crowdstrike weekly options trade shot higher hitting $16.05 – a potential profit of 114%.

Why The Original Crowdstrike Weekly Options Call Trade Recommendation?

Stocks have been a volatile place for investors to be lately, and that's been especially true for the companies that make up the Nasdaq Composite. Big drops have been a regular part of the picture for Nasdaq investors.

Some popular stocks have taken big hits in recent months. However, cloud-based endpoint cybersecurity company Crowdstrike Holdings Inc (NASDAQ: CRWD), based in California, is a growth stock that is well insulated from the COVID-19 crisis and other macro headwinds over the past year and has churned out double-digit revenue growth throughout the tough times.

The revenue driver for CrowdStrike is the steady demand for cybersecurity protection. CrowdStrike provides cloud workload and endpoint security. The company also provides cyber-attack response services and threat intelligence. Utilizing its Falcon platform, CrowdStrike has created the first multi-tenant, intelligent security solution. It is capable of protecting workloads across on-premise, virtualized, and cloud-based environments running on a variety of endpoints.

No matter how well or poorly the U.S. economy is performing or how big or small a business is; hackers, robots, and malware don't take vacation days. This creates a transparent demand for cybersecurity solutions that simply doesn't wane, and which has only been magnified by the work-from-home trend precipitated by the coronavirus pandemic.

CrowdStrike Holdings, Inc. provides cloud-delivered solutions for endpoint and cloud workload protection in the United States, Australia, Germany, India, Israel, Romania, and the United Kingdom.

The Major Catalysts for The Crowdstrike Weekly Options Call Trade.....

1. Earnings on Wednesday, June 03, 2021.....

CrowdStrike is expected to report earnings Wednesday, June 03, 2021, after the market closes. The report will be for the fiscal Quarter ending April 2021.

The company is expected to report EPS of $0.06, up 200% from the prior-year quarter. Meanwhile, the latest consensus estimate is calling for revenue of $292.2 million, up 64.08% from the prior-year quarter.

For the full year, our Consensus Estimates are projecting earnings of $0.30 per share and revenue of $1.32 billion, which would represent changes of +11.11% and +51.12%, respectively, from the prior year.

2. Previous Earnings.....

In March, the company reported a record fourth quarter and fiscal year 2021 financials. In it, CrowdStrike reports that its annual recurring revenue (ARR) surpassed the $1 billion milestone-driven by a record net new ARR of $143 million. The company also delivered record operating and free cash flow.

Also, the company saw its net new subscription customer grow by 70% year-over-year. CrowdStrike also mentions that it continues to gain incredible momentum with both marquee enterprises and small businesses as it expands its partner ecosystem.

3. Leader Position.....

Last week, the company was named a leader for the second time in the 2021 Gartner Magic Quadrant for endpoint protection platforms. The company is the only company to maintain its leader position and obtain the furthest position in Completeness of Vision in the EPP Magic Quadrant for the second consecutive time. This establishes CrowdStrike as an industry pioneer and changes the way organizations tackle security threats.

4. Breakeven.....

CrowdStrike is bordering on breakeven, according to the 22 American Software analysts. They anticipate the company to incur a final loss in 2023, before generating positive profits of US$61m in 2024. The company is therefore projected to breakeven around 3 years.

In order to meet this breakeven date, it is calculated an average annual growth rate of 37% is expected.

5. Products.....

The cybersecurity specialist announced a couple of new product launches that emphasized the value of its software-as-a-service platform.

CrowdStrike said it had added new features to its cloud security posture management product, Falcon Horizon. The cloud-based software looks at internet traffic behavior and seeks to detect patterns that could signal current or future attacks. By using real-time telemetry and analytics, CrowdStrike is able to detect threats more quickly and take action to protect clients across its entire platform.

In addition, CrowdStrike has expanded its broader Falcon platform to incorporate more features and allow for more users. Expanded macOS coverage will appeal to clients who favor hardware platforms that run that operating system, while new capabilities from CrowdStrike's Zero Trust and the addition of a new message center for its Complete and OverWatch services will enhance the value of Falcon for users.

On March 5, Crowdstrike completed the acquisition of Humio. The acquisition will help accelerate Crowdstrike's growth in XDR capabilities for cybersecurity.

6. Headline Making.....

Cybersecurity stocks appear to be making headlines right now.

Recent incidents in the field of cybersecurity are setting the industry ablaze now. The largest fuel line operator in the U.S., Colonial Pipeline, was hacked earlier this month. Because of the ransomware attack, the East Coast saw widespread fuel shortages. In order to remedy this, the company had to shell out a whopping $4.4 million ransom to remedy this.

As a response, President Joe Biden signed an executive order last week, bolstering federal cybersecurity infrastructure. Biden’s administration will turn to the top cybersecurity companies now..

Analysts’ Opinions.....

The shares of Crowdstrike have received a price target decrease from $265 to $250. And JMP Securities analyst Erik Suppiger is keeping an “Outperform” rating on the shares as part of a broader research note on Cybersecurity and IT Infrastructure. JMP Securities' target price would suggest a potential upside of 28.04% from the stock's current price. The analysts noted that the move was a valuation call.

Suppiger pointed out that some of the group’s stocks have relatively high valuation multiples. And the recent volatility in the market caused multiples for highly valued tech stocks to decline.

As a result, his new price target more accurately reflects market multiples that are commensurate with comparable stocks.

CRWD has been the subject of a number of other research reports.....

- Needham & Company LLC upped their price target on CrowdStrike from $200.00 to $275.00 and gave the stock a "buy" rating in a research report on Tuesday, March 23rd.

- Canaccord Genuity assumed coverage on CrowdStrike in a research report on Tuesday, February 16th. They set a "buy" rating and a $280.00 price target for the company.

- Robert W. Baird upped their price target on CrowdStrike from $185.00 to $235.00 and gave the stock an "outperform" rating in a research report on Tuesday, March 23rd.

- Royal Bank of Canada raised their target price on shares of CrowdStrike from $220.00 to $250.00 and gave the stock an outperform rating in a report on Tuesday, March 23rd.

- Oppenheimer lifted their price objective on CrowdStrike from $190.00 to $225.00 and gave the company an outperform rating in a report on Tuesday, March 23rd.

- JMP Securities reduced their target price on CrowdStrike from $295.00 to $265.00 and set a market outperform rating on the stock in a report on Thursday, April 15th.

- Finally, Deutsche Bank Aktiengesellschaft started coverage on shares of CrowdStrike in a research report on Wednesday, April 21st. They set a buy rating and a $265.00 price objective for the company.

Five research analysts have rated the stock with a hold rating and twenty-one have assigned a buy rating to the company. CrowdStrike presently has an average rating of Buy and a consensus price target of $229.30.

Summary.....

The company looks poised for further growth, in part due to its recently completed acquisition of Humio, a provider of cloud log management and observability technology. Those new additions to its offerings will help Crowdstrike to expand its threat detection capabilities and deliver better real-time protection for its clients.

Crowdstrike has strong fundamentals with positive cash flow from operations and more cash and short-term investments than debt.

Therefore…..

Should Members Exit This Crowdstrike Weekly Options Call Trade?

Or, Will Crowdstrike Stock Price Continue Its Upward Momentum?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Weekly Options USA, and get the full details on the next trade.

Recent Articles

-

191% Weekly Option Win on Super Micro Computer Amid Market Mayhem

191% Weekly Option Win on Super Micro Computer Amid Market Mayhem – What’s Next? -

Tariffs and the Stock Market: Positive and Negative Impacts in 2025

Tariffs and the Stock Market: Positive and Negative Impacts in 2025. This article explores both the positive and negative effects of tariffs on the stock market based on recent data, forecasts, and ma… -

SMCI’s Wild Ride: Options Traders Are Profiting From the Ups and Downs

SMCI’s Wild Ride: How Options Traders Are Profiting From the Ups and Downs

Back to Weekly Options USA Home Page from Zynga Earnings