TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

DRAFTKINGS Provides 91% Potential Profit

Using A

Weekly CALL Option!

Sports betting is legal in more states than ever following the March 11 launch in North Carolina.

Draftkings Inc (NASDAQ: DKNG) now operates in 27 states as well as Ontario, Canada, following the March 11 N.C. launch.

Shares of DraftKings surged Monday with March Madness in full swing.

This set the scene for Weekly Options USA Members to profit by 91% using a DKNG Weekly Options trade!

Join Us And Get The Trades – become a member today!

Saturday, March 23, 2024

by Ian Harvey

UPDATE

It's been a great 12 months for DraftKings (NASDAQ: DKNG) shareholders. After being completely upended by 2022's bear market, DraftKings stock has rallied more than 150% from last March's low. And it's still going.

DraftKings is a sports betting name. Its roots are in the fantasy sports

business, but when the U.S. Supreme Court lifted the federal ban on sports

wagering back in 2018, DraftKings was already well-positioned to capitalize on

the new opportunity. Since then, 38 states have legalized sports betting of one

sort or another.

The industry's resulting growth is the key reason this company's top line reached nearly $3.7 billion last year, versus 2018's mere $226 million.

Why the Draftkings Weekly Options Trade was Originally Executed!

The AGA in late February reported that U.S. commercial gaming revenue rose 10% in 2023 to a record $66.52 billion, driven by a 44.5% increase in sportsbook revenue to $10.92 billion. Fourth-quarter gaming revenue increased 9.5% to $17.42 billion. Sportsbook revenue in Q4 leapt 30.8% to $3.41 billion.

Meanwhile, sports betting is legal in more states than ever following the March 11 launch in North Carolina. AGA data shows sports betting is now live and legal in 38 states and Washington, D.C.

Draftkings Inc (NASDAQ: DKNG) now operates in 27 states as well as Ontario, Canada, following the March 11 N.C. launch.

Shares of DraftKings surged Monday with March Madness in full swing.

"With March Madness on the horizon, North Carolina is poised to be one of the leading markets in the country," GeoComply wrote in its social media post.

Meanwhile, DraftKings is coming off its Q4 earnings beat from Feb. 16 that showed adjusted earnings improved to 29 cents per share from a loss of 14 cents the year prior. However, the revenue growth rate slowed for the second quarter in a row, at 43% to a record $1.23 billion.

UBS lifted its price target on DKNG stock on March 4, noting continued improvement in DraftKings' ability to retain customers and its unit economics across existing businesses. UBS raised its price target on DKNG to 56 from 44 and kept a buy rating on the shares.

The Draftkings Weekly Options Potential Profit Explained.....

** OPTION TRADE: Buy DKNG APR 26 2024 44.000 CALLS - price at last close was $2.50 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the DKNG Weekly Options (CALL) Trade on Wednesday, March 20, 2024 for $2.82.

Sold half the DKNG weekly options contracts on Friday, March 22, 2024 for $5.40; a potential profit of 91%.

(This result will vary for members depending on their entry and exit strategies).

Holding the remaining contracts for further profit.

Don’t miss out on further trades – become a member today!

About DraftKings.....

DraftKings Inc. is a digital sports entertainment and gaming company serving industry and gamers alike. The company offers multi-channel sports betting and gaming technologies that are used by sports and gaming entertainment operators in 17 countries. In the U.S., the company operates iGaming through its DraftKings brand in 5 states, as well as operates Golden Nugget Online Gaming, an iGaming product and gaming brand in 3 states.

DraftKings is headquartered in Boston, Massachusetts, and is the only vertically integrated online gambling platform headquartered in the US and targeting US gamers. The company was founded in 2011 by three close friends and went public in 2020 with a listing on the NASDAQ stock exchange. The initial offering is noteworthy because the company went public via merger with a SPAC formerly known as Diamond Eagle Acquisition Company.

Draftkings is run by Jason Robins, Matt Kalish, and Paul Liberman. The three started as friends but turned into cofounders, entrepreneurs, and corporate executives. Robins is CEO and in charge of corporate operations while Kalish and Liberman are president of DraftKings North America and Global Technology and Product respectively. Together, they manage a team of 10 executives and a network of 14 locations including 8 outside the US.

The company began as a dream to improve fantasy sports leagues. The goal was to change the way fantasy sports were played and open the door to a host of new gaming opportunities. The product was first launched in 2012 and now the company’s daily fantasy sports product is available in 6 countries internationally with 15 distinct sports categories.

Draftkings sets itself apart from the average fantasy sports provider by not only offering the widest selection of sports but the most control for the players. Players can re-draft new line-ups at will for most sports and there are daily contests within each league. The idea is for players to have a chance to win on a seasonal, quarterly, monthly, weekly, and daily basis.

DraftKings Sportsbook is live with mobile and/or retail betting operations in the United States pursuant to regulations in 18 states. The Sportsbook connects sports fans with legal sports betting operations in states with legalized gambling.

DraftKings expanded its offering with the launch of DraftKings Casino. DraftKings Casino is home to all the favorite table and slot-machine games but in a digital format. The Casino games are available on desktop and mobile like all of DraftKings offerings making them easily accessible to players.

In addition to gaming and sports betting, DraftKings is banking on the cryptocurrency revolution with DraftKings Marketplace. DraftKings Marketplace is a digital collectibles ecosystem designed for easy use that offers curated NFT drops and secondary-market transactions.

DraftKings SPAC merger included the addition of SBTech, a sports betting technology platform. DraftKings sports betting and casino technologies are available as a white-lable for businesses through this platform. SBTech offers an end-to-end solution including the gaming platforms and back-office services.

DraftKings also owns Vegas Sports Information Network (VSiN), a multi-platform broadcast and content company. Vegas Sports Information company can be accessed online or screened on live TV featuring world-renown sports commentators, players, and coaches.

Further Catalysts for the DKNG Weekly Options Trade…..

Draftkings Inc has announced several changes to its senior leadership team which have been viewed as positive by analysts at Jefferies.

The fantasy sports contest and sports betting company has appointed its current chief financial officer Jason Park as chief transformation officer, effective May 1, 2024. In this role, he will lead initiatives to deploy new technologies to drive operating improvement and oversee the integration of Jackpocket, a leading lottery app in the US being acquired by DraftKings (NASDAQ:DKNG) for $750 million.

“Our impression is that Jason Park has experience with operational roles before, and given the timing of the pending Jackpocket acquisition, the transition seems appropriate,” the Jefferies analysts wrote.

DraftKings’ Senior Vice President of Finance and Analytics Alan Ellingson will take on the role of chief financial officer, also effective May 1, 2024.

“He has been with the company since 2020 and our impression is that he has been heavily involved in building the company's guidance and long-term forecasts, which implies there should be no shift in philosophy or outlook, despite limited Street-facing engagement,” the analysts wrote.

As such, they reiterated their first quarter fiscal 2024 revenue and earnings before interest, taxes, depreciation and amortization (EBITDA) estimates of $1.116 billion and $2.6 million, respectively.

The analysts have a ‘Buy’ rating on the stock and a $52 price target, representing an upside of 19% to DraftKings’ share price at the time of writing of $43.52.

“Our view remains that DraftKings is a leader in the digital space and will maintain its approximate share levels despite increasing competition and market evolution,” they wrote.

“We believe the evolution of existing markets coupled with further legalizations over time and the Jackpocket acquisition as an incremental positive, all suggest that estimates should continue to progress higher over time, with the stock moving commensurately.”

Other Catalysts.....

It’s expected that DraftKings will reach a 59% growth rate, and average annual growth will potentially allow the company to push for breakeven sooner.

That’s largely because the online gaming company has expanded its online betting presence in key markets, strengthening its sports gambling branding. DraftKings recently expanded into 24 U.S. states and in Canada as well.

Acquiring Jackpocket for $750 million broadens the company’s market reach. DraftKings dominates 31% of the U.S. online gambling market, boasting 3.5 million monthly unique payers, up 37% from 2022. This growth drives DKNG stock, which surged 125% in the past year.

My Stat Sheet.....

DraftKings has introduced a tool called My Stat Sheet. This gaming tool allows players to track and analyze their gaming activities, helping them make data-driven decisions and promote responsible gaming. This new feature is now available on all DraftKings and Golden Nugget platforms.

With My Stat Sheet, customers can see various details like the time spent on the gaming platform, deposits and withdrawals, contest involvement, and overall wins or losses. These stats are presented through easy-to-understand charts and filters. The tool is accessible to all customers using DraftKings platforms.

Analysts.....

Jordan Bender from JMP Securities maintained a Buy rating on DraftKings, with a price target of $52.00. The company’s shares closed last Monday at $43.52, close to its 52-week high of $45.62.

According to the issued ratings of 26 analysts in the last year, the consensus rating for DraftKings stock is Moderate Buy based on the current 2 sell ratings, 1 hold rating and 23 buy ratings for DKNG. The average twelve-month price prediction for DraftKings is $43.93 with a high price target of $60.00 and a low price target of $23.00.

Summary.....

DraftKings rallied more than 23% so far this year following a double-bottom breakout in late January.

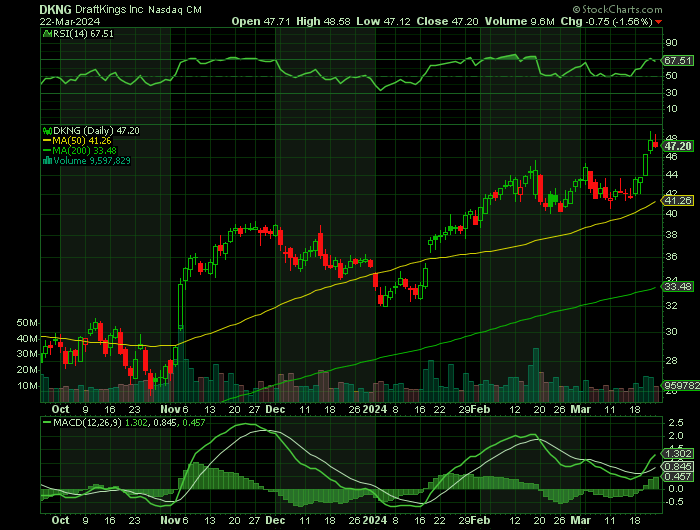

Shares of DKNG stock opened at $43.78 on Wednesday. The stock has a market cap of $37.94 billion, a P/E ratio of -25.02 and a beta of 1.87. The company has a debt-to-equity ratio of 1.49, a current ratio of 1.34 and a quick ratio of 1.34. The company has a fifty day moving average price of $40.65 and a two-hundred day moving average price of $35.55. DraftKings Inc. has a one year low of $17.02 and a one year high of $45.62.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from Draftkings

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!