TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

draftkings Falls 21.6% After Earnings!

But, Members

of “Weekly

Options USA” Are Up 259%

Using A Weekly Put Option!

Sunday, February 20, 2022

Draftkings Inc shares dropped 21.6% after reporting earnings on Friday, after the fantasy sports and online betting company warned of larger losses in the coming year.

But, “Weekly Options USA” Members were up 259% after earnings using a weekly put option!

More profit is expected!

Don’t miss out on further trades – become a member today!

Draftkings Inc (NASDAQ: DKNG) shares slumped lower Friday after posting stronger-than-expected fourth quarter earnings but forecast a much wider loss over the coming year for the online sports betting and gaming group.

Draftkings Inc shares fell after cautioning that the company would generate adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) loss of $825 million to $925 million in 2022, in part because of the expenses related to entering new markets in New York and Louisiana. Analysts had expected an adjusted EBITDA loss of only $573 million.

“In the present environment where tech investors have displayed zero tolerance for large losses, the 2022 Ebitda guidance is going to be a disappointment,” Vital Knowledge analyst Adam Crisafulli said.

Also, adding to DraftKings Inc shares falling their most in almost two years as they announced that the company added fewer new customers in the fourth quarter.

DraftKings Inc said Friday that an average of 2 million monthly unique paying customers engaged with the company during the fourth quarter. Analysts were looking for 2.1 million monthly payers.

DraftKings Inc said revenues for the three months ending in December rose 47% from last year to $473 million as more states eased restrictions on online gaming. Marketing and expansion costs, however, ate into the group's bottom line, which came in at $128 million.

Sports betting has spread to an increasing number of U.S. states since the Supreme Court struck down a federal ban in 2018. That’s led to a free-for-all of introductory offers as DraftKings, FanDuel and others try to persuade people to use their phone to place wagers for the first time. DraftKings has entered the New York and Louisiana markets, and said Friday there are new potential opportunities in Maryland, Puerto Rico and Ohio.

Building relationships with new customers -- and sports leagues -- costs money. DraftKings spent nearly $1 billion on sales and marketing last year, almost double its allocation in 2020.

DraftKings is far from profitable. It generated a net loss of $326 million in the fourth quarter alone. Its adjusted loss per share of $0.35, however, was better than the $0.81 per-share loss Wall Street had expected.

Read the article.... .“ Draftkings Inc Earnings Expectations!”

Members Profits on the Draftkings Inc Trade.....

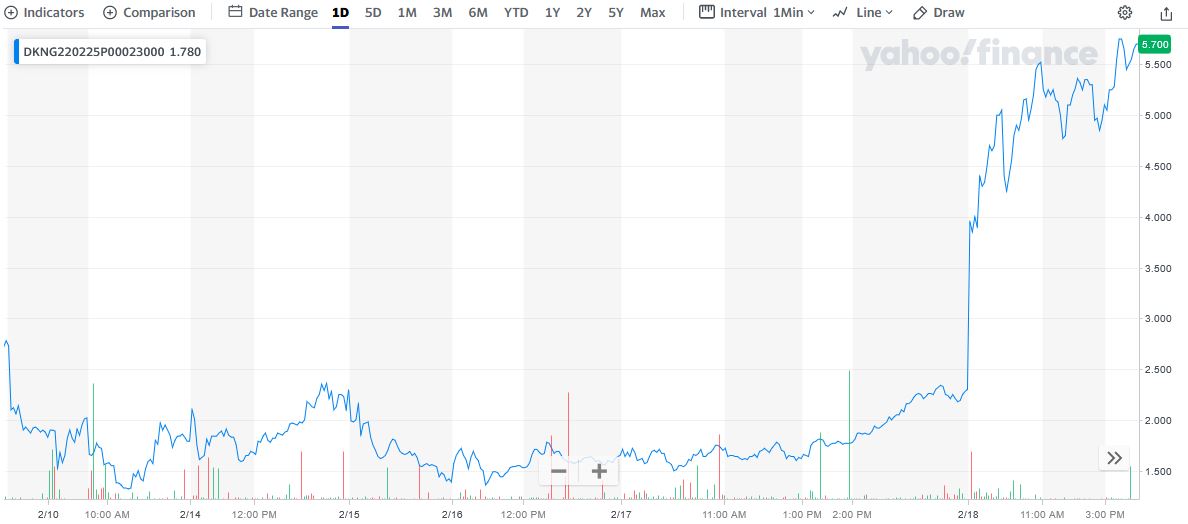

Weekly Options USA Members entered this trade on Monday, February 14, 2022 for approximately $1.60; and by Friday the price had settled at 5.75.

This Draftkings Inc Options Put trade provided a potential profit of 259%.

Summary.....

Unfortunately, DraftKings' report didn't live up to the higher expectations of its shareholders, and that motivated the sharp decline in the stock price. That's been an ongoing theme this earnings season, and it could cause further negative sentiment about other high-growth stocks that have yet to release their latest results.

The stock had already fallen 63% over the past year through Thursday’s close.

Therefore…..

We Have Had A Successful DraftKings Inc Trade Based On A Put Option!

What Further DraftKings Inc Weekly Trades Will We Recommend?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Stock options Made Easy, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from

DraftKings

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!