TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Google

Weekly Options Trade Up 114%!

Alphabet Inc (NASDAQ: GOOG, GOOGL) is known for having the world's dominant search engine, and that's been the company's bread and butter for more than 20 years. And that business has allowed the company to build arguably the best infrastructure and pipelines of products in tech.

Showing a New Year's resolution of resilience, Google stock remains in buy range as parent Alphabet unveils the biggest upgrade yet to its artificial intelligence assistant.

Shares of tech giant Alphabet jumped 55% in the past year, and the good part is that investors can still buy this Nasdaq stock at an attractive valuation.

This set the scene for Weekly Options USA Members to profit by 114% using a GOOGL Options trade!

Join Us And Get The Trades – become a member today!

Sunday, January 28, 2024

by Ian Harvey

Alphabet Inc (NASDAQ: GOOG, GOOGL) is known for having the world's dominant search engine, and that's been the company's bread and butter for more than 20 years. And that business has allowed the company to build arguably the best infrastructure and pipelines of products in tech.

Showing a New Year's resolution of resilience, Google stock remains in buy range as parent Alphabet unveils the biggest upgrade yet to its artificial intelligence assistant.

Known as Gemini Ultra, the upgrade ushers in the next stage in the battle of AI-driven chatbots between Google Bard and Microsoft Copilot, which combines the power of Bing search with ChatGPT.

Shares of tech giant Alphabet jumped 55% in the past year, and the good part is that investors can still buy this Nasdaq stock at an attractive valuation.

Why the Google Weekly Options Trade was Originally Executed!

Showing a New Year's resolution of resilience, Google stock remains in buy range as parent Alphabet Inc (NASDAQ: GOOG, GOOGL) unveils the biggest upgrade yet to its artificial intelligence assistant.

Known as Gemini Ultra, the upgrade ushers in the next stage in the battle of AI-driven chatbots between Google Bard and Microsoft Copilot, which combines the power of Bing search with ChatGPT.

Google Bard currently uses the midlevel Google Gemini Pro. Last month, Google announced that Gemini Ultra has begun to roll out in two stages.

As Google's most sophisticated model, Gemini incorporates multimodal reasoning capabilities. It can run on everything from data centers to mobile devices.

Starting in December, Bard has begun using a specifically tuned version of Gemini Pro in English for more advanced reasoning, planning, understanding and more. Early this year, Google plans to introduce Bard Advanced. This will give users access to Google's most advanced AI models and capabilities — starting with Gemini Ultra.

The Google Weekly Options Potential Profit Explained.....

** OPTION TRADE: Buy GOOGL FEB 09 2024 145.000 CALLS - price at last close was $4.10 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

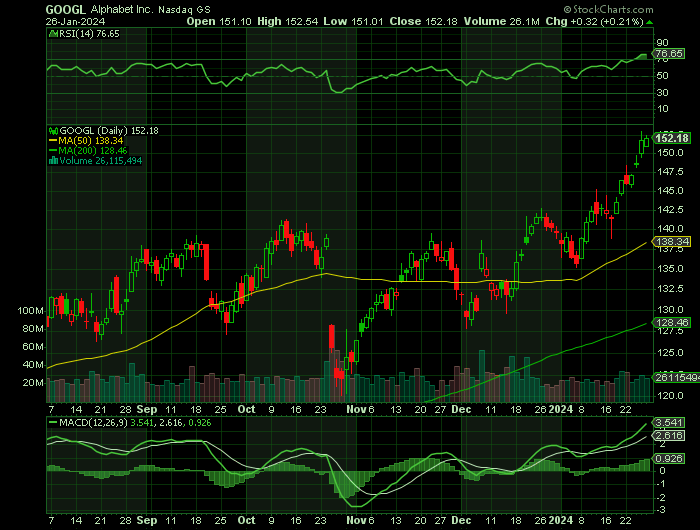

Entered the GOOGL Weekly Options (CALL) Trade on Friday, January 19, 2024 for $4.65.

Sold the GOOGL

weekly options contracts on Thursday, January 25, 2024 for $9.95; a potential profit of 114%.

Don’t miss out on further trades – become a member today!

About Alphabet (NASDAQ:GOOGL).....

Alphabet Inc. is a holding company formed in 2015 with the restructuring of Google. The move was made to allow the company more flexibility in its business pursuits and to create more transparency in the core Google business. Google, which began as a simple search engine, is now synonymous with the Internet, cloud, and services related to each. Today, Alphabet is the 3rd largest tech company globally and the G in FAANG.

Google began in 1996 as a research project into Internet search. Founders Lary Page and Sergey Brin thought there was a better way to search and rank web pages than simply counting the number of times a keyword was used. The original algorithm was called Page Rank and the system Back Rub but those monickers did not last long. The new system instead determined a page's relevance by analyzing the websites that linked back to it. The more websites with higher rankings linking back to the original site the better.

The original prototype of the Google search engine was launched in 1997. The name Google was chosen because it is a very large number and refers to a large amount of information a Google search can provide. If not for an investment Andy Bechtolsheim, co-founder of Sun Microsystems, the company may never have incorporated and become the behemoth it is today.

The company grew over the next few years, changed it headquarters to Palo Alto and then began selling ad space. It was he shift to an ad-based and supported model that provided the income and earnings to grow the company to its current size. Advertising still makes up more than 80% of the revenue. In 2000, the company became the default search engine for Yahoo! and then in 2004 Google went public.

At the time of the IPO, company founders and then-CEO Eric Schmidt agreed to work together for the next 20 years. While that did not come to pass, the trio helped get the company on its current path. In the time since the IPO, Google has not only grown to surpass 3 billion daily searches and 1 billion unique monthly active users it has also acquired other businesses to enhance that growth. The two most notable are the acquisition of Youtube (which is included in the ad-generated revenue) and Motorola. The addition of Motorola was strategic in many ways that include the acquisition of intellectual property and better positioning in patent and other disputes with other tech companies.

Alphabet now operates in 3 core segments providing Internet and Internet-based services globally. Those segments are Google Services, Google Cloud, and Other Bets. The Google Services business is the core Google business and includes search, ads, Google Home, and Youtube among others. The Google Cloud segment is a host of cloud-based services for businesses and individuals that include software suites, security, and cloud-based operations. The Other Bets segment includes a variety of applications and services that do not have a direct bearing on the core business and/or are immaterial to revenue on an individual basis.

Further Catalysts for the GOOGL Weekly Options Trade…..

Shares of tech giant Alphabet jumped 55% in the past year, and the good part is that investors can still buy this Nasdaq stock at an attractive valuation. Alphabet stock is now trading at 27 times trailing earnings, which is a discount to the Nasdaq-100's trailing earnings multiple of 30. What's more, Alphabet's forward price-to-earnings ratio of 22 points toward a nice jump in its bottom line, and the multiple is lower than the Nasdaq-100's forward earnings multiple of 28.

Buying Alphabet at its current valuation looks like a no-brainer considering that its growth is set to accelerate in 2024. Consensus estimates are projecting Alphabet's 2023 revenue to land at $306 billion, which would be an increase of 8% over 2022. The company is anticipated to show double-digit top-line growth in 2024 and 2025.

Other Catalysts.....

Alphabet looks like it is a typical Growth at a Reasonable Valuation (GARP) stock. For example, analysts expect to see 11% growth in revenue this year vs. 2023. This is based on Seeking Alpha's survey of 49 analysts who project $340.1 billion in revenue for 2024 vs. $305.73 billion forecast for 2023.

Moreover, earnings per share (EPS) is forecast to be 16% higher at $6.66 in 2024, vs. $5.74 predicted on average for 2023.

That puts GOOGL stock on a fairly cheap 21.4 times forward earnings (i.e., $142.65/$6.66). This is cheap compared to its peers like Microsoft (MSFT) which is trading on a 34x forward multiple.

So, if we use a 25x multiple to value this FCF, the market cap could rise to $2,775 billion. That is 55% over its present $1,79 billion market cap.

In other words, GOOGL stock could be worth $221.11 (i.e., 1.55 x $142.65 price today).

So, despite the stock's recent rise, investors in GOOGL stock have a lot to look forward to given this valuation. Alphabet's earnings will be released on Jan. 30. If it shows a powerful free cash flow margin just like last quarter, investors could potentially see GOOGL stock move higher.

Moving Forward.....

A closer look at the prospects of the digital advertising market will make it clear why Alphabet is anticipated to grow at a faster pace this year. According to eMarketer, digital ad spending is predicted to grow 13.2% in 2024, which would be an improvement over the 10.7% growth this market had last year. Given that Alphabet's Google Search business accounts for nearly 60% of global search advertising revenue, the company is in a solid position to take advantage of the improvement in digital ad spending this year.

More importantly, Alphabet is integrating generative AI tools into its advertising solutions, which should allow the company to consolidate, or even grow, its share in the lucrative digital ad market. The company claims that its AI tools allowed advertisers to increase ad conversions, reduce acquisition costs, and boost subscriber growth by helping them select the right keywords, generate relevant headlines and descriptions, and even select AI-suggested images to improve ad performance.

Alphabet says that advertisers using its AI-powered campaigns witnessed an average of "18% more conversions at a similar cost per action." Thanks to Alphabet's AI-powered ad campaigns, the company could gain more share in the search and digital ad market.

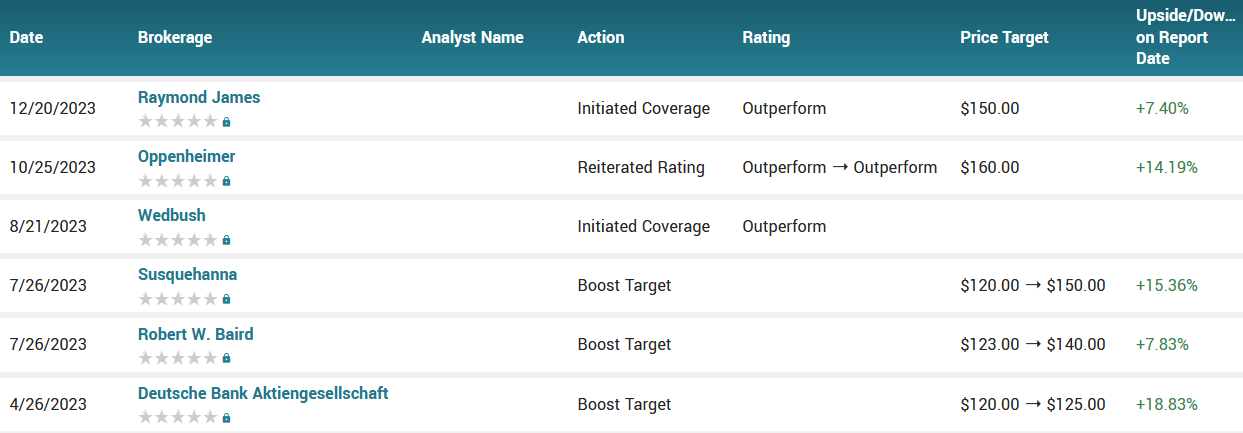

Analysts.....

According to the issued ratings of 8 analysts in the last year, the consensus rating for Alphabet stock is Buy based on the current 8 buy ratings for GOOG. The average twelve-month price prediction for Alphabet is $132.43 with a high price target of $160.00 and a low price target of $118.00.

Summary.....

Alphabet could keep growing at an impressive pace in the long run thanks to new opportunities such as generative AI.

Alphabet has a debt-to-equity ratio of 0.05, a current ratio of 2.04 and a quick ratio of 2.01. The business’s fifty day moving average is $138.04 and its 200 day moving average is $133.66. Alphabet Inc. has a 52 week low of $88.86 and a 52 week high of $146.66. The company has a market capitalization of $1.79 trillion, a PE ratio of 27.65, and a P/E/G ratio of 1.29 and a beta of 1.06.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from GOOGLE

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%! -

Palantir Future Looks Promising!

Palantir Future Looks Promising! Weekly Options Members Profit Up 102%! As of 2024, Palantir has seen a significant uptick in its stock performance, with a remarkable 114% increase year-to-date.