TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

dollar general Earnings Expectations!

Members of “Weekly

Options USA” Are Using A Weekly Option To Profit!

Join

Us and GET THE TRADE!

Monday, March 14, 2022

The market expects Dollar General to deliver a year-over-year decline in earnings on higher revenues when it reports results for the quarter ended January 2022.

DG is expected to deliver a year-over-year decline in earnings on higher revenues when it reports results for the quarter ended January 2022.

Join Us And Get The Trade – become a member today!

Prelude.....

There is one company that will report Thursday, that will probably be greatly affected by current events - Dollar General Corp. (NYSE: DG).

Ominous signs are piling up that more turmoil is still coming, as key indicators point toward a potential recession.

The Ukraine-Russia crisis continues to dominate market movements, causing extreme volatility in the financial market and pushing the oil prices to a decade high and depressing stocks.

The U.S. Federal Reserve is widely expected to hike by 25 basis points to 0.25%-0.5% on Wednesday.

The U.S. Treasury yield curve has collapsed to near inversion -- a situation when short-term rates exceed those with longer tenors, which has often preceded a downturn. In Europe, energy costs have climbed to unprecedented levels, as sanctions against Russia exacerbate a global commodity crunch.

“Over time, the three biggest factors that tend to drive the U.S. economy into a recession are an inverted yield curve, some kind of commodity price shock or Fed tightening,” said Ed Clissold, chief U.S. strategist at Ned Davis Research. “Right now, there appears to be potential for all three to happen at the same time.”

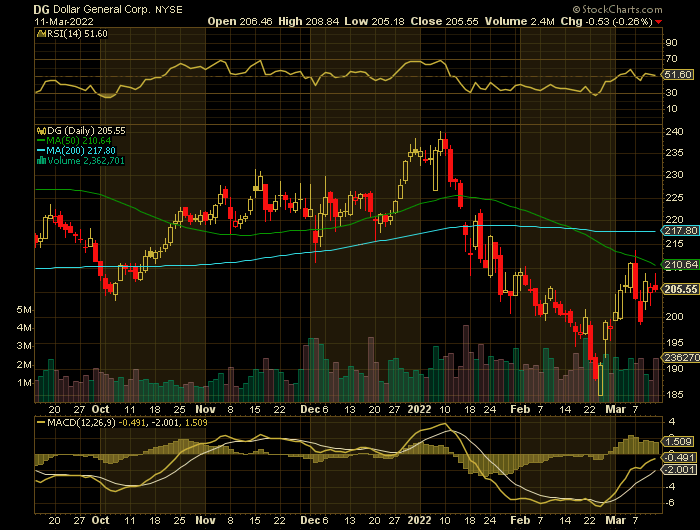

Dollar General Corp. (NYSE: DG)

Dollar General Corporation will report earnings at approximately 6:55 AM ET on Thursday, March 17, 2022.

The market expects Dollar General to deliver a year-over-year decline in earnings on higher revenues when it reports results for the quarter ended January 2022.

The consensus earnings estimate is for $2.56 per share on revenue of $8.69 billion; but the Whisper number is $2.55 per share.

Consensus estimates are for earnings to decline year-over-year by 2.29% with revenue increasing by 3.27%.

For the last reported quarter, it was expected that Dollar General would post earnings of $2.02 per share when it actually produced earnings of $2.08, delivering a surprise of +2.97%.

Over the last four quarters, the company has beaten consensus EPS estimates three times.

Short interest has increased by 23.5% and overall earnings estimates have been revised lower since the company's last earnings release.

Dollar General Company Profile.....

Dollar General Corp. engages in the operation of merchandise stores.

Its offerings include food, snacks, health and beauty aids, cleaning supplies, basic apparel, housewares, and seasonal items. It sells brands including Clorox, Energizer, Procter & Gamble, Hanes, Coca-Cola, Mars, Unilever, Nestle, Kimberly-Clark, Kellogg’s, General Mills, and PepsiCo.

Therefore…..

What Weekly Options Trade Have Members Entered!

Still Time To Take Advantage Of The Profit!

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Stock options Made Easy, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from Dollar General

Recent Articles

-

191% Weekly Option Win on Super Micro Computer Amid Market Mayhem

191% Weekly Option Win on Super Micro Computer Amid Market Mayhem – What’s Next? -

Tariffs and the Stock Market: Positive and Negative Impacts in 2025

Tariffs and the Stock Market: Positive and Negative Impacts in 2025. This article explores both the positive and negative effects of tariffs on the stock market based on recent data, forecasts, and ma… -

SMCI’s Wild Ride: Options Traders Are Profiting From the Ups and Downs

SMCI’s Wild Ride: How Options Traders Are Profiting From the Ups and Downs