TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Draftkings Inc Stock Keeps

Roaring Upwards!

Members Make

Potential Profit of

160%, Using A Weekly Call

Option!

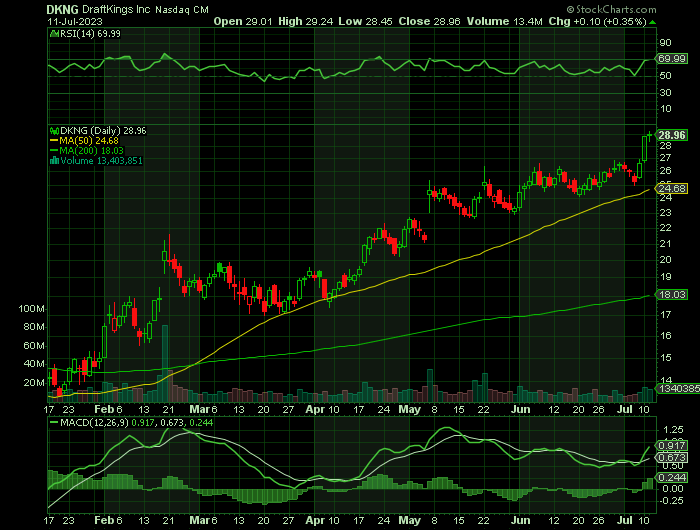

The share price of the multi-channel sports betting and gaming company DraftKings Inc. has been climbing northward so far in 2023, primarily on tech resurgence.

DraftKings stock hit a fresh 52-week high yesterday as investors grew more bullish on the mobile sports wagering company that saw shares decline nearly 60% in 2022.

This set the scene for Weekly Options USA Members to Make Potential Profit Of 160%, using a DKNG Weekly Options trade!

Join Us And Get The Trades – become a member today!

Wednesday, July 12, 2023

by Ian Harvey

Wall Street analysts have recently raised their price targets noting the Street hadn't expected this strong of a first half of the year for DraftKings.

"The industry has been better than expected given single game parlays and reduction in promos, so I think that's good for the overall space, mainly DraftKings and FanDuel," Macquarie Securities managing director Chad Beynon.

DraftKing surprised the Street to the upside during its first quarter earnings release in May, posting revenue of $769.65 million versus Street estimates for $705.18 million. Most notably, the company guided for a full-year adjusted EBITDA loss of $315 million in 2023, down from prior guidance for a loss of $400 million.

"Analysts are realizing that Q2 expectations are too low for [DraftKings] and the industry, and then we're trying to figure out what that means for their commentary for 2023," Beynon said.

DraftKings shares have responded accordingly, skyrocketing more than 150% to start the year.

Why the DKNG Weekly Options Trade was Executed?…..

Draftkings Inc (NASDAQ: DKNG), the sports-betting company, has seen plenty of momentum in 2023 as traction grows in newly-added states. Year to date, the stock has more than doubled - yet even so, there's still plenty of room for upside left.

The company's growth in active users has been driven by new state legalizations - at one point, the market had feared that DraftKings' pandemic-era uptick in monthly gamers and overall betting activity was due to COVID shutdowns and bored consumers making bets at home - now, however, that increased activity levels are organic and have been sustained. Also in DraftKings' favor is the fact that it has reduced marketing spend and improved gross margins, without materially impacting its growth rates.

The DKNG Weekly Options Trade Explained.....

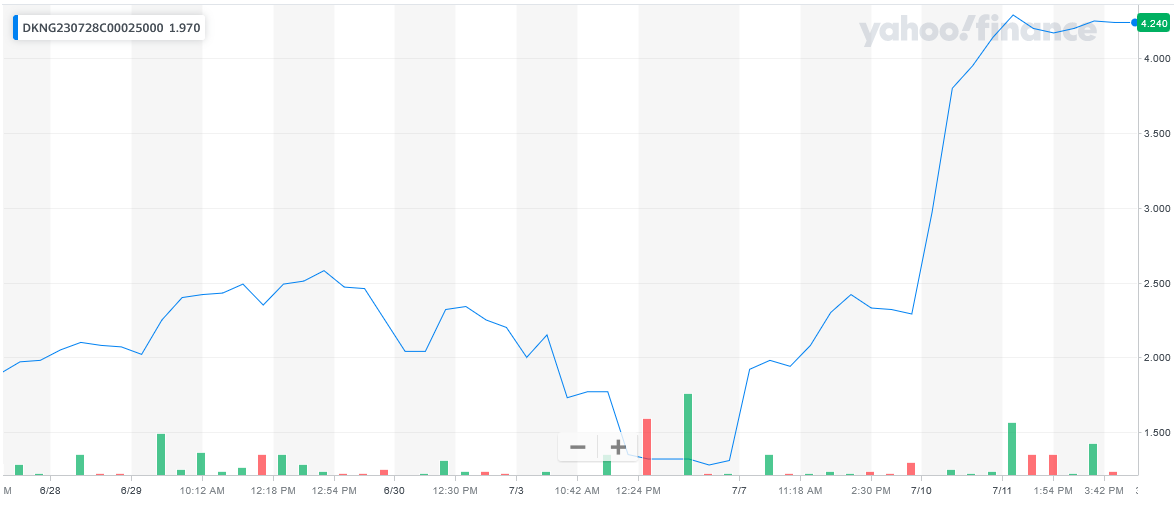

** OPTION TRADE: Buy DKNG JUL 28 2023 25.000 CALLS - price at last close was $1.66 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the DKNG Weekly Options (CALL) Trade on Tuesday, June 27, 2023 for $1.67.

Sold half the DKNG Weekly Options contracts on Thursday, June 29, 2023, for $2.58; a potential profit of 54%.

Sold more of the DKNG Weekly Options contracts on Tuesday, July 11, 2023, for $4.35; a potential profit of 160%.

Holding the remaining DKNG weekly options contracts for further profit before expiry.

Don’t miss out on further trades – become a member today!

Where to Now?

Expect Draftkings Inc stock to keep powering upwards due to several catalysts.....

- Same game parlays - are products where bettors combine the chances of multiple separate things happening within the same game into one bet. The increase of same game parlays and movement from a "sharp," or very engaged gambler, to a general audience are likely benefiting DraftKings.

- Legalization - Since online sports betting was cleared for state-by-state legalization in 2018, multiple states have been added each year. It's been an important part of the growth story for companies like DraftKings as new markets have boosted revenues.

Conclusion.....

Draftkings Inc. is a major player in a relatively new and fast-growing space. After the removal of the ban on sports betting by the Supreme Court in 2018, the sector has exploded, and around 33 states currently allow online betting of some sort in their territory. In these markets, depending on the state, Draftkings has around a fifth share of the pie.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from DRAFTKINGS

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!