TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Docusign Earnings

Docusign earnings are set for approximately 4:05 PM ET on Thursday, December 2, 2021.

expectations for Docusign Earnings

The consensus earnings estimate is $0.46 per share on revenue of $530.63 million; but the Whisper number is higher at $0.52 per share.

The company's guidance was for revenue of $526.00 million to $532.00 million. Consensus estimates are for year-over-year earnings growth of 187.50% with revenue increasing by 38.57%.

Short interest has decreased by 11.9% and overall earnings estimates have been revised lower since the company's last earnings release.

About Docusign (DOCU)

It is inevitable that you will need to sign documents throughout your life. And Docusign Inc (NASDAQ: DOCU) is transforming this cornerstone of business by unblocking the signing bottleneck. They have opened the entire agreement process to automation and, in doing so; have become a clear leader in an area with room for massive growth.

And, the coronavirus was a big boost to Docusign's e-signature platform as businesses scrambled to continue operating in a remote environment.

Understanding The Pricing of Docusign Products…..

This is really important to understand as we look at the future of DocuSign and how companies adopt this product and end up potentially paying more every year. There are really two key components. As product functionality, whether you're a single-user, a business pro, or buying the enterprise platform, there's a couple of different platforms, and this is really [about] features. What kind of features do you want, and how many users are generally going to log into the platform. That sets a base subscription fee.

Then they tag on components. There's no magic formula that they publish, but this is certainly what goes through the contract process and the pricing process for enterprises is they look at the capacity of what's called envelopes. Think of envelopes as a document that needs to get a couple of signatures, that's running around the internet to make those happen.

Influencing Factors for Docusign Earnings

More Covid Variants and Remote Work to Effect Docusign Earnings.....

DocuSign is a pandemic-market darling. As the leading digital signature platform, investors in its stock have been rewarded with returns of 230% since January 2020, as the stay-at-home economy demanded innovative new tools to keep the economy turning. If there's ever a resurgence of COVID-19 restrictions, this company could be in a great position to capitalize.

Yet even if there isn't one, its diversification into other business verticals over the last couple of years makes it a favorable long-term investment. For instance, its DocuSign Insight platform leverages artificial intelligence to read and analyze legal contracts to identify troubling clauses, or even beneficial ones.

Further, the DocuSign Negotiate for Salesforce platform can generate customized agreements, then act as a collaborative contract negotiating tool between internal and external parties who can make adjustments in real time.

The effects of remote work in the stay-at-home economy on this company are apparent through its revenue and earnings growth compared to fiscal 2019 (DocuSign's fiscal year ends Jan. 31).

Metric Fiscal 2019 Fiscal 2022 (Estimate) CAGR

Revenue $701 million $2.09 billion 42%

Earnings per share $0.09 $1.70 166%

Ramp-up in Earnings…..

Docusign earnings per share has been ramped up partly from diversifying its business, and partly from achieving scale through its more than 1 million paying customers. Rapidly growing revenue combined with a high gross margin (which hovers around 80%) means the company can aggressively invest in growth, as fixed costs are quickly becoming a smaller portion of overall sales -- leading to the powerful rise in earnings.

Benefitsto Boost Docusign Earnings…..

DocuSign’s

cloud-based suite offers over a dozen apps for e-signature, document

generation, contract lifecycle management, and more. DocuSign also sells

industry and department-specific solutions and it has over 350 pre-built

integrations with applications such as Salesforce CRM and other huge technology

players.

At a time

when banking is done online, hospital records are stored electronically, and

mortgages documents are signed digitally, DocuSign appears increasingly valuable.

DocuSign’s revenue climbed 50% last year (its fiscal 2021) to reach $1.45

billion and roughly 40% in FY20.

Estimates

currently call for its FY22 sales to surge over 43% to $2.1 billion and then

climb another 30% in FY23. Meanwhile, its adjusted EPS are set to soar 91% to

$1.72 a share this year and then jump 25% higher next year. Plus, it’s crushed

our earnings estimates by an average of 60% in the trailing four quarters.

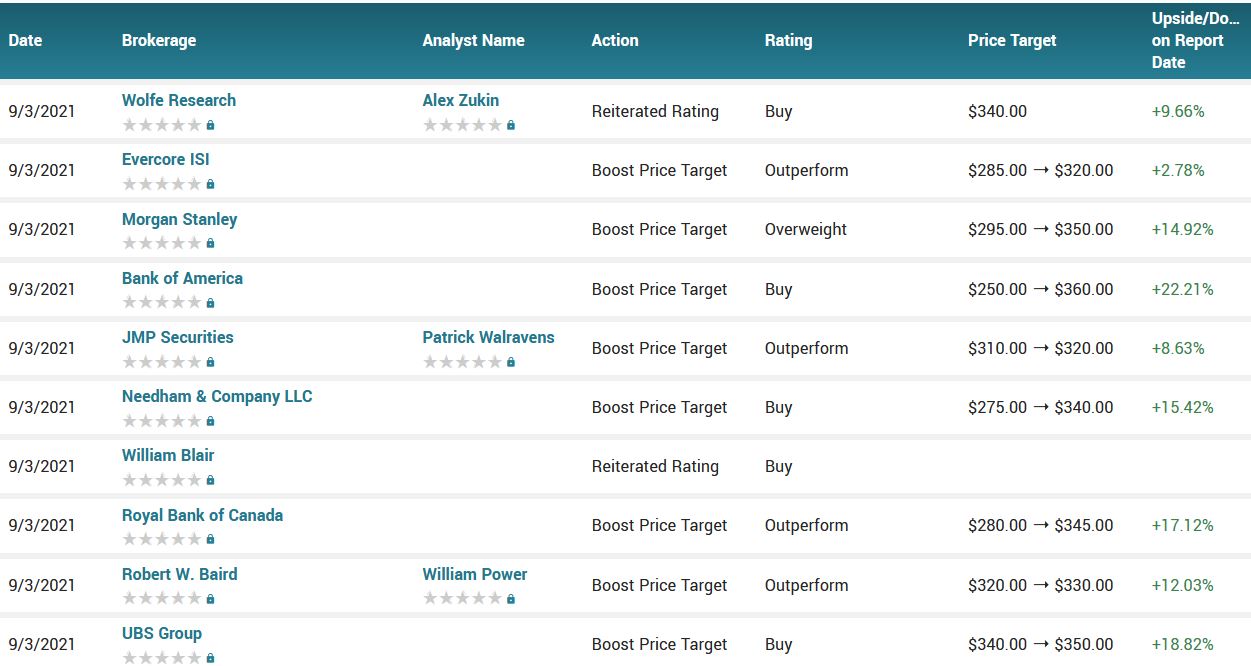

Analysts Thoughts about Docusign Earnings.....

Loup

Ventures analyst Gene Munster said Monday that he preferred DocuSign over

Peloton (NASDAQ:PTON) as a stay-at-home play, as the hybrid working environment

is likely to give the stock staying power beyond the pandemic.

Munster argued that market response to the new variant suggests that people don't expect mass lockdowns in response to the latest COVID strain. He also warned that stocks that performed well during the initial pandemic won't necessarily continue to show strength in the aftermath.

"You can't look at all stay-at-home stocks equally," he cautioned. "Pattern recognition from the past, the surge that they have had, doesn't necessarily mean they will continue to surge."

The Loup Ventures managing partner contended that DOCU could continue to deliver growth, as it takes advantage of the stickier remote-working trend.

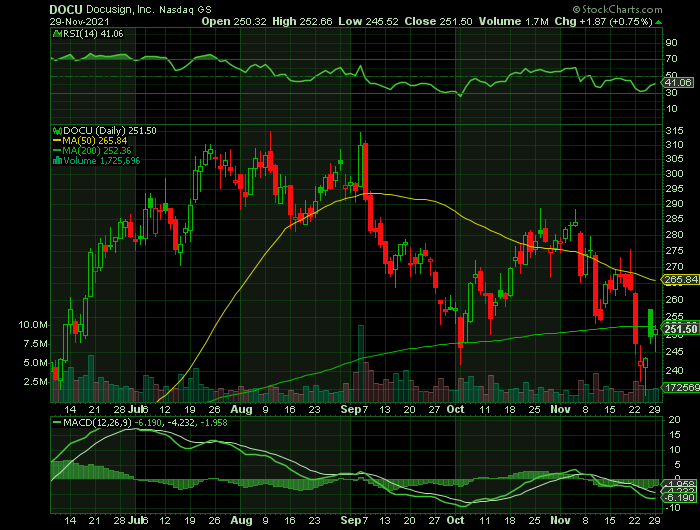

The past year has seen a start turnaround for DOCU, receiving a dramatic boost during the pandemic lockdowns but has underperformed since late 2020.

Ahead of the CRM earnings date of November 30, 2021, the consensus rating for Salesforce.com stock is “Buy.” This is according to the issued ratings of 40 analysts in the last year, based on the current 6 hold ratings, 32 buy ratings and 2 strong buy ratings for CRM. The average twelve-month price target for salesforce.com is $323.87 with a high price target of $375.00 and a low price target of $242.00.

According to the issued ratings of 19 analysts in the last year, the consensus rating for DocuSign stock is Buy based on the current 3 hold ratings and 16 buy ratings for DOCU. The average twelve-month price target for DocuSign is $314.78 with a high price target of $389.00 and a low price target of $215.00.

Summary.....

Estimates currently call for its FY22 sales to surge over 43% to $2.1 billion and then climb another 30% in FY23. Meanwhile, its adjusted EPS are set to soar 91% to $1.72 a share this year and then jump 25% higher next year. Plus, it’s crushed our earnings estimates by an average of 60% in the trailing four quarters.

Docusign has a quick ratio of 0.98, a current ratio of 0.98 and a debt-to-equity ratio of 3.45. The firm has a market capitalization of $49.11 billion, a PE ratio of -290.27 and a beta of 0.91. DocuSign, Inc. has a twelve month low of $179.49 and a twelve month high of $314.76. The company has a 50-day moving average price of $265.68 and a two-hundred day moving average price of $267.56.

Back to Weekly Options USA Home Page from Docusign Earnings

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!