TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Disney Co Continues To Have

Problems!

However, Members Make

Potential Profit of 76%,

Using A Weekly put Option!

Walt Disney Co (NYSE:DIS)’s stock was downgraded this week by investment advisory company KeyBanc Capital Markets over fears of stalled growth at its Disney+ and Hulu streaming services and lower attendance at its theme parks, according to reports.

This set the scene for Weekly Options USA Members to Make Potential Profit Of 76%, using a DIS Weekly Options trade!

Join Us And Get The Trades – become a member today!

Thursday, July 06, 2023

by Ian Harvey

Why the DIS Weekly Options Trade was Executed?…..

Walt Disney Co (NYSE:DIS)’s stock was downgraded this week by investment advisory company KeyBanc Capital Markets over fears of stalled growth at its Disney+ and Hulu streaming services and lower attendance at its theme parks, according to reports.

"While Disney appears less expensive versus its historical average, we believe the stock is unlikely to work until a number of items have line of sight to being resolved," analysts led by Brandon Nispel said on Wednesday.

KeyBanc analysts lowered Disney’s rating from overweight to sector weight Wednesday, causing its stock price to fall.

The analysts' main concerns included the slow growth of subscribers to Disney+ and Hulu, a possibly too-high price for the new ESPN streaming service, weak theme park attendance compared to company expectations, the company being too ambitious about content distribution profits and shares dropping last year with a similar financial setup this year, the outlet reported.

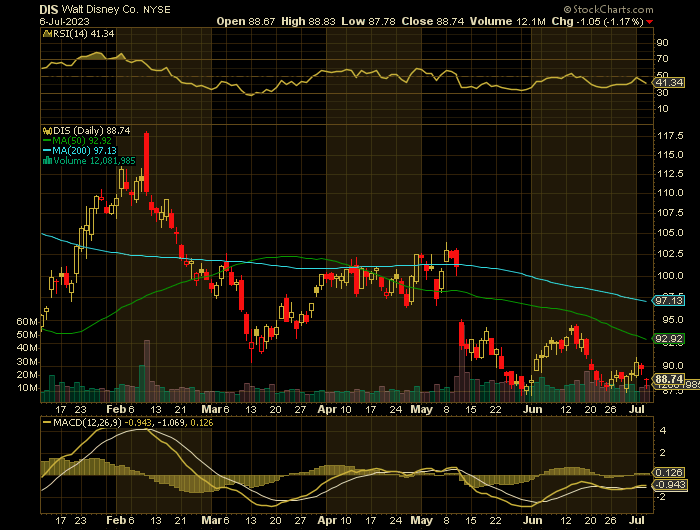

Since its peak of nearly $200 in late 2021, Disney’s stock has fallen sharply.

The DIS Weekly Options Trade Explained.....

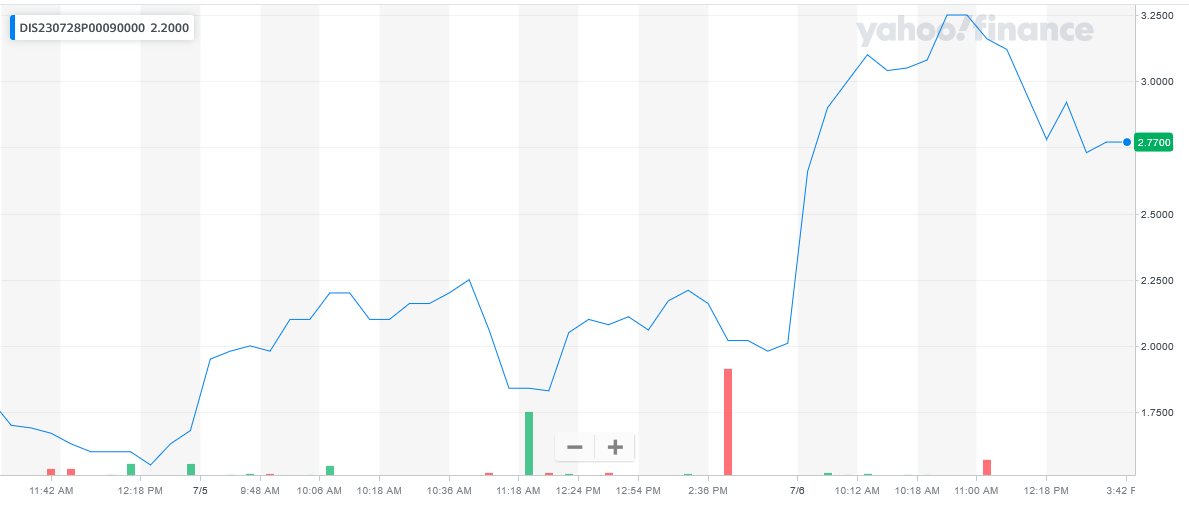

** OPTION TRADE: Buy DIS JUL 28 2023 90.000 PUTS - price at last close was $1.68 - adjust accordingly.

Entered the DIS Weekly Options contract on Wednesday, July 05, 2023, for $1.85.

SOLD HALF the DIS weekly options contracts on Thursday, July 06, 2023, for $3.25; a potential profit of 76%.

Holding the remaining DIS weekly options contracts for further profit before expiry.

Don’t miss out on further trades – become a member today!

About Walt Disney.....

The Walt Disney Company, together with its subsidiaries, operates as an entertainment company worldwide. It operates through two segments, Disney Media and Entertainment Distribution; and Disney Parks, Experiences and Products.

The company engages in the film and episodic television content production and distribution activities, as well as operates television broadcast networks under the ABC, Disney, ESPN, Freeform, FX, Fox, National Geographic, and Star brands; and studios that produces motion pictures under the Walt Disney Pictures, Twentieth Century Studios, Marvel, Lucasfilm, Pixar, and Searchlight Pictures banners.

It also offers direct-to-consumer streaming services through Disney+, Disney+ Hotstar, ESPN+, Hulu, and Star+; sale/licensing of film and television content to third-party television and subscription video-on-demand services; theatrical, home entertainment, and music distribution services; staging and licensing of live entertainment events; and post-production services by Industrial Light & Magic and Skywalker Sound.

In addition, the company operates theme parks and resorts, such as Walt Disney World Resort in Florida; Disneyland Resort in California; Disneyland Paris; Hong Kong Disneyland Resort; and Shanghai Disney Resort; Disney Cruise Line, Disney Vacation Club, National Geographic Expeditions, and Adventures by Disney as well as Aulani, a Disney resort and spa in Hawaii; licenses its intellectual property to a third party for the operations of the Tokyo Disney Resort; and provides consumer products, which include licensing of trade names, characters, visual, literary, and other IP for use on merchandise, published materials, and games.

Further, it sells branded merchandise through retail, online, and wholesale businesses; and develops and publishes books, comic books, and magazines.

The Walt Disney Company was founded in 1923 and is based in Burbank, California.

Further Catalysts for the DIS Weekly Options Trade…..

KeyBanc noted that Disney would likely have to raise prices for current Disney+ and Hulu customers and devise strategies to retain those same customers such as a tiered system for those wanting to pay less.

Theatrical releases like "The Little Mermaid" also face smaller audiences at theaters, the analysts said.

The analysts also noted that while demand for sports on cable TV remains high, customers aren’t showing the same willingness to pay for an ESPN streaming service just yet.

Higher theme park attendance at Disneyland during its 100th Anniversary celebration this year was also seen as a "contraction" compared to the attendance at Disney World’s 50th Anniversary celebration from 2021 to earlier this year, and KeyBanc said those realities weren’t included in the company's expectations for the parks.

Nispel predicted a "deceleration of revenue" between the third and fourth quarter despite Disney’s bullish expectations.

Other Catalysts.....

Brandon Nispel downgraded the mass media company to “sector weight”. He doesn’t have a price objective on it, though.

The analyst turned dovish on Disney stock primarily because he sees expectations of its theme parks as too high particularly considering the tougher comps ahead.

We prefer to step aside, acknowledging meaningful uncertainty, and wait for further catalysts, as buying the dip has been a losing trade.

He also noted that the data for its domestic theme parks was weak for the past two months straight.

Subscriber Decline .....

The KeyBanc analyst also warned of a potential decline in the total number of subscribers at Disney+ and Hulu in its current financial quarter.

He downgraded the Disney stock today also because the demand for ESPN or sports in general appears to be not as resilient on streaming as it is on linear TV, as per the KeyBanc research.

While [the company] has started to drive pricing, we have yet to see Disney services separate from peers from a churn standpoint, though it arguably has had a bundling advantage.

Nispel sees the need for Disney to better monetise the subscribers it already has via price hikes. The Burbank-headquartered multinational is expected to report its third-quarter financial results in early August.

Analysts.....

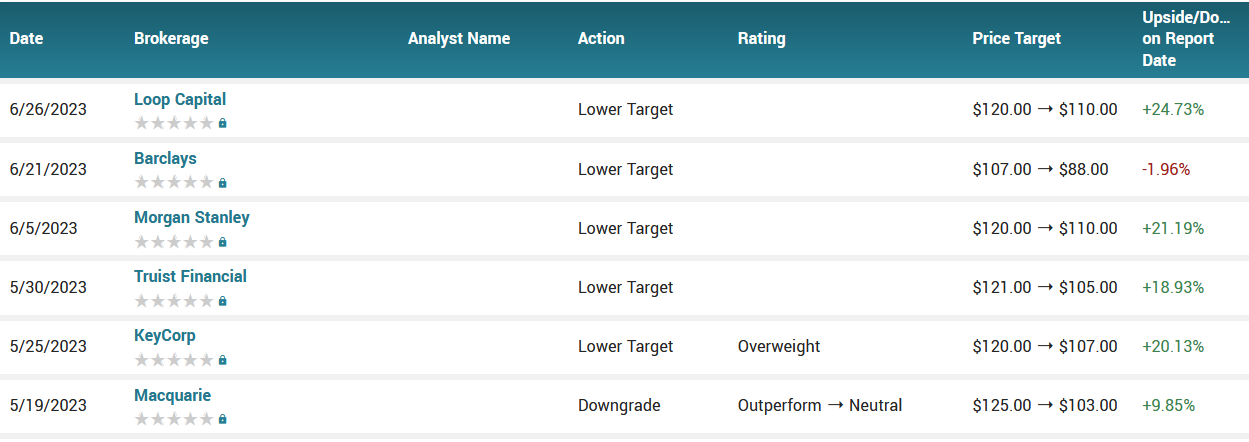

According to the issued ratings of 19 analysts in the last year, the consensus rating for Walt Disney stock is Moderate Buy based on the current 3 hold ratings and 16 buy ratings for DIS. The average twelve-month price prediction for Walt Disney is $121.82 with a high price target of $177.00 and a low price target of $88.00.

Summary.....

Shares of DIS opened at $90.50 on Wednesday. The business's 50 day moving average is $92.79 and its two-hundred day moving average is $96.78. Walt Disney has a 52-week low of $84.07 and a 52-week high of $126.48. The firm has a market cap of $165.37 billion, a price-to-earnings ratio of 40.22, and a PEG ratio of 1.99 and a beta of 1.28. The company has a quick ratio of 0.94, a current ratio of 1.01 and a debt-to-equity ratio of 0.44.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from DISNEY

Recent Articles

-

191% Weekly Option Win on Super Micro Computer Amid Market Mayhem

191% Weekly Option Win on Super Micro Computer Amid Market Mayhem – What’s Next? -

Tariffs and the Stock Market: Positive and Negative Impacts in 2025

Tariffs and the Stock Market: Positive and Negative Impacts in 2025. This article explores both the positive and negative effects of tariffs on the stock market based on recent data, forecasts, and ma… -

SMCI’s Wild Ride: Options Traders Are Profiting From the Ups and Downs

SMCI’s Wild Ride: How Options Traders Are Profiting From the Ups and Downs